Property tax in Surat like many other municipal corporations can be paid through Surat municipal corporation property tax online paymentor manually to SMC. The tax is used on development of the area, constructing infrastructure and providing civil amenities.

There has been a swift wind of change since the inception of digital India. Digital India holds a lot of promise and potential that has revolutionized the way used to function previously in the departments of the governments and elsewhere. It has resulted in transparency in the functioning of the government when it comes to interface between officials and the people. This emblem of digital India has a panoramic vision of a new and resurgent India and it is important for any country in the 21st century. Surat Municipal Corporation has followed suit and it has digitized most of its services to the delight of the citizens of Surat. It has benefited citizens of all ages.

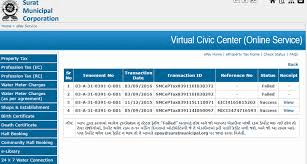

The municipal corporation has become digitized and it has started online services through a dedicated portal. It has been very successful in this direction because it has put up most of its services online. Different apps have been created for the convenience of citizens of Surat for different services provided by the Surat Municipal Corporation. Now there are payments done through Surat Municipal Corporation property tax bill online payment. There is another handle of property tax Surat for payment of property tax to the government.

Important Apps in Surat

There is this first app known as SMC app which is known as the one-stop solution to the citizens who approach it with multiple issues right from getting an online birth certificate, death certificate, and payment of property tax, professional tax, and bill related to water. You can lodge your complaint here and make an appointment for baby’s vaccination. There is another famous app known as Citylink app for daily commuters like students who can track and find buses and other means of transport through this app. These will be provided by the GPS system. As Surat has a rich cultural heritage, there is an apt app called Heritage walk app which can be used like your personal guide that will take you to the famous heritage sites of Surat including historical locations.

Surat Smart city app is another famous app that gives you information about Surat smart city initiative and you can get all your desired information about Smart City Surat. Another famous app in Surat is SAFAL app that lets you have a peek into the pool of manpower like carpenter, plumber, electrician, cook, engineer, technician, office boy, painter, nurse, sweeper or welder. You can make use of Surat Smart money card which can be used to pay taxes, to libraries, public amenities, etc. this will also enable you to get discounts in city buses. Though Surat has not become fully digital, it is on its way.

Levy of property taxes

Property tax is imposed by the municipal corporations on the real estate properties. There is Surat Municipal Corporation property tax which can be paid online and offline. It is also known as SMC property tax or simply SMC. Rates of property tax and the manner they are paid vary. It is based on some factors; the value of the property is one of them.

Property tax, what is it?

Property tax is levied on the owners of property by the municipal corporations for the services they provide for the people. These municipal authorities are like Municipal Corporation, municipality or Panchayat. The revenue generated is used to maintain and upkeep the civic amenities of the municipal areas.

These amenities are like roads, drainage system, sewerage, electricity and water supply. It is also used to make and maintain parks, gardens, and infrastructure. It is levied on both residential and commercial properties. It is not imposed on a vacant piece of land.

Property tax calculation

Property tax is calculated by the Municipal Corporation or authorities. It is imposed in proportion to the values assessed of the property. There are different ways of calculating property tax. Please see the FAQ section.

1. What is CVS and how is it calculated?

Capital Value System (CVS): This is calculated in terms of percentage of the market value of the property in question. The market value is ascertained by the government and it depends on the locality in which the property is situated. The market value is variable and it gets revised every year.

2. How is RVS calculated?

Rental Value System (RVS): Here the tax is calculated based on the yearly rental value of the property. This value thus assessed might vary from actual rent collected. This is calculated on the basis of the type of property, its usage, age of the property, proximity to landmarks, amenities, etc.

3. U A S, what is it and how is it arrived at?

Unit Area Value System (UAS): In this category, the tax is calculated on the per-unit price of the property’s built-up area. It is fixed based on per sq ft per month. It is based on the returns expected from the property and it depends on locality, land price, and usage. It is multiplied by the built-up area.

4. What are the different modes of tax payment and where can I pay?

The tax can be paid at the municipal office of an area or at a designated bank that is affiliated with the municipal corporation. You have to provide inputs such as the Khata number or property tax number in order to identify the property. In Surat, like many other MCs of India, the taxes can be paid online. These online payments can be made on the dedicated portals of municipal websites.

This system is quite convenient for the owner of the property. There may be an exemption on taxes paid based on location, age of the property, the income of the owner, etc. you should contact the local municipal authority to assess your tax liability.