Form 26AS is a tax credit statement and one of the most important documents related to income tax return filings. The days of manually downloading Form 26AS are long gone, owing to the new and improved income tax portal. The income tax authorities have also made numerous changes in the Form 26AS itself to include more details.

The extent of this form has also been expanded to include other details like refund details, foreign remittances, mutual fund purchases, dividends, etc. In this blog, we will look at the scope of the new form to learn what all is included in it and how we can download and submit Form 26AS online.

What is Form 26AS?

Form 26AS is an annual income tax statement that contains information regarding all the TDS transactions during the financial year. Given below are the various details mentioned in Form 26AS that make this crucial for return filing:

- Information on the TDS deducted by your employer on your salary.

- Details of taxes collected by collectors.

- Details of advance tax payments made to the income tax authorities.

- Details of self-assessed tax payments.

- Regular assessment tax paid by taxpayers.

- Details of all income tax refunds received in the financial year.

- Details of high-value transactions related to shares, mutual funds, return on investments, etc.

- Other details like dividends, interest received on income tax refunds, salary breakup, off-market transactions, and foreign remittances.

3 Major Reasons Why Form 26AS is Important

Given below are 3 crucial reasons that make Form 26AS so important:

- Through Form 26AS, you can cross-check the TDS statement to verify if the deductor has provided accurate details about the TCS.

- You can also check if the tax collected on their behalf has been deposited with the income tax department.

- In Form 26AS, you can even find the tax credit details to calculate the actual due amount before filing the income tax return.

How Can You View Form 26AS Online?

You can view your Form 26AS on the TRACES portal and also download the same. However, you will have to make sure that your Form 26AS is linked with your PAN. You can also use the net banking facility of your bank to view the Form for FY 2008-09 onwards.

This facility is made available to PAN-holding taxpayers having a net-banking account with an approved bank. Given below is the list of NSDL registered banks which provide the facility of viewing Form 26AS:

- Axis Bank Limited

- Union Bank of India

- Bank of India

- Karnataka Bank

- State Bank of India

- City Union Bank Limited

- Bank of Baroda

- Indian Overseas Bank

- Kotak Mahindra Bank Limited

- IDBI Bank

- UCO Bank

- Corporation Bank

- State Bank of Mysore

Structure and Parts of Form 26AS

In this section, we will take a look at the format and all the components of Form 26AS. Given below are the different parts of this tax credit statement in brief:

- Part A: This section has details of TDS during the financial year.

- Part A1: Details of TDS from Form 15G/Form 15H.

- Part A2: Details of TDS charged for the sale of immovable property.

- Part B: This section has the details of all TCS for the financial year.

- Part C: Comprise details of tax payments other than TDS or TCS.

- Part D: Provides information on income tax refunds.

- Part E: Has details of any high-value financial transactions.

- Part F: Shows TDS charged on the sale of immovable property.

- Part G: Contains details of any TDS processing defaults.

Now let’s take a look at the format of the different parts of this form:

Part A: Details of Tax Deducted at Source

Part A of Form 26AS reflects all the details of any tax deducted at source on the taxpayer’s salary, income earned from interest, pension income, prize money, etc.

The TDS deducted amount and the TAN of the deductor are also mentioned on the form. This form is updated as per the information provided quarterly.

Part A1: Details of Tax Deducted at Source for Form 15G or Form 15H

This part of the form reflects all the income details for which there has been no TDS deduction. You can also cross-check the status of the TDS deducted. If no Form 15H or Form 15G has been submitted, this part will display ‘No Transactions Present’.

Part A2: Details of TDS on Sale of Immovable Property

This part of the form is only applicable if the taxpayer has sold some property in the financial year, and there was a TDS deduction for the same. The entries regarding such transactions will be listed here.

Part B: Details of TCS

This part of the form contains all the information of the tax collected at source (TCS) by the seller during the transaction. If you are a seller who has collected TCS, then its entries will be available in this section.

