CIBIL or the Credit Information Bureau India Limited provides a credit score to individuals and companies depending on the credit history. CIBIL publishes this information after verifying it from various financial sources on a credit report. Any error in this report affects the credibility of the loan borrower. Hence, it is essential to rectify the error through a CIBIL dispute.

If you have found an error in your credit report and don’t know how to rectify it, then you have landed on just the right page. This blog describes how to raise a dispute in CIBIL, fill the CIBIL dispute form and contact CIBIL customer care, among other details.

Table of contents

- CIBIL Disputes and its Meaning

- CIBIL Disputes and its Types

- Company Disputes

- Individual Disputes

- How to Raise a Dispute on the CIBIL Website Online?

- Raising Dispute with myCIBIL

- Online Resolution Form

- Company Dispute Resolution

- How to Dispute CIBIL Report Offline?

- The Process of CIBIL Dispute Resolution

- Important points related to the CIBIL Disputes

- What are the Details of CIBIL Customer Care?

- Frequently Asked Questions (FAQs)

CIBIL Disputes and its Meaning

TransUnion CIBIL is the apex credit bureau in the country that produces a credit score based on your creditworthiness. CIBIL score is a three-digit number given to an individual based on his credit history, the recurrence of loan applications & repayment of debts. CIBIL collects data from different sources and lenders to determine its accuracy before printing it on the credit reports.

Discrepancies or errors in your credit report like name, birth date, contact information etc., affects your credit score and hampers the eligibility for a loan. Therefore, it is crucial that you immediately rectify the mistakes by raising a dispute with CIBIL, also known as CIBIL dispute.

CIBIL Disputes and its Types

A company’s or individual’s credit report might have certain disputes to be resolved. The process might get more manageable if you already know the type of dispute. Have a look at the most prevalent categories of dispute that might arise in a credit report.

Company Disputes

1) Ownership

If the mentioned company account is not in your name, then an ownership dispute might arise.

2) Account or Company Details

Various types of details like address, name etc., might be disputed. Account details also include company PAN, sanction amount and credit type, among other information.

3) Incorrect fields

A dispute can be raised for the following company details:

- Legal constitution

- Company name

- State

- City

- The registered address of the company

- Branch address of the company

- PIN code

- Company PAN

- Telephone numbers

- Partner name/Director/Promoter/Proprietor

- Relationship

The following account details can be disputed:

- Credit type

- Sanction date

- Asset classification

- Current balance

- Status

- Suit filed status

- Suit amount

- Date of suit

- The date which is classified as willful defaulter

- Remarks by bank

- High credit/sanctioned amount

4) Duplicate Account

If a similar account is being replicated multiple times, you must raise a dispute and amend it.

Individual Disputes

1) Duplicate Account

If your account is present twice and getting repeated, you must raise a duplicate dispute with CIBIL.

2) Personal Details

If the personal details like address, customer name etc., are misspelt, you can raise a dispute. For example, Vijay Malhotra might be misspelt as Vijay Malhotra; in that case, you have to get the name rectified.

Please Note, There is certain information for which you cannot raise a dispute. These are:

- Control Number

- Account Number (Except Ownership dispute)

- Member Name (Except Ownership dispute)

- Enquiry date

- Date reported

How to Raise a Dispute on the CIBIL Website Online?

The CIBIL and Company Credit reports can be taken up in three ways via my CIBIL. Further, it can be raised through the online dispute resolution form and method.

Raising Dispute with myCIBIL

You have the option to dispute more than one detail or field on your report (within the purview of an individual dispute) by steering through different parts of the credit report (Personal, Employment, Contact, Enquiry and Account Details).

Follow these easy steps to raise a dispute(s):

Step 1: Reach the official website of CIBIL and select ‘myCIBIL’. Login to obtain the CIR (Company Information Report).

Please note that if you got your CIR through your lender during the examination of your details, then you can only access your CIBIL score and CIR at www.cibil.com/freecibilscore. Then, head to myCIBIL to raise the dispute.

Step 2: After logging in, select the section ‘Credit Reports’ and go to the desired sub-section. Select ‘Raise a Dispute’.

Step 3: Finish off the online dispute form.

Step 4: Select the section you would like to raise a dispute.

Step 5: If you raise a dispute for Duplicate/Ownership, select ‘Dispute Type’. Click on the ‘Submit’ button.

Step 6: If you raise a dispute for Data Inaccuracies, you need to insert a particular value for the disputed field. Click on the ‘Submit’ button.

Online Resolution Form

Step 1: Begin by logging into your account on myCIBIL.

Step 2: Fill the online form with the required details and click on the ‘Submit’ button.

