Stamp duty and registration rates in Maharashtra are a fixed tax amount that the buyer must pay to the government of the state for each property transaction. Under the Maharashtra Stamp Act 2022, it is mandatory to pay stamp duty and property registration charges in Maharashtra. The charges include the tax on assets and instruments, as well as the amount of Mumbai/Maharashtra stamp duty on property that should be paid to the government of the state.

Due to operational or ongoing metro projects in Mumbai, Thane, Pune, Nagpur, and Nashik, stamp duty on sales, gift deed details, and mortgages would be subject to a 1% metro cess beginning on April 1, 2022. In Mumbai, Rs 1000 crore in metro cess revenue is anticipated for 2022–2023. The rest of the cities are expected to pay the Maharashtra government Rs 900 in metro cess.

On March 23, 2022, the government of Maharashtra passed a measure that would waive stamp duty in Maharashtra for properties sold after one to three years. The pandemic has made it harder to make money on real estate sales. Therefore, Maharashtra’s decision to extend the waiver for a further three years was made in an effort to help. Thus, over the next three years, stamp duty in Maharashtra will only be paid on the difference in the price of a property, starting in 2022.

Table of contents

- Maharashtra Stamp Act

- Maharashtra Stamp Duty and Registration Charges

- Stamp Duty Property Registration Charges in Maharashtra

- Stamp Duty Charges in Maharashtra

- Gift Deed Stamp Duty in Maharashtra

- How is Maharashtra Stamp Duty On Property Calculated?

- Maharashtra Stamp Duty Payment Method

- How to Pay Stamp Duty in Maharashtra?

- How to Get Refund on Maharashtra Stamp Duty?

- Maharashtra Stamp Duty Adjudication

- How Stamp Duty Maharashtra has Impacted Property Registration?

- Latest Updates on Maharashtra Stamp Duty and Registration Charges

- FAQ’s about Stamp Duty in Maharashtra

Maharashtra Stamp Act

The Maharashtra Stamp Act, which was passed in 1958, implies the payment of stamp duty rates to the state. The payable duty is applicable to all the movable and immovable possessions mentioned in Schedule 1 in the act. It has not been a long time since this act underwent the alterations which brought the light upon the insertion of penalty clauses, stamp duty e-payment, increment of duty as per certain clauses and revised stamp duty on gift deeds.

Maharashtra Stamp Duty and Registration Charges

Stamp duty and registration fees in Maharashtra state are determined by various factors. Such factors include determinants such as total cost incurred for the transaction, whether the location of the property comes within urban or rural areas etc.

| City | Applicable Stamp Duty Rates | Applicable Stamp Duty Rates from September 1, 2020 to December 31, 2020 | Applicable Stamp Duty Rates from January 1, 2021 till March 31, 2021 |

| Mumbai | 5% (with 1% metro cess inclusive) | 2% | 3% |

| Pune | 6% (with local body tax & transport surcharge inclusive) | 3% | 4% |

| Thane | 6% (with local body tax & transport surcharge inclusive) | 3% | 4% |

| Navi Mumbai | 6% (with local body tax & transport surcharge inclusive) | 3% | 4% |

| Pimpri-Chinchwad | 6% (with local body tax & transport surcharge inclusive) | 3% | 4% |

| Nagpur | 6% (with local body tax & transport surcharge inclusive) | 3% | 4% |

Stamp Duty Property Registration Charges in Maharashtra

When it comes to the plot registration charges in Maharashtra, there is 1% of the total cost chargeable amount for the properties that are priced under the Rs 30 lakhs slab. It is capped to Rs 30,000 for properties that are priced more than Rs 30 lakhs.