Part C: Details of Tax Paid That is not TDS or TCS

Entries on your self-assessment tax payments during the financial year will be available in this section. Here, you will also get all Challan details used to deposit the payments.

Part D: Details of Income Tax Refunds Received

This section of the form will reflect information regarding any income tax refund received during the year. It also contains details like amount paid, interest paid on the amount, assessment year, date of payment, and mode of payment.

Part E: Details of High Value Transactions

As per the Income Tax Act, banks and other financial organizations are required to report any high-value transactions to the income tax authorities. Transactions related to high-value mutual fund purchases, corporate bonds, property purchases, etc., are mentioned here.

Part F: Details of TDS on Sale of Immovable Property

When buying a property, the taxpayer is required to deduct TDS on the transaction before making the payment to the seller. This section reflects the details of TDS deducted and deposited by the taxpayer.

Part G: Details of TDS Defaults

This part of Form 26AS shows all the details of defaults relating to TDS statement processing. However, the demands raised by the assessing officer are not present in this section.

What’s in the New Form 26AS?

Before the latest update, the scope of Form 26AS was extended in the annual budget in 2020. In accordance with the same, updates were made in the Form to include tax refunds and demands, completed and pending assessment proceedings, specific financial transactions, etc.

An Annual Information Statement (AIS) was released by the income tax authorities to integrate the new components like off-market transactions, interests received from income tax returns, salary break-up details, foreign remittances, and ITR information of the other party.

According to the AIS, the new Form has been divided into Part A and Part B. Let’s take a look at the components of the new Form 26AS:

Part A

Part A of the new Form 26AS has some basic details like the taxpayer’s name, PAN card details, Aadhaar number, mobile number, email address, correspondence address, etc.

Part B

This part of the form contains information regarding the type of transactions as mentioned below:

- TDS or TCS details.

- Details of specific financial transactions.

- Information on self-assessment tax payment.

- Details of any income tax demand or refund.

- Information regarding any completed or pending proceedings.

Benefits of the New Form 26AS

Given below are some of the benefits of the new Form 26AS:

- The AIS is used for data collection and provides pre-filled ITR to the taxpayers. This data pre-filling process is planned in phases by the income tax authorities. This is going to make the ITR filing process a lot easier.

- The income tax authorities are also working towards removing duplication of information or errors. The AIS has introduced an innovative feature of submitting online feedback in case of any mismatch information. You can even upload offline feedback for the same.

- The new Form 26AS ensures all details are integrated into one statement. Additionally, as a taxpayer, you will also have the feature to report any error and ask for coercive action.

- The new Form also makes things a bit easier for the income tax authorities. The authorities can now easily compare the information provided by the taxpayer with the one from the source and quickly identify any mismatch of information.

What is the Form 26AS Download Process?

Check out the step-by-step Form 26AS download process below:

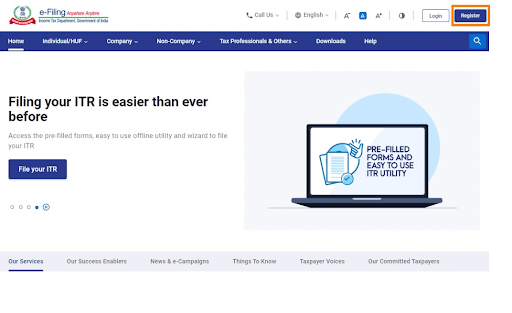

Step 1: Visit the official income tax portal.

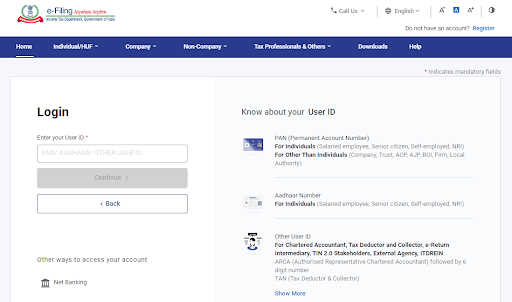

Step 2: Login using your User ID (Aadhaar number, PAN, or any other user ID). You can also access your account via net banking.

