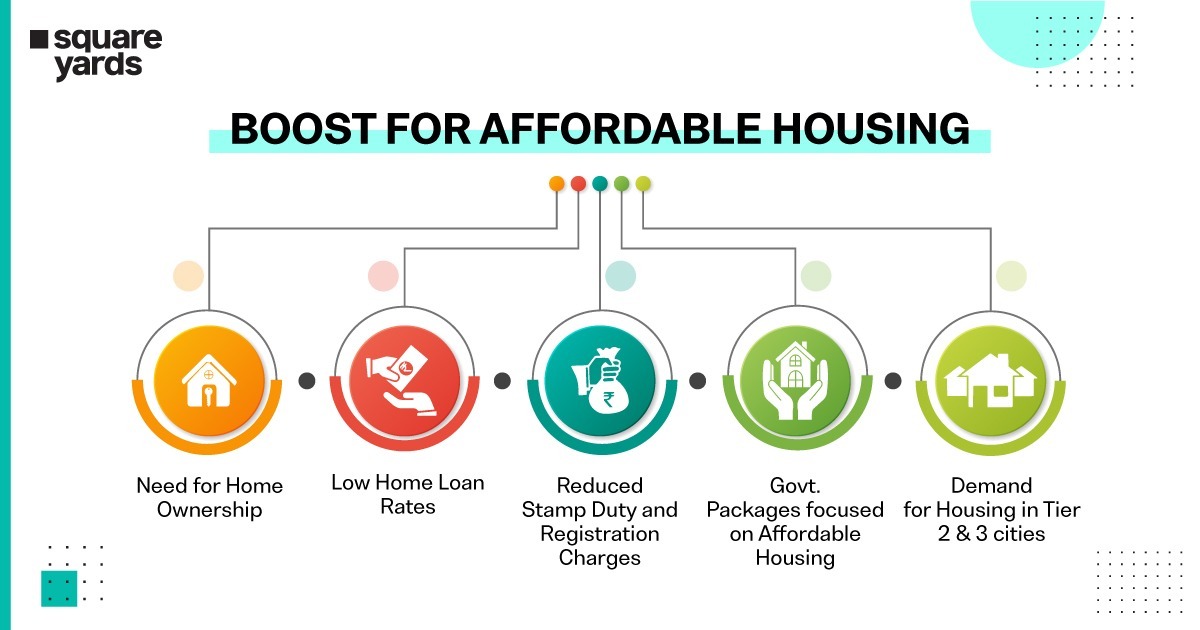

Unlike other industries that faced a major slump in 2020 due to COVID-19, the real estate sector, especially the affordable housing segment, seems to have gained mileage thanks to a slew of pandemic-induced stimulus measures announced by the government throughout the year.

With the COVID-19 pandemic taking the world for a toss, all industries and initiatives have suffered a setback. Real Estate was no different and it suffered the same fate. However, gradually, as the economy entered the unlock mode, construction activity resumed which was followed by homebuyers returning to the market. The government’s and RBI’s timely interventions assisted the sector to get back on its feet. In fact, it would not be wrong to say that COVID-19 might have acted as a blessing in disguise for real estate, especially the affordable housing sector. Here’s why!

Even though affordable housing has always been a focus area for the current government, the year 2020 saw several pandemic-induced trends emerge in the real estate sector which when backed by economic packages turned out to be quite fruitful for the affordable housing segment.

Need for home ownership pushes demand for Affordable Housing

The pandemic has forced people to stay indoors and the residents of smaller homes have majorly felt the pinch. With zero to low access to green and open spaces and high density within their homes, people, especially millennials, are looking at investing in a home of their own. Further, homeowners who put their properties on rent are also refraining from renting their properties at the moment because of poor returns. Thus, the rising need for safety, stability, and security has led people to think about homeownership.

