Depending on your aggregate turnovers, e-invoice GST is applicable for B2B businesses, SEZ items, import, and export, etc. The decision to implement the e-invoicing system was taken in the 35th meeting of the GST Council. It pertains to submitting a standard invoice that has already been generated on the e-invoice portal while simultaneously automating multiple manual actions related to various tax filings, tax monitoring, GSTR-1 returns, etc.

In this article, let’s get to know what e-invoicing in GST is, its benefits, process, mandatory and non-mandatory fields in the form, and how it looks as a PDF file.

What is e-Invoicing in GST?

e-Invoicing refers to a system where the B2B (Business-to-Business) invoices are authenticated by GSTN (GST Network) electronically so that they can be published and used in the GST portal. All invoices under this e-invoicing system will have a unique identification number issued by the IRP (Invoice Registration Portal).

Once the invoice information has been entered into the portal, it will automatically reflect in the GST portal and e-way bill portal in real-time. This eliminates the need for any manual entries while filing GSTR-1 returns or generating part-A of the e-way bills, given that the information is disseminated by the IRP directly to the GST portal.

When is e-Invoicing Applicable?

The first phase of e-invoicing commenced on October 1, 2020. It included taxpayers with an aggregate turnover of over Rs.500 crore under Notification no. 61/2020-Central Tax as well as 71/2020-Central Tax.

However, the next phase (initiated from January 1, 2021) also involved businesses whose aggregate turnover crossed Rs.100 crore under Notification No. 88/2020.

A couple of months later, the CBIC (Central Board of Indirect Taxes and Customs), under Notification No.5/2021, informed that from April 1, 2021, e-invoicing is even applicable for businesses with a gross turnover of over Rs. 50 crore. Additionally, taxpayers would also have to adhere to e-invoicing in case their turnover crossed the said limit in any of the financial years between 2017-18 and 2019-20.

The aggregate turnover should also incorporate all GSTIN turnovers within a single PAN across the country. However, as per CBIC Notification No.13/2020, e-Invoicing does not apply to certain categories of registered people as of now. These include:

- GTA (Goods Transport Agency).

- Registered individuals, offering public transport services.

- Insurers, banking companies, and financial institutions, including NBFCs.

- SEZ unit.

- Government departments and local authorities.

- Registered individuals, providing services of granting admission to multiplexes.

Benefits of e-Invoicing for Businesses

Here are the benefits of using an e-Invoicing in GST for businesses:

- The e-Invoice generated on one software can be viewed by another. This reduces data entry losses, opening doors for interoperability.

- The e-Invoice helps fix data reconciliation, eradicating the chances of mismatch errors.

- There is also an option to track invoices arranged by the supplier in real-time.

- It initiates automated entries of relevant information for tax return filing and generation of part A of the e-way bill.

- It allows quick and genuine availability of input tax credit.

- It reduces the chances of audits and surveys that need to be carried out by the tax authorities, given that the details which they need to inspect are already available on the transaction level.

What is the Process of Getting an e-Invoice?

Follow the below-mentioned steps to generate or raise an e-invoice under GST.

Step 1: As a taxpayer, you must follow the PEPPOL standards when using the reconfigured ERP system. You can always seek guidance and assistance from the software service provider to adhere to the set standards for e-invoicing (the e-invoice schema) and the CBIC parameters.

Step 2: You will have two options to generate the IRN:

- Whitelist your computer’s IP address on the e-invoice portal, which will enable a direct API integration. You can also do the same via any GST Suvidha Provider.

- Download the bulk tool to upload bulk invoices. This will create a JSON file which you can then upload on the e-invoice portal to generate bulk IRNs.

Step 3: You will then need to put up a regular invoice on the same software providing all the required details including, the billing name and address, transaction value, supplier’s GSTN, item rate, applicable GST rate, tax amount, among others.

Step 4: Once any of the above options is selected, you can generate the invoice on the ERP software. Upload the invoice details on the IRP either through the JSON file, an application service provider, or a direct API and mention the mandatory fields. The IRP will then function as the central recorder for e-invoicing as well as its authentication. SMS and mobile app modes of IRP interaction are also available.

Step 5: The IRP will now verify the chief B2B invoice details, inspect replications, and issue an invoice reference number. Invoice number, type of document (DN/CN/INV), seller GSTIN, the financial year in YYYY-YY format are the four parameters considered for an IRN generation.

Step 6: After generating the IRN, the IRP signs the invoice digitally and issues a QR code for the supplier. The e-invoice generation is communicated to the supplier through email.

Step 7: IRP will transfer the authenticated payload for GST returns to the GST portal. Apart from that, all details will be routed to the e-way bill portal. The GSTR-1 then gets auto-filled for the concerned tax period and determines the tax liability.

