The government accepted the Goods and Services Tax regime with the idea of “One Nation – One Tax – One Market”. With a number of advantages, this type of administration has an eminent role in eradicating the chances of tax evasion practices and bribery along with several other kinds of corruption-driven activities. After the GST regime, there unfold different types of GST Return Forms that have a specific service to bring forth for varying purposes. They namely go as GSTR-1, GSTR-2, GSTR-5, GSTR-6, etc. As of now, anything pertaining to the taxation rituals is accessible and doable online, unfurling things for a more feasible and transparent action, if we compare it to the former mechanics used in the tax system.

As we have a series of GSTRs to help you understand the workings of, let’s start getting to know the GSTR 6 meaning, GSTR 6 due to date, how to file a GSTR-6 form, and not to forget- who can file a GSTR-6 after all.

What is GSTR-6?

GSTR-6 is one of the GSTR Forms launched by the Government of India. It refers to a document or statement that must be filed by the Input Service Distributors every month, not unlike all the other GSTR forms in the battalion. This form features a cluster of details in the light of Input Tax Credit (ITC) received as well as the ITC distributed by Input Service Distributors. Note that a GST Returns-6 bears 11 sections in total.

Why is GSTR 6 Important?

GSTR is treated as a crucial form that needs to be filed by the eligible persons by the due date. It is important as it comprises details and information on all the documents that are issued for the distribution of ITC and the way of distribution of credit as well as tax invoice on which the credit has been received. It needs to be filed by every individual who is titled under the ISD category even when the return is put as NIL.

Key Features of GSTR 6 Return Form

The features mentioned here will help you know and understand the workings of GSTR-6 better.

- The GSTR-6 is a form that is filled by the Input Service Distributors, the ones that are enlisted under the GST (Goods and Service Tax) title.

- The form must be filed on or before the 13th of the ensuing month.

- The taxpayer is obliged to make a mention of all the details that fall in relation to the tax invoices for which the credit is received.

Who Should File GSTR-6?

The major question about this type of GSTR form is who can file the GSTR-6 form? Know that the return must be filed by Input Service Distributors. We have listed below the titles who are eligible to file this form.

- Composition dealers

- Taxpayers who are liable to get TCS

- Taxpayers who must deduct TDS

- Suppliers of Online Information and Database Access or Retrieval (OIDAR)

- The compounding taxable persons

- The non-resident taxable persons

What is ISD?

ISD or Input Service Distributor is a title given to the office that is responsible for receiving the tax invoices towards receipt as well as prescribing a document regarding the purposes of distribution of the credit for CGST/ SGST / IGST/ UTGST that has been paid on the services to the one who supplies goods and/or services.

The entire idea behind ISD is to facilitate businesses a notable share expenditure and payment or billing that is actionized from a central stance. The process is meant to reduce the previous procedure of receiving credit that was complex. It has turned out to be useful in establishing a stronger and easier flow of the entire facility.

GSTR-6 Due Date

Know that you can file a GSTR-6 for the specific month only after the completion of the concerned month. The last day to file GSTR-6 is on or before the 13th of the subsequent month. For instance, if you are filing a GSTR-6 for the month of August 2021 then, you must make sure that you do it on or before the 13th of September 2021.

What is GSTR-6A?

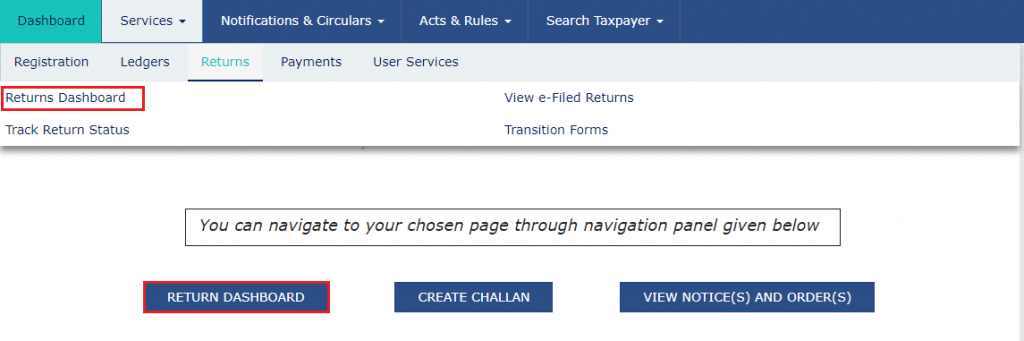

GSTR-6A refers to the auto-generated form based on which the details that are provided in GSTR-1 from the part of suppliers of ISD (Input Service Distributor). It is to be noted that you can make any changes to it. However, there are any changes that have to be made then it will only be done at the time of filing of GSTR-6. You must also note that you can easily view GSTR-6A by visiting the “Return Dashboard” that is there on the official GST portal and then clicking on the “Prepare Online” option which you will find on the GSTR-6A tab.

