The GSTR 2A is a tax return related to purchases, which is automatically generated by the GST portal for every registered business. This return is generated and auto-populated on the basis of the information provided in GSTR 1, GSTR 5, GTSR 6, GSTR 7, and GSTR 8 as filed by the suppliers. In this blog we will talk about the GSTR 2A return in detail and look at how to file it. Let’s begin!

Table of contents

What is GSTR 2A?

GSTR 2A is a dynamix GST return that is related to the purchases made by a business in a financial year. This return is automatically generated for every registered business by the official GST portal. When GSTR 1 is filed by the seller, the information automatically reflects in the GSTR 2A form. The information of the goods/services purchased in the financial year are taken from the supplier’s GSTR 1 for the GSTR 2 A return. The GSTR 2 A can also be used as a reference for details of input tax credits for filing GSTR 3B and GSTR 9. The GSTR 2 A will be auto-filled by the below given returns of the seller:

- GSTR 1- for casual registered seller

- GSTR 5 – for registered non-resident seller

- GSTR 6 – for input service distributor

- GSTR 7 – for individual liable to charge TDS

- GSTR 8 – for e-commerce operators

What is the Difference Between GSTR 2A and GSTR 2B?

The following table illustrates the difference between GSTR 2A and GSTR 2B:

|

Basis of Comparison |

GSTR 2A |

GSTR 2B |

| Purpose | This is an auto-drafted return that provides details of input tax credits to the recipient of supplies. This is generated on the basis of information provided by the supplier. | This is a constant auto-generated statement that provides details of input tax credit to every registered person receiving supplies. |

| Nature | This statement is subject to change on a daily basis, and when the information is provided by the supplier. | This statement is static as the GSTR 2B of a particular month is not affected by the events taking place after |

| Frequency | Monthly | Monthly |

| Source of Details | GSTR 1, GSTR 5, GSTR 6, GSTR 7, GSTR 8, and ICES | GSTR 1, GSTR 5, GSTR 6, and ICES |

| Advisory Related to Input Tax Credit claims | Does not have any guidelines regarding the actions to be taken by a buyer | There are guidelines on each section regarding whether ITC is applicable, reversible, or ineligible |

| When are ITC entries transferred | The ITC entries are transferred when:

GSTR 1 is saved, filed, or submitted. GSTR 6 is submitted. GSTR 7 and GSTR 8 are filed. |

When GSTR 1, GSTR 6, or GSTR 5 is filed. |

| Due Date | There is no due date as it is a dynamic statement | Depending on the frequency of filing, it can be due on either 11th or 13th of the next month. The statement is generated on the 14th of the next month |

| Maximum ITC entries that can be viewed without downloading | Upto 500 rows | Upto 1000 rows |

How to File GSTR 2A

Since GSTR 2A is an auto-generated read-only document, you are not required to file it. It contains the details of invoices from the sales during the month.

What if the Seller Does Not Upload Invoices or Delays GSTR 1?

If the details of the invoice are not uploaded by the seller, then the same will not reflect in the GSTR 2A for the month. The buyer can bring the same to the notice of the supplier, and ask them to upload the invoices. Effective August 2020, every buyer is required to refer to form GSTR 2B for the details of input tax credit available during the tax period.

Nevertheless, an input tax credit can be claimed on a provisional basis by the buyer via GSTR 3B. This can be upto 5% of the eligible tax credit according to GSTR 2B.

Comparing GSTR 2A and GSTR 3B

The Form GSTR 3B is basically a monthly summary return submitted by a registered taxpayer on or before the 20th of the succeeding month. Taxpayers are eligible for Input Tax Credit on the basis of details declared in Table 4 of the GSTR 3B form.

GSTR 2A is an auto-filled form that contains the details of all the outwards supplies as declared by the seller. This is automatically generated on the recipient’s login.

Syncing GSTR 3B and GSTR 2A or GSTR 2B: When the GSTR 1 for a particular month is filed by a supplier, the details are captured in the buyer’s GSTR 2 A and GSTR 2B. Which is why it is important to make sure that the amount of ITC in Table 4(a) is the same as disclosed in GSTR 2A or GSTR 2B. The following are some of the reasons it is important to integrate GSTR 3B with GSTR 2A or GSTR 2B:

- A notice has been issued by GST authorities to many taxpayers, instructing them to reconcile GSTR 2A or GSTR 2B with GSTR 3B. Notices of this nature are issued in the GST AMT-10 form. The taxpayer must reply to such notices or pay the due amount.

