Demand has increased exponentially for luxury housing units after the pandemic, especially in H1 2022. 25,680 such units have been sold in the country’s top 7 cities in this period as per reports, accounting for 14% of overall home sales between January and June. These are housing units with prices exceeding Rs. 1.5 crore and were sold throughout the NCR, MMR, Hyderabad, Kolkata, Bengaluru, Chennai, and Pune.

DLF has already sold out 292 luxury residential units at its project in Gurugram called The Grove within only eight days, generating Rs. 1,800 crore in the process. Macrotech Developers Ltd has already seen its best-ever quarterly figures of Rs. 3,148 crore in sales, indicating 57% of growth (year-on-year). The company notched up Rs. 6,004 crore in sales figures for H1 2022, accounting for 52% of its Rs. 11,500 crore of full-year guidance.

Reports also highlight higher luxury home supply in this period, with 33,210 such units launching throughout these cities for the period. This is massive in comparison to only 16,110 units launching in the segment back in H1 2019. Demand was also high in the premium real estate category with prices between Rs. 90 lakh and Rs. 1.5 crore. This had vote share going up to 24% in H1 2022 as compared to 18% before the pandemic. This means that demand is still strong, despite the increase in property prices and interest rates on home loans.

However, budget homebuyers may still face a crunch with the increases in home prices and interest rates alike. Home affordability levels are still in sync with pre-pandemic times although it has come down by 17% over the last year. It may also come down by another 8% in the next year as per reports. ASPs or average selling prices have increased by 12% (year-on-year) for July to August this year. The Reserve Bank of India has also increased its repo rate for the fourth successive time to 5.9%.

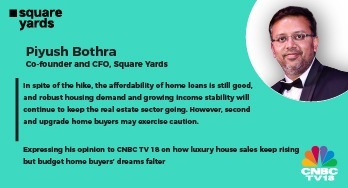

Experts feel that budget home buyers may be impacted before the festive season. Yet, rates of interest will still hover below 9% and they should tap this opportunity to buy their homes, while leveraging other festive discounts and offers as well. The CFO and Co-Founder at Square Yards, Piyush Bothra, feels that despite the increases, home loan affordability still remains good, while rising housing demand and increasing stability of income will keep the realty sector moving forward. However, he added that homebuyers looking for upgrades or second homebuyers may remain a little cautious for now.

For a detailed report on this read the articles we were featured in:

Times Property - https://bit.ly/3ExdxtP

Published Date: Oct 6, 2022