The real estate sector in India is gradually on a path towards recovery and prospects ahead are starting to look up again. The Indian market was reeling from the effects of demonetization and cash crunch had stalled several projects. Prices had plummeted and yet homebuyers were filled with doubts and were not willing to invest their money on risky ventures. It must be said that real estate is a globally recognized sector and it basically comprises of four sub categories: housing, hospitality, retail and commercial. Of these, the first and the last affect the general public the most.

The construction industry currently ranks the third among the 14 major sectors in terms of direct, indirect and the induced effects among all the sectors of the economy. It is also the sector that draws NRI investments in huge numbers. Most of the luxury and high end homes are bought by NRIs who want to invest in a good property back home, whether for investment or for their personal use once they are back in the country. As of now, Bangalore is the preferred destination for NRIs for investments, and other cities to draw in huge numbers are Pune, Chennai, Goa, Ahmedabad, Dehradun and Delhi.

So why are the factors contributing to the growth of the real estate sector again?

To start with, certain new measures were taken by the government to revive the failing sector. They included steps like PMAY and Credit Linked Subsidy Schemes or CLSS, RERA, and GST rate reduction among other reasons like emphasis on affordable housing.

Pradhan Mantri Awas Yojana and CLSS

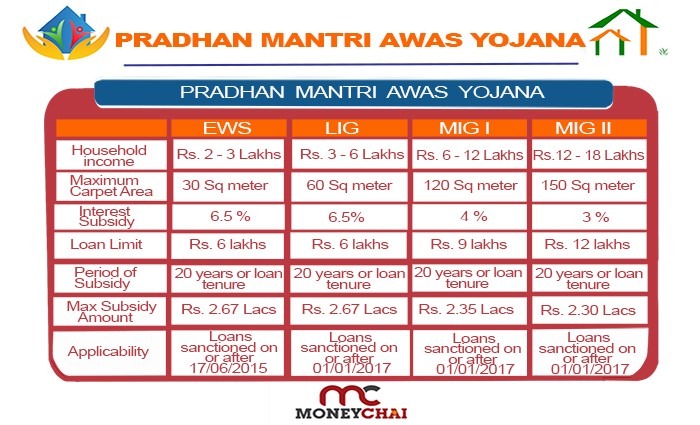

Since the implementation of the Pradhan Mantri Awas Yojana, many homebuyers were finally hopeful that there was something finally in place that would directly help them in their purchasing endeavours. This scheme would definitely provide some limited benefits to the MIG housing and quite a lot more to the LIG housing. The government’s effort to making homes more affordable would definitely increase the medium- termed demand for mortgages, according to industry experts.

Like there is a relative connection between supply and demand, so is there between demand and incentive and developers are now thinking about offering compact flats are reduced ticket sizes and even housing companies are focusing on loans below 20 lakhs, which is a good thing for real estate in India. There are Credit Linked Subsidy Schemes or CLSS under the Yojana that will help to considerably reduce the internal rate of return on most home loans and that too by a margin of 100 bps or a 2 to 10 percent discount on purchase of any new property, ensuring much higher benefits at reduced ticket size. However, according to the government spokesperson as well as real estate professionals, although this Yojana is definitely an incentive, it is not the only catalyst during an actual purchase. The spending power of the buyer has to increase and that can only happen with better employment and reduction in inflation leading to greater affordability. Real estate developers in India are keeping all of this in mind while launching new projects.

A good thing is that CLSS has been expanded to include the average middle class as well though the benefits might be a bit lower on the high end. The CLSS comes with the clause that a buyer’s income has to be within Rs 18 lakhs for him to avail this PMAY in the MIG segment. In the LIG segment, borrowers of home loans up to Rs 6 lakhs would be entitled to a 6.5% interest subsidy for fifteen years and the MIG segment would also be brought under the scheme from financial year 2018 onwards when a 4% subsidy would be allowed on loans for within 9 lakhs and 3% for loans up to 12 lakhs.

The interest subsidy for real estate in India is most credited to the beneficiary’s loan account through most of the leading lending institutions like banks and it results in effective and reduced loan liability. In general, the subsidy for loans across multiple categories is about 2.3 lakhs and this advantage is only for first time buyers to enjoy. The CLSS for MIG is now saving around 5 to 8 % on Rs 3 to 4 lakhs per unit home. The income cap of 18 lakhs per annum can even enable a buyer to purchase flats worth 70 lakhs or more and yet they should keep in mind that benefits in subsidy is just about 3%. For real estate developers in India, this would still translate to better sales.