Stamp Duty Charges in Maharashtra

| Area | Stamp duty Rates in Mumbai |

| Within the municipal territory of any urban area | 5% of the market value |

| Within the realm of any municipal council/ panchayat or cantonment of an area that comes within MMRDA | 4% of the market value |

| Within any gram panchayat territory | 3% of the market value |

Gift Deed Stamp Duty in Maharashtra

Gift deed and stamp duty in Maharashtra is 3% of the property’s worth, following Article 34 of the Stamp Act of Maharashtra. However, the stamp duty in Maharashtra on a gift deed in blood relation is Rs 200 if the property under consideration is residential or agricultural and is gifted (without any payment) to family members.

| Conveyance Deed | Stamp Duty Rate |

| Gift deed | 3% |

| Stamp duty for residential/agricultural property gifted to family members | Rs 200 |

| Power of attorney | 3% for properties that are located in gram panchayat areas and 5% for properties that are located in municipal areas. |

| Lease deed | 5% |

As per the Article 34 of the Maharashtra Stamp Act, amended in 2017, 3% of the property’s value is applicable as stamp duty on gift deeds. However, in case the property under consideration is of residential or agricultural property type and is also gifted (without involvement of any payment) to members of the family, then the applicable stamp duty is Rs 200.

You might also like to Read: IGR Maharashtra

How is Maharashtra Stamp Duty On Property Calculated?

The Maharashtra Stamp duty calculation is practised on the ground of the ready reckoner rate in Maharashtra. Here, the property value is highlighted in the buyer and seller agreement. It should also be noted that the stamp duty of property depends on its location. To see it with an instance, the property that is located in the municipal realm of an urban area will feature 5% of the current market value. On the other hand, the one located within the proximity of any gram panchayat bears 3% of the current market value as stamp duty.

Maharashtra Stamp Duty Payment Method

Stamp Duty in Maharashtra can be paid in the following three ways:

Stamp Paper

Using stamp paper, a paper with agreed terms on it and then signed by the authorised authority after being reviewed, stamp duty in Maharashtra can be paid. After four months, the stamp paper is registered at the sub-registrar office.

Franking

When the agreement is printed and submitted to an authorised bank, the Maharashtra stamp duty on property is paid. The franking machine is used to process the documents for stamp duty payment after submission.

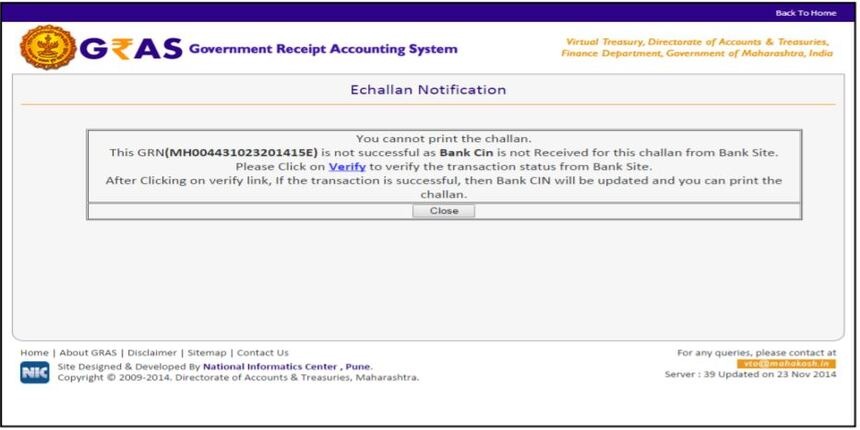

E-Stamp

The most practical way of paying Mumbai or Maharashtra stamp duty on property is by using this approach. RTGS or NEFT are used to pay the Maharashtra land/plot registration charges. This method of paying e-stamp duty in Maharashtra has the benefit of preventing applicants from submitting false documents.

How to Pay Stamp Duty in Maharashtra?

The revision in the Maharashtra Stamp Act deployed the online payment of stamp duty. How to pay Maharashtra stamp duty online? Here, you will find all the steps to be followed in order to make a successful online stamp duty payment in Maharashtra-

Step 1- First of all, you have to hop to the Maharashtra Stamp Duty online portal.

Step 2- Then, tap the “Pay Without Registration” option. This step is for you in case you haven’t registered yourself on the portal already. Fill in the login information if you have come as a registered user.

Step 3- In case you have chosen the “Pay Without Registration” option, you will land on the new page where you will have to select the “Citizen” option.

Step 4- After that, you need to choose the type of transaction you would like to make.

Step 5- In the next step, you will choose the “Make Payment to Register your Document” option. Then you can move on to the payment of stamp duty and registration charges.

Step 6- You can now fill in the required details including sub-registrar’s office, district, party details, payment details, property and property value details.

Step 7- Select the payment option. Once you have done that, you can generate the challan. This challan will be presented during the execution of the deed.