- Strict actions have been levied against fraudulent ITC claims on the basis of fake invoices

- By reconciling the three forms, the authorities can make sure that every tax credit being claimed is only with respect to tax which has actually been paid

- Ensures the integrity of recording the invoices

- In case the supplier’s GSTR 1 does not record the outwards supplies, then the buyer can request the supplier to fix the discrepancy

- Any errors made during filing GSTR 1 or GSTR 3B can be fixed

The following are some of the reasons form GSTR 3B and GSTR 2A or GSTR 2B may not be reconciled:

- GST credit charged on RCM

- IGST credit on import of services

- IGST credit claimed on import of goods

In the above mentioned cases, the details will not be reconciled as the GSTR 1 form has not been filed by the supplier or the Input Tax Credit is being claimed later on.

Differences in GSTR 3B and GSTR 2A or GSTR 2B: Keeping the above situations in mind, if there are any discrepancies in GSTR 1 and GSTR 3B which leads to extra ITC being claimed by the recipient, the same has to be paid by the taxpayer along with interest. Therefore, it is necessary that this reconciliation is done regularly.

Reconciling during Annual Return filing: Reconciliation is to be done in Table 6 and 8 according to GSTR 3B and GSTR 2A.

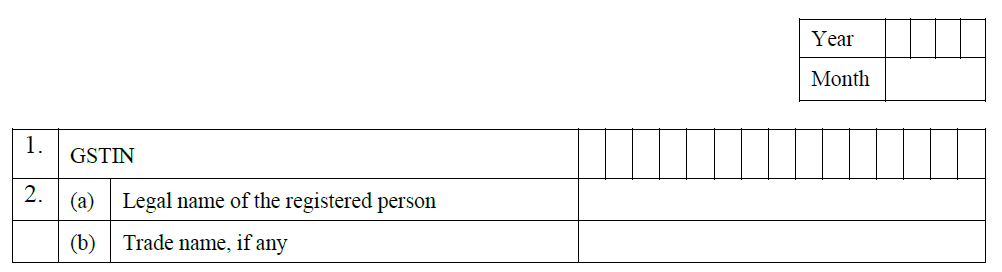

Details of Form GSTR 2A

The format of GSTR 2A as prescribed by the government has 7 headings. The following are the details to be mentioned in each section of GSTR 2A:

- GSTIN: this section reflects the dealer’s GSTIN.

- Name of the Taxpayer: This section is for the legal and trade name of the taxpayer

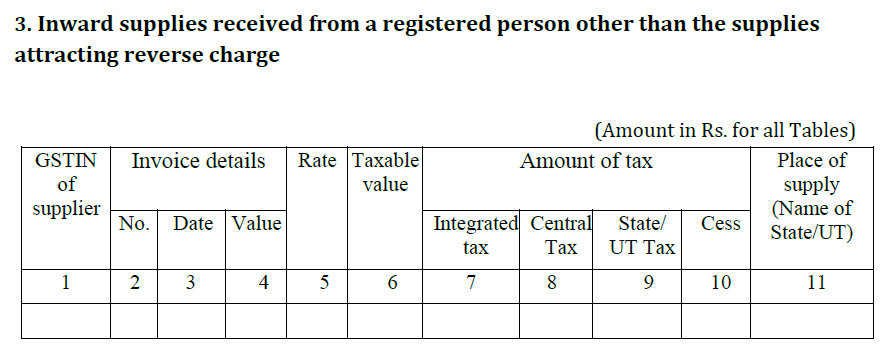

PART A

- Details of inwards supplies except supplies eligible for reverse charge.

The details here will be auto-populated based on the GSTR 1 filed by the supplier. It will contain the details like type and rate of GST, eligible Input Tax Credit, GST amount, and ITC amount.

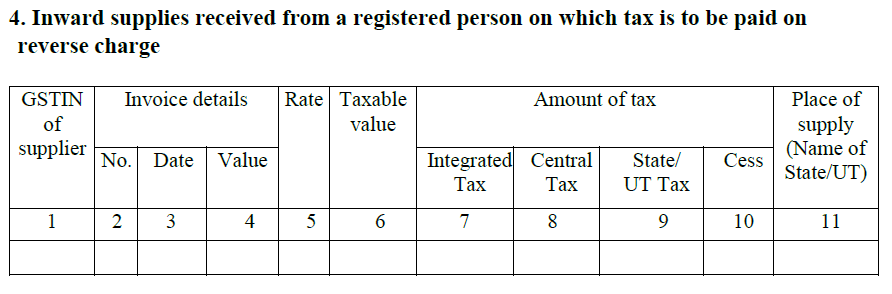

- Inwards supplies from a registered taxpayer on which reverse charge tax is to be paid. This will contain supplies and purchases for which GST under reverse charge is applicable.

