The Credit Linked Subsidy Scheme (CLSS) is among the four verticals of the Pradhan Mantri Awas Yojana-Urban(PMAY-U) scheme. It aims to provide interest subsidies on mortgage loans obtained by beneficiaries of the Economically Weaker Section (EWS) and Low-Income Group (LIG) for buying or building construction and accumulative homes.

The PMAY CLSS (Credit Linked Subsidy scheme) will be carried out by two prominent nodal organisations: Housing Urban Development Corp and National Housing Bank. This strategy will concentrate on the required components of the subsidised housing cost and its operations, in addition to pouring the flow of credit needed to meet the housing crisis.

To see the progress of your PMAY CLSS application, go to the authorised PMAY website and enter your application ID and DOB (date of birth). You will be allowed to check the application's current status and determine whether you qualify for interest payment after logging in. Folks can also get help from the PMAY helpline.

Table of contents

What is PMAY CLSS?

CLSS is an element of the Pradhan Mantri Awas Yojana (PMAY CLSS) that aims to provide subsidised home mortgages to low and middle-income organisations. Generally, eligible applicants within this scheme are authorised to a reduction in one‘s home mortgage involvement. However, in order to be eligible for this framework, applicants must meet certain criteria.

In addition, the subsidy on the home mortgage is calculated using the current rates of interest. It should be acknowledged that the payment of interest is also premised on tenure and capped at Rs.2.35 lakh. The value is deducted from the primary mortgage balance, and the receivable EMI is decreased as a result.

In general, PMAY CLSS is accessible for residential development, outgrowth, and renovation of existing dwellings' apartments, toilets, dining rooms, and so on. The government is promoting housing affordability via the CLSS strategy of residences for all by 2022.

Documents Required for PMAY CLSS

Potential applicants can obtain a loan subsidy implementation from the bank, which must be completed and submitted along with the documents listed above. Following is a list of documents that are deemed essential for PMAY CLSS are:-

- Proof of Identity such as an Aadhaar Card, PAN Card, Voter card, Passport, Driving License and so on

- Proof of Address such as electricity bills, Residence Address certificate, Stamp paper on the rental agreement, etc

- Current Salary Slips/ ITR/ Form number 16

- Bank Statement documents regarding the recent loans and repayment of at minimum six months

- Property Documents such as a photocopy of chain documents, agreement of sale, allotment letter, payment of receipt

Eligibility for Credit Linked Subsidy Scheme (CLSS)

A list of the eligibility for the Credit Linked Subsidy Scheme (CLSS) is mentioned below:-

- Candidates for PMAY CLSS or one‘s family members should not be government workers

- Claimants for PMAY CLSS or their families mustn't be expert taxpayers

- The families of PMAY CLSS candidates ought not to have benefited from any federal or state government programmes

Based on Income

Potential applicants can save a significant portion of their mortgage EMI and get the most out of their housing loans. People must prove their suitability by providing important documents and achieving obligations. The below table depicts PMAY CLSS for Economically Weaker Sections (EWS) and Low-Income Groups (LIG).

| Particulars | EWS | LIG |

| Annual Income | Up to ₹3 lakh | ₹3 lakh to ₹6 lakh |

| Maximum Loan Tenure | 20 years | 20 years |

| Revised Carpet Area | 30 sq. mt | 60 sq. mt |

| Interest Subsidy | 6.50% | 6.50% |

CLSS for Middle Income Group (MIG)

| Particulars | MIG-I | MIG-II |

| Annual Income | ₹6 lakh to ₹12 lakh | ₹12 lakh to ₹18 lakh |

| Maximum Loan Tenure | 20 years | 20 years |

| Housing Loan Amount Eligible For Interest Subsidy | Up to ₹9 lakh | Up to ₹12 lakh |

| Revised Carpet Area | 120 sq. mt | 150 sq. mt |

| Interest Subsidy | 4% | 3% |

Based on Property Ownership

As well as with economic classes, the following Pradhan Mantri Awas Yojana enrollment requirements must be met in order to receive EMI at a lower rate:

- The CLSS strategy was applied in 2017, housing loans accepted after 2017 are eligible for concessions

