If you’re reading this, you’re probably wondering what a PAN card is. PAN is an abbreviation for Permanent Account Number which is issued by the Income Tax Department. This 10-digit alphanumeric number is assigned to every tax-paying citizen of the country in a bid to fight tax evasions. This number is provided to all taxpayers in the form of a laminated card called the PAN card.

A PAN card can help you in tax return filings and help you save on TDS. Further, this is also a mandatory document for various financial transactions. Now, you must be wondering ‘How can I get one?’. Read on to know more!

Table of Contents

- What is a PAN Card?

- History of PAN

- Importance of PAN Card: Uses and Benefits

- Who Issues a PAN Card?

- PAN Card Eligibility Requirements

- What are the Different Types of PAN Card?

- Documents Required for a PAN Card Application

- How Much Does a PAN Card Application Cost?

- What If I Don’t Have a PAN Card?

- What are the Different PAN Card Forms?

- Guidelines for PAN Card Application: Do’s and Don’ts

- How to Apply for a PAN Card Online/Offline?

- How to Make Changes in PAN Card Details?

- What if I Have Lost My PAN Card?

- Tracking PAN Applications and Transactions

- Structure of PAN Card

- Permanent Account Number for e-KYC

- Other Concepts Similar to a PAN Card

- Frequently Asked Questions (FAQs)

What is a PAN Card?

The Permanent Account Number (PAN), is a unique 10-digit number containing both alphabets and numbers. This is usually assigned to every tax-paying citizen of the country. When a citizen is assigned a PAN, a PAN Card is also issued by the Income Tax Department. The PAN Card is a physical card that contains the details of the PAN holder. The card mentions important information like name, date of birth, and photograph.

The system used for the allocation of PAN is technology-driven. This computer-based model assigns a unique number to every tax-paying citizen of India. This ensures that all the tax-related information of a citizen is registered against the PAN card number, which acts as a key for information storage. This is a system that is followed uniformly throughout the country, thus ensuring that no two tax-paying citizens have the same identification number.

History of PAN

Prior to the inception of PAN, the taxpayers were assigned a GIR number. This was a manually regulated system, and the numbers issued were unique in only one particular ward. These numbers were not unique to taxpayers on a countrywide level. This meant there was a greater possibility of errors, miscalculations, and mistaken identity.

The Government of India introduced the concept of PAN in 1972. Initially introduced as a voluntary measure, it was made mandatory in 1976. The PAN was also written into law under Section 139A of the Income Tax Act of 1961.

Importance of PAN Card: Uses and Benefits

Having a PAN card is very important, as it is one of the documents required during the income tax returns filing process. This is used to track the details regarding several different financial transactions. The card also comes in handy while submitting tax payments, receiving correspondence from the Income Tax Department, and receiving income tax refunds.

The annual budget of 2019 stated that taxpayers that do not have a PAN can also use their Aadhaar details to file returns and complete any other process for which a PAN card was previously required. That being said, it should be noted that the rules about this statement are still in the approval stages. Till this rule comes into effect, the PAN card remains a necessary document for various financial transactions. Let’s take a look at some of the other benefits of having a PAN:

- The Permanent Account Number needs to be mentioned while filing tax returns.

- The taxpayer has to enter a PAN while submitting tax payments.

- PAN details are required to be mentioned while registering a business.

- Various other financial transactions require a PAN card:

- Sale of an immovable property that is more than INR 5 lakh in value.

- Sale or purchase of a vehicle that is not a two-wheeler.

- Payments of over INR 25,000 made to hotels or restaurants.

- Payments made in regards to overseas travel. The individual needs to quote PAN if the amount exceeds INR 25,000.

- In the case of bank deposits of more than INR 50,000.

- Purchase of shares or bonds worth more than INR 50,000 in value.

- Insurance policy purchases greater than INR 50,000.

- Mutual fund purchases

- Purchase of jewelry or bullion more than INR 5 lakh.