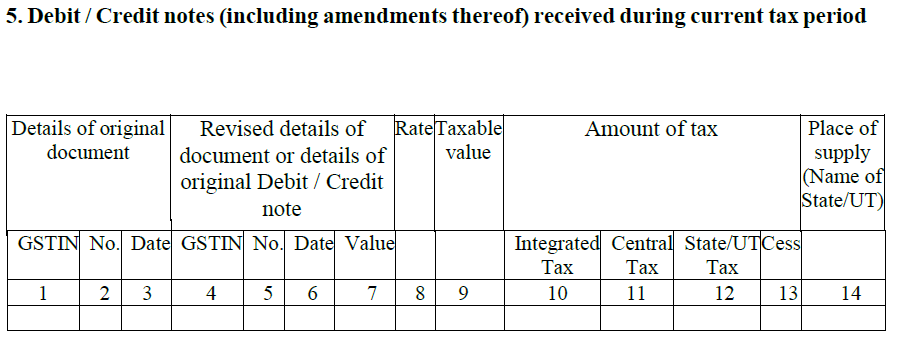

- Details of inwards debit/credit notes. This will reflect details of the credit and debit notes issued by the supplier during the financial month.

PART B

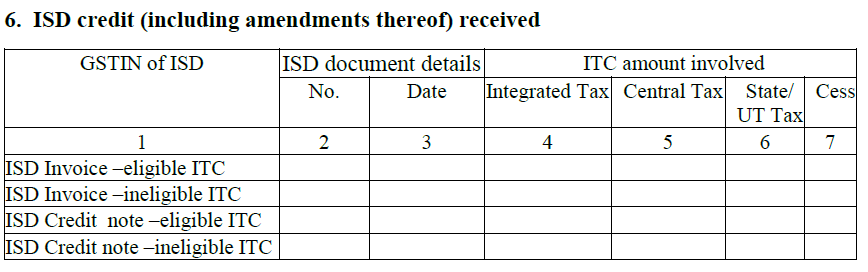

- Details of any inwards ISD credit and any amendments regarding the same. If the taxpayer is a branch, then the details in this section will be auto-filled whenever the GSTR 6 is filed by the head office.

PART C

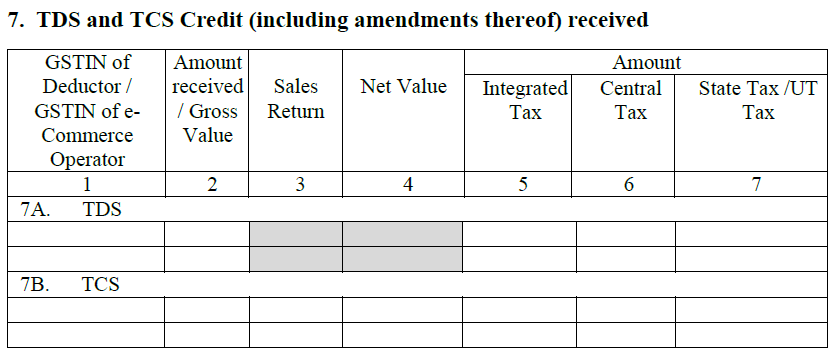

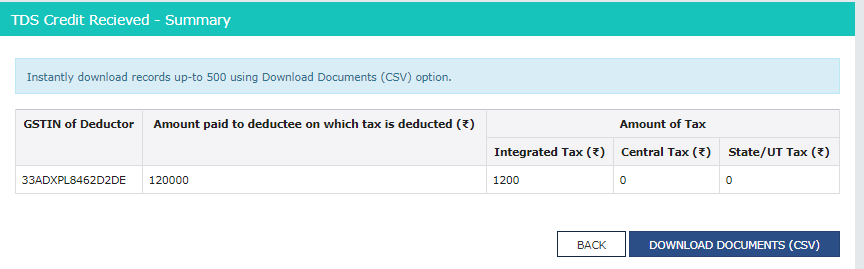

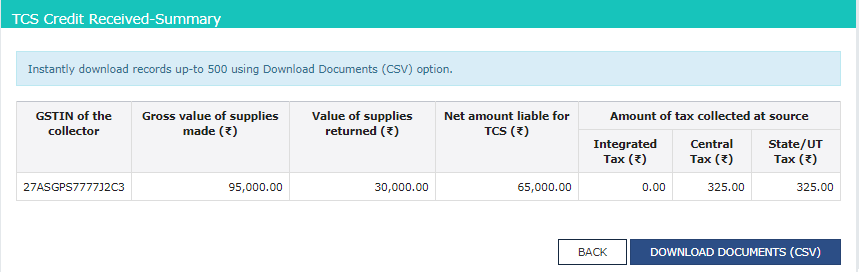

- Details of TDS and TCS credit received.

