The Municipal Corporation of the bigger urban center once called the Metropolis Municipal Corporation is the ruling public form of the urban center, the capital town of Maharashtra. It is India's one of the richest public corporations. The annual budget of MCGM's beats that of several smaller states of the nation. It had been established beneath the metropolis Municipal Corporation Act. MCGM is accountable for the public foundation and management of the town and a few suburbs.

In the year 2017, the legislative assembly of MCGM additionally called the Corporation Counsel of almost 227 people. The 2017 year was the primary time, thirty-one aspirants were opposed from one ward. One of the aspirants was named Raghvendra Singh, a freelance aspirant at the age of twenty-one.

BMC Online Services

|

Brihanmumbai Municipal Corporation Official |

http://portal.mcgm.gov.in/ |

|

Pay Property Tax Online |

https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login |

|

Pay Water Bills Online |

https://aquaptax.mcgm.gov.in/aqua/CitizenHome.html |

|

Mumbai Property Card |

http://prcmumbai.nic.in/jsp/propertyNew.jsp |

|

Mumbai Property Card (Suburban) |

http://164.100.236.141/pcsql/Default |

|

Pay Octroi Online |

https://octroi.mcgm.gov.in/ |

|

Maharashtra State excise |

http://services.mahaonline.gov.in/Excise/Home/Home.Aspx |

|

Aadhaar Card |

http://aadhaar.maharashtra.gov.in/home/home.aspx |

|

Aadhaar enrollment Online |

https://wenrol.uidai.gov.in/enrolment_request/view/enrol/home.php |

|

Maharashtra Online |

https://www.mahaonline.gov.in/portal/web? |

|

Maharashtra Tourism |

http://www.maharashtratourism.gov.in/mtdc/Index/Index.aspx |

|

Maharashtra State transport |

http://www.msrtc.gov.in/msrtc_live/index-eng.html |

|

e-Registration Leave and License |

https://efilingigr.maharashtra.gov.in/ereg/MainForm.aspx |

|

Apply for Ration card Online |

http://mahafood.gov.in/website/english/home.aspx |

|

Owners and Tenants, Online Mumbai Police Verification |

https://mumbaipolice.gov.in/TenantForm?ps_id=0 |

|

Building Plan approval |

https://autodcr.mcgm.gov.in/bpamsclient2/Login.aspx |

|

CBSE, ICSE Mumbai Public school-Online application form |

https://portal.mcgm.gov.in/irj/portal/anonymous/qlMumPublic12 |

History of MCGM

Bombay was the primary British Indian possession that came as a section of the royal dower in 1661 to King Charles II of European country on his wedding to the Portuguese aristocrat, Infanta Catherine Delaware Braganza. Ironically enough, the metropolis additionally set the stage for India’s freedom movement, similarly as for a few of its landmarks, together with Gandhiji's 1942 decision to a people to "Quit India". The metropolis reported that in 1885, the Indian National Congress was born. It is a junction rectifier to India’s struggle for political independence and to the liquidation of a people's Empire in an indirect manner.

The name "Bombay" was changed to "Mumbai" by Corporation Resolution No.512 dated August twelve, 1996, Maharashtra Act of 1996. During the time between the increase and fall of a people's Empire, the metropolis bit by bit developed into a city, a city, and a metropolis of world honor. Today, the Brihanmumbai Mahanagarpalika covers a region of 480.24 Sq. Km with a population of 1,19,14,378 as per the census of 2001. The metropolis accounts for a major portion of India's international trade and government income, from being one of the foremost centers of education, science, and technological analysis and advancement. It is additionally pertinent to notice that Mumbai's comprehensive growth owed heaps to the first development of the system of regime beneath British rule.

MCGM property tax guide

In Mumbai formerly known as Bombay, the acquisition and management of property tax were taken care of by a government body called BMC i.e. Brihanmumbai Municipal Corporation in the Marathi dialect and MCGM i.e. Municipal Corporation of Greater Mumbai referred to in English. Moreover, New Mumbai also known as Navi Mumbai is controlled by NMMC i.e. Navi Mumbai Municipal Corporation.

Introduction to property tax in Mumbai

BMC was established under the urban center Municipal Corporation Act in the year 1888, it is one of the richest corporations in India. BMC supports a property value-based method for land tax calculation.

Due date and penalty

- The maturity for payment of land tax in BMC is the thirtieth Gregorian calendar month.

- The penalty is charged at two per month just in case of delay in payment on the far side of the maturity on the outstanding quantity of land tax.