- Funds transfer to an NRO account from an NRE account.

Other General Benefits of PAN Card

Given below are some of the other general advantages of having a PAN card:

- PAN card is considered to be a valid government ID card as it contains information like name, age, and photograph.

- It is a very efficient tool to keep track of the tax payments made by you.

- Since the PAN allotted to every citizen is unique, misuse for tax evasion is impossible.

- PAN cards can be used to avail basic utilities like gas, electricity, internet, and telephone.

PAN and Income Tax Related Articles

| PAN Card for Income Tax |

| PAN Card and Income Tax |

Who Issues a PAN Card?

The Income Tax Department of India, assisted by district-level PAN agencies, are responsible for issuing PAN Cards to taxpayers. There are a number of TIN facilitation centres all over the country that are governed by the National Securities Depository Limited (NSDL), that allot PAN to taxpayers. The PAN is issued on the basis of a Public Private Partnership model, in order to ensure efficiency in processing and issuing PAN applications.

How is PAN Allotted?

Given below is the process which is followed by PAN centres while allotting PAN to citizens:

- Once the citizen submits a filled-up PAN application form along with the required documents, the authorities verify the same with original documents.

- In case of an online application, the taxpayer needs to submit the application online, and mail self-attested copies of the supporting documents to NSDL, Pune.

- The information entered by you in the application is then verified by assessing officers. The details provided by you will be cross-checked against already existing information in the database.

- The request is approved and processed if there are duplicates present in the central database. A permanent account number is then allotted according to the taxpayer category.

PAN Card Eligibility Requirements

In accordance with Section 139A of the Income Tax Act, the taxpaying entities as mentioned below are required to have Permanent Account Number:

- Any person who is a taxpayer or is liable to make tax payments is required to have a PAN card.

- Any person involved in business or professional practice with an annual turnover exceeding INR 5 lakh during the financial year.

- People involved in export or import who are liable to be charged any duty or tax as stated in the Income Tax Act of 1961.

- All types of charitable organization, associations, and trusts.

Pan Card Related Articles

What are the Different Types of PAN Card?

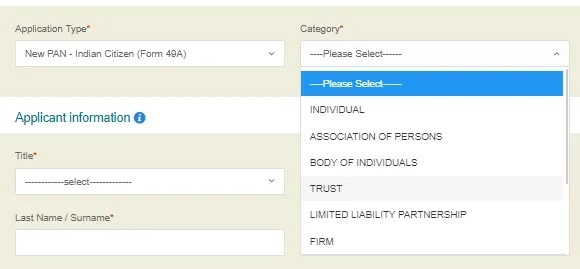

Since a Permanent Account Number is allotted to both individuals and entities, different types of PAN are required to be applied by using the variants of Form 49 as issued by the government. Given below are the different types of PAN cards along with the forms to be used for applying for the same:

PAN Card for Individuals

This is the most commonly issued type of PAN card. Individuals can apply for this card on the UTIITSL and NSDL websites by using form 49A. Individuals can be defined as any Indian residents that are eligible for a PAN.

PAN Card for NRIs or Persons of Indian Origin (POI)

For the purpose of taxation, PAN cards are also issued to NRIs and POIs. This can be done by submitting Form 49A online.

PAN Card for Tax Paying Foreign Entities in India

Large organizations or companies that are registered overseas but pay taxes in India with regards to any business operations in the country, can also apply for a PAN card. They can do so by using the Form 49AA.

PAN Card for OCI and NRE

Overseas citizens of India and Non-Resident Entities are also eligible to apply for a PAN card. This can be done by using the Form 49AA.

PAN Card for Indian Companies

Large companies and firms that are registered and operating in the country are also eligible to apply for a PAN Card.