RERA or Real Estate Regulatory Act

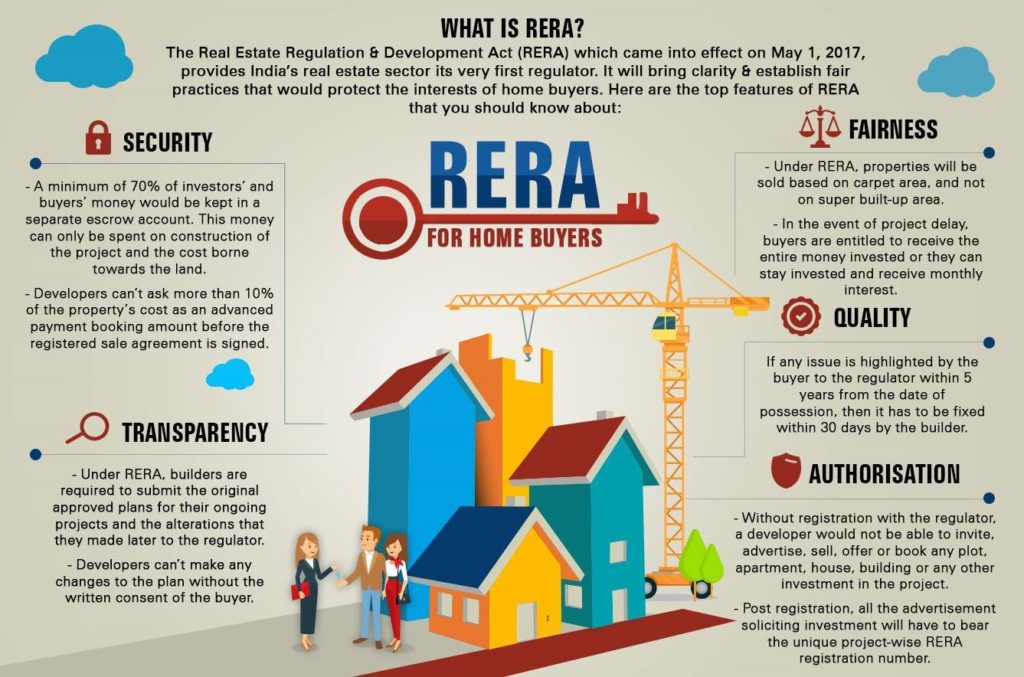

General buyers had a lot of grievances when it came to buying property and complaints of lack of transparency were also quite rampant because of which the government had decided to take some measures, the result of which was the RERA Act 2016, the full Act to be in motion from the first of May, 2017. The RERA, or the Real Estate Regulation and Development Act was passed by the Rajya Sabha and is being hailed a pro- consumer law in the real estate sector, a first of its kind. The new law is sure to reshape how real estate works in India and developers would be more accountable about their property.

Here are ten things one should know about the RERA Act, which among other things which reduced cost of capital and improve the liquidity and likewise helped the real estate market to revive.

- According to the Act, it is not mandatory for the state to establish a State Real Estate Regulatory Authority and the government body can now be approached by the buyers if they have any grievances against their developer.

- Any under construction realty project would now come under the scanner of the regulator and that would make registration compulsory for all commercial and residential real estate project where the area of land is above 500 square meters or has at least eight apartments.

- Failing to register a property, a real estate developer would attract a penalty equivalent to 10% of the project cost and a repetition of the same offence could land him in prison.

- It would now be compulsory for any developer to put aside a minimum of 70% of the amount collected from the buyer in a separate account for the completion of that project only. The move is a precaution against those developers who use the money to start a new project instead of completing the one for which the buyer had paid in the first place. This is great move that will ensure that projects are completed on time.

- From now on, every phase of the apartment would be treated as an independent project and the developer would have to register each phase separately.

- Under the new law, it would now be illegal to sell flats on built- up areas and flats have to be sold now on carpet area basis only.

- The act states that henceforth, if the possession of the property by the buyer gets delayed that the promoter would be responsible to pay interest- the same rate that the buyer is paying as EMI to the bank- to the buyer.

- In case the developer fails to comply with the order of the appellate tribunal of the RERA for three years, he would be jailed.

- If the buyer notices any discrepancy in the project after possession, he would have one year to complain to the developer in writing as a part of post project sales service.

- Once the plan has been shown to the buyer and sanctioned, the promoter will not be able to change the plans without notifying the buyer, so that he cannot raise the price of the project citing rising cost of the project during construction.

