Trying to find out the basic details about property tax thane? Don’t know where to start? Let’s help you out here!

If you are a resident of Thane and own property there in your name, then you will have to pay the property tax thane. It is important to remember here that you need to have a property to your name for you to be eligible for paying property taxes.

We know that Thane is located nearby Mumbai. It is a city that is located very near to the greater city of Mumbai, but Thane does have its local municipal corporation. It is a residential area that has developed over the years and hence Thane too has built its municipal corporation. Now, if you have your property in Thane, then you will have to pay your property taxes here. So, what are the basic details that you need to be aware of? Come, let’s take a look:

How do I pay my property taxes online in Thane?

Like every other city, you have two ways of paying your property taxes. One is you can get the property tax online payment thane done, or you can choose the offline mode. The online one helps you to save more time and energy since you don’t have to travel much. So, how do you go about the online process?

It’s quite simple and here is a step by step guide to help you along the way:

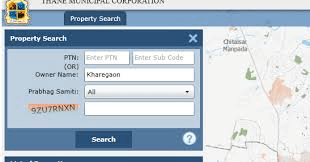

1. Visit the https://myptax.thanecity.gov.in/ website.

2. You will get several options to choose from – from downloading your bill to paying it, you will have all the options here.

3. First, you will have to log in using your registered mobile number, and then you need to click on the service that you wish to avail of.

4. Once you click on the online payment option, you will be redirected to a fresh page, where you will have to provide your various property details. You need to keep your property ID number handy for this step.

5. Once you key in all the correct details, you will get the bill and then you can go to the payment page from there.

6. You can pay through various online methods. Choose the one that you are most comfortable with and then pay the property tax thane.

It’s fast, simple, and easy if you know how to do it. And if you do not want to make the payment online, then you can also collect the bill in person and pay it at their municipal corporation office.

Understanding Self-Assessment

Don’t want the property tax value to spring upon you? Well, then you can self-assess it from beforehand so that you can get to know your value. If you have not received the bill or do not want to wait for that, you can conduct an online self-assessment before the property tax online payment thane. When you get your self-assessment done, you know the rough value of how much your property tax for this term will be, so you can accordingly have your finances in order.

It is also important to remember here that you will have to pay your taxes twice annually.

How Property Tax Is Calculated For Thane?

Like every city, Thane also has its system in place, which is the one system that is followed in Mumbai as well. This method of calculation can be summed up as follows. The property tax online payment thane is done based on this method. So, the system of calculation followed here is a Capital value-based system.

How Does That Function?

This directly related to the market value of the property which determines it rateable value on which the amount of property tax is calculated. Thus, if you have a high market value of your property, then naturally your property tax value will also be higher. Now, if you have a lower one, then it might go down, but that is hardly the case. It is also important to remember here that the total value of the property tax thane depends on the position of real estate in the market and hence it is subject to change with time.

So, this is how it is calculated. And if you have to calculate the capital value then you will have to take into account a lot of other factors like Base value, Use category, Built-up area, Age, floor factor, and type of building.

What Happens In Case Of Dues?

Well, there might be times when you might run into dues. You might miss the last date of submission, which will be fined. So, if you have some payment waiting and you have become a defaulter then you will have to clear all your property tax thane dues based on the relevant guidelines or it might lead to legal dispute and damage. So, if by any chance you miss a payment, you will be fined and you will have to clear it before the next payment.

So, when it comes to property taxes in Thane, the rules are quite specific, simple, and easy to follow. You can get your tax calculated beforehand and have the finances ready. Try not to miss out on the final submission dates because apart from the fine, it becomes a hassle. Pay your taxes regularly!