TDS Credit Received: This section is only applicable when the taxpayer is involved in specific contracts with specified people. The recipient deducts a certain percentage of the amount with respect to TDS. The information here is auto-filled from deductor’s GSTR 7.

TCS Credit Received: This section is applicable only for online suppliers registered with e-commerce suppliers. The e-commerce suppliers need to collect tax while making payments to such sellers. The details here get auto-filled from GSTR 8 of the e-commerce operators.

How to View GSTR 2A?

The following is the step-by-step process to view your GSTR 2A on the GST portal:

Step 1: You need to login to the GST portal.

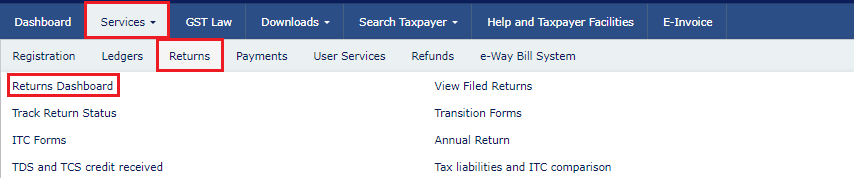

Step 2: Click on the ‘Services’ tab. Then click on ‘Returns Dashboard’ under the ‘Returns’ tab.

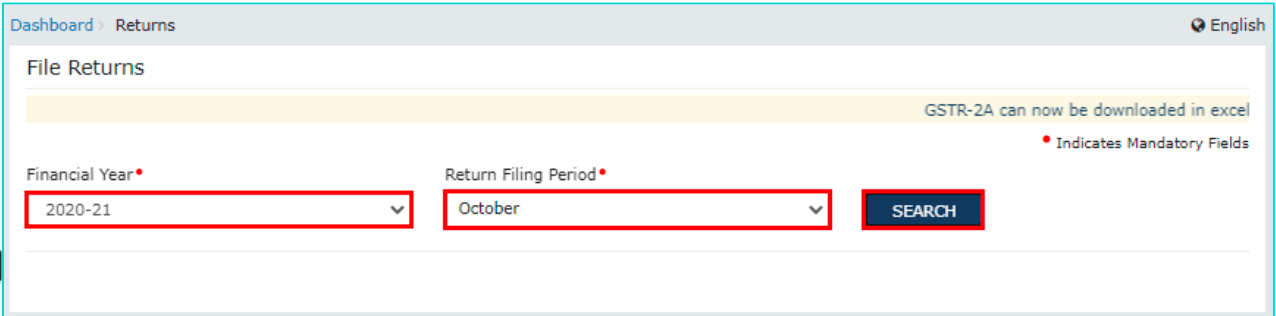

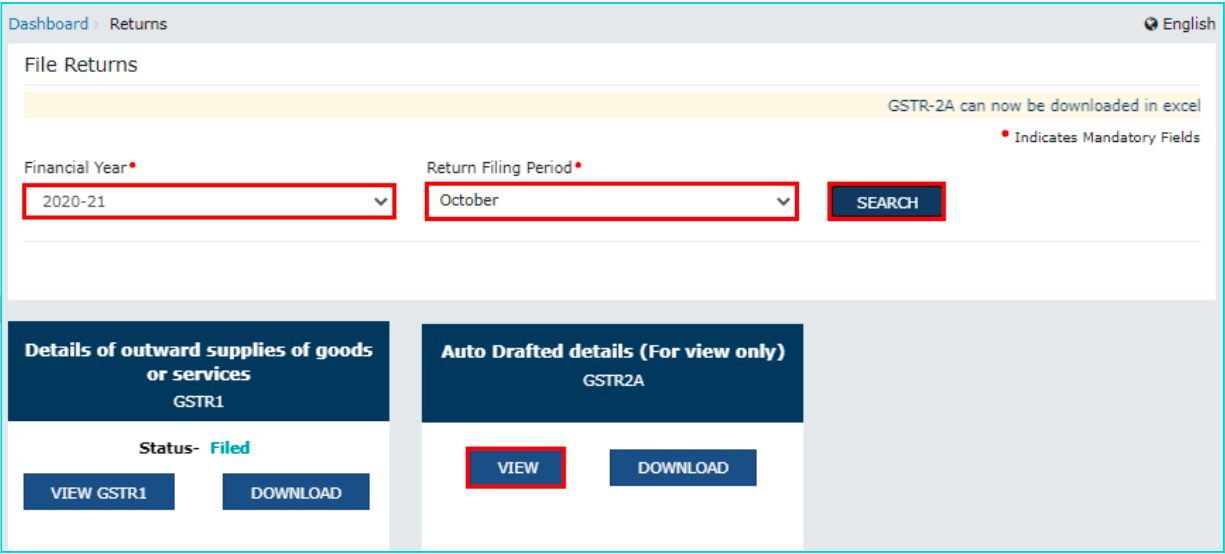

Step 3: Here you need to select the relevant details from the drop down like Financial Year and Return Filing Period. Then click on the ‘Search’ button.

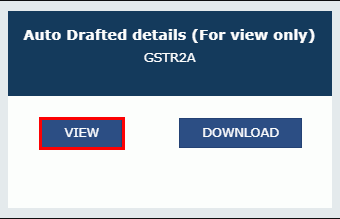

Step 4: Then select the ‘View’ option in the GSTR 2A tile.