How to view property tax bills online in Mumbai?

To view your outstanding dues and land tax bills online in the metropolis, follow the steps given below:

Step 1: Go to the Citizen Portal Services (https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login) and enter your property/account variety.

Step 2: Enter the captcha. You may be redirected to your account, where you will be able to read all of your outstanding and paid land tax bills.

How to calculate BMC property tax online/MCGM property tax formula?

The land tax could be a proportion of the capital price of the estate/house.

Property tax = charge per unit * Capital price

Where capital price = Rate of base value * usage factor * building sort * floor issue * age factor *Total carpet area/area of land just in case of vacant land.

The base price relies on the handbook that is used to calculate taxation by the revenue authority.

An estate tax is calculated online at BMC web portal (https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login) by giving the following details:

- Ward

- Locality

- Usage

- Area

- Zone

- Total carpet space

- Floor-type

- Year of construction

- Occupancy sort

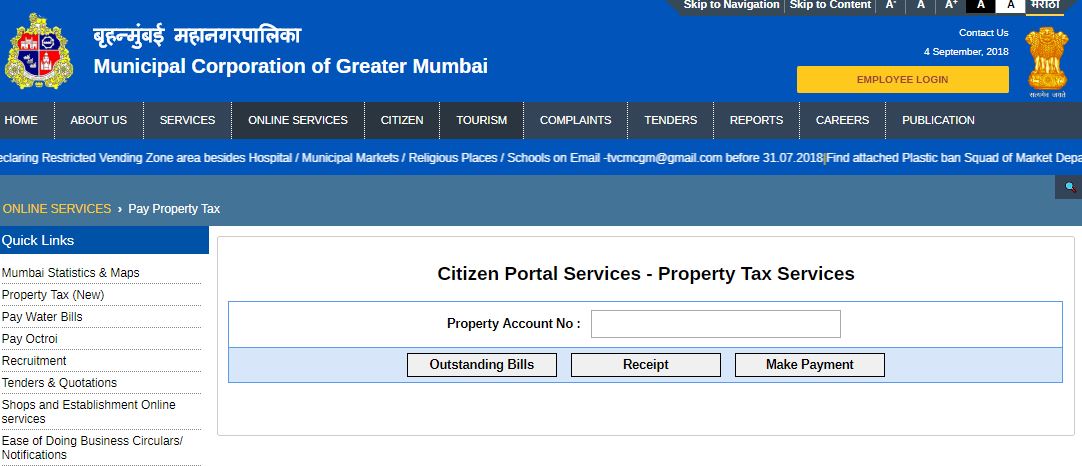

How to pay property tax online using MCGM in Mumbai?

Property tax will be paid each offline and online in Pune.

Step-by-Step Guide: Online payment on the BMC/MCGM web portal:

- Go to the BMC online website (https://portal.mcgm.gov.in/irj/portal/anonymous).

- In the "Online Services" label, click on the button "pay property tax".

- Fill in the property account range (registered on the higher portion of recent capital levy receipt) and select whether or not you wish to look at the below options:

- Outstanding bills

- View ‘receipts

- Make payment

- You can additionally visit the BMC subject login portal (http://portal.mcgm.gov.in/) and enter your property account range for logging in.

- If one cannot grasp the property account range, one should click on the "search" button.

- Once you are successfully logged in, confirm details of the assets that are presented and then click on the button "accept".

- The total outstanding quantity year-wise are going to be displayed

- Enter the quantity you want to clear (note payments are going to be settled on a first in first out principle) and agree on the "online payment" button.

- BMC web portal currently supports solely web banking. Select a bank /payment entranceway credential, plus click on "pay now" and create the payment.

- Download the receipt for later use.

- You can additionally download then print the receipt as specified on top of it by visiting the BMC online website (http://www.mcgm.gov.in/irj/portal/anonymous?NavigationTarget=navurl://16752e124c9b8ed0cd57e504788888b8) and selecting to look at ‘receipts’ underneath ‘online services.

Online payment NMMC (Navi Mumbai Municipal Corporation)

Property taxes to NMMC are paid digitally by visiting the NMMC website (https://www.nmmc.gov.in/property-tax2) and getting into ‘property code’.

Offline payment: Manual payment can be done by visiting one of the BMC centers. It is paid at the closest assistant revenue workplace or BMC help centers, or subject facilitation center in any respect ward offices.

How to get the BMC property tax bill by email?

