The country’s investment population has seen a big increase, for which the Central Government has begun stressing the importance to link Aadhaar with mutual funds. Looking upon the Prevention of Money Laundering Second Amendment Rules 2017, asset management and mutual fund organisations are obliged to collect the investor’s Aadhaar number. Along with this, they also have to verify the UIDAI details for credibility. Hence, this has made it mandatory to link Aadhaar to mutual funds.

It is a widely known fact that even youngsters above the age of 21 actively participate in mutual funds, which has built investor accountability. This also refers to the significance of investors checking out and learning how many ways they may link Aadhaar with mutual funds effortlessly without missing.

Table of contents

Important Points to Link Aadhaar with Mutual Funds

There are several reasons why it was potential for government to make such a great move over mutual fund-Aadhaar linkage. Let us understand each value that will be added to investors’ bag of benefits if they link Aadhaar to mutual funds:

- All holders of mutual funds, be it first holder, guardian, or even joint holders, Power of Attorney (POA) holders or children’s schemes, have to link their Aadhaar with mutual funds.

- NRIs are not obliged to link Aadhaar with mutual funds as they do not have access to Aadhaar.

- Other exemptions are for Assam, Jammu & Kashmir residents, and Meghalaya residents to link Aadhaar with mutual funds.

- Organisations, companies, ventures, and more are authorised signatories who must submit the information for Aadhaar.

- For HUFs’ investors, the family’s ‘Karta’ has to submit the Aadhaar card.

Different Modes to Link Aadhaar to Mutual Funds Online/Offline

Linking Aadhaar to mutual funds is not a tough nut to crack, especially with multiple methods one can adopt. Primarily, the applicant has to ensure a working mobile number linked with an Aadhaar for accessing the OTP, which is required for all methods. Here, investors may also look for the Mutual Funds Registrar linkage option, eliminating the struggle to visit different mutual fund organisations.

Including this, almost every mutual fund company provides investors with an online processing mode to synchronise the data effectively via CAMS, Karby, and more.

Methods to Link Aadhaar Card with Mutual Funds

- Online: CMAS, KARVY, e-Mail

- Offline: SMS, Mutual Funds Company’s Branches

Steps to Link Aadhaar with Mutual Fund Offline

If this is your first-time mutual fund transfer and your account is not linked with your mobile number or email ID, you may follow some steps to link it offline:

- Fill up the provided Aadhaar linking form with details of your mutual fund along with the Aadhaar pieces of information

- Add your documents, such as copies of the Aadhaar card with self-attestation along with the linking form.

- Submit the Aadhaar Linking form at the nearby service centre.

- On confirmation, a text via SMS or mail will be received from the applicant.

Steps to Link Aadhaar Card with Mutual Funds via SMS

Applicants can even process the linking of Aadhaar with mutual funds by dropping an SMS by following these potential steps:

- Linking Aadhaar with Mutual Funds has become so easy without having a smartphone also by following just a few simple steps:

- Type a text in the pattern ADRLNK<space>Your PAN<space>Your Aadhaar<space>Y

- Y in the message refers to the consent of KARVY to verify and link Aadhaar with mutual funds.

- Send the message to +91 9212993399.

- A confirmation message will be sent to the applicant on successful Aadhaar linking

