Pradhan Mantri Jan Dhan Yojana was established by PM Narendra Modi in 2014. The scheme aims to provide financial services, including savings, credits, pension, insurance, deposits, and banking to the underprivileged section of society and the low-income groups. PMJDY strives to make these services and products affordable for them.

Since the establishment of the scheme, approximately 32.41 Jan Dhan accounts have been registered and opened with more than ₹81,200 crores in deposit balance. Let’s have a closer look at the objectives and features of this attractive scheme in this article.

Table of contents

- Objectives of the Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Pradhan Mantri Jan Dhan Yojana (PMJDY) Features

- Basic Savings Bank Deposit Account (BSBDA)

- Small Account/Chota Khata Account

- RuPay Debit Card

- Bank Mitra

- Who is Eligible for Pradhan Mantri Jan Dhan Yojana?

- Documents Required for Pradhan Mantri Jan Dhan Yojana

- Benefits of Pradhan Mantri Jan Dhan Account

- Life Cover under Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Death Benefit Eligibility

- Claim Settlement Procedure

- How to download the Jan Dhan Yojana account opening form in Hindi and English?

- Bank List under Pradhan Mantri Jan Dhan Yojana (PMJDY)

- You Might Also Like to Read

- Frequently Asked Questions (FAQs)

Objectives of the Pradhan Mantri Jan Dhan Yojana (PMJDY)

The primary objective of the Pradhan Mantri Jan-Dhan Yojana is to ensure easy access to numerous financial services like the accessibility of a savings bank account, remittances facility, availability of need-based credit and pension. It also offers insurance to the excluded groups like low-income groups and weaker sections of the society.. Effective and efficient use of technology can help in the deep penetration of this scheme at a reasonable and affordable cost.

Pradhan Mantri Jan Dhan Yojana (PMJDY) Features

Listed below are the various essential features of the Pradhan Mantri Jan Dhan Yojana:

Global Access to Banking Facilities

This includes segregating the country into sub-service areas and appointing them to different banks. It also focuses on the financial inclusion of the urban area along with the rural areas. Additionally, PMJDY offers banking services through the National Unified USSD Platform (NUUP) and promotes mobile banking through bank accounts and mobile wallets.

Basic Savings Bank Deposit (BSBD) Accounts and RuPay Debit Cards

Under this section, the PMJDY helps every household open one BSBD account. It also provides RuPay cards to the PMJDY account holders and an overdraft facility of up to US $71.43.

Financial Literacy Initiative

Providing financial literacy is important because it will help people in making use of formal banking services. Mapping all SSAs to different banks.

Credit Guarantee Fund

This contingency fund has been designed to facilitate the poor borrowers to match their basic credit needs for farming, health, micro-enterprises, and other things.

Micro-Insurance

This feature provides insurance or risk coverage to the economically weaker sections of society.

Pension Schemes for the Unorganised Sector

Pension schemes feature ensures that the retirement needs of the poor are taken care of.

Basic Savings Bank Deposit Account (BSBDA)

BSBDA or the basic savings bank deposit account is a savings account that does not have a minimum balance. However, there is a maximum balance that has to be maintained in the account.

The individual or BSBDA holder receives an ATM cum Debit Card for opening the account. Passbook services will also be provided for free and no charge will be levied for a non-operative account. The bank only allows a certain number of withdrawals and deposits for free.

The banks might also provide facilities like Demand Drafts, cheque book, cheque collection, email statements, and various other facilities at a nominal charge or without cost. The rate of interest offered on these accounts is the same as that for a Regular Savings account.

Small Account/Chota Khata Account

If you desire to open a bank account under the Pradhan Mantri Jan Dhan Yojana but do not possess the required documents, you can get a Small Account or Chota Khata account under the PMJDY scheme for a period of up to 12 months. However, you need to produce the required documents, including the Aadhaar card within this period to protect your account from being deactivated.

The PM Jan Dhan Yojana offers two kinds of accounts - Chota Khata Account or Small Account and Zero Balance Account. A small account is ideal for those who do not have the relevant documentation. A maximum deposit of ₹50,000 is required in this account. A maximum credit limit of ₹1,00,000 is provided and an individual cannot withdraw more than ₹10,000 per month.

