The GST form GSTR-9 is a tax return that is to be filed annually by all the registered taxpayers regardless of the annual turnover of the company. Any registered taxpayer is required to declare all outwards supplies, inwards supplies, tax deposited, refunds claimed, and income tax credit claimed in the GSTR-9 form. In this blog, we will take an in-depth look into how you should fill the details in tables 6-8 and 12-13 of the GSTR-9 form.

Table of contents

- Guide to Fill Table 6: ITC Availed During the Fiscal Year

- Guide to Fill Table 7: ITC Ineligible and Reversed for the Fiscal Year

- Guide to Fill Table 8: Other ITC Related Details

- How to Download Table 8A Document Details

- Guide to Fill Table 12 and 13: Details Regarding Previous Fiscal Year’s Transactions Declared in the Next Financial Year

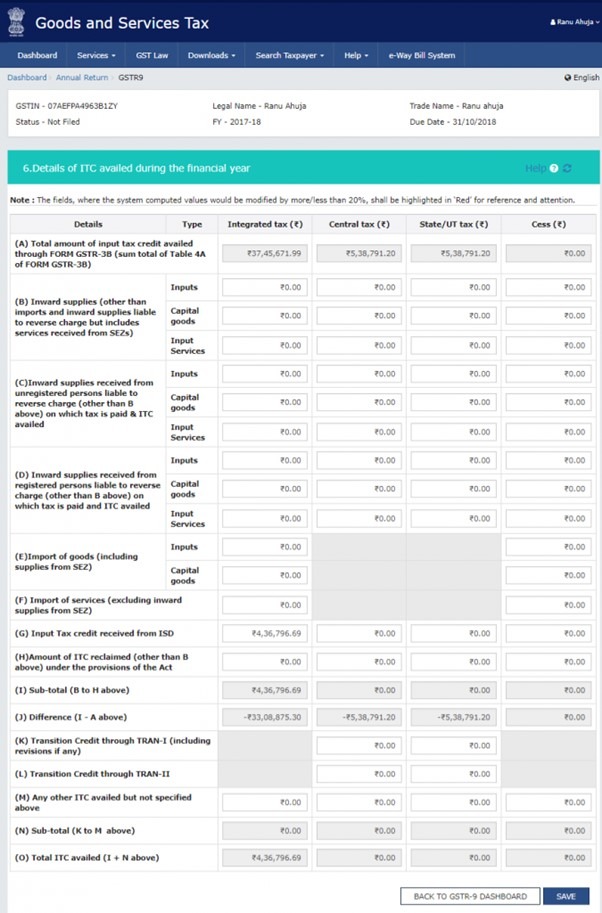

Guide to Fill Table 6: ITC Availed During the Fiscal Year

Given below are the guidelines for filling Table 6 of the GSTR-9 return form:

Notification Number: 79/2020 Dated 15/10/2020

A registered taxpayer is required to declare all the input tax credit with respect to any capital goods as stated through tables 6B to 6E. However, taxpayers have the choice to declare ITC with regards to the input services and inputs in tables 6B to 6E or subsequently report the total amount in the ‘inputs’ row for the fiscal year 2019-2020.

Notification Number: 56/2019 Dated 14/11/2019

All registered taxpayers have the option to declare the detailed report of the ITC in separate rows of capital goods, input services, and inputs in tables 6B through 6E, or the total amount can be declared in the inputs row for the fiscal year 2017-18 and fiscal year 2018-19.

| Section of Table 6 | Name | Details to be Mentioned |

| A | Amount of ITC claimed through Form GSTR-3B | The details of input tax credit claimed via table 4A of GSTR-3B are automatically filled in this Table, and this is non-editable in nature. |

| B | Inwards Supplies (apart from imports and liable inwards supplies to reverse charges but including the services received from Special Economic Zones) | This Table requires the classification of all the input tax credit claimed on total inward supplies excluding imports and those subject to reverse charges but encompassing supplies received from Special Economic Zones into Services, Capital, Input, and Services. This may be done in table 4 (A)(5) of the GSTR-3B form. |

| C & D | Inward supplies under the scope of reverse charge on which the tax has been paid, and input tax credit has been availed.

6C: Input received from unregistered persons. 6D: Received from registered individuals |

The total value of ITC on all inbound supplies falling under the scope of reverse charges should be declared in the following tables:

6C: Inward supplies from unregistered persons. 6D: Inward supplies from registered persons. Note: The ITC should be categorised into capital goods, input services, and inputs. This can be done using Table 4(A)(3) of GSTR-3B. |

| E | Import of goods including inbound supplies from Special Economic Zones | The total value of input tax credit availed on all imports from special economic zones outside India should be declared in this table.