The BMC has currently proclaimed that property taxpayers will get their bill in their inbox if they fill the KYC i.e. Know Your Client type online. All notifications, alerts, and tax bills are sent to the registered email ID, once the KYC formalities are completed by the voters. All taxpayers should complete the KYC as shortly as doable and avert delayed payment penalties of the capital as per the civic body’s request.

Here’s the way to do the KYC on the BMC capital levy portal:

Step 1: Go to the MCGM subject Portal (https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login) and enter your property account range.

Step 2: Fill in the captcha given and click on the ‘login’ button.

Step 3: Transfer the requisite documents and submit the genuine copy.

Step 4: Enter the email address and phone details for receiving capital levy alerts through email and SMS.

Step 5: Once approved, you may get the confirmation in your email.

Exception/Permission from payment of property tax

- Property completely utilized for public offering/generous purpose.

- Properties happiness to Strategic or diplomat Purpose of a far off State as such as by the state management.

- Houses/Flats measurement but five hundred Sq. Ft is excluded from the amount of the capital levy.

- 60% permit on the capital levy for apartment measurement within 500 to 700 square measure.

Income Tax Indications

Identify to assert the municipal taxes given throughout the time as a reduction from your family property financial gain.

MCGM property tax latest news

Jan 21, 2021: Land tax bills on email, BMC asks voters to register on the web portal

The Brihanmumbai Municipal Corporation (BMC) on weekday said that land tax bills are going to be on the market via e-mail and urged voters to fill KYC forms on the BMC’s web portal. The BMC forced all the taxpayers in Mumbai to replenish the KYC i.e. Know Your Client on the link https://ptaxportal.mcgm.gov.in/CitizenPortal/ concerning land tax.

“Kindly replenish the relevant authentic details. Taxpayers can receive updates/notifications through email on registered email/SMS on registered mobile numbers concerning land tax. The land tax bills will be received on registered email id,” the BMC said during a statement.

Apr 27, 2020: A medical checkup of the BMC budget

Earlier this year once the Brihanmumbai Municipal Corporation (BMC) declared its budget very little did it understand that town would be affected by a scourge that might bleed its resources. Actually, in its budget, the BMC had projected to strengthen the health infrastructure of the monetary capital of the Republic of India. But the epidemic hit as nobody would have unreal and reports currently emerge of shortage of beds, PPE (personal protective equipment), and alternative necessities in town hospitals.

As of 31st Dec 2019, reserves of BMC were at ₹78,669 chromium (including reserves towards committed liabilities). Their revenue financial gain is ₹23,846 large integers and revenue expenditure ₹19,240 Crore, transporting their surplus at ₹4,606 Crore.

Nov 14, 2019: Income Tax department raids BMC contractors

Amid a high-voltage political drama in Maharashtra, the tax department has turned its glare on a clutch of huge contractors employed by Brihanmumbai Municipal Corporation (BMC) - a knife Sena defensive structure.

IT aforesaid that they had conducted search action in Bombay and Surat on Gregorian calendar month, 6 on entry suppliers and beneficiaries. UN agencies are engaged within the execution of civil contracts primarily BMC. “Exposure on record difficulties and issues that are mentioned above is to the number of ₹735 crores and range of settlement records is getting measured”, the press media states that an entirety of thirty-seven assets was placed underneath quest action as well as the seven assets were arranged below the study. There have been stories that surely the contractors had received records within the type of loans from entry suppliers and conjointly inflated costs within the records of accounts to defeat financial gain.

In Asia, BMC is the richest civic body. In keeping with sources, a minimum of two of the contractors raided by IT square measure blacklisted by the civic body associate degrees, their promoters had been in remission by the Bombay Police in an over Rs Three hundred crores road repair scam.

How much do you know about the Property Tax Mumbai? What are the important things that you need to remember about it? Let’s find out!

Different countries follow a different form of the tax-paying system especially when it comes to properties. If you have a property in Mumbai, which is legally in your name, then you will have to pay property tax Mumbai for that particular piece of land. However, as tax-paying citizens, we are often struck with various questions. Let us try and understand the various important things that we need to remember when it comes to paying taxes for properties in Mumbai.

To begin with, let us first find out, as to who collects the property taxes in Mumbai.

Who do I pay my Property Tax to?

Every city has its municipal corporation and Mumbai has one too. It is known as the BMC or the Brihanmumbai Municipal Corporation or the Municipal Corporation of Greater Mumbai (MCGM). This is true for the Greater part of Mumbai, whereas Navi Mumbai has a separate municipal corporation known as the Navi Mumbai Municipal Corporation. So, for the properties that fall under either of the two mentioned municipal corporations, taxes will have to be paid accordingly. Suppose your apartment is located in Navi Mumbai and since it falls under the Navi Mumbai Municipal Corporation, you will have to pay it not as BMC Property Tax but to the NMMC.