Increased demand for housing in Tier-2 cities

The pandemic has resulted in reverse migration across the country. As the migrant working class has moved back to their hometowns, a surge in the demand for housing in Tier 2 and 3 cities has also been witnessed. Work- from-home model in major IT companies can be accounted for this trend. As the ticket sizes in these cities are way lower than the major cities, the growing need for housing here would indirectly push demand for affordable housing.

Govt SOPs for Affordable Housing

The government has taken numerous measures since the lockdown to revive the housing sector.

While it has been promoting housing for all since 2015, the prevailing unprecedented times have helped speed up the process. Many government initiatives in the form of fund allocation, lower interest rates and reduced stamp duty were announced and implemented in order to push the fence-sitters into taking the plunge towards the much-awaited homeownership.

- In May 2020, FM Nirmala Sitharaman extended the CLSS (Credit Linked Subsidy Scheme) for affordable housing from March 2020 to March 2021 with a liquidity boost of ₹70,000 Crore.

- The Alternative Investment Fund – Special Window for Completion of Affordable and Mid-Income Housing (SWAMIH) – which was introduced in November 2019, has also gained traction post the pandemic.

- In September the government announced a ₹20,000 Crore fund to help real estate developers complete non-NPA and non-NCLT housing projects that are stuck on account of "last mile" cash shortage.

- In August 2020, the National Housing Bank announced a liquidity infusing fund worth ₹10,000 Crore for the HFCs to provide an impetus to individual home loans for affordable housing.

- An additional outlay of ₹18,000 Crore for PMAY (Urban), over and above the ₹8000 Crore allocated in the budget, by finance minister Nirmala Sitharaman was announced in November 2020 to boost the sector. It will also boost the ‘Housing for All’ mission by 2022.

Reduced Home Loan Rates

In order to ensure adequate liquidity in the system and to ease the financial stress caused due to COVID-19, the RBI had announced several Repo Rate cuts in 2020. This resulted in historically low home loan rates which in turn aided in reviving the housing sector.

- By announcing a steep cut of 75 basis points 2 days after the lockdown started, the RBI brought the repo rate to a 15-year low, closing at 4.40 per cent.

- Further, the RBI also announced a reduction in reverse repo rate by 25 basis points from 4 percent earlier to 3.75 percent now.

- It again cut the repo rate by 40 basis points. The repo rate now stands at 4 percent and the reserve repo rate at 3.35 percent. In total, the RBI cut the repo rate by 115 bps since the lockdown started.

After the RBI directed banks and financial institutions last year to link their retail lending interest rates to one of the external benchmarks set by them, most banks had selected the repo rate as their choice of external benchmark. As a result, after the repo rate hit a historic low, home loan interest rates also fell to an unbelievable range. This has led to a definite surge in housing demand particularly in the up to Rs 45 Lakh price bracket.

Home loan floating interest rates today are starting at 6.75 percent per annum and fixed interest rates are starting at 8.75 percent approximately.

Reduced Stamp Duty

In order to boost sluggish sales this year, the Housing Ministry had advised states to reduce the stamp duty and registration charges.

- As a result, the Maharashtra government had slashed the stamp duty by 3 percent with effect from 1st Sep – 31st Dec 2020. It further decided to continue the reduction by 2 percent from 1st Jan – 31st Mar 2021. With a 3 percent cut, the stamp duty rates in Maharashtra are now one of the lowest in the country.

- Following suit, the Karnataka government also reduced the stamp duty on houses costing less than ₹20 Lakhs to 3 percent from the existing 5 percent.

Many industries across the world suffered as an after-effect of the pandemic and so did the real estate sector. However, the crisis only acted as a blessing in disguise for the affordable housing segment in India. Combined with the government’s aim to accomplish Housing for All by 2022, it received a major boost.

To date, many incentives have been announced and funds have been allocated to bring the segment back to the fore. In a country like India where people from Low-Income Groups (LIG) and Economically Weaker Sections (EWS) comprise 80-90% of the country’s total population, this shift towards the Affordable Housing segment only makes sense.