To pay your taxes right, you need to be well informed about the various clauses of the GVMC property tax and this guide will help you with just that.

Every state and city has its system of collecting taxes and hence the GVMC property tax collection system also follows a particular pattern. How is it done? How will you file for the taxes and pay them? What are the various things that you need to keep in mind? These are all the important questions that we will attempt at answering to become more informed tax-paying citizens. So, first things first, the Greater Visakhapatnam Municipal Corporation or GVMC is the body that you will you be paying your taxes to if you are a resident of Greater Visakhapatnam in the state of Andhra Pradesh. When it comes to paying our property taxes, you have to pay it to the municipal corporation. So, you need to know under which municipal corporation area your property falls. Sometimes a single city has more than one municipal corporation, so best is you have that figured out and then proceed with the GVMC property tax online payment.

Well to become more informed tax-paying citizens, here are some of the most important questions that one needs to know about.

Also Read:

Property tax Coimbatore: A brief guide to Online Payment

How Does GVMC Calculate My Property Taxes?

As we have mentioned before, every city and state has its system of property tax collection. There are mainly three modes which are followed in India. Let us take a look at what system is followed in Andhra Pradesh.

This state calculates the taxes based on the rentable value of the property. Let’s dive deeper into this. Now, suppose you want your GVMC property tax calculated. So, how will this calculation (rest assured, you won’t have to do it yourself) be done? How much rent would your property fetch if it was rented? Rs.8000/-, Rs.10,000/-, Rs.20, 000/-? Now, the higher the rentable value of your property, the higher will be your property tax value and vice versa. Now, it is crucial to remember here that the focus is on the rentable value of the property and it does not have to be rented. So, if the property is not a rented out one, then what rent would it have fetched had it been rented? That would be taken into account and the property tax value will be calculated over that. The location, built-in area, etc. everything will come into play here when the value is calculated.

How Do I Find How Much Tax I Need To Pay?

Let’s come to another important question – what is my tax value. Now, you can find that before you get your GVMC property tax online payment done. How? Through the process of Self-Assessment.

You will have to log in to their official website at https://visakhapatnam.emunicipal.ap.gov.in/ptis/citizen/search/search-searchForm.action#no-back-button

Once you do, you will have to provide a few details regarding your property and the ownership details and you will have your tax value calculated for you. Yes, it’s that simple. It is best that you get it done as soon as possible so that you know how much property tax you will have to pay by the end of the cycle and you can be prepared with the finances accordingly.

How Do I Pay My Property Taxes Online?

So, how will you get the payment of your GVMC property tax done? It can be done online. Or you can do it offline as well if you are not comfortable with the technical aspect of it. The process, when done online, is a fairly simple one.

You will have to go to the link which has been provided above. You will need to provide your assessment number as well. This you will get with your property tax bill. Enter the relevant details and the online bill will be displayed. Once you have that bill you will have to proceed towards payment.

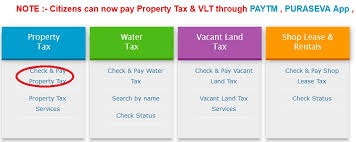

This online payment can be done either through Net banking or Credit or Debit Card. When it comes to the GVMC property tax online payment you can also get it done through Paytm. All you need to do is make sure that your wallet is an active one and the KYC has been verified; otherwise, you will not be able to make a transaction.

If you want to avoid doing it online, then you can always opt for the offline method. Your property tax bill will be prepared and delivered to you by post, or you might have to collect it from the office. Once you have the bill, you will have to submit it to the relevant officials at the GVMC office.

The online mode saves you a lot of travel time.

Things to Remember

Well, when it comes to your GVMC property tax there is one very important thing that you will have to remember – if you do not pay your taxes by the due date, you will become a defaulter and then you will have to clear out your dues along with fines. You will have to fill up a form and provide other relevant documents and then pay the dues and fine. So, it is very important to make sure that you get your payment done on time.

Also, when you are making GVMC property tax online payment you have to make sure that you keep the e-receipts. It will be required for future use. Hence keep the receipts handy.

Remember that the online self-assessment option closes one day before the last date of payment. So get it done a day before and do not keep it pending for the last minute.

So, these are some of the most important things that you need to remember about your GVMC property tax payment and its various details. Get the information in order and pay your taxes on time!