If you want to get a Small Account opened, you need to reach out to the nearest bank which is mentioned in the PMJDY scheme list. You would only need 2 self-attested photographs to open a small account.

RuPay Debit Card

The PMJDY RuPay card is provided to the individuals who have their accounts opened under the Pradhan Mantri Jan Dhan Yojana (PMDJY). The facilities of the card include payments at POS terminals, e-commerce websites, and all ATMs. It also provides a total disability coverage and Personal Accidental death coverage of up to ₹2 lakhs. The individual can also avail of various domestic merchant offers on the RuPay PMJDY debit card.

Bank Mitra

The PM Jan Dhan Yojana makes services like insurance, pension, credit, deposit and savings accounts, etc. affordable and accessible for the weaker sections. This scheme promises a bank account along with these services. Bank Mitra are the instruments or people who execute the scheme.

Bank Mitra are retail agents who can also be called Business Correspondent Agents of the PMJDY scheme. These people are appointed by the banks to help and advise the common man regarding various banking services in the areas where the services are not available. The representatives of the bank provide a connection to the people living in far-flung areas of the country where there is a bank branch or ATM. Thus, making it easier for the poor people to avail different services.

Who is Eligible for Pradhan Mantri Jan Dhan Yojana?

Here are the eligibility criteria of the Pradhan Mantri Jan Dhan Yojana.

- The individual must be between the age of 18 to 69 years.

- The life insurance cover is offered only to the head of the family. If the head is more than 60 years old, this cover is given to the next eldest earning member of the family.

- If an account is opened by joint members then the first one will get the cover.

- If the individual is already a part of another government scheme like the ‘Aam Aadmi Bima Yojana’, they will not be eligible to receive the life cover provided by PM Jan Dhan Yojana.

- Minors under the age of 10 can also open an account under the scheme provided that the account is managed by a guardian.

- Minors will also receive Rupay cards through which they can withdraw money.

- Individuals can transfer their savings account to a PMJDY account to avail the benefits of Jan Dhan Yojana.

- Individuals who do not have proof of Indian citizenship can also open a PMJDY account on the condition that they are declared as ‘low risk’ individuals by the bank in which they are opening their account. A thorough background check has to be done for this.

Documents Required for Pradhan Mantri Jan Dhan Yojana

An official recognised document can be presented to apply for the scheme. These include:

- Passport

- Driving Licence

- Permanent Account Number (PAN) card

- Voter’s ID (issued by the Election Commission of India)

- Aadhaar card

- Any other document authorised by the Central Government in coordination with the Regulator

In cases where simplified documents are considered for verifying the identity of the applicants, the below given documents will be considered officially valid.

- Identity card along with the applicant’s photograph (issued by State/Central Government Departments, Regulatory/Statutory Authorities, Scheduled Commercial Banks, Public Financial Institutions, and Public Sector Undertakings).

- Any letter issued by a Gazetted officer, along with an attested photograph of the individual.

- If there is any change in the current address, you would need to provide the following valid documents to move the account to a new address:

- 2 passport size photographs

- If the individual does not have a valid residential address, they need to provide valid identity proof issued by the Government of India.

Please Note: The Reserve Bank of India (RBI) stated in 2014 that individuals who do not have the ‘officially valid documents’ can open ‘Small Accounts’ with the banks. This account can be opened by the individual by simply providing a self-attested photograph and a signature/thumbprint in the inspection of bank officials.

These accounts are valid for only 1 year and can only be opened for 12 more months on a provision that the account holder provides proof that they have applied for the Officially Valid Document within a period of 12 months from opening the account.

Benefits of Pradhan Mantri Jan Dhan Account

Here are the benefits of having a Jan Dhan account:

- Deposits made for the savings account under the scheme offer attractive interests.

- The account holders do not have to maintain a minimum balance in the account. However, if cheque facilities have to be availed then a minimum balance has to be maintained.

- An overdraft facility is provided if an individual does not default on the account for continuous 6 months.

- Under the RuPay scheme, an accidental insurance cover of ₹1 lakh is received by the individual.

- If the account was opened between the period 20 August 2014 to 31 January 2015, a life cover of ₹30,000 is given if the beneficiary has passed away.

- Pension access and insurance products are provided under the benefits of the scheme.