Note: If the goods are supplied by a special economic zone to a DTA without a valid entry bill, it will be considered a normal transaction that should not be declared in this table. The ITC should be further bifurcated into capital goods and inputs. |

| F | Service Import other than inwards supply from Special Economic Zones | The total value of input tax credit on all import services from outside the country should be declared in this table.

Note: The origin of the service supply should be within the country for the transaction to be considered service import. |

| G | Input Tax credit gained from ISD | This table is for the declaration of the aggregate ITC on invoices created by ISD.

Note: The details of this table can be auto-populated from GSTR 3B Table 4(A)(4). |

| H | ITC amount reclaimed | The total value of the ITC claimed, reversed, and reclaimed during the fiscal year should be declared in this table. Details regarding the ITC availed and reversed during 2017-18 and 2018-19 need not be declared in this table. |

| I | Sub-total of B to H | This table will be auto-filled with the subtotal of B to H. |

| J | Difference of I to A | This is calculated on the basis of the difference between rows A and I. Here the difference should ideally be 0 since the details in 6A are auto-filled from GSTR 3 B, and Table 6B to 6H is a simple categorisation of ITC availed into capital goods, inputs, and input services. |

| K, L & M | Transitional and other input tax credit | Table 6K: This table is for the amount of transition credit deposited in the electronic credit ledger done through TRAN-1.

Table 6L: This table is designated for credit input in the electronic credit ledger done through TRAN-II. Table 6M: This table is for the declaration of input tax credit availed which was not declared in rows B to L. Details of input tax credit availed via FORM ITC 01 and FORM ITC 02 is to be declared here. Any ITC availed with regards to merger, demerger, sales, lease, amalgamation, or transfer of business should also be declared here. |

| N | Subtotal of K to M | This table will be auto-populated with the subtotal of rows K to M. |

| O | Total Input Tax Credit Availed in I to N | The total ITC availed which is a total of rows I and N is to be declared here. |

Guide to Fill Table 7: ITC Ineligible and Reversed for the Fiscal Year

Given below is the process and details to fill Table 7 of the GSTR-9 Form:

Notification: 79/2020 issued on 15th October 2020

- The taxpayer has the choice to report ITC details individually in tables 7A to 7E, or the total amount can be declared in Table 7H under “other reversal”.

- Information regarding the reversal of ITC with regards to TRAN I and TRAN II credit is to be compulsorily reported in tables 7G and 7F.

Notification: 56/2019 issued on 14th November 2019

- Taxpayers can choose to declare the details of ITC reversals individually in tables 7A to 7E, or the total amount can be declared in Table 7H under “other reversal”.

- Details of the ITC reversed with regards to TRAN I and TRAN II credit should be mentioned in tables 7F and 7G.

| Table Number 7 | Name of Field | Details of ITC |

| A | As per Rule 37 | According to Rule 37, all registered taxpayers have to reverse the input tax credit claimed on input supplies for which the payment has not been made to the supplier within 180 days of the date of invoice issue. The same should be declared in this table. |

| B | As per Rule 39 | Rule 39 dictates the process of distribution of ITC by ISD. Thus, if an ISD is issued a credit note by a supplier, then the reversal of the same ITC should be proportionate to the distribution of ITC. |

| C | As per Rule 42 | Rule 42 talks about the credit reversal where inwards supply is partly utilised for business and partly for other miscellaneous purposes, or for taxable inputs including zero-rated supplies and partly for exempted inputs. The details of the same have to be mentioned in this table. |

| D | As per Rule 43 | Rule 43 is regarding the reversal of part of the input tax credit of capital goods which are partially utilised for making taxable supplies, exempt supplies, zero-rated supplies, and other actions. Therefore, the ITC reversal is required which can be attributed to non-business applications or exempt supplies. Such ITC reversals have to be reported in this table. |

| E | As per section 17(5) | Section 17(5) declares some ITC as blocked credits. Such credits have to be declared in this table. |

| F | Reversal of TRAN-I credit | Any reversal related to TRAN I credit which has been previously claimed and reported in Table 6K need to be reported here. Such reversals can be because of ITC claims which are not approved by GST. |

| G | Reversal of TRAN-II credit | Any ITC credit related to TRAN II which has been claimed and reversed in Table 6L previously should be reported in this table. |

| H | Other reversals (if any) | This table is for the reporting of ITC reversed via FORM ITC -03. |

| I | Total ITC Reversed (Sum of A to H above) | This is a total of the rows A to H |

| J | Net ITC Available for Utilisation (60 – 7I) | Input Tax Credit available for use is 60 – 71 |

Guide to Fill Table 8: Other ITC Related Details

Given below are some of the updates and details that you should know regarding filling table 8 of the GSTR-9 form:

Notification No: 79/2020 Issued on 15th October 2020

The information from Form GSTR-2A as on 1st November 2020 will be auto-filled in Table 8A for the fiscal year 2019-2020.