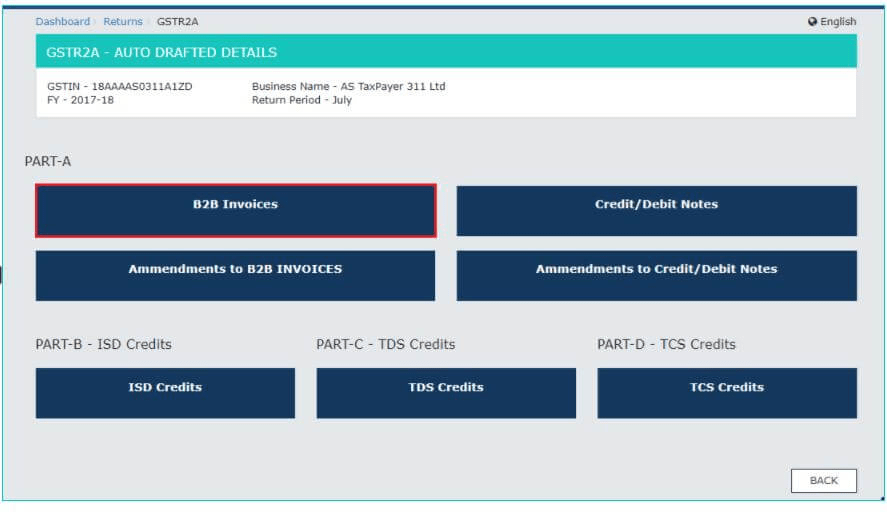

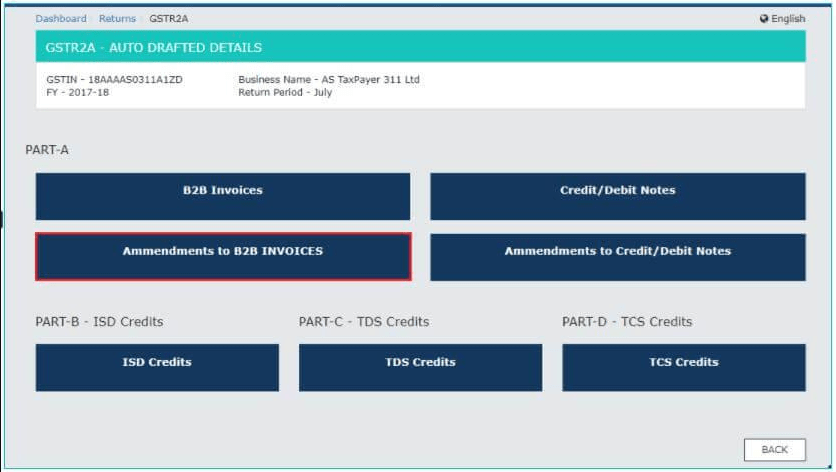

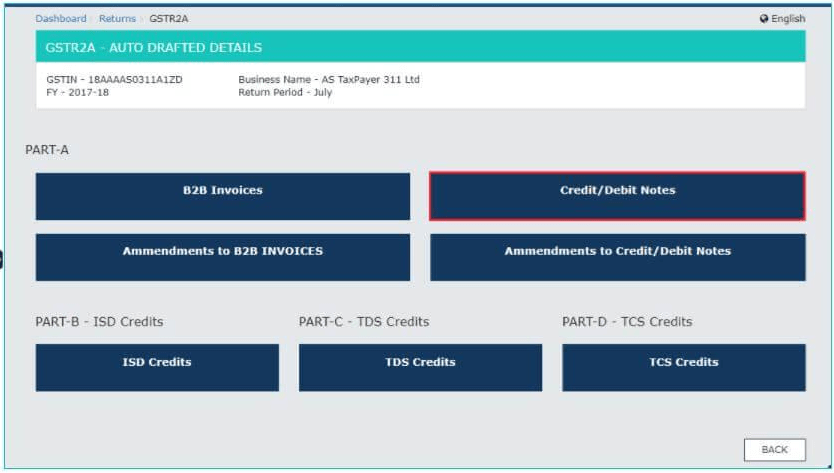

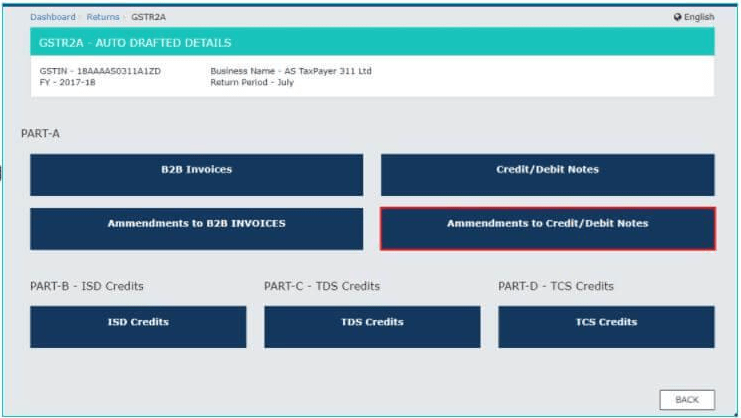

Step 5: GSTR 2A: the auto-populated information will be displayed here.

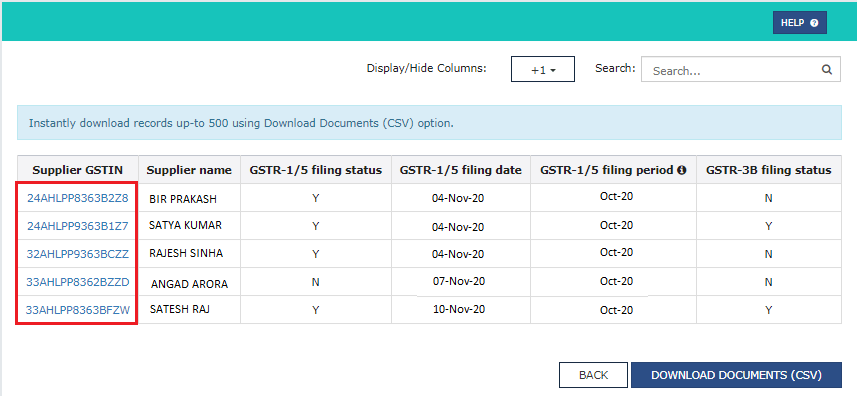