How to Get Refund on Maharashtra Stamp Duty?

The process for a refund on the stamp duty value of property is a question of concern across all the states. Know that the stamp duty refund is applied upon meeting certain conditions.

Here are the different types of conditions on which you can get the Maharashtra stamp duty refund-

- The stamp duty paper is not ideal for use because of writing errors.

- The stamp paper is not signed and complete.

- The stamp paper is partly filled with information.

- The stamp paper is signed but the party found the translation on it illegal according to Section 31 of the Specific Relief Act.

- The court has found the given transaction illegal as per Section 31 of the Specific Relief Act.

- The person who is needed to sign has refused to do so or died before that.

- Any party does not meet the compliances in terms and conditions.

- Any party denies singing the stamp paper.

- The value as per the stamp for the documents has been found insufficient and another stamp paper has been used to complete the transaction.

- The stamp paper is ruined and both parties have incorporated a new stamp paper document to perform the purpose.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Gujarat | Stamp Duty in Gujarat |

| Kolkata | Stamp Duty in Kolkata |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Punjab | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Goa | Stamp Duty in Goa |

| Noida | Stamp Duty in Noida |

Maharashtra Stamp Duty Adjudication

Adjudication of stamp duty refers to adjudging the amount of stamp duty that has to be paid for the registration of a specific document. The government provides services related to the adjudication of the stamp duty in order to determine the stamp duty that is to be payable. In these services, the government officer inspects the documents which helps him determine how much amount should be paid in the face of stamp duty.

Adjudication of Stamp duty in Maharashtra is administered under the following laws-

- Maharashtra Stamp (Determination of True Market Value of Property) Rules, 1995

- Section 31 of Maharashtra Stamp Act

As per the Article 31 of Maharashtra Stamp Act, a fee of Rs. 100 is payable under adjudication. The fees can be paid at the counter at the Stamp Office.

How Stamp Duty Maharashtra has Impacted Property Registration?

Stamp duty collection in Maharashtra was impacted with many ups and down after April 2020. Property registrations witnessed a sink of 50% in April if compared to registrations that took place in the month of March. This downfall began to appear after the state government restored the 5% stamp duty rate effectively from 1 April 2021. As per the data by the state government, Mumbai faced a record-breaking hike with 2.13 lakhs registration before the sanctions were about to be lifted.

Official announcement in respect to the cut of stamp duty rates has faced a spike in the sale, especially in Mumbai that comes from the group of the most expensive cities in India. There were a number of Bollywood A-listers including Hrithik Roshan who were spotted buying properties. From the month of September 1 to October 2020, 25 registration offices welcomed registration for many luxurious properties that were worth 2200 crores.

Latest Updates on Maharashtra Stamp Duty and Registration Charges

As per recent judgements on Maharashtra stamp duty, the Maharashtra government had been directed by the Bombay High Court to refund excess stamp duty amount. The same has to be done within the period of four weeks starting from the date of receipt for the application. Upon failing to do so, the court also introduced a penalty of interest at 12% rate per annum.

FAQ’s about Stamp Duty in Maharashtra

Q1. What are registration charges in Maharashtra?

The registration charges in Maharashtra cost 1% of the total cost incurred by the purchase of a property or land. This rate falls under the Rs 30 lakhs slab and the rate is capped at Rs 30,000 for all the properties that cost beyond Rs 30 lakhs.

Q2. How is Maharashtra stamp duty calculated?

The Mumbai stamp duty rates depend on the area or region the property falls within. The property value is always mentioned in the buyer-seller agreement. The property situated in the municipal limits of the urban area will cost 5% of the market value while any property located inside the proximity of a gram panchayat costs 3% of the market value for stamp duty.

Q3. How can I reduce property registration charges?

You can try to have some relief with the property registration charges by making negotiations in rates with the deed writer, agreeing to pay for the stamp papers and negotiating legal charges.

Q4. Can I get a refund on Maharashtra stamp duty?

You can claim a refund for the stamp duty if the property deal gets cancelled. Know that there are certain terms and conditions which you should meet in order to get the refund. Besides that, the government also deducts about 1% of the charges. Also know that you need to raise the claim for refund within 6 months from the date of property registration.