In the past few months, Covid restrictions were uplifted and a large number of offices reopened. Like the pre-pandemic times, a majority of the working populace shifted to the IT/ITes cities once again. In Q1, 2022, residential trends showed that while demand in Gurugram and Bengaluru experienced a Y-o-Y growth of 33 percent and 52 percent in rental searches, an overall spike of 91 percent was seen across the top six cities. Similar trends were also observed for home buying as well. Here’s a look at some of the key trends!

Almost two years back, the pandemic hit the world and the booming markets came to a standstill in the blink of an eye. Schools and offices were shut down and stringent lockdown regulations were in place. While a significant portion of the working populace moved to their home cities, others continued to remain in the metropolis, looking forward to easing restrictions.

With the entire family living under one roof, the millennial population who were earlier strong proponents of rentals or smaller configurations started looking out for certainty in such uncertain times. And a few months down the line, owning a home became an imperative need for many prospective homebuyers, following the crowd to Q1 2022.

The trends for home hunting during the pandemic, however, varied subjectively across different cities. In some cities, HNIs and NRIs went on for spacious luxurious units at reduced prices as the majority of the developers were keen on selling inventory combined with slashed stamp duty rates.

Affordable and mid-segment housing on the other hand also recorded an all-time high demand and on-ground real-time sales conversions. All of these were backed by none other than, strong and proactive sales strategies and digitisation of the real estate sector.

However, as the government uplifted restrictions and markets once again inched up in the post-COVID scenario, new trends emerged in the housing market. Taking cognizance of the same, at Square Yards we took a deep dive looking for answers behind the surge in housing demand across IT/ITes cities. And the results were surprising just as they were impressive.

More People Looking Into Metropolitan Housing Markets

During Covid, as the government imposed multiple curbs and restrictions, a large number of people fled to their family homes, majorly in tier-2 and tier 3 cities. As remote working was rife, people continued their jobs from the comfort of their native abodes. However, in the present scenario, with major giants resuming work from the office and/or adopting the hybrid model, a large number of people poured into the IT/ITes cities, once again.

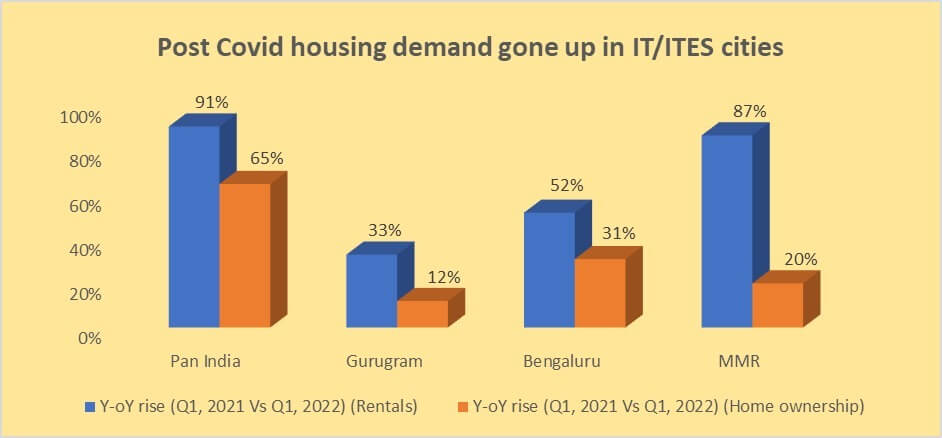

The figure represents the year-on-year rise (Q1, 2021 taken as the base quarter) witnessed in demand (online searches) for home buying as well as rentals in cities namely Gurugram, Bengaluru, Mumbai Metropolitan Region, and across Pan India as well.

Approbating the same, Square Yards data showed that in Q1, 2022 residential trends across the top six cities witnessed an uptick. Rental searches went up by a staggering 91 percent on a year-on-year basis wherein the big cities, home to corporate giants, led the demand share at large. While MMR witnessed a Y-o-Y rise of 87 percent, Gurugram and Bengaluru noted a yearly rise of 33 percent and 52 percent, respectively.