Step 6: Click on B2B invoices under Part A. The details on this page will be auto-filled based on the supplier’s GSTR 1.

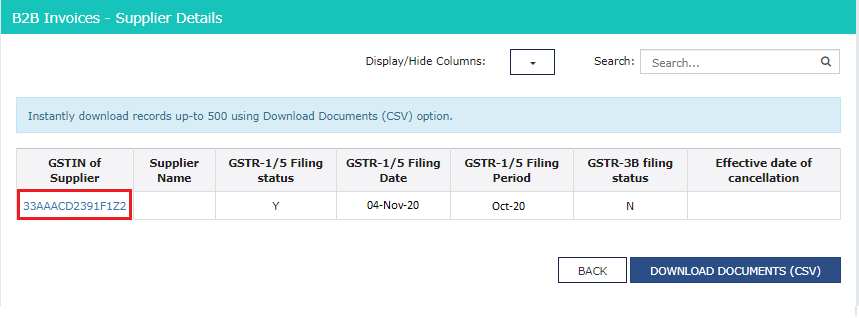

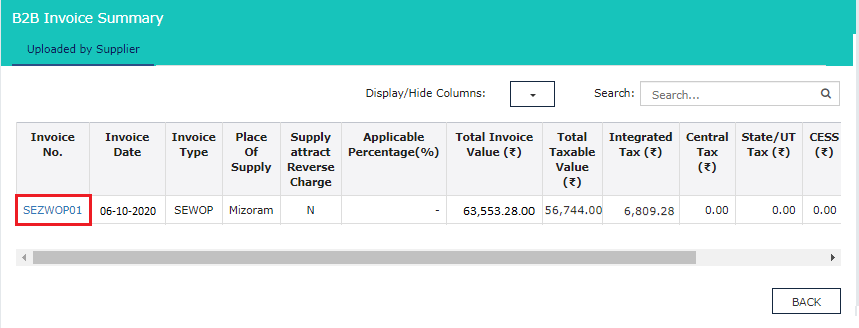

Click on the GSTIN to view the invoices uploaded by the seller.