According to Latest Update Dated 6th August 2020

Updates have been made to the GST portal to include a “Download Table 8A Document Details” button. Registered taxpayers now have the option to obtain the invoice wise details of the ITC auto-populated in the GSTR-9 form in Table 8A.

Notification: 56/2019 Issued on 14th November 2019

- GSTR-2A which was generated on 1st November 2019 for the fiscal year 2018-19 will be auto-populated in Table 8A.

- A registered taxpayer has the option to upload all the details regarding the entries in Table 8A to 8D in Form GSTR-9C in PDF file format.

- For the Fiscal Year 2017-18: The total value of input tax credit availed on all inwards supplies received from July 2017 to March 2018, but credit that was availed between April 2018 to March 2019 is to be declared in Table 8C.

- For the Fiscal Year 2018-19: The total value of input tax credit availed on all inwards supplies received from April 2018 to March 2019, but credit that was availed between April 2019 to September 2019 is to be declared in Table 8C.

| Table 8 | Name | Details |

| A | ITC as per GSTR-2A | The total ITC available for input supplies regarding the fiscal year 2017-18 which is recorded in the GSTR-2A form will be auto-filled in this non-editable table. |

| B | ITC as per sum total of 6(B) and 6(H) above | The ITC details declared in Table 6H and 6B will be auto-populated in this table. |

| C | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from an SEZ) received during 2017-18 but availed during April to September 2018 | The total ITC availed on all inputs other than imports which are liable to reverse charges, attained during July 2017 to March 2018, but credit availed from April 2018 to September 2018 has to be reported in this table.

Note: Details here can be auto-filled from GSTR-3B Table 4(A)(5). |

| D | Difference [A-(B+C)] | This table is the difference in amounts between the total of rows B and C and row A. Nevertheless, there might be situations where the ITC availed in Form GSTR-3B was more than the ITC available in GSTR-2A. In such cases, the value of Row D will be negative. |

| E & F | ITC available but not availed & ITC available but ineligible | The ITC which was available but was not availed in GSTR-3B as it was deemed ineligible has to be declared in this table. Please note, if 8D is positive, then the sum of rows 8E and 8F will be equal to the value in 8D. |

| G | IGST paid on import of goods (including supplies from SEZ) | This table is designated for the IGST deposited during import during the concerned financial year. |

| H | IGST credit availed on import of goods (as per 6E above) | The details in this table will be auto-populated from Table 6(E). |

| I | Difference (G-H) | This table displays the difference between rows H and G |

| J | ITC available but not availed on import of goods | Details in this table will be auto-populated from the row I |

| K | Total ITC to be lapsed in the current financial year (E + F + J) | This table will contain an amount which is the total of rows E, F, and J. |

How to Download Table 8A Document Details

If you wish to get an invoice-wide detail of table 8A, you can do so by clicking on the ‘Download Table 8A Document Details’ which can be found under the instructions for filling the GSTR-9 form.

Guide to Fill Table 12 and 13: Details Regarding Previous Fiscal Year’s Transactions Declared in the Next Financial Year

Given below are some of the details and instructions to fill Table 12 and 13 of the form GSTR-9:

Notification: 56/2019 Issued on 14th November 2019

The taxpayers can choose not to fill the table 12 and 13 of the GSTR-9 form for the fiscal year 2017-18 and 2018-19.

| Table | Name | Details |

| Table 12 | Reversal of ITC availed during the previous financial year | This row contains the aggregate amount of ITC reversal which was availed in the fiscal year 2017-18 but was later reversed in the ITR filing for April 2018 to September 2018. |

| Table 13 | ITC availed for the previous financial year | This row is designated for the aggregate amount of ITC for goods and services, which was availed in the fiscal year 2017-18 but was later reversed in the ITR filing for April 2018 to September 2018. |

You May Also Read