In India, a Permanent Account Number (PAN) is provided to every taxpayer account holder by the Income Tax Department (ITD). It consists of a 10-digit unique identification number.

After the users receive this number, it cannot be changed for the remainder of their lives. Thus, filling in the relevant form details for a PAN card with UCO bank account is compulsory.

Banks and investment organisations have made the Pan Card a mandatory KYC mechanism. Therefore, according to amended RBI rules and regulations, a PAN card is an essential document for creating new bank accounts.

With many customers, UCO is one of the country’s largest public banks. Customers of UCO Bank must also link their PAN Card details to their bank accounts. While creating a new savings account, if the customer does not have a registered PAN Card, you have to fill out form 60/61.

In this article, we elaborate on the offline and online methods for linking PAN cards with UCO bank accounts.

Table of contents

How to link PAN Card with UCO Bank Account online through Internet Banking?

To Link a PAN card to UCO Bank account online some of the steps are mentioned below:

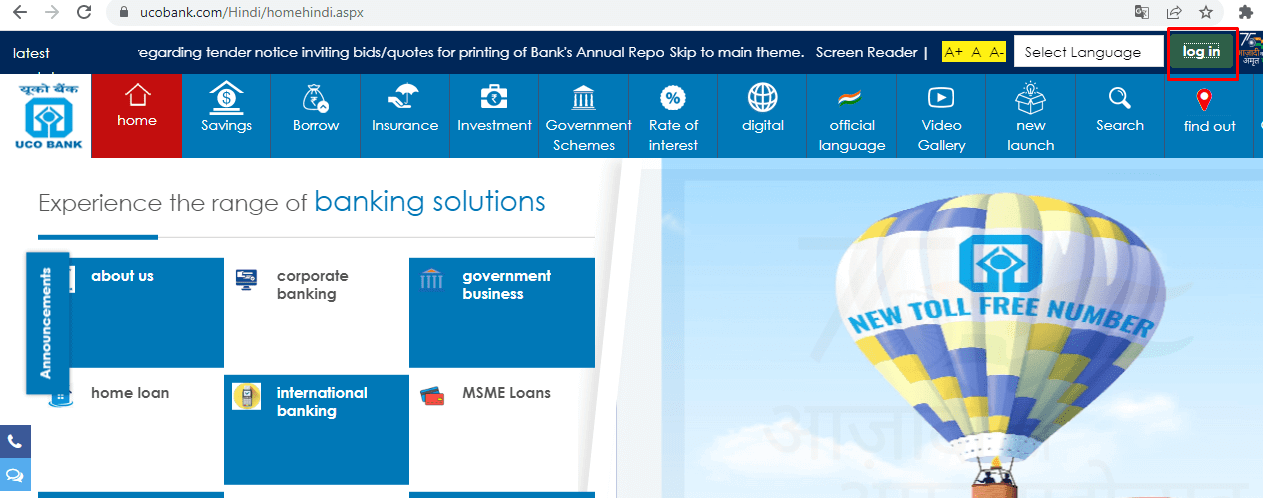

- Go to the official portal of UCO and, on the right hand, click on the ‘login’ option.

- Log in by entering the credentials provided by the bank.

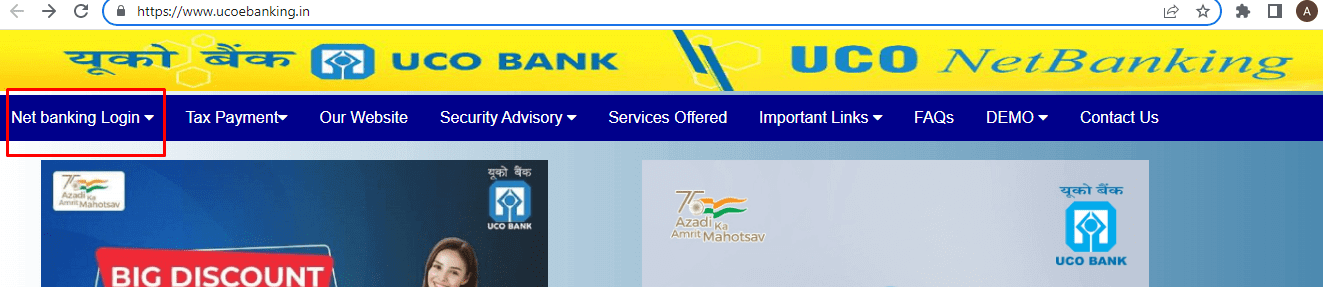

- Select the ‘Net Banking Login’ category, which is present at the top left.

- Choose the option of ‘Retail login’ or ‘Corporate login’ accordingly.