- If the individuals are the beneficiaries of government schemes then a Direct Benefit Transfer facility is offered to them.

- One account in a household is provided with an overdraft facility of ₹5,000. The lady of the house is offered this facility.

- An individual can claim the Personal Accident cover after a successful financial or non-financial transaction has been made through a RuPay card. Transactions done within 90 days of the accident are regarded as PMJDY eligible transactions under this scheme. Provided that the transaction is made at a POS, Bank Mitra, E-Com, bank branch, ATM, etc.

- The account balance can be checked with the help of a mobile banking facility.

Life Cover under Pradhan Mantri Jan Dhan Yojana (PMJDY)

The Pradhan Mantri Jan Dhan Yojana was initiated as a scheme to include the less privileged classes in financial organisations. The main aim of the scheme is to dispense a bank account to each family that did not have one yet.

An accident insurance cover of ₹1 lakh and a Rupay card are provided in the scheme. PM Narendra Modi announced a life cover of ₹30,000 in August 2014 for all the account holders involved in the scheme.

Coverage is provided for the life of the account holder under the insurance. The Government of India sustains the premium for the life cover. Additionally, the accounts which have been opened after 28th September 2018 will also get an accidental cover of ₹2 lakh.

Death Benefit Eligibility

An amount of ₹30,000 is provided as a death benefit under the Jan Dhan Yojana. When the account holder or the insured passes away, this amount is provided to the nominee.

In cases where the nominee is absent, or the nominee is not the spouse (wife/husband), parent, or child, then the account holder’s legal heirs are required to furnish an indemnity bond for the further proceedings of the LIC.

LIC’s Pension and Group Scheme offices are appointed for the death benefit claim aspect. The nominee is legally bound to receive ₹30,000 as a death benefit, in a scenario where something happens to the insurer and he is deceased.

Claim Settlement Procedure

The process to settle claims has been elaborately explained below:

- The first step is that the nominee needs to provide information about the death of the insured or the account holder to the bank in which the PMJDY account is active.

- The following documents have to be provided:

- Aadhaar card of the account holder

- Account holder’s death certificate

- RuPay card verification details

- Claim form

- Ration card xerox, and

- Discharge receipt.

- Legal heirs must also provide indemnity bonds.

- The bank which owns the PMJDY account will then register the LIC claim.

- After all the details have been verified, a death claim benefit of ₹30,000 will be resolved by LIC’s Pension and Group Scheme office.

- The amount will then be credited to the legal heir or nominee’s bank by ABPS.

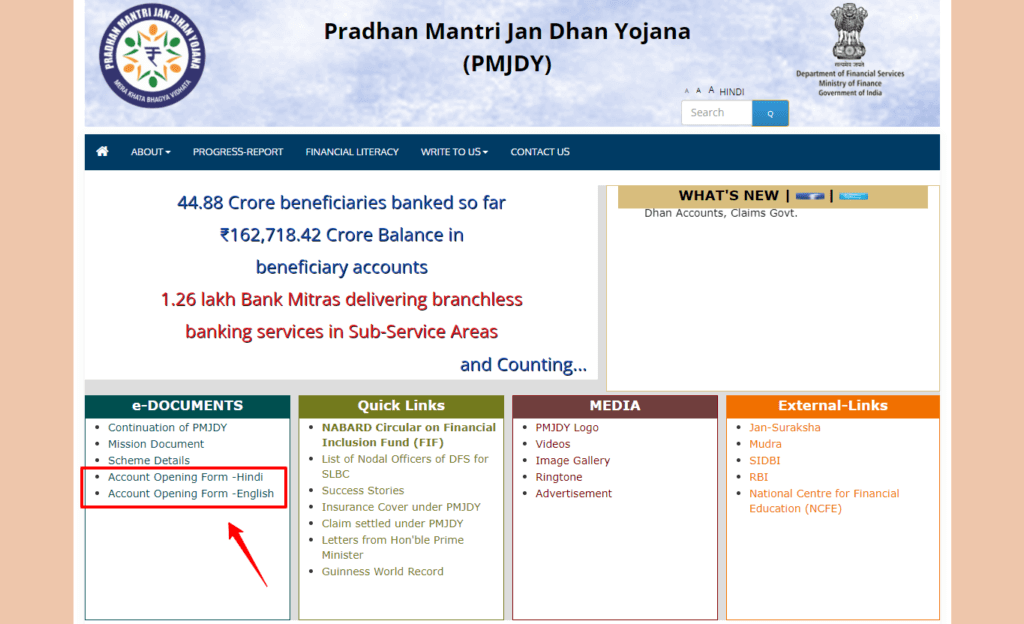

How to download the Jan Dhan Yojana account opening form in Hindi and English?