The disputed field (s) in the respected section (s) are filed under “Under Dispute”.

Company Dispute Resolution

Follow these steps to apply for a company dispute resolution:

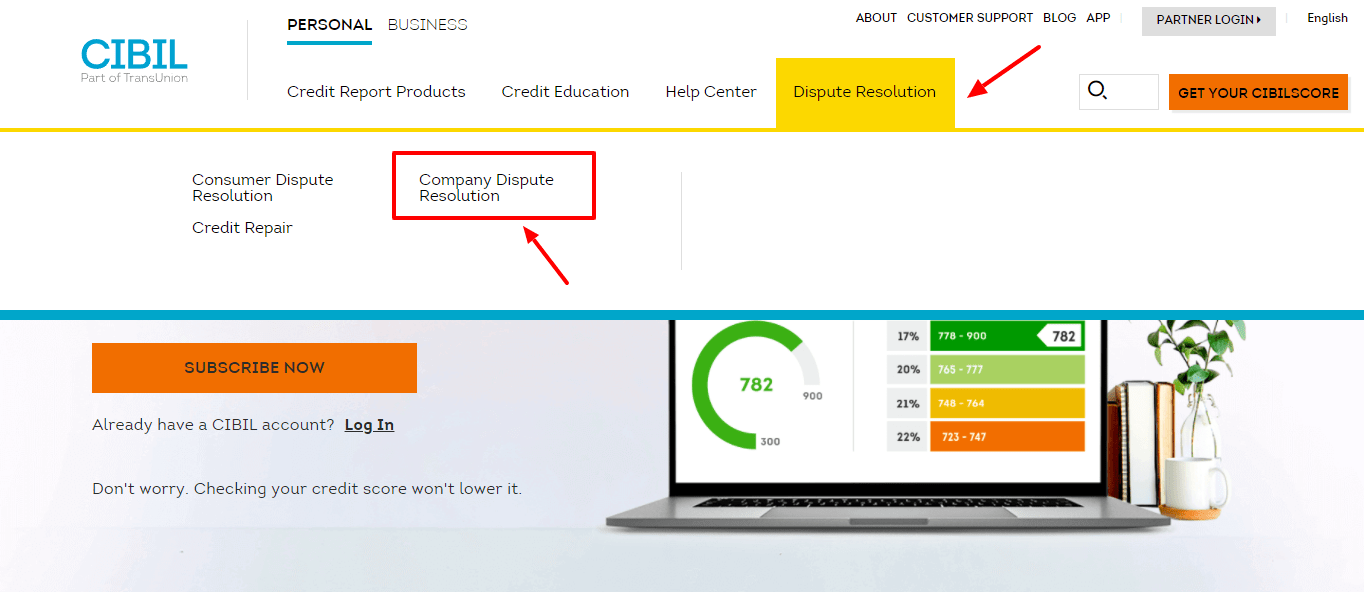

Step 1: Visit the official website of CIBIL and select the ‘Company Dispute Resolution Portal’.