Here’s a rather fun fact: The BMC has been calculated to be the richest municipal corporation of the country.

So, know that we know who we need to pay the taxes to, let’s find out how the taxes are calculated.

How Is My Property Tax Value Calculated ?

Mumbai follows a capital value-based system when it comes to calculating property taxes. In this system, the market value of the property is taken into account to find the Property Tax Mumbai value. Let us see, how this calculation is done.

Property tax value = Tax rate that is applicable in the case of the city x Capital Value or the market value of the property in question.

When it comes to calculating the capital various factors are taken into account like:

- The total carpet area or if it is a vacant land without any construction then the total area of that

- The type of building

- Age of the building / construction/ land

- The usage factor

- The floor factor

So basically, the total amount of property tax that you will have to pay will be dependent on various factors. All these calculations can be done online so that you know how much you will have to pay for Property Tax Online Payment Mumbai.

This brings us to the next most important thing to remember.

How can I pay my property taxes?

Like every other state in the country, Mumbai has an online system of collection of taxes. Having said that, it is to be mentioned here that there is also an offline mode of payment available. This has been done so that paying taxes can be done easily and without much hassle. So, how can we go about the process?

It’s rather simple; all you need to do is know your property account number, which you can find out online as well.

Here are the basic steps outlined for you:

- You will have to login in at the BMC portal at https://portal.mcgm.gov.in/irj/portal/anonymous

- Choose the services that you want to opt for, which in this case will be – online services, under which you will have to choose payment of property taxes.

- To make the payment, you will have to give your property account number. For those who do not know the property tax Mumbai account number, instead of login, you can opt for a search and get your property account number by keying in some details like ward number, area, location, etc.

- Once you have the account number, you will have the option to check whether there are any outstanding payments (default in payment attracts penalties), view your receipts, and also make your payment. So if you are about to pay your taxes, check the last option.

- The details of your property and the tax value and all its necessary details will be displayed once you log in, which you can verify and then accept to make the payment.

- You can also check whether you have any outstanding payments or not, which you need to clear.

- One very important thing to remember about BMC Property Tax is that you will be able to make the payment only through net banking. So you need to make sure that your bank account is net banking activated and then you can go ahead and make your payment through a secure gateway.

- Once your payment has been successful, a receipt will be generated which is best if you keep it for future use. This will be an e-receipt, which you can save in your mail.

The process is not exactly a very difficult one and once you have done it a couple of times you will get a hang of it. If you want to pay your taxes offline, however, then you can easily visit the BMC and make the payment to the various ward officers in charge, who will guide you through the entire process.

Some kinds of properties are exempt from paying the Property Tax Mumbai:

- Properties that are less than 500 sq ft in

- All diplomatic residences and buildings which if directed by the Government

- A concession will be given on properties measuring between 500 sq ft to 700 sq ft

- Any place solely used for religious purpose

These are some of the basic pointers that one needs to remember when it comes to paying property taxes in Mumbai. Just make sure that whether you choose to go for Property Tax Online Payment Mumbai or not, you pay it on time!

How do I transfer my BMC land tax bill?

Visit BMC's online website. Underneath the 'Online Services' tab click on 'pay land tax.' Enter property account variety (indicated on the higher portion of recent property tax receipt) and opt for whether or not you would like to look at 'outstanding bills' or view 'receipts' or 'make payment' and click on consequently.

Is land tax applicable in Mumbai?

Residential properties in the city that area units up to five hundred Sq. Feet are exempted from tax. Properties are units used for charitable and public worship functions. Just in case the Sq. Feet of the property vary between five hundred and 700, an hour concession is provided.

What is a land tax in India?

Property tax could be a charge that the homeowners of land area units pay to the government. The tax is collected either by the native governing bodies or by the Municipal Corporation of a State. A land tax is charged on all types of land, whether or not residential or business, and whether or not self-owned or rented out.

Where am I able to find the property account variety in Mumbai?

The property account variety is written on the higher portion of the land tax receipt. When keying in your property account variety, opt for one choice of the 3 heads listed - Outstanding Bills, read Receipts, or create Payment.

How is House land tax calculated?

Net Annual worth (NAV) is that the worth calculated as Gross Annual worth minus Municipal taxes paid. This area unit is subtracted to determine the particular ratable financial gain.