Where is GSTR-6 Applicable?

GSTR-6 features the group of all the details related to all documents that have been declared in favour of distribution of ITC (Input Tax Credit) among the different departments of the organization as well as of credit & tax invoice upon which the credit has been received. Know that it must be filed by each ISD even the return is NIL.

Details to be Provided in GSTR-6

Since the GSTR-6 form is elevated by tons of details, it can be a tricky side on the lane to walk into filing the form, given you may not understand the significance of these fields. We have brought you an explanation to each of the heads with the details that are required to be furnished under them.

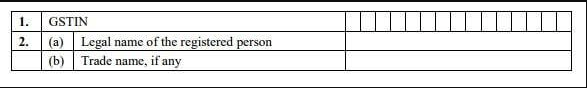

- Goods and Services Taxpayer Identification Number (GSTIN)- Here, a 15-digit GSTIN (a state-wise PAN-based number) state must be entered.

- Name of the Concerned Registered Taxpayer- This is an auto-generated field that appears when you log in to the government website for GST and input GSTIN.

- Tax period- Taxation period for which you are filing the GSTR-6 form. You have to make your pick from the drop-down menu that will be displayed on the screen.

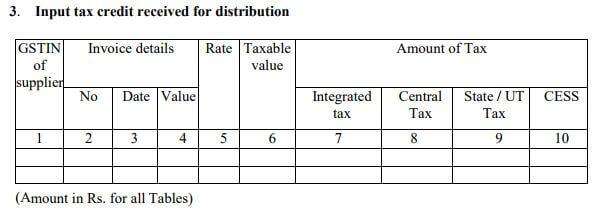

- ITC Received for Distribution- You will put in the information related to the supplies that have been received from the side of a registered person along with the amount of “Input Credit” that is available for the present tax period. The details related to the inward supply are auto-populated on the counterparty GSTR 1 and 5. You must input the amount of credit that is available for CGST or SGST or IGST.

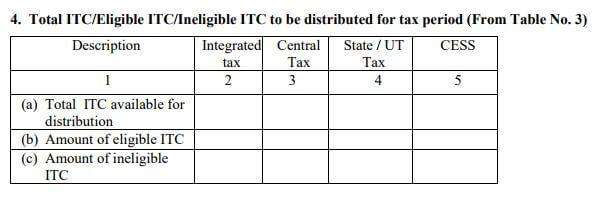

- Total ITC/Eligible ITC/ Ineligible ITC that is to be Distributed for the Taxation Period- In this table, you will have to furnish all the eligible as well as ineligible credits (CGST/SGST/IGST) wise separately from the total Income Tax Credit that is available.

- Details related to Distribution of the ITC- the Income Tax Credit, eligible/ineligible that is allocable for the respective recipient must be displayed here.

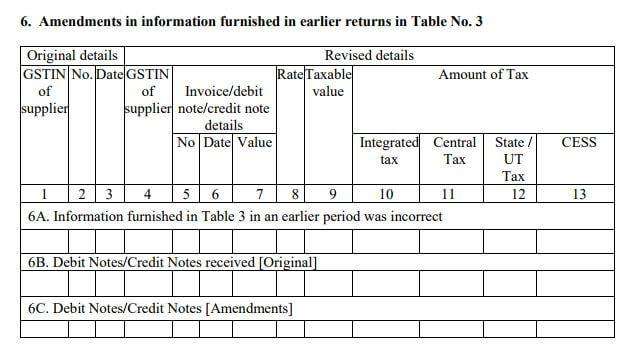

- Any changes in the Distribution Documents and debit/credit notes of last tax periods- Any amendment or correction or changes that have been made in the distribution document as well as the debit or credit note of past months have to be put under this heading.