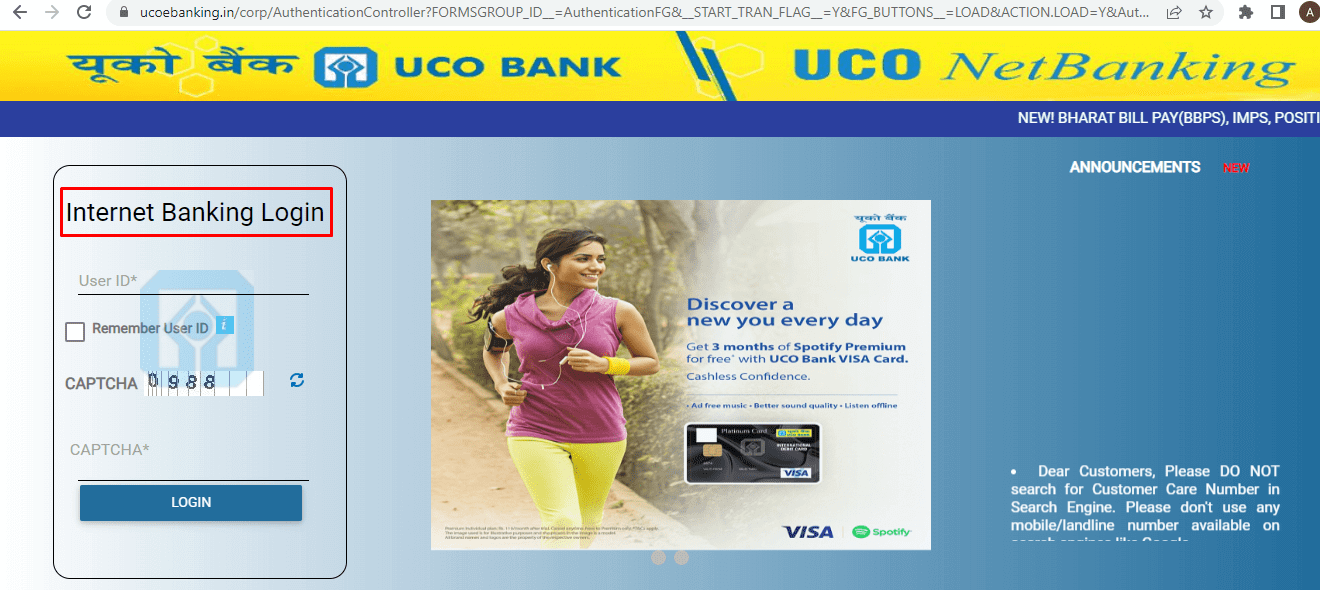

- Fill out the required fields like ‘User ID’ and ‘Captcha’ and submit.

- After the login process, select the ‘Service Request’ option and choose ‘PAN update.’

- A new window will open, which will require details like name, PAN card number, DOB, address, etc.

- After filling in the information, select the ‘submit’ icon.

- Within two working days, your UCO account will be updated with your PAN card details.

- For verification, you will receive a call and an SMS on the registered phone number and email ID.

How to Link PAN Card with UCO Bank Account Offline

Here are some steps you can take to link your PAN card to your UCO Bank account offline:

- Go to the nearest branch of UCO bank to link the PAN card with the UCO savings account.

- Take the PAN linking form or get it downloaded from the official website of UCO.

- Fill in the details correctly, such as name, address, PAN card number, etc., and submit the form.

- While submitting the form, an executive might ask you to show the original documents. Carry the documents as well for the verification.

- After verification, within a day or two, the bank will link your PAN card to the UCO bank account.

- When your PAN card is updated, the bank will send an SMS to the registered phone number or email ID.

Importance of Linking PAN Number with UCO Bank Account

Registering PAN Card to UCO Bank account can boost accessibility while also delivering a number of advantages like online assistance 24*7, online net banking, and so on. On the other hand, failing to link PAN card to a UCO Bank account can have serious consequences. For example, if your PAN registration with UCO Bank still hasn’t been upgraded, you will have to pay tax on the income on your earnings. Customers who already hold their PAN Cards but have not synced their details with UCO Bank. They will not be issued a TDS Certificate; Form 16.

Impacts of Non-Linking of PAN Card with UCO Bank account

The failure to link the PAN card to the account holder’s UCO Bank account has a number of negative implications:

- Without pan card details, KYC would not be accomplished, preventing banks from being used for money laundering by criminal elements.

- PAN cards are required for all Demat Account operations, including the buying and selling of stocks, investment companies, mortgages, financings, and other securities.

- It’s also necessary to link your PAN card to your savings account in order to receive your tax credits quickly.

- Unless the PAN card isn’t registered to the savings account, the user will be unable to deposit funds of more than ₹ 50,000 physically.

- If the PAN is not connected to their account, then the amount of money will be digitally limited.

PAN Card Linking Related Articles

Frequently Asked Questions (FAQs)

Is it Possible to Create an Account with UCO Bank Without a PAN Card?

Yes. However, a PAN card is required to create a new account. If the user does not possess a PAN card when the account is opened, they can complete form 60/61. It is advisable to register for a PAN card at that time.

Is it Mandatory for Every Joint Account Holder to Register their PAN Cards to the Savings Account?

Yes, it is compulsory for all joint account holders to link their PAN cards to the savings account.

Is The e-PAN Certificate Accepted?

Yes. The e-PAN card is a PAN card number that is assigned by the ITD (Income Tax Department) in digital format. It is accepted in the same way as a physical or conventional PAN card.