Once you have followed the steps mentioned above, you can print a copy of the invoice. Note that the e-Invoicing system only goes further with the invoices on IRP in an electronic format.

How does e-Invoicing Curb Tax Evasion?

e-Invoicing under GST helps prevent tax evasion in many ways. Here we have listed the functions of e-invoice in GST that keep tax evasion at bay:

- The mandated generation of e-invoices through the GST portal enables all information to get auto-filled and transferred in real-time. This offers tax authorities direct access to all transactions.

- As invoices are generated before any transactions, any invoice manipulation is strictly and successfully curbed, reducing all chances of fake GST invoices.

- e-Invoice cuts the chances of fake practices in GST invoices and only allows a genuine input credit tax to be claimed, given that all the invoices have to be generated via the GST portal. Matching input credits and output tax details also enable GSTN to monitor fraudulent tax credit claims.

How is the Current System of e-Invoice Generation?

Currently, businesses can generate invoices via diverse software, and the information associated with these invoices is uploaded manually in the GSTR-1 return. After the suppliers successfully file GSTR-1, the invoice details are conferred in GSTR-2A, which can only be viewed by the recipients. On the flip side, it is mandatory for transporters or consignors to generate e-way bills manually by importing invoices in excel or JSON format.

The procedure for generating and uploading the details of an invoice is still the same under the e-invoicing system. Whether directly or with GSP assistance, this can be done with the help of an excel tool, JSON, or through API integration. Overall, the e-invoicing process offers a seamless and transparent flow in both GSTR-1 preparation and e-way bill generation.

What are the mandatory fields of an e-invoice?

e-Invoice in GST comprises both mandatory and optional fields. As of July 30, 2021, the CBIC notified via Notification No.60/2020 that the e-invoice format includes 12 sections and 6 annexures, making up 138 fields in total.

Out of the total 12 sections and 6 annexures, 5 sections and 2 annexures are mandatory. While the five compulsory sections include supplier and recipient information, details of invoice items, documents, and basic details, the two annexures comprise item details and documents.

Check out the complete list of the mandatory fields below:

- Type of document (INV/CRN/DBN).

- Supplier and buyer’s legal name as per PAN card.

- Supplier and buyers’ alphanumeric GSTIN.

- Supplier and buyer’s address and location mentioning flat number, street, state, city, pin code, etc.

- Sequential number pertaining to business to identify the invoice. For example: Sa/2/2020.

- Original details of the preceding invoice, including date and reference number.

- Date of invoice generation in DD/MM/YYYY format.

- Invoice reference number (IRN).

- Shipping details, including GSTIN, address, location of the person the product is being shipped to.

- Dispatch details, including the name, location, and address of the entity.

- Select Y(yes)/N(no) for mention of the supply service.

- Supply type code to identify its type as in B2B, B2C, SEZ supply, etc.

- Relevant description of the supplied item or service and its price without applied GST.

- HSN Code, assessable value, and GST rate.

- IGST value, CGST value, and SGST value.

- Total billable amount with GST.

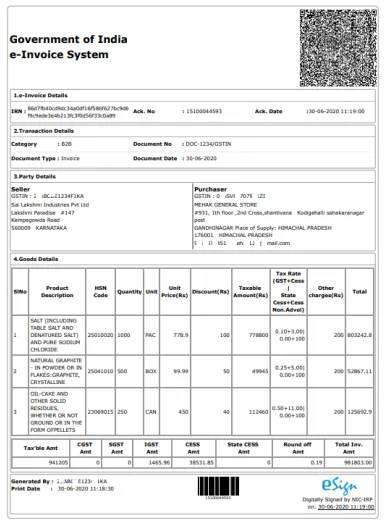

What does an e-invoice under GST look like?

Take a look at the image below to understand the format of an e-invoice GST thoroughly.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ)

What are the Different modes of registering e-invoices on the IRP?

Web, API, GSP are the three online modes of registering e-invoices on the IRP. However, one can register offline as well.

Which Supplies do e-invoicing under GST cover?

e-Invoicing under GST covers B2B and SEZ supplies, exports, and deemed exports.

Do we need to report commercial or financial credit notes to the IRP?

No. The IRP accepts only those credit and debit notes generated under Section 34 of the CGST or SGST Acts.

How many line items do per e-invoice support?

Per e-invoice allows the inclusion of a maximum of 1000 line items.

Can a business brand logo be used on an e-invoice?

No. There is no placeholder for a company logo in the e-invoice scheme. Even if you use the same in its accounting software, the IRP will not receive it.