What is CIBIL Score?

Credit Information Bureau India Limited or CIBIL score is a tool that is used by lenders in the organized financial sector to understand & judge whether the given prospect holds the right credibility to receive a loan amount. With Reserve Bank of India (RBI) becoming more stringent about loan eligibility of borrowers, it is imperative for prospective borrowers to maintain a good CIBIL score in order to qualify for a loan with an attractive rate of interest.

How does CIBIL gather information?

The lending institutions like Banks, Financial companies have an informal arrangement with each other where they share the information of the loans disbursed through them to each other. It is done so that the fraudulent practices of taking loan and defaulting with one institution & thereafter applying for loan with other institutions could be curbed down.

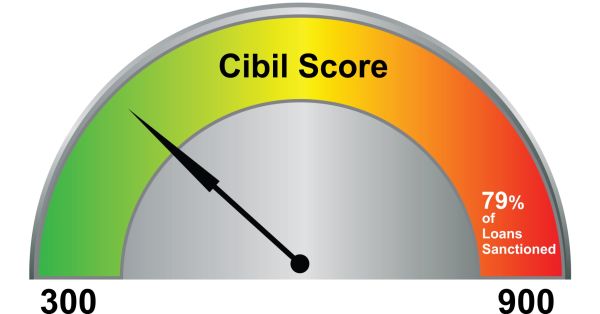

What score is a good Score?

CIBIL score ranges between 300-1000. A score higher than 700 is generally considered good by banking institutions

What goes into the making of CIBIL score?

CIBIL score captures both behavioral and quantitative history of a prospective borrower.

There are primarily five components that define a CIBIL Score such as, repayment history, credit utilization, duration of debt/ loan serviced, number of new loans/ credits applied & the mix of debts. As discussed below every component has a specific weightage attached.

- Repayment history (35%):

The most essential thing that influences credit score is repayment history, accounting for 35% of the total CIBIL score. An individual should clear all bills and loan installments within the stipulated timeframe in order to maintain a good repayment history. Even a single default is captured and can entail a negative impact on the score. On the other hand if an individual has taken up a loan and has repaid all the installments on time without any delays, it gives a positive impact on the score.

- Credit utilization (30%):

There are two basic parameters when it comes to calculate the credit utilization.

- Has the total of credit card limits sanctioned?

- How much credit card limit has been utilized?

A credit utilization ratio is calculated as sum total of balance outstanding on all credit cards as a percentage of sum total of limits on all credit cards. If credit utilization ratio is above 1, the borrower’s profile is considered to be “risky” as it is already leveraged. Also note that as a Guarantor to a loan the lien is marked on your credit eligibility as the liability is the same as that of a borrower.

- Duration of Debt/Loan Serviced (15%):

The amount of time for which an individual has been paying a debt also plays an important role on credit score. For example, if an individual has been servicing debt for a long period of time and handling it responsibly, i.e. making timely repayments without any cheque bounce etc., the CIBIL score will get a positive boost. It will demonstrate that individuals are capable of managing their finance well.

This is also an important factor in refinancing a home loan or switching the loan at a better rate.

- The number of new loan/credit applied for (10%):

Every time a person applies for a new loan, credit card etc., the banks and other financial institutions run an inquiry on CIBIL report to check credit history and repayment capability.

There will be a negative score, in case of a large number of such inquiries. (It should be noted Individual’s enquiry on their own score would not affect CIBIL scores. Only the enquiries from institutions are considered).

- The mix of debts (10%):

A mix of various credit types such as mortgage, personal loan, car loan, credit card etc. & the ability to manage it, will automatically translate into a score higher than others who generally opt for a single type of credit. A healthy blend of various types of credits, instills a certain level of confidence to the lending institution with regards to the lender’s ability to manage their credit well.