TAN Card Related Articles

| TAN Card | TAN Card Details |

| PAN TIN Facilitation Centre | Know Your TAN |

| PAN-TAN-TIN Difference | TAN Card Application |

| TAN Card Status |

Documents Required for a PAN Card Application

The table given below illustrates the documents required for a PAN card application, according to the category of applicants:

| Type of Applicant | Documents Required |

| Individual Applicants |

|

| Hindu Undivided Family (HUF) |

|

| Company Registered in India | Registration certificate issued by Registrar of Companies |

| Liability Partnerships or Firms Registered in India |

|

| Trusts Registered in India | Copy of registration certificate as issued by a Charity Commissioner. |

| Association of Persons (AOP) |

|

| Non-Citizen Applicants |

|

How Much Does a PAN Card Application Cost?

Any individual or entity can apply for a PAN Card online by submitting applications and making payments on the NSDL website or UTITSL portal. Given below are the Pan Card charges associated with applying for a Permanent Account Number:

- For Indian Address: Rs. 93 (not including GST)

- For Overseas Address: Rs. 864 (not including GST)

What If I Don’t Have a PAN Card?

Any individual that is liable to be taxed under the Income Tax Act of 1961 is required to have a PAN. Not having a Permanent Account Number will lead to:

- A flat taxation of 30% as stated by the Income Tax Department of India. This rule is applicable to all individuals and entities that are eligible for income tax.

- You will not be able to purchase a vehicle or property that is over RS. 10 lakh in value. You will also not be able to open a bank account.

- Businesses will find it difficult to carry out a major portion of their financial activities.

What are the Different PAN Card Forms?

There is an application form that has to be filled up in order to apply for a PAN Card. These forms can be found on both online and offline platforms. The different types of application forms are:

- Form 49A: Indian individuals or entities that are eligible for a PAN, can use this form to apply for the same.

- Form 49AA: This application form is to be used by NRIs, NREs, and OCIs.

Given below are the components of both these forms:

- Assessing Officer Code (AOC)

- Name

- Address

- Email ID

- Date of Birth

- Mobile Number

- Aadhaar Number

PAN Card Forms Related Articles

| PAN Card Forms | Rule 114B |

| Form 49A | Rule 114E |

| Form 49AA | Amendment Rules for PAN transactions |

| Form 60 | Intructions for Form Filling |

| Form 61 |

Guidelines for PAN Card Application: Do’s and Don’ts

Given below are the guidelines to be followed while filling the PAN Card application form:

- Write all the details as it is in the identity and address proof documents that you are submitting.

- The form is to be filled in uppercase letters only.

- Make sure that you do not make any corrections or overwrite anywhere on the application form.

- Do not write names with any salutations like Mr/Mrs/Ms/Dr.

- Do not use initials in the name column of the form.

- Fill the form in English along with the local language used for enrollment.

- The thumb impression is to be attested by a Notary. Failure to do so will lead to application disqualification.

- Do not apply for a new card in case the card is lost/defaced. Apply for a duplicate card instead.

- Make sure the form is updated with the current details.

- Provide correct and complete address to which the PAN is to be dispatched.

How to Apply for a PAN Card Online/Offline?

You can apply for a PAN card in two ways. You can choose to apply for a PAN card on the portal. Alternatively, you can also use the offline method of the PAN card application. Let’s take a look at the process for each of these methods:

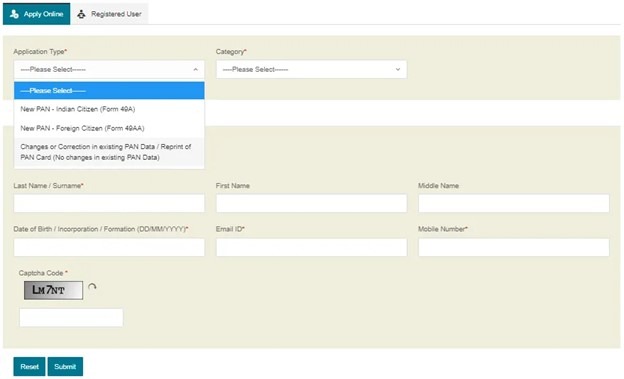

Online PAN Application Process

Given below are the steps that you should follow to apply for a PAN card online:

Step 1: Visit the NSDL or UTIITSL portal.

