Wondering how to ease out the process of property tax Kerala online payment? We have just the guide for you!

Are you a resident of Kerala? Well, then you will have to pay your property tax Kerala if you are the owner of a property here. There are a few key points that are imperative to be cleared out first, before you find out how the online tax payment can be made, without any hassle. But, let’s begin with the basics first.

The most important thing that you have to bear in mind is that, like every state, Kerala too has its system of property tax calculation. The tax will be collected by the municipal corporation in charge of that area. This also brings us to a very important aspect for consideration – under which corporation do you fall. There are very fine lines of division when it comes to municipal corporations and hence you will have to find out under which corporation you belong before you can pay property tax online Kerala.

Once that is sorted then we can move on to the other important details. First, let us find out, how the online payment can be done:

Paying property taxes online in Kerala

According to a country-wise mandate, all municipal corporations of India have to accept online payment of property taxes, through their official website. So, if you want to get your payment done online, then you will have to visit the official page of the municipal corporation. There are various local self-governments in the state, who will collect the taxes for you and you can find your required one.

This is the main website, through which you will be able to pay Kerala property tax online. Once you visit this website, you will see that there are various options from where you can take your pick. If you want to get an assessment of your tax done then you can do that too; if you are interested in making the payment, then that can be done too. This assessment of the tax value is done based on various factors, which we will come to later on.

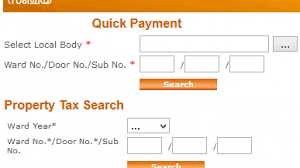

So, if you want to pay property tax online Kerala, you will have to select on the relevant option and then you will be redirected to a page. Once the page opens, you will have to fill up the relevant details like your assessment number, if you have already completed it, and other details related to your property. So keep the documents handy while you sit down to make the payment. Your bill will be shown to you and then you can select the mode of payment.

You can opt for internet banking or payment through debit and credit card when it comes to property tax Kerala. Once the payment is completed, you will get an e-receipt. Keep this e-receipt with you for future use, because it might come in handy.

Defaulters

Well, if you have missed out on making a payment for a particular tax cycle, then you will have to pay it during the next cycle and with a heavy fine. So, it is best that you keep a check on the dates and get it done by the 31st of March. For this year, 2020, the fines were waved off because of the coronavirus pandemic and in some cases, the last date of submissions was also extended. But these are extraordinary circumstances and it is best to pay property tax online Kerala on time!

Factors determining the property tax value

What are the various factors on which your property tax value depends? In case of Kerala, the type of land, the type of building, the total area covered by the property, the location, the rentable value of the property, whether qualifies as a luxury apartment or not, etc. all these factors determine the final value. Your property tax is also applicable in case you own a piece of land. In that case, the charges for the property tax Kerala value will vary. Thus, a lot of factors need to be taken into account, before one can determine the final value.

FAQs

1. Are there rebates on property taxes?

Yes, depending on the type of property and its usage, rebates can be applied for. For example, if it is a place solely dedicated to worship, then you will not have to pay any property tax. It is also the same for various charitable organizations.

2. Do I have to pay property tax if my land has no construction?

Even if the piece of land that you own does not have any construction, you will still have to pay some property tax. It might be up for some rebates, but that will be determined based on various factors.

3. What is a fine value for missing a payment?

Generally, a heavy fine of almost 24% is levied when there is a default in payment. However, the amount might vary depending on the building type

These are all the things that you need to know to get a basic grasp on property tax Kerala online payment and how the system works. So, get to know it in details, so that when you pay your taxes, you know exactly what you are doing.