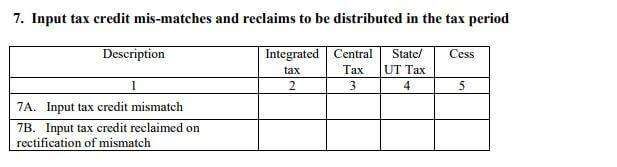

- Mismatch in ITC that must be distributed at the time of the tax period and reclaims- Under this heading, you must report “Reversal and Reclaim of ITC” and this detail will be put tax-wise among the recipients.

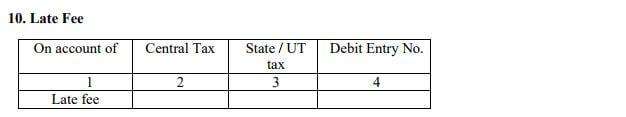

- Details of Late Fee (If any)- Here, you will mention complete details of the late fee related to the CGST/SGST/IGST account.

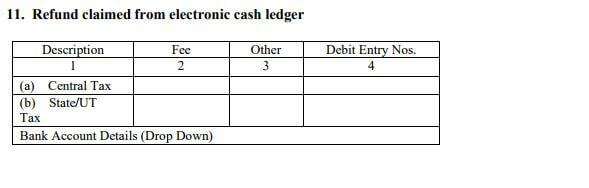

- A refund that has been claimed from Electronic Cash Ledger- If any refund is to be or has been claimed at the electronic cash ledger, then the information related to the same will be furnished under this heading with the bank details.

Step by Step Guide to file GSTR-6

Explained below are the steps to file GSTR-6 on the official GST portal quick and easy-

Step 1: Visit the official GST common portal.

Enter your “Username” as well as the “password”.

Click on the “Login” button so that you can proceed to your GST account.

Step 2: Now you will be able to view a welcome message on your screen. Proceed further by clicking the “Return Dashboard” option.

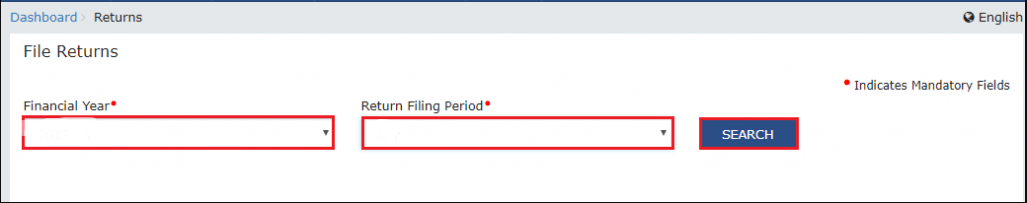

Step 3: Select the preferred “Financial Year” from the dropdown menu.

Choose the “Return Filing Period” for which you are going to file GSTR-6. Now click on the “Search” tab.

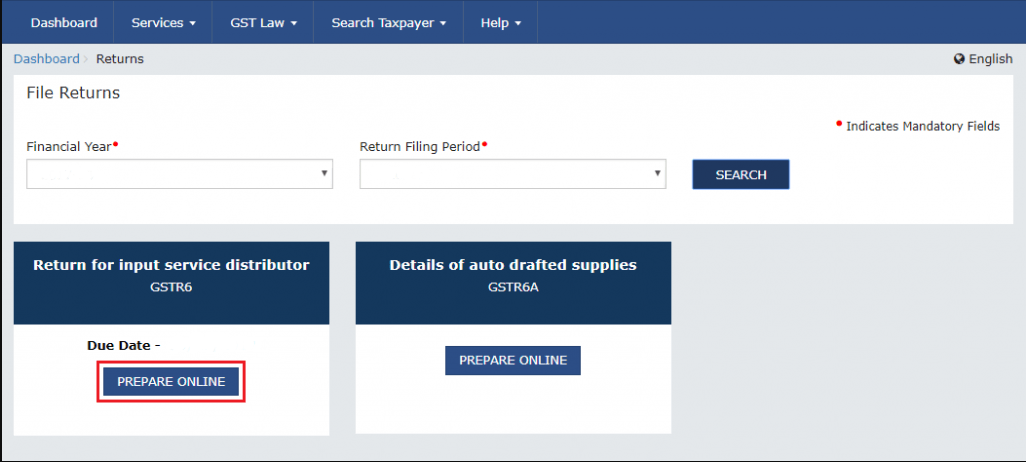

Step 4: Clicking the “Prepare Online” button.

Then select the “Return for input service distributor GSTR6 option.