- The applicant for PMAY CLSS has to be a first-time home buyer

- PMAY CLSS candidates or beneficiaries should not own a pucca property in India

- Recipients of PMAY CLSS candidates encompass husbands, wives, and unmarried children

- PMAY CLSS applicants with a one or two-room residence with a kutcha ceiling or wall are also eligible to apply

- PMAY CLSS applicants from Scheduled Tribes (STs), Scheduled Castes (SCs), and Minority groups are also qualified

- If the PMAY CLSS candidate has a Kisan Credit Card (KCC), the credit card limit must not exceed ₹ 50,000

- Candidates for PMAY CLSS must belong to a family which includes a spouse and unmarried children

- Applicants for PMAY CLSS should not possess a two-wheeler, three-wheeler, or four-wheeler

- The individual's residence cannot have a refrigerator or a telephone service

- Female adult equity is required for EWS and LIG mortgage loan affordability

Based on Loan & Subsidy

The Pradhan Mantri Awas Yojana selection criteria for mortgages and subsidisation that PMAY CLSS candidates must fulfil when utilising Pradhan Mantri Awas Yojana are listed below.

| Perks | EWS | LIG | MIG I | MIG II |

| Loan Tenor(Years) | 20 | 20 | 20 | 20 |

| Home Up-Gradation | Covered | Covered | Not Covered | Not Covered |

| Ownership of Female | Complusary | Complusary | Not Complusary | Not Complusary |

| Maximum Mortgage Amount for Subsidy | Up to ₹3 Lakh | Up to ₹6 Lakh | Up to ₹9 Lakh | Up to ₹12 Lakh |

| Maximal Subsidy | ₹ 2.67 Lakh | ₹ 2.67 Lakh | ₹ 2.35 Lakh | ₹ 2.30 Lakh |

| Subsidy % | 6.5 | 6.5 | 4 | 3 |

How Interest Subsidy is Calculated under CLSS?

To calculate the subsidy under CLSS, a subsidy calculator is present on the official portal. The interest subsidy would be determined by calculating at 9% net present value (NPV) over the highest loan period of 20 years or the true tenure, whichever one is shorter. Residential loans in excess of Rs. 9 lac and Rs. 12 lac would be considered non-subsidised.

How to Avail of the PMAY CLSS Subsidy Scheme?

To Avail, you must evaluate whether you're qualified for the Home Mortgage Credit Linked Subsidy Scheme. If you are eligible for PMAY CLASS, follow the following steps:

- Users must fulfil each of the prerequisites; you should inform the participating financial firms

- Enter all the PMAY Home Mortgage Credit Linked Subsidy Applications and send them to the loan company with the necessary documents

- After confirmation, the loan balance will be transferred into your savings account

- Your mortgage company will notify the nodal organisations after the mortgage is transferred to start the procedure of accumulating equity subsidies

- Upon validation, the impact of finances will be given credit to your loan facility, and your loan balance will be lowered, reducing your Affordable Monthly Instalments

