Homeowner in Bangalore? Want to understand BDA property tax better? Here’s a comprehensive guide for you!

Every city has its municipal corporation to which people need to pay their taxes and for Bangalore, it is the payment of the BDA property tax. BDA stands for Bangalore Development Authority and they are in charge of collecting all the taxes in Bangalore.

Now, when it comes to property taxes, you will have to remember a couple of things:

- You will have to pay property taxes if you have the ownership of any property which falls within the ambit of BDA. Thus, first, you will have to check whether you are under the BDA or any other municipal corporation and then abide by their rules accordingly.

- The other thing that you need to know is that, if you have rented out a property, then since, you are the owner, you cannot charge the tenant for property tax or ask them to pay it. You will have to get the BDA property tax online payment done because you are the owner.

- And yes, you can save a lot of time by getting the payment done online and you will have a detailed set of instructions as to how you can get it done online later in this guide. But, if you want to get it offline, then you can do that too.

So, with these important pointers in tow, let us approach the details of the process.

Paying BDA property tax online

So, if you are thinking of how you can get your payment done when it comes to BDA property tax online, then here are the respective steps that you need to follow, one after the other:

Step 1

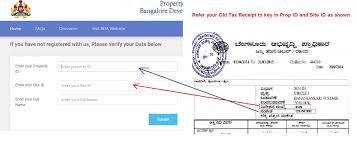

You will have to visit the propertytax.bdabangalore.org/

Step 2

To enter the site, you will need to log in. To log in, you will need to provide you property ID number, the site ID and your full name.

Step 3

Once you have entered these details, your data that you have keyed in will be verified. And once the verification process is complete, you will get a request to enter your mobile number.

Step 4

Once you enter your mobile number, an OTP will be sent to your phone and that you will have to enter and that marks the completion of the login process.

Step 5

Now, once you have logged in, you will be redirected to a page which will have the details of your bill, including your dues, if you have any.

Step 6

The BDA property tax payment can be done easily by clicking on the Pay button. This can be done through internet banking, debit or credit card.

Step 7

Once the transaction is complete, an e-receipt will be generated which you will have to save with you for future use.

If, by any chance, you do not get the receipt, then do call the officials and inform them about the issue and await their instructions to clear the process out and get you the receipt.

So, these are the steps that you will have to follow, one by one, to ensure that you have paid your tax online. If you want to do it offline then head out to the BDA office, collect the challan and then pay it in a bank.

Calculation of BDA property tax

Have you seen your property tax bill recently? Have you ever wondered who decides how much tax should you be paying for your property? Well, like various municipal corporations, the BDA to have its system of calculation.

Do you want to know how that goes? Let’s take a look:

It follows a simple enough formula –

Property Tax (K) = (G – I) * 20%

Now in this Formula, G stands for Gross Unit Area, which is calculated based on the formula:

G = X + Y + Z,

Where in case of BDA property tax online,

X stands for “Tenanted Property area × Per square ft. property rate × 10 Months”,

Y stands for “Self-occupied property area × Per square ft. property rate × 10 Months” and

Z stands for “Parking area × Per square ft. rate of Parking area × 10 Months”

The I in the main equation stand for Depreciation Amount, which is calculated by,

I = G(Gross Unit Area) x H(Depreciation rate in Percentage, which is determined by the property’s age) / 100

Thus, when it comes to BDA property tax calculation, you will have to take everything into account, from the property’s Age to its rented value, parking space etc.

FAQs

Are there rebates on BDA property tax online payment?

No, there are no rebates if you pay the tax online. But, depending on the type of property you might be exempt from taxes. For example, a property used for solely religious purposes, cannot be taxed.

What happens if I miss my property tax payment?

Then you will have to clear it out before the next cycle with a fine. It’s a hassle and hence it is best to pay your taxes on time.

Can I pay my taxes in any bank?

No, just the ones that are tied up with the BDA.

These are all the basic things that you need to know about BDA property tax!