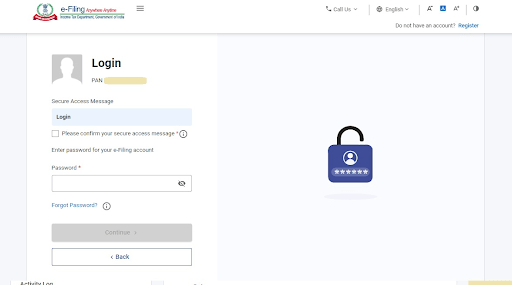

Step 3: Select the checkbox to accept the secure access message. The secure access message by default will be ‘Login’. This helps in authenticating anyone who accesses the income tax website.

As a taxpayer, you can even choose your own unique secure access message. Enter a password and click on ‘Continue’.

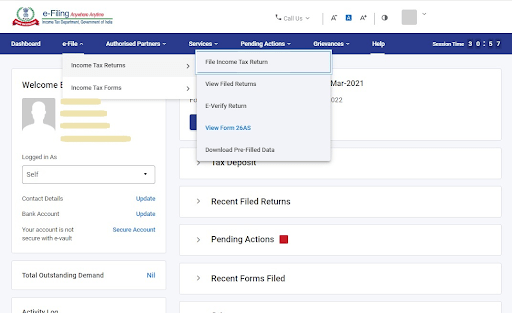

Step 4: Click on the ‘Income Tax Returns’ option under the ‘e-file’ tab on the menu and click on ‘View Form 26AS’ from the resulting dropdown.

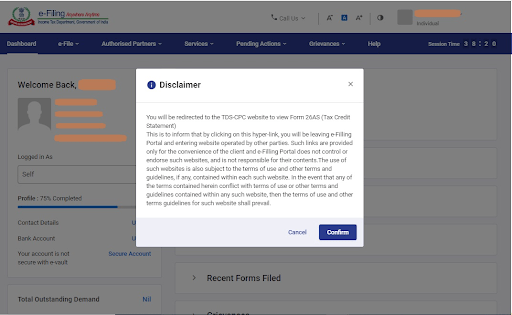

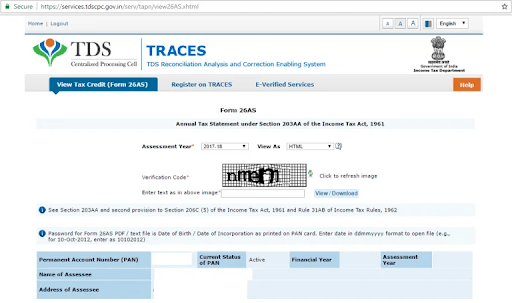

Step 5: Once you click on the disclaimer confirmation, you will be redirected to the TRACES website.

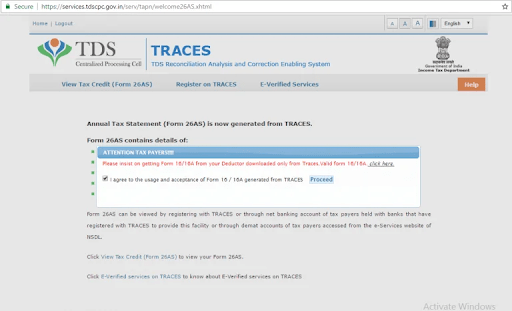

Step 6: In the TRACES website, select the box on the screen and click on ‘Proceed’ to continue.

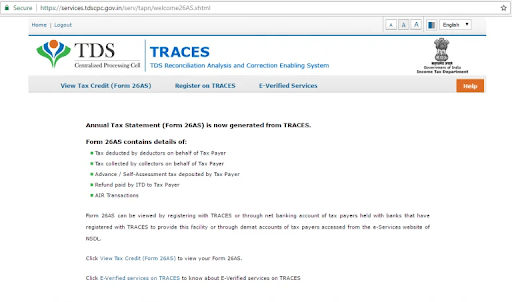

Step 7: Click on the ‘Click View Tax Credit (Form 26AS) to view your Form 26AS’ hyperlink present on the bottom of the page.