Step 2: On the homepage, click on the ‘New PAN’ option, under the ‘Apply Online’ tab.

Step 3: Select the relevant application type. Form 49A in the case of Indian citizens, and Form 49AA for foreign applicants.

Step 4: Select the category from the dropdown menu.

Step 5: Fill in all the details like Title, First name, Middle Name, Last Name, Date of Birth in DD/MM/YYYY format, email ID, and phone number. Verify the captcha code and submit the form.

Step 6: After you have submitted the form, you will be redirected to a page with a submission acknowledgement and token number. Click on the ‘Continue with PAN Application Form’ button.

Step 7: This will in turn redirect you to another page where you have to enter information similar to the one in Form 49A or Form 49AA.

Step 8: Choose the method of document submission. You can forward documents physically, submit documents digitally using digital signature, or submit through e-sign.

Step 9: You will also be required to declare what documents you are submitting as identity proof, address proof, and DOB proof. Review the form thoroughly and make sure there are no errors before submitting.

Step 10: Clicking on ‘Proceed’ will take you to the page where you need to select your payment option. You have to choose between paying via Demand Draft (DD) or Online Payment through Bill Desk.

Step 11: If you wish to proceed with DD for payment, you need to make the DD before you begin the application process. You will need to provide the DD number, amount, date, and name of the bank on the portal.

Step 12: If you choose to pay through Bill Desk, you can complete the payment online by Net Banking/Debit Cards/Credit Cards.

Step 13: Agree to the terms of service and continue with payment. The fees will vary according to whether you are uploading documents or sending them through post.

Step 14: If you’ve made the payment online, an acknowledgement receipt will be generated. Take a print out of the same.

Step 15: Attach 2 recent passport size photographs to the acknowledgement slip. Do not clip or staple the photographs. Sign the photo on the left hand side of the receipt.

Step 16: Send the supporting documents via post to NSDL.

Offline PAN Application Process

Given below is the process to apply for a PAN card offline:

Step 1: Visit the official TIN-NSDL website.

Step 2: On the homepage, click on ‘PAN’ under the ‘Downloads’ tab. This will redirect you to a new page.

Step 3: Select Form 49A

Step 4: The form will then appear on the screen in PDF format. Take a print out of it.

Step 5: Make sure that you fill the form completely with all the correct information.

Step 6: Attach all the necessary documents along with 2 passport size photographs.

Step 7: The registration fees can be paid via DD in favor of ‘NSDL-PAN’.

Step 8: Enclose the completed application form and documents in an envelope. Mention ‘APPLICATION FOR PAN-N-Acknowledgement Number’ on the front of the envelope and send it to the following address

Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016.

How to Make Changes in PAN Card Details?

Mentioned below are the steps that you need to follow to make corrections to your PAN Card online:

Step 1: Visit the NSDL website and click on ‘PAN’ under the ‘Services’ tab.

Step 2: On the resulting page, click on ‘Apply’ under ‘Change/Correction in PAN Data’.

Step 3: Click on ‘Change/Correction in PAN Data’ under the ‘Application Type’ tab.

Step 4: Enter all the relevant information and click ‘Submit’.

Step 5: A token number will be generated, which can be used for tracking the status.

Step 6: Make the desired changes in the application form. Submit the form and make payment.

Step 7: Send the supporting documents via courier or post to NSDL. You will have to submit the proof of document showing your desired change, along with your identity and address proof.

Step 8: The application will be processed. If all the information and documents submitted by you are correct, changes will be made to the PAN Card. You will receive the PAN Card to your communication address within 15 days.