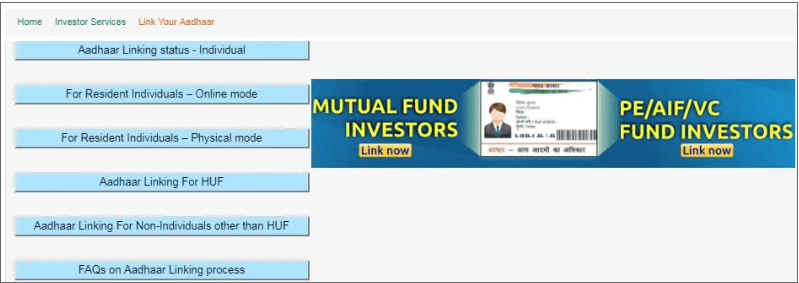

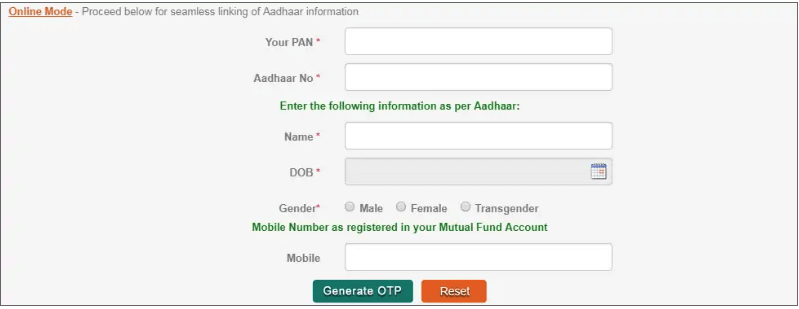

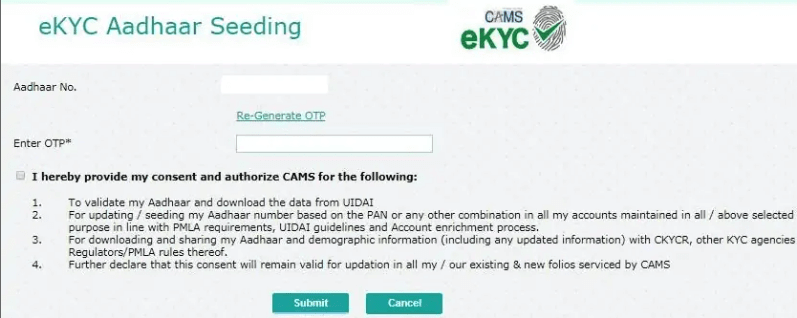

Steps to Link Aadhaar with Mutual Funds Online via CAMS

Aadhaar -mutual fund can be linked online by visiting the CAMS website. You can follow these simple steps to link mutual funds with Aadhaar:

- Go to CAMS’s official portal: www[dot]camsonline[dot]com

- Click on the ‘Investor service’ option and tap on the ‘Link Your Aadhaar’ button on the left-hand side of the page.

- Also, an investor can go to this website: camsonline[dot]com/InvestorServices/COL_Aadhar[dot]aspx

- Fill in the PAN card number.

- Choose any one of either the registered mobile number or date of birth or even a valid email in the second box

- Provide the pieces of information as per the selected options in the given box

- Click on the ‘Verify’ button.

- It will redirect you to a new page, where you enter your Aadhar number and the registered mobile number. An email ID is optional.

- Tap on the ‘Generate OTP’ button

- Enter the received OTP in the provided column and click on ‘Submit.’

- Lastly, a confirmation message will be sent to your email and mobile number.

Steps to Link Aadhaar to Mutual Funds Through KARVY

KARVY is a financial services company engaged in debentures, shares, equity, and more. One may count on Karvy as an online mutual fund registrar by reaching out to Karvy’s official portal and following these instructions:

- Reach out to KARYA’s official website.

- Click on the ‘Link Your Aadhaar’ option.

- Inside this, select the dropdown ‘online linking process.’

- Fill up the PAN number and click on the ‘Generate OTP’ button.

- Do not miss out on linking the mobile number along with Aadhaar.

- You will receive an OTP at the given number or email ID.

- Select the mutual fund scheme that you wish to link.

- Tap on the confirmation box to continue the processing

- Fill in the Aadhar number in each provided box and tap on ‘Submit.’

- You will receive an email to finish the steps.

Don’t Miss Out!

Latest Documents on Aadhaar Card

| eAadhaar | Eaadhar Download, Benefits & Check UIDAI E-Aadhar Status |

| My Aadhaar | Complete Information about My aadhaar |

| Aadhar PVC Card | How to Download PVC Aadhaar Card? |

| NPS Aadhaar Link | How Link Aadhaar Link with NPS Account? |

| eSign Aadhaar | How to Validate esign Aadhaar? |

| PM Kisan Aadhaar Link | How to Link Aadhaar with PM Kisan? |

| Masked Aadhar | How to Download Masked Aadhaar |

| Aadhaar VID | How to Generate Aadhaar Virtual ID? |

| Jan Aadhaar Card | How to Download Jan Aadhaar Card? |

| AePS | Aadhaar Enabled Payment System |

| maadhaar | How to Download maadhaar App? |

| Aadhaar Card Appointment | How to Book and Appointment for Aadhaar Enrolment? |

List of Mutual Fund Organisations to Provide Aadhaar Linking Facility

Massive companies are working to link Aadhaar with mutual funds through CAMS and Karvy.