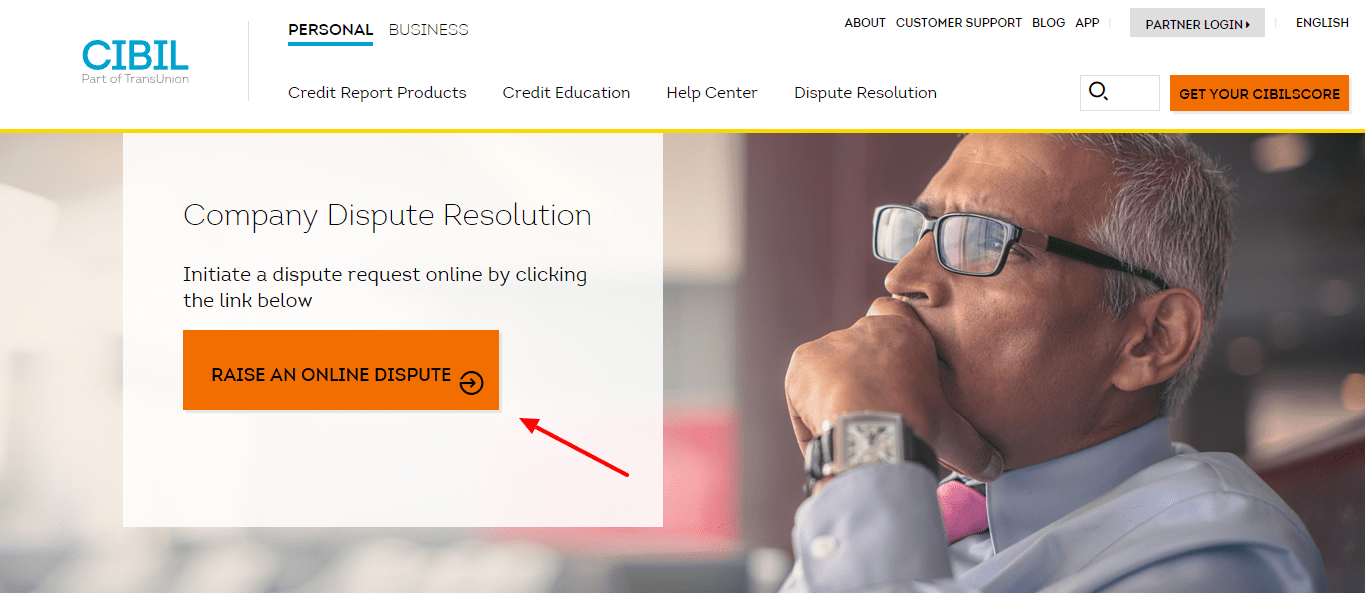

Step 2: Click on ‘Raise an Online Dispute’.

Step 3: Enter the required details and the reason for the dispute.

Step 4: Insert the given captcha code and click on ‘Submit’.

How to Dispute CIBIL Report Offline?

You can additionally raise a dispute by sending a written letter to the below mentioned official address of TransUnion CIBIL.

TransUnion CIBIL Limited, One Indiabulls Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

The Process of CIBIL Dispute Resolution

Step 1: The dispute is transferred to the respective financial institution/bank based on the category or type.

Step 2: The financial institution/bank rejects or accepts the dispute.

Step 3: If the dispute is accepted, the required corrections are made, visible on the credit report, which is produced next time.

Step 4: The “Under Dispute” is taken off from the disputed field under the relevant section.

Note: The turnaround time of the entire process takes place within 30 days. It is subject to the time taken by the financial institution/bank.

Important Points Related to the CIBIL Disputes

- Filling out an online-dispute form is the first step to rectifying a CIBIL report. Ensure that you mention the control number displayed on the credit report. The control number is a 9-digit figure which is regenerated every time you ask for the CIBIL report.

- After filling out your dispute form, a dispute ID will be provided. Use this ID to keep track of the dispute request and further communications.

- In the scenarios where CIBIL itself can solve your dispute, the required changes can be made quickly. But, if CIBIL lacks the relevant information, it reaches out to the credit provider to resolve the dispute. After the loan supplier has confirmed that the report has an error, the data is updated in the CIBIL and CIBIL report records.

- A dispute raised through CIBIL might be resolved approximately in a month. When your report is corrected, you will receive an SMS regarding the same.

- You would have to request the report again to verify that the changes have been made or not.

- It is essential to understand that CIBIL is an organisation whose responsibility is to collect and verify information from lending entities and credit associations. It is not responsible for changing or manipulating your data.

What are the Details of CIBIL Customer Care?

| CIBIL customer care number | (+91)22-6140-4300 |

| FAX | (+91)22-6638-4666 |

| CIBIL Corporate Office Address | TransUnion CIBIL Limited One Indiabulls Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai – 400013 |

| CIBIL customer mail ID | info@cibil.com |

| Portal | CIBIL Self Service Portal |

Frequently Asked Questions (FAQs)

How can I clear my CIBIL dispute?

Your CIBIL dispute can be resolved online if you want a quick process. You can also send your dispute in writing to the CIBIL office in Mumbai.

What is a CIBIL dispute?

A CIBIL dispute is a process of identifying and rectifying the mistakes in your credit report.

How do I contact CIBIL for a dispute?

You can contact the CIBIL customer care number at +91 - 22 - 6140 4300 or write to their official address of CIBIL in Mumbai.

Is CIBIL a Government organization?

No, CIBIL is not a government organization. It is an agency authorized by the Reserve Bank of India.

Does RBI authorize CIBIL?

Yes, CIBIL is authorized by the Reserve Bank of India.

What are the various situations in which I can raise a CIBIL dispute?

If you face ownership issues, you can raise a dispute if incorrect personal details or overdue balance information are in your credit report.

What to do when my CIBIL report has an error?

You should raise an issue with the credit bureau for rectifying the errors you see in your CIBIL report.

How will I get to know that CIBIL has resolved my dispute?

You will receive an SMS immediately after your error has been corrected. To verify whether it has been updated or not, you would have to request your CIBIL report again.

What should I do if my dispute resolution is not satisfactory?

If you are not satisfied with the dispute resolution, you will have to contact CIBIL or put in a new request.