What is MHADA?

The MHADA lottery is a housing lottery conducted by the Maharashtra Housing and Area Development Authority (MHADA). The lottery offers housing units at affordable prices, making it an attractive option for many people. This lottery system is a way to promote social inclusion and reduce housing inequality in the state of Maharashtra.

The MHADA lottery is open to all Indian citizens at least 18 years of age. To apply, interested applicants must submit an application form and a non-refundable processing fee. Application forms are available online on the official website of MHADA.

Table of contents

- What is MHADA?

- Benefits of MHADA Lottery for Homebuyers

- Eligibility Criteria of MHADA Lottery

- Documents Required for MHADA Lottery Scheme

- Registration Fees For MHADA Lottery 2022

- Steps to Apply For MHADA Lottery 2022

- How to Check MHADA Lottery Results Online?

- How to Check MHADA Refund Status?

- List of MHADA Lottery Boards

- MHADA Lottery Mumbai Projects 2022

- MHADA lottery Mumbai Konkan Board 2023

- MHADA Lottery Aurangabad 2022

- Buying MHADA Flats in Resale

- MHADA Lottery Mumbai Contact Information

- FAQ's about MHADA Lottery

Benefits of MHADA Lottery for Homebuyers

The MHADA lottery is a great opportunity for homebuyers in Mumbai to get their hands on affordable housing. The lottery offers housing at prices significantly lower than the market rate, making it a great option for those looking to buy a home on a budget.

Additionally, the lottery process is designed to be fair and transparent, ensuring that all eligible buyers have a chance to purchase a flat.

Eligibility Criteria of MHADA Lottery

The MHADA lottery is conducted by the Maharashtra Housing and Area Development Authority. The applicants must fulfil the following eligibility criteria to participate in the MHADA lottery:

- Minimum age for applicants is 18 years old.

- The applicant must be a resident of Maharashtra. Furthermore, they must be able to provide a domicile certificate as proof.

- The applicant must have a valid PAN Card.

Documents Required for MHADA Lottery Scheme

The MHADA lottery scheme offers affordable housing to residents of Maharashtra. To be eligible for the scheme, applicants must submit certain KYC documents. These include

- Aadhaar card

- PAN card

- Drivers license

- Voter ID

- Domicile certificate,

- School leaving certificate.

Registration Fees For MHADA Lottery 2022

The Maharashtra Housing and Area Development Authority (MHADA) is getting ready to conduct a lottery for buying Low-Cost-Housing. The same registration fees are categorised according to the applicant's income. The details of the registration fees are tabulated below:

| Income Group | Registration Fees |

| Economically weaker section (EWS) | INR 5,560 |

| Low-income group (LIG) | INR 10.560 |

| Middle-income group (MIG) | INR 15,560 |

| High-income group (HIG) | INR 20,560 |

Steps to Apply For MHADA Lottery 2022

Here are the steps to apply for the MHADA lottery:

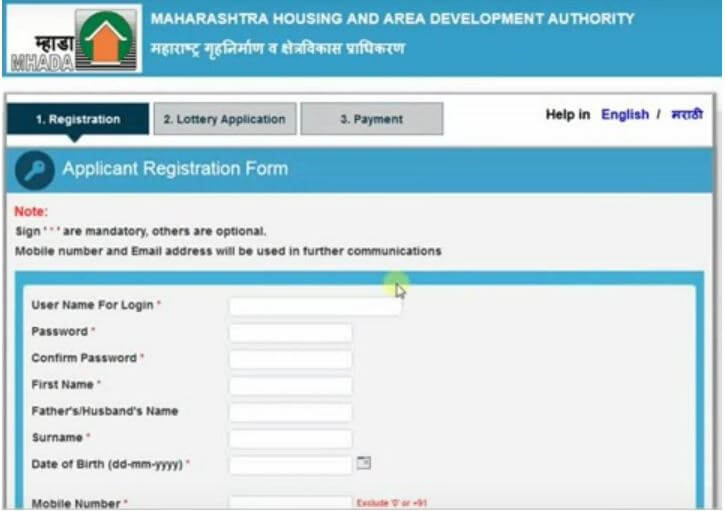

Step 1: Visit the official website of MHADA lottery and register yourself by filling in the basic information.

Step 2: Enter the OTP received on your mobile number.

Step 3: Fill in the MHADA lottery application form by entering your name, monthly income, PAN details, address and pincode, contact number, bank account details, and the verification code.

Step 4: You must now upload the documents in JPEG format as prescribed in the rules and regulations.

Step 5: Pay the application fees and print out the application form for future reference.

How to Check MHADA Lottery Results Online?