Step 7: Part A< Amendments to B2B Invoices displays the invoices that have been changed by the suppliers in their GSTR 5 or GSTR 1.

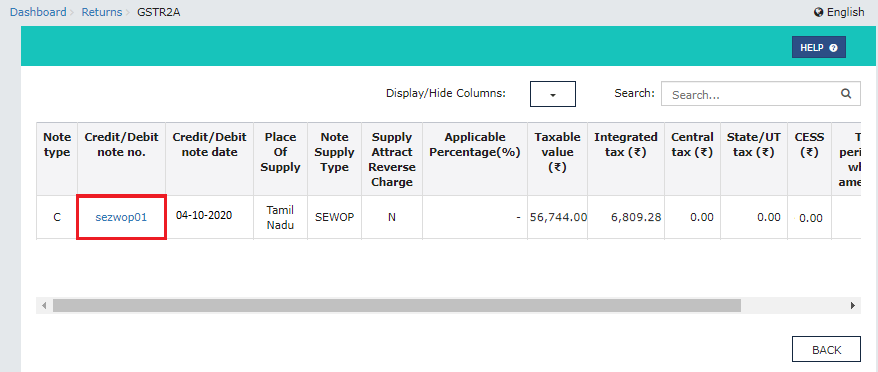

Step 8: The next section is the Credit and Debit Notes in Part A. This has the details of all the credit/debit notes added by the supplier. Click on each tile to view the details.

Step 9: These have the details of any changes made to the credit/debit notes under Part A. Click on each tile to see the supplier wise details of changes.

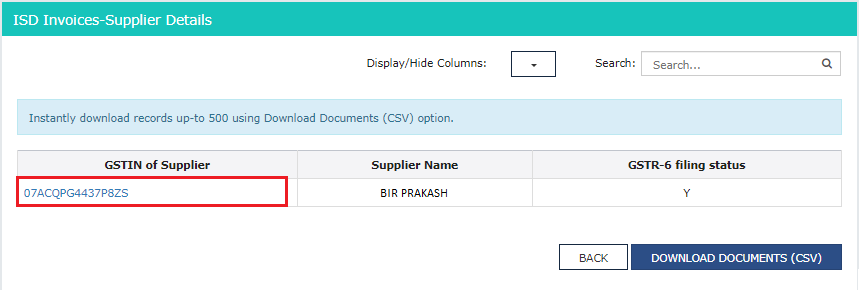

Step 10: The next tile is for the ISD credits under Part B. The information in this tile is auto-filled on the basis of GSTR 6 filed by the Input Service Distributor.

Step 11: This tile under Part C of GSTR 2A is for TDS credits. This tile gets auto-filled on the basis of the GSTR 7 filed by the dealers collecting TDS.

Step 12: TCS Credits under Part C is the next part of the form. This has all the information regarding TCS collected by dealers. The information is auto-filled in this part based on the form GSTR 8 filed by the dealer collecting TCS.