On the right of your screen, you will find an option reading “Details of auto drafted supplies GSTR6A”. It refers to an auto-generated GSTR-6A which can only be viewed by the user.

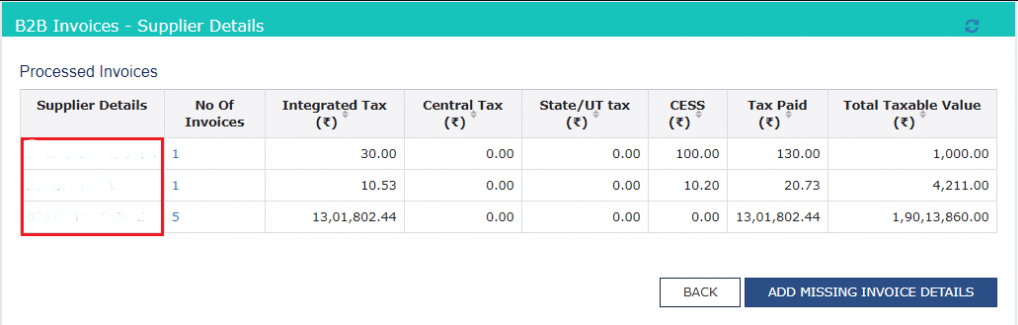

Step 5: You can now view the details related to the invoice as well as the distribution of input tax credit once you click GSTR- 6.

Step 6: Now click the “3 – Input Tax Credit received for distribution” option which you will find under the tab reading “Invoice Details”.

After this, you will be able to see a new page on your screen on which you have to hit the “Add missing invoice details” button.

Step 7: All the details such as “Supplier’s GSTIN” and “Supplier Name’ will be visible automatically and the details like “Invoice Date”, “Invoice no.”, “POS”, “Supply Type” and “Total Invoice Value” have to be furnished by the user only.

Step 8: In the next step, you must hit the “Back” option to be able to view the previous page.

There, you need to click the box reading “6B – Debit Notes/Credit Notes received” and then, click the “Add Credit Note/Debit Note” button.

Step 9: Details related to the credit note along with “Supplier GSTIN”, “Note Type”, “Debit/Credit Note No.” “Supplier Name”, “Note Value”, “Debit/Credit Note Date”, “Original Invoice No.” and “Original Invoice Date” and many others must be filled by the person himself/herself.

Once you are done with that, you need to click on the “Save” button.

Then, you will be able to go to the menu that was there in step 5.

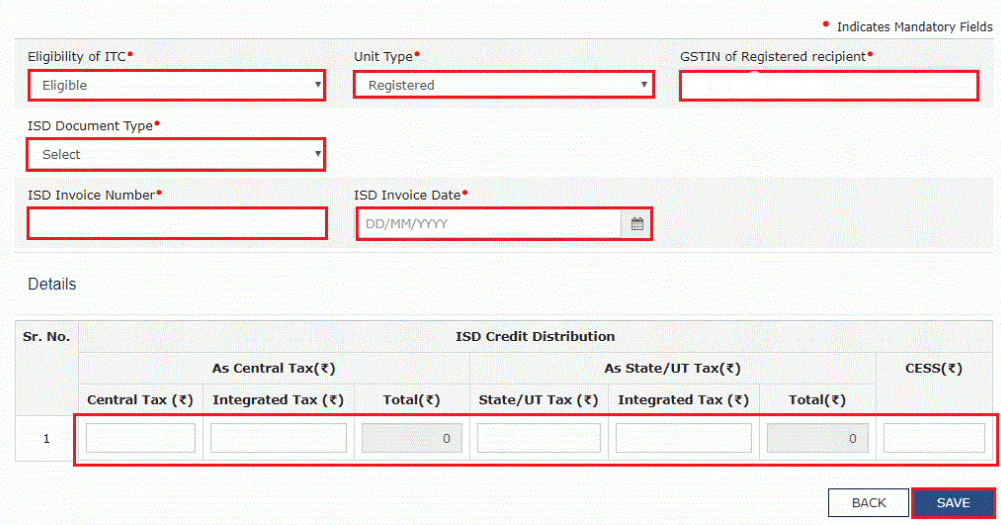

Step 10: Moving on to the next step, you must click the box reading “4 – Total ITC available and Eligible ITC/Ineligible ITC distributed”.

Now you can fill in all the required details that have to be there in the given fields.

Once that is covered, you can then click the “Calculate ITC”.