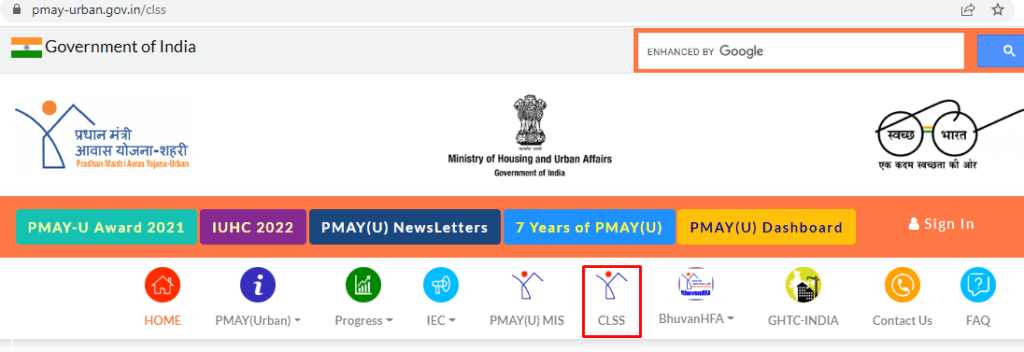

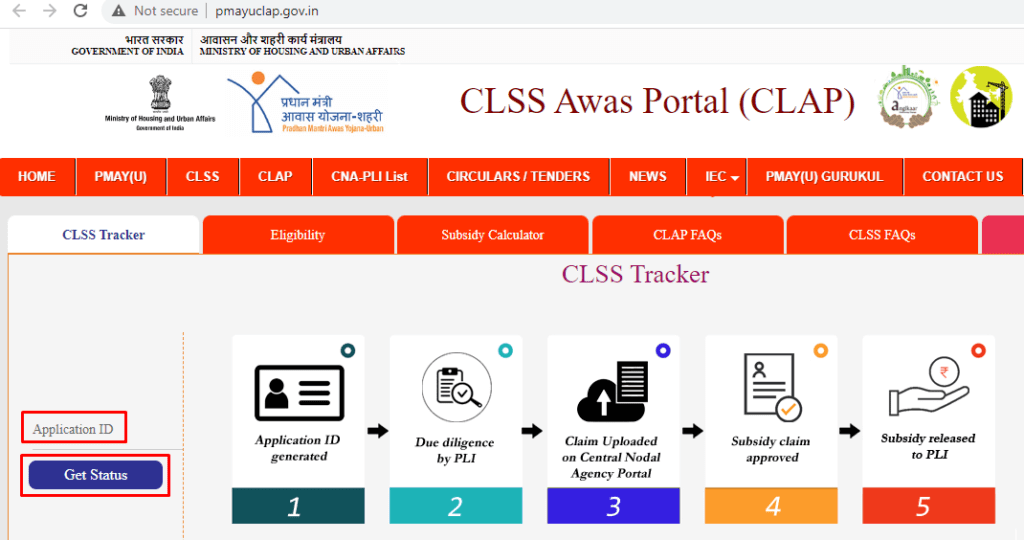

Track the Status Process of PMAY CLSS

Some of the steps are mentioned below to check the status of PMAY CLSS:

Step 1: Visit the official portal of PMAY.

http://pmayuclap.gov.in/

Step 2: Click on the ‘CLSS’ category present on the navigation panel.

Step 3: Enter the ‘Application ID’ and click on the ‘Get Status’ button.

Step 4: An OTP will be sent to your registered email or mobile number.

Step 5: Enter the required information and submit it.

Helpline Number for PMAY CLSS

You can contact the PMAY CLSS helpline numbers(Toll-Free) for any enquiries.

- The PMAY CLSS toll-free helpline number is 1800116163 for Housing and Development Corporation (HUDCO)

- The PMAY CLSS toll-free helpline numbers are 1800113377 and 1800113388 for National Housing Bank (NBC)

Conclusion

With the assistance of this article, you ought to be able to recognise the importance of the PMAY CLSS scheme that is used in housing units for EWS (Economically Weaker Sections) or LIG (Low-Income Groups).In addition, it might have cleared any remaining significant doubt about Pradhan Mantri Awas Yojana (PMAY CLSS) subsidy.

FAQ's

What is the appropriate rate of interest on the Pradhan Mantri Awas Yojana (PMAY CLSS) subsidised quantity?

The Pradhan Mantri Awas Yojana (PMAY CLSS) measured values are subject to a fixed rate of interest of 6.5 % for a duration of up to 20 years.

Is the Credit Linked Subsidy accessible at all of the country's financial institutions?

Yes, all financial institutions present on the list of the RBI’s offers the Credit Linked Subsidy.

Who is qualified for the Credit Linked Subsidy Scheme's payment of interest?

Economically Weaker Section (EWS) and Low Income Group (LIG) recipients looking to find housing loans through banks, mortgage companies, and other similar organisations will be qualified.

Can a borrower extend the term of the loan further than 20 years?

Yes, a client can request a loan term of much more than 20 years if two parties agree.

Should I include any additional documentation to be eligible for this subsidisation?

No, the beneficiary must sign an identity general belief that he or she may not possess any pucca housing units.