Verification Related Articles

| PAN Verification | NSDL & UTIITSL Pan Verification Online |

| TAN Verification | How To Apply For New Pan Card With The Verification Certificate |

| Bulk Pan Verification |

What if I Have Lost My PAN Card?

In case you have lost your PAN card due to theft or any other reason, you can apply for a duplicate card. It’s actually quite simple to get a duplicate card. The application to do so can be filed online, as well as through post. Let’s take a look at the online process to apply for a duplicate card:

Step 1: Visit the TIN-NSDL portal and select the ‘Changes or correction in existing PAN data/ Reprint of PAN card (No changes in existing PAN data)’ application form.

Step 2: Fill in all the mandatory information and submit the form.

Step 3: A token number will be sent to the email address you provided in the form. Keep this number in handy for future reference.

Step 4: Fill all the required information in the ‘Personal Details’ page and select the way you want to submit the application. You can forward the documents physically, or digitally through e-KYC and e-sign.

Step 5: Select whether you want an e-PAN Card or a physical one. If you choose a digital card, then it will be sent to your registered email address.

Step 6: Enter ‘Contact and other details’ and ‘document details’ and submit the form.

Step 7: You will then be redirected to the payment portal. Make the payment and note down the acknowledgment number. This number can be used to track the status of your application. You will receive the duplicate within 2 weeks after the application has been received.

Duplicate and Lost PAN Related Articles

| Lost PAN Card – Reapply for a lost PAN card |

| Duplicate PAN card/Reprint PAN Card |

Tracking PAN Applications and Transactions

The income tax authorities have introduced various methods of tracking PAN card applications and transactions. This has been made possible by the Income Tax Business Application software (ITBA). Given below are the some of the ways of tracking PAN card applications and transactions:

Tracking PAN Card Status Online

You can track your PAN card application status online on the TIN-NSDL website. You will need to visit the status tracking page of the portal and key in your acknowledgement number.

Tracking PAN Card Status Through SMS

If you wish to track your PAN card through SMS, you can do so by texting ‘NSDLPAN 15-digit acknowledgement number’. You will receive a message with the most recent status of your application.

Tracking PAN Card Via Telephone

You can also choose to speak to a TIN representative to enquire about the status of your PAN card application. You will need to provide your acknowledgement number to the representative. After the number has been verified, you will get the update of your application.

Tracking PAN Card Status Without Acknowledgement Number

In case you do not have your acknowledgement number, you can always track the Pan Card status through your name and DOB. You can do so by submitting an application on the TIN-NSDL portal.

PAN Card Status Related Articles

| PAN Card Status | Check TDS Status Through PAN |

| PAN Card Delivery Status | Download ePAN Card Online |

Structure of PAN Card

Now let’s take a look at the structure and components of a PAN card and what all those letters and numbers mean.

PAN card is an important government document that acts as an identity and date of birth proof. These details also comply with the KYC (Know Your Customer) guidelines. The details of the PAN card are as follows:

- Name of cardholder: Individual/Company.

- Cardholder’s father’s name: For individual cardholders.

- Date of birth: In the case of an individual, the cardholder’s date of birth is mentioned. In the case of companies, the date of registration is mentioned.

- PAN Number: The Permanent Account Number is a 10-digit alpha-numeric number. Each character of this number stands for some distinct information about the individual.

Understanding the Permanent Account Number

As discussed above, the PAN is a combination of 10 alpha-numeric characters. The structure of the PAN is explained below:

- The first 3 characters of this number are a random combination of the English alphabets.

- The 4th character represents what category the cardholder falls under. They can be one of the below given categories:

- A- Association of Persons

- B- Body of Individuals

- C- Company

- F-Firms

- G-Government

- H-Hindu Undivided Families

- L-Local Authorities

- J-Artificial Judicial Person

- P-Individuals

- T-Trust

- The fifth character is the initial of the cardholder’s surname.

- The next 4 characters are a random combination of numbers.

- The 10th character of the number is again an alphabet.