Step 11: Now you can choose the option named “Eligible ITC” and then you will be able to see the total amount that has been distributed to the branches along with the detailed summary of all the invoices. This features any of a couple of options- “Processed Invoice” on which you can check the details that have been accepted or it shows “Pending Invoice” which means that the details are in the process of getting approved.

Step 12: You must choose the “Ineligible ITC” option in which the detailed summary of the total amount that has been distributed to the branches (that is ineligible) will be presented. Now this will show, again, either of the two options- “Processed Invoice” on which you can check the details that have been accepted or it shows “Pending Invoice” which means that the details are in the process of getting approved.

Step 13: Details related to the “Eligibility of ITC”, “ISD invoice number”, and “ISD invoice date” will be required to be filled up correctly by you. Once you have done that, you can click the “Save” button to proceed with the next step.

Step 14: Form GSTR-6 will be auto-populated and the details regarding the Input credit that has been received for the distribution as well as the debit/credit notes that have been received during the current period will be projected in the form.

Step 15: In the final step, you can click the last option named “10 – Late Fee” under the title “GSTR-6- Other Details”. After you fill in all the required fields correctly, you can hit the checkbox below the title “Generate GSTR-6 Summary” and then click the “Submit” button.

After that, you can click on the “File Return” option to finish the entire process of GSTR-6.

How to Revise GSTR 6?

There is nothing specified under GST in respect to the GSTR-6 revision. If any mistake is found in the return, it can be corrected at the time of GSTR-6 filing of the month that follows.

GSTR-6 Late Fees

Every individual who is registered as ISD is required to file GSTR-6 before or on the set due date. However, in case someone, for any reason, fails to adhere to it gets charged with a penalty or late fee. It is as follows-

- Rs 50 per day (here, Rs 25 is charged for CGST, and RS 25 is charged for SGST)

- Rs 20 per day (here, the CGST is Rs 10 per day and the remaining Rs 10 goes to SGST)- if it is a case of any tax liability.

Final Word

You must adhere to the rules of GSTR-6 that have been set up to avoid hefty late fees and penalties or any other means of head-wringing which may occur upon the failure to do your part. In case you are facing any challenge in filing GSTR-6 online then it is best that you reach out to a reliable service provider to abstain from landing yourself on complications.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

How do I download the GST registration certificate?

Follow the steps mentioned below to download the GST registration certificate-

- Go to the official GST portal and log into your account using your user ID and password.

- Now click on the “User Services” under the “Services” tab.

- Click on the “View/Download Certificate” tab.

- Hit the “Download” option.

Now you can open the documents that you just have downloaded and keep a printout for future use.

What are GSTR-6 late fees?

In case you fail to file GSTR 6 form within the due date then you will have to face the repercussions in the face of late fees. The GSTR 6 late fees are Rs 50 per day with Rs 25 each for CGST and SGST. In case of tax liability, the late fees will be Rs 20 per day including Rs 10 for CGST and Rs for SGST.

How do I view GSTR 6A?

You need to do the following to view GSTR 6A-

- First, go to the official GST portal.

- You need to log into the portal using your credentials.

- Now choose the “Returns” option under the “Services Tab” and then, you will click on the “Return Dashboard” tab.

- After that, you must select the relevant “Financial Year and Return Filing Period” in the dropdown list.

- You will now click on the “Search” button.

- You will be able to view the “File Returns” page on the screen which shows the due date for returns. Click on the “Prepare Online” option from the GSTR-6A tab if you want to get the returns prepared.

How do I file GSTR 6 offline?

You must follow the steps given below to file GSTR 6 offline-

- Go to the GST portal.

- Now move to the “Downloads” tab and then click the “Offline Tools” button.

- Then, head to the “GSTR6 Offline Tool with Amendments” option and tap on it.

- You must unzip the Zip file which you have downloaded. This file has GSTR 6 along with the Amendment.

- After that, you must open the GSTR 6 amendment excel sheet.

Once you are there, you can read the instructions provided there and then start filling GSTR 6.

What are the details that are provided in the GST registration certificate?

GSTR 6 form contains the following information-

- GSTIN (Goods and Services Taxpayer Identification Number) of the taxpayer.

- The trade as well as the legal name.

- Type of Business (For instance- Company, Proprietorship, Partnership, Trust , etc.)

- Date of Liability

- Type of Registration

- Validity Period

- Of the Approving Body- Here, the name, designation, and the jurisdictional office along with signature are mentioned.