The dynamics of demand for homeownership were no different. In the first quarter of 2022, Gurugram saw a maximum rise of more than 150 percent in Y-o-Y demand, followed by MMR and Noida. Apart from registering a Y-o-Y and Q-o-Q rise, the quarterly numbers in the housing segment also put forth that be it space or spending extra bucks, home buying sentiments continue to be in the favour of the market growth.

Showing a positive outlook, developers’ sentiments also remained buoyed as new launches witnessed a significant quarterly growth of 43 percent and yearly growth of 68 percent in Q1, 2022. Gurugram and Bengaluru, the hub of corporate offices, specifically noted a Y-o-Y rise of 35 percent and 78 percent, respectively, in the context of new housing projects.

With more people pouring into these top six cities and the work from home culture gradually translating into a widely preferred hybrid model, similar housing trends can be expected in the future. The latter, at large, contributes to the changing paradigms of the Indian realty sector.

Demand for Spacious Housing Units is “Significant”

Even though many homebuyers are zeroing down on mid-segment housing for property purchases to eschew profligate expenses, it didn’t seem to compromise the demand for spacious units.

Reflecting the same, Square Yards data revealed that in Q1, 2022 rentals witnessed a notable 7 percent year-on-year rise in demand share of residential units sized 1000-2000 Sq. Ft. This was entirely in contrast to the trend noted earlier, where a major chunk of the demand was noted for residential units less than 1000 Sq. Ft.

Adding on to that, some of the top searched locations for rental units sized 1000-2000 Sq. Ft. were Vashi in MMR, Indira Nagar in Bengaluru and Sector 57 in Gurugram. This clearly indicates the surge in demand for those locations that serves both as the proximus middle ground for home buyers to big corporate offices and providing them the comfort of spacious residential units.

From a home buying perspective also, despite 2BHK forming a major chunk of the demand, 3BHK and above configurations gained prominence, accounting for a significant 26 percent of the total demand share in Q1, 2022. Also, in view of the luxury units (above 4000 Sq. Ft.) in metro cities like Bengaluru and MMR recorded the highest demand share of 30 percent and 21 percent, respectively.

Large Number of Buyers Willing to Flex their Pockets

Apart from demand for spacious homes gaining momentum, a large number of homebuyers also seemed aligned and in favour of spending a few extra bucks, if presented with multiple options offering the comforts and amenities they are searching for.

Reverberating the same, Square Yards data revealed that in the first quarter of 2022, there has been a 5 percent rise in the demand share of rental units worth Rs 30K and above, since Q1, 2021. On the flip side, the on sale residential units worth more than Rs 1 Crore formed a major portion of the demand share in the top six cities.

In Q1, 2022, Bengaluru and MMR formed about 23 percent of the demand share for properties worth above Rs 1 crore. On the other hand, premium housing segments (worth Rs 1 Crore and above) in Hyderabad and Gurugram noted a demand share of 20 percent and 12 percent, respectively.

With larger spaces being one of the main driving factors for housing markets in the past two years, the majority of the people were seen as more willing to stretch their budget, especially when it comes to paying checks for the comfort offered.

Rooted in the same, it was pretty evident that the demand for semi-furnished units in IT/ITes cities has also gone up, be it for rentals or home ownership. Semi-furnished units formed more than 57 percent of online home buyer searches in Gurugram, Bengaluru and Noida, which was quite similar to the trend observed for rental homes.

What’s Next?

In the backdrop of people returning to metro cities and offices resuming their pre-pandemic lifestyle, the requirement for housing as well as the prices attached are for sure going to shoot up. But whether this surge in demand will be absorbed by the existing housing inventory in IT/ITes cities or not, remains to be seen.

Also, in the prevailing scenario, with other extraneous factors such as increased cost of building raw materials, dwindling supply chain and revised lending rates, more new housing trends can be expected to surface in the mainstream. However, whether the rise in housing demand in metro cities will also result in ballooning prices, continues to be an interesting market trend to actively watch out for.