Financial institutions or banks rely on CIBIL, which is one of the most eminent agencies for credit reporting. So, individuals or companies who wish to apply for a loan or a credit card can check their CIBIL score, which implies the creditworthiness of the individual.

This blog describes the CIBIL login and registration process, which will help you in accessing the CIBIL Report and CIBIL Score. Read on to get the gist of it.

Table of contents

- Who are Members and Consumers?

- Process of CIBIL Registration for Individuals

- CIBIL Login Process for Individuals

- Process of CIBIL Registration for Companies

- Process of CIBIL Login for Companies

- What is CIBIL Rank?

- KYC Documents Required for CIBIL Registration

- How to Upload the KYC Documents?

- Advantages of Registration on myCIBIL

- You Might Also Like

- Frequently Asked Questions (FAQs)

Who are Members and Consumers?

Before we dive into the process of CIBIL login registration, it is important to get clarity of who the members and consumers are. The financial institutions, banks, asset reconstruction companies, credit rating companies, and Telecom companies are known as the CIBIL members, who can access through CIBIL member login. On the other hand, individuals or companies can be described as CIBIL consumers who can access CIBIL through CIBIL consumer login.

Process of CIBIL Registration for Individuals

Individuals need to follow the below-given instructions to complete the CIBIL login registration.

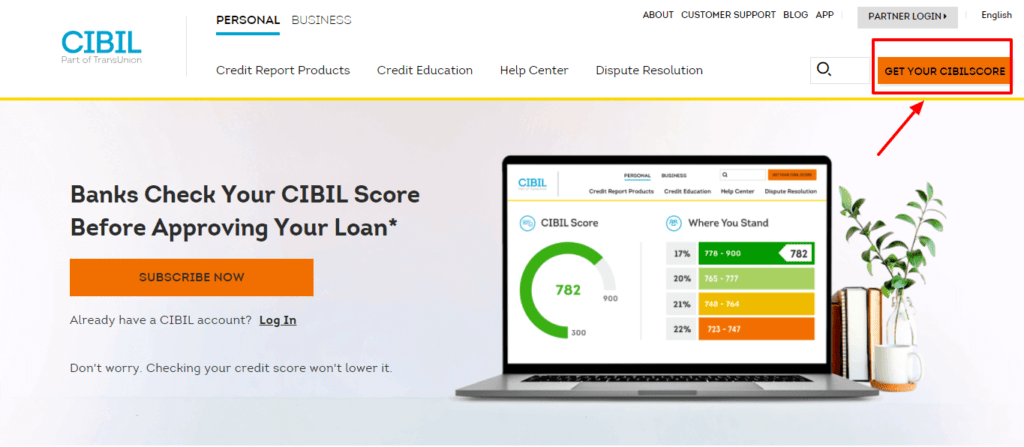

Step 1: Head to CIBIL’s official website.

Step 2: Choose ‘Get Your CIBIL Score’ option and select the required plan. There are three subscription options, namely Basic, Standard, and Premium.

Step 3: Under the ‘Create your account’ option, insert the personal details like the email address, name, ID number, government ID type & mobile number. You will be asked to set a password to secure your account.

Step 4: In order to move ahead to the next step, select the ‘Accept & Continue’ option. The next step is to ‘Verify your identity.’

Step 5: After entering your details in this section, move to ‘Payment’ option to make your payment for the required plan subscription.

Step 6: After making the payment, you will be registered on the CIBIL site. All you have to do is log in and make use of the site’s attributes.

CIBIL Login Process for Individuals

CIBIL consumer login can be done by following the below-mentioned steps.

Step 1: Visit the official website of CIBIL.

Step 2: Select the option ‘Get your CIBIL score’.

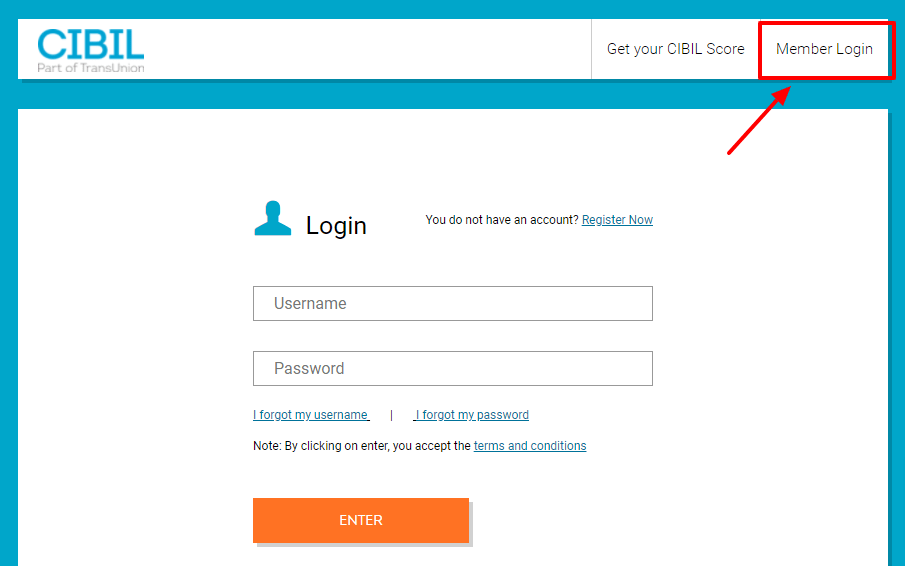

Step 3: Now select ‘Member login’ and you will be redirected to the login page.