Step 1: Head to the official website pmjdy.gov.in.

Step 2: On the main page, under the subhead e-Documents, select ‘Account Opening Form -Hindi’ if you want to download the form in Hindi.

Or

Select ‘Account Opening Form -English’ if you want to download the form in English.

Step 3: The PDF will open in a new tab for you to download.

How to Avail Pradhan Mantri Jan Dhan Yojana (PMJDY)?

To avail of the benefits of Pradhan Mantri Jan Dhan Yojana, you will have to download the application form first. The application form is available both in Hindi and English. The form is named the financial inclusion account opening form. The form is available on the PMJDY official website. Fill out the application form and submit it with the mandatory documents. The form has three parts where you have to fill in your details, the bank in which you will open the account, and the nominee.

Bank List under Pradhan Mantri Jan Dhan Yojana (PMJDY)

Here is the list of private and public banks that come under the Pradhan Mantri Jan Dhan Yojana:

Private Sector Banks

- Dhanlaxmi Bank Ltd.

- YES Bank Ltd.

- Kotak Mahindra Bank Ltd.

- Karnataka Bank Ltd.

- ING Vysya Bank Ltd.

- IndusInd Bank Ltd.

- Federal Bank Ltd.

- HDFC Bank Ltd.

- Axis Bank Ltd.

- ICICI Bank Ltd.

Public Sector Banks

- Oriental Bank of Commerce (OBC)

- Union Bank of India

- Allahabad Bank

- Dena Bank

- Syndicate Bank

- Punjab & Sind Bank

- Vijaya Bank

- Central Bank of India

- Punjab National Bank (PNB)

- Indian Bank

- IDBI Bank

- Corporation Bank

- Canara Bank

- Bank of India (BoI)

- Bank of Maharashtra

- Andhra Bank

- Bank of Baroda (BoB)

- State Bank of India (SBI)

You Might Also Like to Read

- Pradhan Mantri Gram Sadak Yojana

- Pradhan Mantri Suraksha Bima Yojana

- Saksham Yuva Yojana

- Pradhan Mantri Awas Yojana

- Atal Pension Yojana

- PM Kisan Samman Nidhi Yojana

- Pradhan Mantri Vaya Vandana Yojana

- Basava Vasati Yojana

- Kanya Sumangala Yojana

- Bharatmala Pariyojana

Frequently Asked Questions (FAQs)

What is the full form of PMJDY?

PMJDY stands for Pradhan Mantri Jan Dhan Yojana.

Where can I open my bank account under the PMJDY scheme?

The account for Jan Dhan Yojana can be opened in any business correspondent (Bank Mitra) outlet or bank branch.

Can I open a joint account under Pradhan Mantri Jan Dhan Yojana?

Yes, you can open a joint account under PM Jan Dhan Yojana.

Is a person eligible for Pradhan Mantri Jan Dhan Yojana who does not have a ration card?

A person without a ration card can open a small PMJDY account but the required documents would have to be provided after 12 months to continue using the account.

Can I enjoy life insurance coverage under the PMJDY scheme?

Income taxpayers and dependents on them are not eligible to enjoy the life insurance coverage under the Jan Dhan account.

Is accident life insurance cover offered under the PMJDY scheme?

The Pardhan Mantri Jan Dhan Yojana offers an accident life insurance cover of up to ₹1 lakh.

How much life insurance cover is offered under PMJDY?

A life insurance cover of ₹30,000 is offered under the PMJDY scheme.

Can a minor open a bank account under PMJDY?

Yes, a minor is eligible for opening a bank account under Jan Dhan Yojana.

What should be a minor’s minimum age to open a bank account under the PMJDY scheme?

The minimum age for a minor to open a PMJDY account is 10 years.