Step 8: Select the relevant assessment year and the preferred format to view the Form 26AS. Choose ‘HTML’ if you wish to view the form online.

You can also download Form 26AS in PDF format. Verify the captcha and click on ‘View/Download’.

Step 9: After the download is complete, click on the file to view your Form 26AS.

Submitting Form 26A/27BA Online

Given below is the step-by-step process of submitting Form 26A/27BA online:

Step 1: Visit the TRACES website.

Step 2: Click on the ‘Request for 26A/27BA’ under the ‘Statement/Payments’ tab.

Step 3: The guidelines for submitting the form will then appear on the screen. Go through them carefully and click on ‘Proceed’.

Step 4: Select the financial year, form type, transaction type, and select ‘Proceed’.

Step 5: You will now get a request number for the form. Click ‘Go to Track Request for 26A/27BA’.

Step 6: You will now be able to see the requests made by you. You will get the option of uploading a file if you have raised a request for Non-Deduction/Collection.

Step 7: Click on the ‘Download’ option under the ‘Requested Download’ tab.

Step 8: Proceed to download the form.

Step 9: Confirm the verification code and click on the ‘Submit’ button.

Step 10: All the files will be downloaded in WinZip format. Extract the files and add relevant information.

Step 11: Click on the ‘Upload Files’ option under ‘Status’.

Step 12: Enter the verification code.

Step 13: After clicking on ‘Upload’, enter your digital signature and I-PIN to complete the verification process. Once the verification is complete, you will receive a confirmation from TRACES.

Step 14: Navigate back to ‘Go to Track Request for 26A/27BA’. The status of the form will be reflected as ‘Submitted’ there.

Step 15: The request will be sent for ‘E-filing’ after successful validation.

Cross-Checking Your TDS Certificate with Form 26AS

Given below are the most essential factors that you must cross-check in your TDS certificate with Form 26AS:

- Make sure that all the basic PAN holder details mentioned in Form 26AS are correct. Verify information like PAN, name, refund amount, deductor’s TAN, and TDS amount. This is an important step, as any discrepancy in the details will lead to difficulty in return filing.

- Compare the 26AS data with your payslips to confirm that your TDS amount, as stated in the certificate, has been deposited with the Central Government.

- Verify that the TDS stated in your Form16 or Form 16A is also the same as in your Form 26AS. The amount will not reflect in the form if the deductor has not submitted the amount with the Income Tax Department. In such cases, get in touch with the deductor to rectify the issue at the earliest.

Frequently Asked Questions (FAQ)

What are the TDS-related forms that the taxpayer needs to submit?

In part A1 of this form, you have details about your income in cases where TDS has not been deducted, when you have submitted Form 15G or Form 15H.

What if the amount of advance tax paid is incorrect in Part C of Form 26AS?

This is probably due to a data entry error by the bank. You will need to contact the bank to report and rectify this issue.

Can I make changes to the basic details present in Form 26AS?

Yes, you can always change the details in Form 26AS. You can do so by submitting a formal application through the ‘Request for new PAN card or/and changes or correction in PAN data’ tab on the website.

What is the password for Form 26AS?

The password for accessing Form 26AS is the taxpayer’s date of birth. For instance, if the DOB is 27/05/1992, then the password will be 27051992.

What are the transaction date and date of booking in form 26AS?

Transaction date stands for the date of payment or credit, depending on which is earlier. The date of booking is the date on which the TDS return was processed and booked. This is usually the date after the TDS has been filed.

When is TDS reflected in Form 26AS?

The TDS is reflected in Form 26AS after the TDS return is filed by the deductee, and the same has been processed by CPC. This usually takes around 7 days.

When does Form 26AS get updated?

This form gets updated when the TDS returns have been processed by the CPC. Thus the last day for filing TDS for the 4th quarter is 31st May. An additional 7 days are taken to process the TDS return filed.