The world is at its wit’s end with the unfolding of a virulent catastrophe. An uncertainty looming over us like an ominous cloud has thrown the status quo of economies worldwide into a quagmire. Juggling a troika of economic, financial and health crises, the world is desperately looking for a light at the end of the tunnel, with the most dependable emergency exit being a potent vaccine.

While investment packages are being doled out to provide succor to critical sectors across ailing economies, world leaders and experts are coming into a huddle to whip up smart reinvestments that can tune-up economies and help shape societies to be more resilient and equitable.

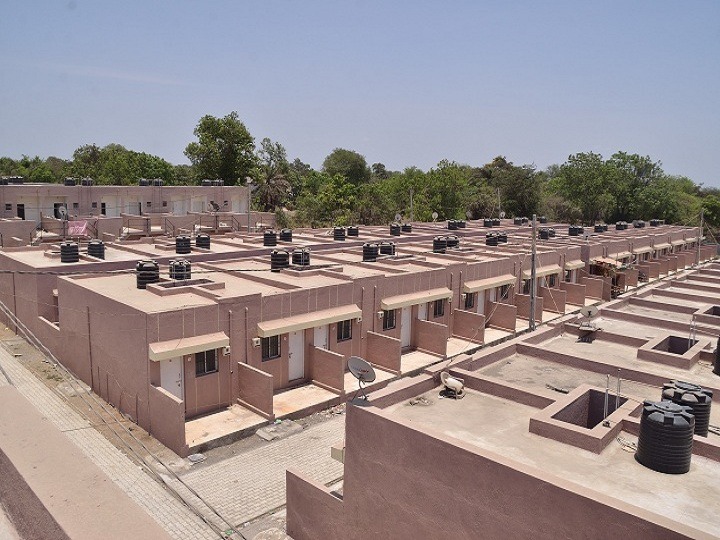

Like a magnifying glass, this invisible spectre has laid bare some of the vulnerabilities our cities are steeped in, including the amplifying existing problem of urbanization, the fragility of the urban poor and the lackadaisical attitude of the government in providing affordable homes to tackle the problem of urban slums that have sprouted across cities and pose a breeding ground for the menacing virus.

Plugging the deficit through affordable housing

If India wants its massive population to be a part of its growth story and emerge as a superpower, it needs to provide sustainable, affordable, and safe living opportunities to its workforce.

The current housing deficit stands at 19 million units which is slated to double by 38 million units by 2030. If we take into account the EWS (Economically Weaker Sections) and LIG (Low Income Groups) segments, 95% or 18 million units deficit belongs to this category.

There is also a chunk of the population belonging to the LIG and MIG segments, termed as the “emerging middle class” that counts a deficit of 4 lakh units, and 80% of this segment are staying in congested areas.

Affordable housing is thus the most comprehensive and sustainable humanitarian response to this pandemic, and a card that the ailing real estate sector can pick to resuscitate its falling fortunes. Already reeling under a severe liquidity crunch, unsold inventory and skeptical homebuyer sentiment, the property sector is desperately in need of some green shoots.

Since demand for affordable housing is mostly coming from end-users and not investors due to a drop in interest rates and need for a bigger home, real estate developers can cash in on this streak of hope by taking up big infrastructure projects in the form of affordable housing. This will help pump fresh liquidity into the real estate coffers and lessen the brunt of the fallout of the pandemic.

Also Read: How growing shift towards affordable housing is changing the way people will live post lockdown

Challenges for affordable housing segment that need to be solved

Though the government and the RBI introduced a raft of liquidity schemes and relief measures to boost affordable housing, various challenges still pose as impediments to the pace of affordable housing development in India.

Paucity of low-cost land parcels: Rampant urbanization, poorly conceived land regulations, rigid requirements on consumption of land with little regard to its costs, have led to a severe shortage of affordable land parcels to accommodate the demand of affordable housing.

Prevailing high-property prices have made it unviable for developers to take up low-cost projects, while the lack of basic infrastructure in peripheral areas has discouraged buyers to take interest in affordable homes. Moreover, developers who are purchasing land parcels from business conglomerates in hundreds of crores prefer to build luxury projects than budget ones in the hope of a good return on investment.

Lengthy approval and clearance process: The real estate sector has long been plagued by clearance issues including layout approvals and building permissions. Any housing project under the sun takes a minimum of 12-18 months to get sanctioned.

Developers have to take approvals from 40 departments of central & state governments and municipal corporations to even start a project. Obtaining this thicket of approvals escalates project costs by 3-5%, which cuts profit margins in affordable housing projects by 8-10%.

Developers who have to wade through this hassle feel that the wait and the effort for obtaining those approvals are not worth for an affordable housing project. This has led to a shortage of housing units for affordable homebuyers.

Labour shortage and high construction costs: Amidst Covid-19 scourge, developers struggling with liquidity issues are left high and dry as banks tightened lending norms. Piling up on that misery is an acute shortage of construction labour spurred by a nationwide exodus of migrants.

This has caused a relentless delay in kickstarting housing projects. On top of that, the cost of raw materials such as steel and cement has increased due to the closure of any manufacturing and ancillary units, which in turn has inflated the cost of affordable housing units.

Flickering sentiments of homebuyers: The pandemic has brought with it a set of miseries including rising unemployment, limited income, dismal GDP rate and unavailability of a vaccine, that has put homebuyers in a quandary.

Though affordable home sales picked up post lockdown, the picture doesn’t look sunny of late as the virus has picked up pace. Homebuyers are thus likely to postpone or cancel their home-buying decisions for now and wait for this crisis to pass. This can demoralize real estate developers who are keen on plugging the affordable housing shortage.

The real estate sector needs a solid alignment of cost-time-revenue of affordable housing projects to make them financially viable for realty developers and in the same breath home in on its mission of providing homes to the urban poor and ride out the crisis successfully. While the affordable housing sector is facing the above-mentioned stumbling blocks, it will still remain as the lone hope for the property sector. Given the demand for low-cost homes, the affordable housing sector can benefit significantly if government-backed incentives are in place and property price corrections and low-interest rates prevail in the months to come.