Companies Providing Linkage Services via CAMS

- L&T Mutual Fund

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- IIFL Mutual Fund

- Birla Sunlife Mutual Fund

- SBI Mutual Fund

- DSPBR Mutual Fund

- HSBC Mutual Fund

- Tata Mutual Fund

- Mahindra Mutual Fund

- Shriram Mutual Fund

- IDFC Mutual Fund

- PPFAS Mutual Fund

- Kotak Mutual Fund

- Union Mutual Fund

Companies Providing Linkage Services via Karvy

- LIC Mutual Fund

- Canara Robeco

- Peerless Mutual Fund

- Principal Mutual Fund

- Quantum Mutual Fund

- UTI MF

- Baroda Pioneer Mutual Fund

- BOI AXA Mutual Fund

- IDBI Mutual Fund

- Axis Mutual Fund

- Reliance MF

- DHFL Pramerica Mutual Fund

- Motilal Oswal Mutual Fund

- Taurus Mutual Fund

- INVESCO Mutual Fund

- Mirae Asset Mutual Fund

- JM Financial Mutual Fund

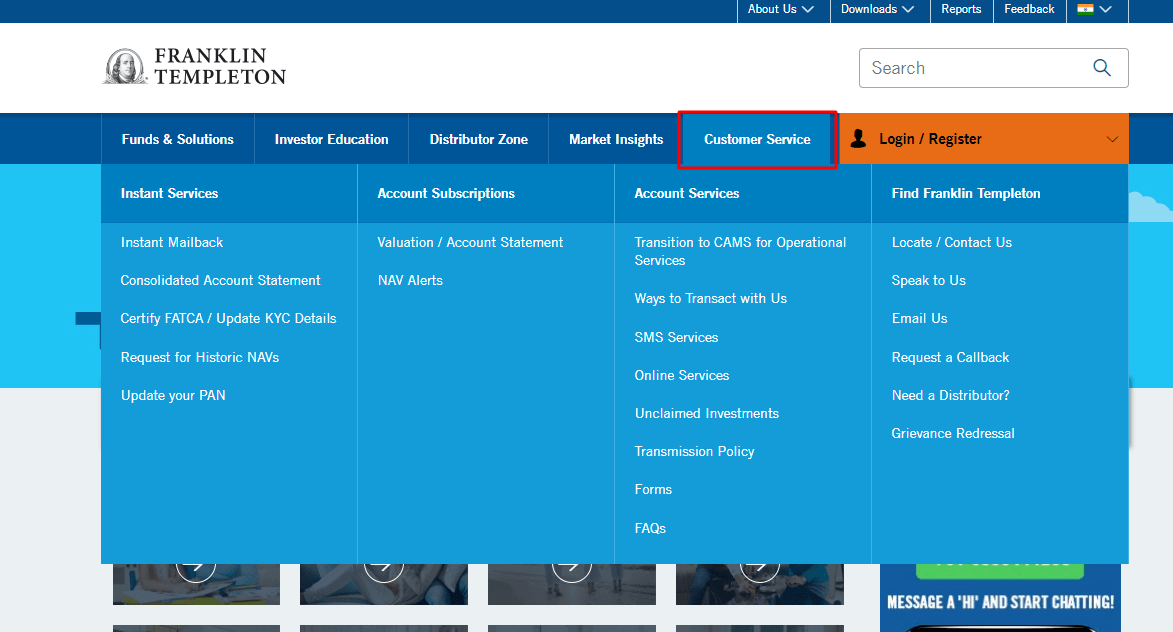

Steps to Link Aadhaar with Mutual Funds via Franklin Templeton Portal

Investors who have access to Franklin Templeton (FT) can use this method easily. In India, investors can legally link Aadhaar to mutual funds through the FT website. However, such investors must link their Aadhaar only through the FT portal. If you are one of those, check out the below-mentioned steps quickly:

- Go to Franklin Templeton’s official website: www.franklintempletonindia.com

- Select the ‘Customer Service’ tab.

- Choose the ‘Update Aadhar Number‘ tab in the ‘Instant Services’ category.

- A new page will open.

- Fill in your PAN card number in the provided column.

- Fill in the required details like your Date of Birth, Pin Code, and Last Transaction Amount info, to name a few.

- After providing the information, select ‘Next.’

- Enter the bank account details here and register with Franklin Templeton while investing.

- Tap on the ‘Next’ button.

- Provide the 12-digit code (unique identification number) in the column given and select the ‘Submit’ button to complete the processing.

- The final step is to get a confirmation notification on the Aadhaar registered mobile number and valid email address.

Steps to Link Aadhaar with Mutual Funds with House Registration

If it is the first investment, the person has the right to initiate the investment in a solitary mutual fund company and then link the Aadhaar to mutual funds. These are the steps through which a new investor can learn more about registering funds in a single house.

- Go to the specific mutual fund house’s portal.

- Provide the PAN card number.

- Choose the category ‘You are not KYC compliant’ among various options.

- Fill in the registered mobile number with the Aadhaar card and enter other information cautiously to finish the process.

End Thoughts

After the central government mandates to link Aadhaar with mutual funds, the authorities store the investors’ data to ensure verified investors. This helps in maintaining a synchronised system and making it transparent. Above this, some significant advantages can also be availed by investors by linking their Aadhaar card with a mutual fund.

FAQ’s about Mutual Funds Aadhaar Link

Q1. How can I update my Aadhar card on a mutual fund?

Linking Aadhaar to mutual funds can be done through online methods like CAMS, KARVY, SMS, email, and offline processes like SMS, and mutual fund companies’ branches.

Q2. Is it mandatory to link Aadhaar with mutual funds?

Recently, the Central Government has made it mandatory for mutual fund companies to demand the linking of Aadhaar with mutual funds for effective record-making and analysis of investors.

Q3. Is there any deadline to link Aadhaar with mutual funds?

Quantum Mutual Funds have announced via mail regarding the processing to link Aadhaar cards to mutual funds along with their PAN card linking without fail to continue services.