To check the MHADA lottery results online, visit the official website of the MHADA lottery. The steps to check the results are outlined below:

Step 1: Visit the official website of the MHADA lottery.

Step 2: Under the menu, go to ‘Lottery Results’

Step 3: Select the lottery board you have applied for and click on ‘View’

Step 4: Next, select the scheme code under which you have filled in your application and click on ‘View’

Step 5: Now, you will be redirected to a pdf file, where you can see the lottery results.

How to Check MHADA Refund Status?

The MHADA lottery refund process is straightforward. The concerned authority will refund the applicant's total expenditure if the applicant fails to win the lottery. The refund will be processed within seven working days.

Step 1: Go to the official website of the MHADA lottery https://postlottery[dot]mhada[dot]gov[dot]in/login[dot]do

Step 2: Fill in your credentials (username/ application number and lottery event number).

Step 3: Upon redirection, you will find a section that allows you to track your refund status.

Note: If the MHADA application money is not refunded within seven working days, you can contact the MHADA officials for assistance.

Don't miss It!

| MHADA Lottery Pune | MHADA Pune Lottery Registration |

| MHADA Lottery Scheme | What is MHADA Lottery Scheme? |

| MHADA Lottery Aurangabad | MHADA Aurangabad Lottery Registration |

List of MHADA Lottery Boards

The MHADA lottery is a housing lottery system in Maharashtra, India. It is run by the Maharashtra Housing and Area Development Authority (MHADA). The MHADA lottery offers affordable housing options to people from all walks of life. The lottery is open to all Indian citizens at least 18 years of age. The list of MHADA lottery boards is listed below:

- MHADA lottery 2022 Mumbai

- MHADA lottery Konkan

- MHADA Nagpur Lottery Housing Scheme

- MHADA Pune Lottery

- MHADA Aurangabad Lottery

- MHADA Amravati Lottery Housing Scheme

- MHADA Nashik Lottery Housing Scheme

MHADA Lottery Mumbai Projects 2022

The MHADA lottery for 2022 is expected to be released soon, and several Mumbai-based projects will be included in the lottery. The most anticipated project locations are Ashokvan, Chandivali, Powai, Shankar Nagar Chembur, and Shastri Nagar.

MHADA lottery Mumbai Konkan Board 2023

Konkan Housing and Area Development Board administers the MHADA Konkan Board lottery in locations like Thane, Raigad, Ratnagiri, and Sindhudurg. MHADA will conduct a Konkan lottery in early 2023. Furthermore, the Konkan board lottery 2022 was announced by MHADA in June 2022. A total of 1,500 houses were allocated through this MHADA lottery in 2022.

MHADA Lottery Aurangabad 2022

MHADA Aurangabad board released the lottery winners list in June 2022. A total of 1,185 houses will be allocated in areas such as Latur, Kannad, Chikalthana, Jalna, and Deola.

Buying MHADA Flats in Resale

Sales of MHADA flats are only allowed five years after purchase. It is critical to be cautious when purchasing a resale flat. During the lock-in period, sellers usually offer the power of attorney instead of a registered deed to transfer the property. An MHADA raid could expel you if you sell through a power of attorney. The allottee has to pay a transfer fee, stamp duty, and agent commissions when selling the flat. MHADA flats are a viable option for buyers looking for affordable housing in Mumbai.

MHADA Lottery Mumbai Contact Information

If you're interested in applying for the MHADA lottery in Mumbai, you can find all the necessary contact information on the MHADA website. You can reach out to the MHADA lottery office by phone or email, and they will be able to provide you with more information about the application process. In addition, the website also has a FAQ section that can answer any other questions you may have about the lottery.

| Address | MHADA, Grihanirman Bhavan Kalanagar, Bandra (E), Mumbai 400051. |

| Contact Number | 9869988000/ 022-66405000 |

| Toll-Free Number | 1800 120 8040 |

FAQ's about MHADA Lottery

Q1. Is there an MHADA lottery in Mumbai?

Yes, the MHADA board conducts a lottery in Mumbai as well.

Q2. Is it good to buy MHADA flats?

Yes, these flats are typically much lower than other types of flats in the city, so you may get a good deal.

Q3. Who is not eligible for the MHADA lottery?

Any individual who does not reside in Maharashtra cannot apply for the MHADA lottery.

Q4. Can I apply for multiple schemes in the MHADA lottery?

Yes, you can apply for multiple schemes in the MHADA lottery.

Q5. Can husband and wife both apply for MHADA?

Yes, the husband and wife have the liberty to apply separately for the MHADA lottery in accordance with the terms and conditions stated by MHADA.

Q6. What is the lock-in period for MHADA flat?

The lock-in period for MHADA flat is five years.