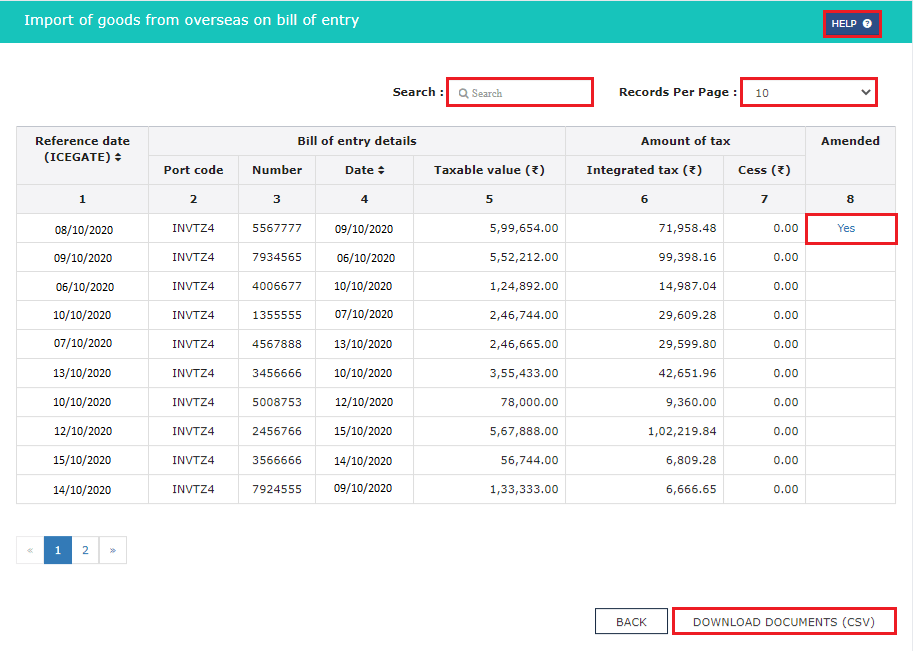

Step 13: Part D of the form has details of all the import of goods and services.

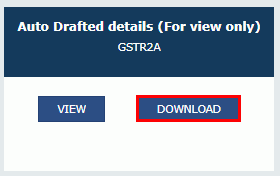

Downloading GSTR 2A

If there are more than 500 invoices, then the taxpayer has to download GSTR 2A. In order to be able to use the file, you will need the GST offline tool. The following is the step-by-step process to download the form:

Step 1: On the GSTR 2A tile, click on the ‘Download’ button.

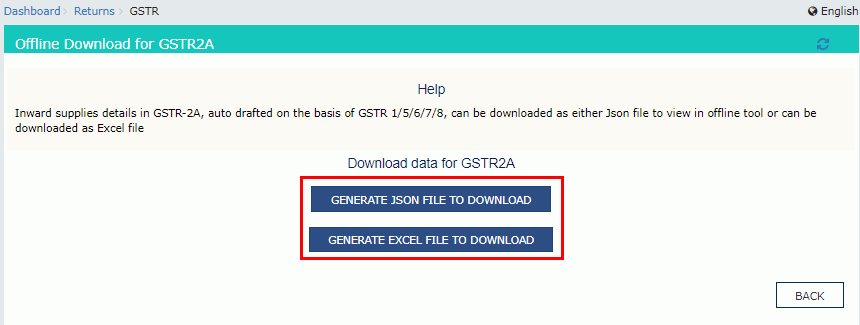

Step 2: Here, click on either ‘Generate JSON file to download’ or ‘Generate an excel file to download’. You will need the Returns Offline Tool to use the JSON file.

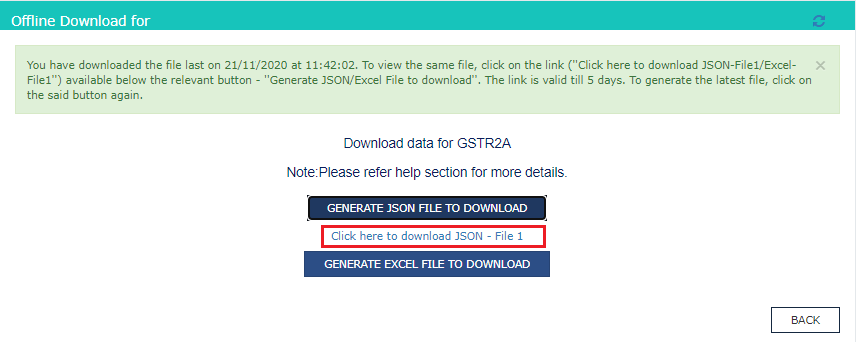

Step 3: A link saying ‘Click here to download JSON-File 1’ will appear. Click on it to download the file.

You May Also Read:

Frequently Asked Questions (FAQs)

What is GSTR 2A reconciliation?

GSTR 2A reconciliation is matching the information in form GSTR 2A to the data of the purchase records of a business.

What is the due date for GSTR 2A?

Since the GSTR 2A is an auto generated form, you are not required to file it.

What is a credit note in GSTR 2A?

A credit note is a document issued when the actual taxable value is less than what was declared by the supplier in the tax invoice.

What is ITC as per GSTR-2A?

The amount of tax paid on the purchase of goods and services under reverse charge is called Input Tax Credit (ITC). This can be reduced while paying tax for outgoing goods and services.

What is GSTR 2A due date?

Since GSTR 2A is a dynamic auto-generated document, there is no due date for filing the same.