Mumbai is a very large city and it has different municipal corporations and hence whether you fall under the ambit of NMMC property tax or not, is something that needs to be seen first. There are clear cut demarcated areas which are under different municipal corporations. If you have a property that is located in Navi Mumbai, then it will fall under the NMMC or Navi Mumbai Municipal Corporation. However, it is best that you check it once before you start following the rules of the NMMC.

As many people are aware, the payment of the NMMC property tax is an important issue and it needs to be done in a certain manner, and one needs to be extremely savvy about these matters. So, what are the most important things that one needs to remember? How can one get savvy with the matters of the NMMC property tax online payment? Well, if you are a first-timer, or you would like to get your basics sorted out, then here are some basic points that you need to remember.

Areas under NMMC

Well, the first and the most important thing to note is whether or not you fall under the NMMC. It covers a total area of 108.5 sq km. The areas that fall directly under the NMMC are Vashi, Belapur, Turbhe, Nerul, Airoli, Ghansoli and Koparkhairane. So, if you have a property in these wards, then you will fall under the NMMC and will have to abide by their regulations, which is not much different from the one covering greater Mumbai.

Checking Your Property Tax Value

Okay, so before you go ahead and pay your NMMC property tax, you will also have to take into account and get to know how much you will have to pay for it. That can be done through a simple process.

On the left-hand side of the page, you will get an option for “Self Assessment of Property Tax”. Once you click on that, you will be redirected to a new page where you will have to fill in some important details like Ward number, plot type, occupancy status, whether it is for residential purposes or commercial or industrial purposes. Once you have keyed in all the necessary information, your property tax value will be calculated automatically and displayed for you on the screen.

Now, if you are wondering how this calculation is made then you need to know that NMMC property tax is calculated based on the market value of the property.

Confused?

Well, let’s try to explain it simply. Suppose you buy a property in your name at a market price. Now whatever amount you have bought it for will determine what amount of property tax you will have to pay for it. Now, suppose the market value of the property goes up, then automatically your property tax value also increases. If the market value goes down, your property tax value also goes down. So, this is how the system of calculation functions.

How Do I Pay My Taxes Online To NMMC?

Let’s come to the most important and frequently asked question – how do I pay my property taxes. Well, when it comes to the NMMC, like most other municipal corporations in the country, you can get the NMMC property tax online payment done. Yup, you can go online and make your payment in a hassle-free manner. So, how can you do that? Here are some steps to guide you along the way:

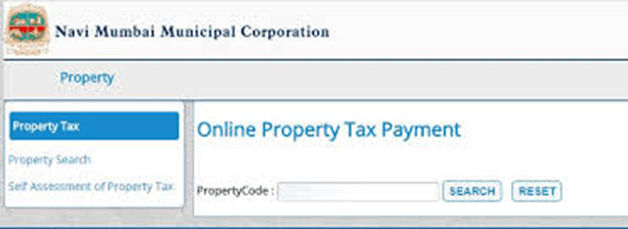

- First, you visit their official online portal and then select the option for property tax.

- When you are redirected to a new page, you will have to enter the property code. This code will be available with you when you sign the proper sale deed and have ownership of the land/apartment/building.

- Once you enter the code, you will get an option of generating a bill.

- When the bill is generated, you will get to see the final amount which you will have to pay as your NMMC property tax.

- Once the amount is known, you can proceed for online payment.

- This payment can be done via Net banking, Debit or Credit card. There are some ways in which the payment can be done through your Paytm wallet as well. Just make sure that you have had your account verified.

- Once the payment is done, you will receive an e-receipt, which you will have to save for any needs in the future. Do not delete or discard it. If by any chance you get no e-receipt, immediately get in touch with the NMMC and get the matter sorted.

Important points to remember while making an online payment

Well, when it comes to making an online payment, there are a few things that you need to bear in mind:

- Make sure that your internet connection is a stable one because if it goes away in the middle of a transaction, it might result in more trouble than usual.

- Always have the documents ready at hand which will help you to make sure that whatever information is required during the transaction or when filling up the form, you will be able to key it in to ensure a smooth NMMC property tax online payment.

- As mentioned before, collecting your e-receipt is also important.

- If there has been a shift in ownership, then the names need to be changed on the property tax papers as well, which has to be done from the NMMC office itself.

- Make a note, if your property falls under the rebate tab.

So, these are some of the basic details that you will have to keep in mind when it comes to filing for and paying your NMMC property tax. Get savvy with the details and get the payment done.