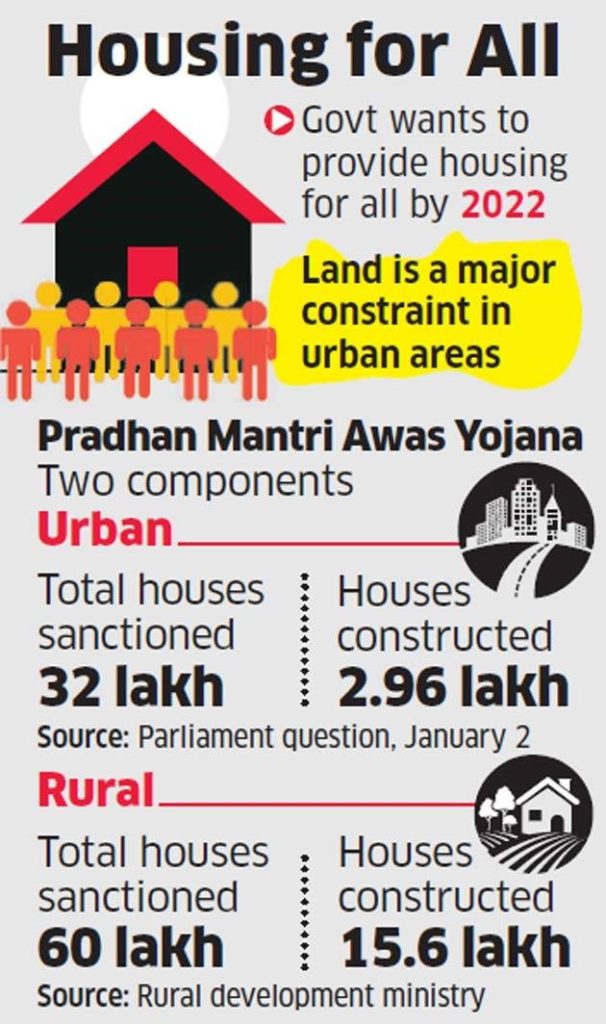

Affordable Housing – Housing for All 2022

The degree of urbanization and housing depicts a nation’s economic growth and the social wellbeing of the citizens. In India, a growth in the urban population is recorded at 2.1% each year since 2015 and that is set to reach above 60 crores by 2031. However, the housing has to be kept in pace as well to accommodate this growing population and currently the shortage stands at 1.9 crore units. On the other hand, the weaker section of the society and the low income group comprise of 96% of the urban shortage.

To mitigate this problem, the Indian Government is laying a great deal of emphasis on low scale housing projects to fill in this gap. It seeks to provide Housing to All by 2020, an ambitious project in itself. There are quite a few initiatives taken in the right direction and this includes a 4% interest rate rebate on housing loan up to Rs 9 lakhs. The rebate would be 3% on loans up to Rs 12 lakhs.

Moreover, the government had also granted infrastructure status to these affordable housing projects. The real estate developers stand to enjoy cheaper sources of funding along with extra commercial borrowings, not to mention that they would also get extra time to complete the project properly, the deadline being increased to five years from the present three years. Builders in India would also get one year time to pay the required taxes on the notional rental income on completed by unsold apartments. The tenure for the long term capital gain for affordable housing has also been reduced and the new tenure is two years against the earlier one of three.

It can be said that the initiative would be great to give more power to real estate developers. The segment has languishing for the last few years with demonetization further adding to the woes. Affordable housing will give them something to look forward to as they would be able to generate alternate income. This definitely is a shift from the global economic crisis of 2009 when builders in India had no choice but to opt for cheaper housing. There was a severe crunch of liquidity along with fewer demands and basically the concept of “affordable” housing emerged after that.

However, it is not as if all is easy and smooth for this segment. There is often a lack to be noticed in acquiring land and the construction costs at time are very high, leaving the builder with very less profit by the time the project is finished. At times, the tax environment is also not an encouraging one. But all is not lost and in the current scenario much is there to look forward too, especially now with major banks ready to finance the builders in India and with the reduction in home loan rates. Hence, the demand for low cost homes should continue over the next decade with customized schemes from HFCs to help, making Housing for All an achievable target.

Reduction in GST and Home Loan Rates

In keeping with the Housing for All 2022 dream, the Government has also reduced the GST rates on such homes and there has been a rise in demand somewhat. The Goods and Services Tax for Under Construction properties have been reduced to 5% from the initial rate of 12%. Also, for affordable housing, this percentage is down to 1% from the previous 8%. And properties that are ready to move and have acquired the Completion Certificate will not attract any GST at all. Naturally, the reduced tax burden has been a major incentive for homebuyers who were stalling because they had to accumulate extra money for paying taxes and this has pushed the demand in this segment.

Moreover, the RBI had also requested the banks to reduce the home loan interest rates as well. The eligibility for getting approved for home loans have also become less stringent and the home loan rates for most banks range from 8.10% to 10.20%. For those who are offering collateral or have a high credit score, the interests can be lower. NBFCs have also contributed to the home financing with their affordable schemes. All in all, the market looks good and according to a report published last year, new housing launches across the top seven cities of India are expected to increase 32% year on year by end of 2018 to 193,600 units. The new housing launches had already increased by 50% quarter on quarter in April to June 2018.

Growth of Commercial Projects

The Smart City Project undertaken by the Indian Government is another major initiative. The government plans to build 100 smart cities and this is a real opportunity for developers. As far as commercial projects are concerned, most of it is driven by the need of corporate office space. Apart from the major metropolitans, the Tier II cities are also coming up fast and offices are being set up in such locations as well. The need for retail space has also grown exponentially over the years as can be clearly seen with the rise in the number of shopping malls in the city. With India now entering a new phase of development, global companies are eager to open their offices here, as can be clearly seen in certain recent transactions.

In May 2018, Blackstone Group acquired the One Indiabulls in Chennai for a record INR 900 crores. Earlier, in February 2018, DLF had acquired 11.76 acres of land for INR 15 billion in Gurgaon. Other commercial buildings like hotels, resorts and spas are opening up in various cities to bring the best of lifestyle and tourism experience to the people. Several other major transactions have been carried out in recent times and the numbers are expected to go up higher. Hence, as of now, the Indian real estate scenario looks good.