Step 4: Enter your username and password (which you created) in the fields to log in.

Step 5: Select the ‘Enter’ option, and you will be redirected to your dashboard.

Process of CIBIL Registration for Companies

Companies need to follow the below-given instructions to register on CIBIL.

Step 1: Head to the website cibilrank.cibil.com.

Step 2: You will have to fill the given form with the required details, such as entity type, company name, ID value, ID type, registered office address, GSTN value, authorized signatory’s contact details, PIN, city, state, applicant’s name and their relationship with the company.

Along with the above information, you will also be asked to provide the Company Identification Number, Loan Account Number, Director Identification Number, Tax Identification Number & Company PAN.

Step 3: After you have filled in the information, agree to the terms and conditions and select the ‘Proceed’ option.

Step 4: You need to make payment in order to register your company on CIBIL. This can be done via debit card, credit card, and net banking.

Step 5: You will receive CIBIL Registration ID (unique) and a payment transaction ID on your mail ID. Use the same information to log in on CIBIL.

Step 6: Now, you have to upload the KYC documents of the company. After you have successfully completed the registration process, CIBIL will confirm your KYC documents and provide you with the Company Credit Report (CCR) and CIBIL Rank for your company.

Please note that the ranking in this scenario will range from 1 to 10, 1 being the highest and 10 being the lowest rank. According to credit institutions, the ideal ranking for a company to get loans is 4 to 1.

Process of CIBIL Login for Companies

Given below is the procedure to log into CIBIL.

Step 1: Proceed to the official website of CIBIL.

Step 2: Enter your email address and follow the instructions to log into your account.

What is CIBIL Rank?

Individuals get a CIBIL score, and companies receive a CIBIL rank which is a summary of the company’s Commercial Credit Report (CCR). The ranking is given from the numbers 1 to 10, 1 being the highest rank. This rank is also given to companies who have a credit exposure of ₹10 lakh and ₹50 crores.

You must be wondering what the rank signifies? The rank signifies the chances of your company not making the payments on time. This ranking is considered by the lenders for the purpose of lending money to the company.

KYC Documents Required for CIBIL Registration

It is important to submit your KYC documents with CIBIL to ensure that the request for credit can be granted to the true (right) owner. The checklist for the KYC documents required for commercial and individual users is mentioned below.

Documents Required for Individuals

- Proof of Identity: Passport, Voters Identity card, PAN card, Driver’s License, and Aadhaar card come under the category of identity proofs.

- Proof of Address: Telephone bill, electricity bill and your bank statements are considered as address proofs.

Documents Required for Companies

Proof of address: The following documents can be submitted as address proofs by the companies

- Bank statement

- Telephone bill

- Electricity bill

PLEASE NOTE: Both the commercial users and companies must ensure that the address which is mentioned in the CIBIL form during registration should be the same as that mentioned in the KYC documents submitted by them. The companies only need to submit their address as identity proof as it gets verified through PAN.

How to Upload the KYC Documents?

Your registration with CIBIL will not be considered complete until and unless you upload the KYC documents to verify your identity. Follow these simple steps:

Step 1: Head to the website cibil.com/kyc-upload.

Step 2: When you reach the next page, you will receive two choices, one for the individuals and one for companies. Select the relevant option and then select the ‘Submit’ option.

Step 3: In case you have chosen the option ‘CIBIL score and CIR’, you have to enter your email address and birth date. Make sure that you upload the correct address and identity proof. Then, click on the ‘Submit’ option.

And, if you selected the option ‘CIBIL Rank and Company Credit Report’, you will need to submit the company ID and email address or company ID and DD number. Ensure that the documents are uploaded in the correct format. Then, click on the ‘Submit’ option.

NOTE: The users of CIBIL can also choose to provide the copies of their documents to the CIBIL registered office. You need to indicate the transaction ID which was generated during the time of payment.

Advantages of Registration on myCIBIL

CIBIL provides a platform called ‘myCIBIL’ for its customers so that they can get a regular update of the CIBIL report and score. The benefits provided by myCIBIL are as follows:

- The CIBIL website will offer you attractive discounts after you log in and reach the platform myCIBIL for accessing your report.

- You receive easy access in the form of an online CIBIL report and CIBIL score login.

- The customers can receive customized pre-approved offers for loans at the competitive rates.

You Might Also Like

Frequently Asked Questions (FAQs)

Is CIBIL registration free?

No, you have to pay a certain amount according to the plan you select during CIBIL login registration.

What is CIBIL consumer report?

CIBIL consumer report gives insights into the borrowings of a consumer across different lending institutions.

How can I check my CIBIL report online?

To check your CIBIL score, log in to the official website of CIBIL and select the ‘Know your Score’ option. Then, you need to fill an online form that consists of personal details like name, address, date of birth, past loan history, etc.

How can I check my CIBIL score without a mobile number?

You can also check your CIBIL score with the help of your PAN card.

What is the normal CIBIL score?

A CIBIL score can range between 300 and 900. A score of 900 denotes the maximum creditworthiness. However, an ideal CIBIL score is 750 or above.