New PAN Structure

The Income Tax Act was amended in 1995 to include the new PAN structure. Given below are the points facilitated by the new series, which previously was not the case:

- Associating all information related to tax to a single unique number.

- Easy access to the data in the centralized database. The new PAN series ensured more efficient recording and collection of data.

- Linking of all financial data against one unique identification number. This means that the details about credit, debit, and loans along with investments can be tracked easily. This means that the authorities are now more effective in preventing tax evasions.

Permanent Account Number for e-KYC

An individual’s PAN can also be used for e-KYC. It is mandatory to link your Aadhar card to PAN for completing the KYC process. It is now a major requirement for most service providers, as it has a number of benefits for the government and the consumers. Let’s take a look at some of the benefits:

- Paperless Process: Since the entire KYC process is entirely paperless, it can be easily done and managed.

- Quick Process: All the details for an e-KYC can be transferred to a service provider via secure channels, in no time at all. This makes things faster and easier, as there are no physical documents involved.

- Secure: Since the process is done through secure encrypted channels, the information shared between the consumer and service provider is tamper-proof.

- Authorised: The information shared between the service provider and consumer is authenticated by the authorities. This makes it acceptable and legal for all the parties in a transaction.

- Relatively Cheaper: Since the whole process is online and does not involve any physical documents, it is relatively cheaper. There is a significant cost associated with the movement of information physically, which is eliminated in this case.

PAN Card Linking Related Articles

Other Concepts Similar to a PAN Card

The concept of every taxpayer being assigned a unique PAN number is new by no standards. In reality, there are a number of different concepts, some of which are given below:

- Tax Deduction and Collection Account Number (TAN): TAN is a 10-digit unique number that is issued to individuals/entities who have to deduct or collect tax on payments, made in respect to TDS in accordance with the Income Tax Act. The TAN has to be cited while applying for TCS or TDS challans in order to disburse refunds as well as on certificates. Failure to cite a valid TAN can attract a penalty of Rs. 10,000.

- Taxpayer Identification Number (TIN): TIN is the 11-digit unique identification number allotted to dealers registered under Value Added Tax (VAT). Assigned by state authorities, this is mandatory for all dealers, traders, and manufacturers. It is necessary to quote this number while generating invoices, quotations, or orders.

Don’t Miss Out!

Frequently Asked Questions (FAQs)

Where can I get the PAN card application form?

The PAN application can be obtained from any NSDL TIN Facilitation Centre or PAN Centre. You can also download the form from the NSDL-TIN website.

Can a PAN card be obtained by a hand written application?

No, one cannot apply for a PAN card with a hand written application. The Central Board of Direct Taxes only accepts applications that are in the prescribed format. The forms for applying for a PAN card are Form 49 and Form 49A.

Does a married woman need to mention father’s name in the PAN application?

All applicants, regardless of their marital status, are required to mention their father’s name in the PAN card application. Married women do not need to update the form with the husband’s name.

Are 2 photos necessary for the PAN application?

Yes, all applicants need to attach 2 recent passport size photographs. Photos should be in the dimensions of 3.5 cm x 2.5 cm. Do not clip or staple the photographs to the application. The quality of the photo on the PAN card will depend on the quality of photo you provide.

What if the applicant does not know how to sign?

In such cases, the applicant can provide his/her left thumb impression on the space meant for signatures. This impression should be attested by a Notary, Magistrate, or a Gazetted officer.

Is the PAN card application form chargeable?

No, the form is absolutely free of charge.

Do applicants need to mention email address or telephone number on the application form?

It is compulsory for all the applicants to provide either their email address or telephone number on the PAN application form. This is so because the authorities can contact them easily in case of any errors or discrepancy. Further, it is also useful for receiving e-PAN card through mail. If the applicant provides a landline number, they should also mention the country and STD code.

Will the applicant get an acknowledgement after submitting a PAN application at a TIN-FC?

Yes, applicants will get a unique 15-digit acknowledgement number.