In this article, you will be able to take a closer look at the Government Housing Schemes launched in India. This includes the detailed framework of the LIG, HIG and MIG housing meaning as given in the Pradhan Mantri Awas Yojana (PMAY).

Why is a housing scheme so crucial in India?

In most countries, especially in India, the real estate market has always proven to be the most efficient stance for trade and commerce. Many individuals have earned profitable income by not only investing in this trade but also has benefitted with the facility of proper accommodation.

Even though there are substantial high-rises and skyscrapers found in the metropolitan areas of the country, yet there are about 70% of the total population who are still under the rural circle with a mere supply of electricity and scarcity of various other infrastructural facilities.

Thus, a housing scheme that not only provides for better accommodation for a living but also improves the standards of the households is crucial for the inhabitants of the country. Not to forget, construction of pucca houses also enables the people of economically weaker section of the society to find employment and a way to enhance their living condition.

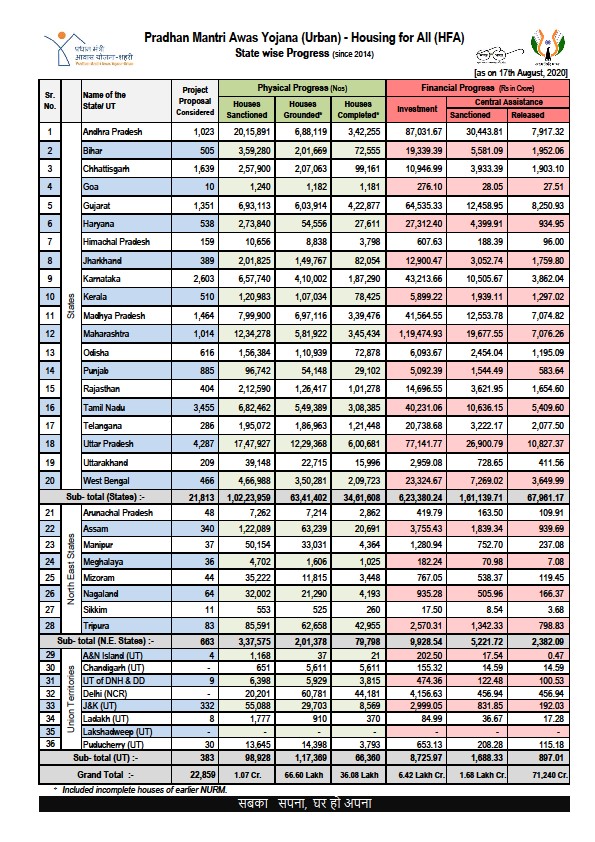

Table 1

What is the housing scheme launched by the Government of India?

Government of India has promised to provide housing facility for all the inhabitants of the country. On the establishment of the Pradhan Mantri Awas Yojana, the government has categorized and subsidized various segments for people belonging to various income slabs. These are as follows:

- EWS Housing: Under this scheme, the people in the category of economically weaker section of the society are eligible to get loans to construct or own a housing property for a living. Individuals with an income of below 3 lakhs per year are witnessed as EWS under the PMAY.

- LIG Housing: Under this scheme, people with an annual income of rupees three to six lakhs can opt for applying for a home loan with subsidized interest rate and a greater tenure for the payments of the loan amount.

- MIG Housing: The middle-income group people are provided with MIG Housing facility. MIG is one sub-category of the PMAY that is further classified into two segments based on the income slab of the households. MIG I and MIG II are the two respective divisions of the middle-income group slab. MIG I home loan is given to households earning an annual income ranging from six lakhs to twelve lakhs, whereas MIG II home loan is awarded to a household earning rupees 12 lakhs to 18 lakhs per annum.

HIG Housing: Privileged as they are, the people belonging to the high-income slab are also not deprived of the PMAY of housing facilities. Just like LIG and MIG households, the HIG households are also provided with home loans with interest subsidies and long-term tenure.

What are the infrastructural advances promised under the Government housing scheme?

Along with the development of pucca houses for the residents of the rural as well as urban residents of the country, the Government also plans to improve various infrastructural facilities for the people. These infrastructural advances aim over the segments of providing a better –

- Water supply and water conservation facility.

- Sewage treatment plants.

- A well-built and proper network of roads.

- Employment to the rural inhabitants.

- Better irrigational and agricultural stances.

- Power supply and network.

Note that, to be able to enjoy the facilities and benefits of the Housing Schemes proposed by the government, an individual needs to enrol him or herself in the PMAY Scheme. The last date to enrol in the EWS and LIG scheme is 31st March 2022, whereas the MIG II and PMAY MIG I last date is 31st March 2021.

Key Pointers in regards to the Government Housing Scheme in India:

- Till date, the government has launched various housing schemes for implementation. Some of the stances at glance include:

– URBAN – MISSION ANTYODAYA – PMGSY – PMAYG – NRLM and others.

- The area allotted for the construction or ownership of the housing complexes varies between the income groups such as:

- EWS houses are single-unit households comprising an area of 30 sq. m.

- LIG houses are a single unit or a unit in a superstructure with a carpet area of 60 sq. m.

- MIG flats and area size varies between MIG I and MIG II categories. MIG I households can get up to 160 sq. m household units whereas MIG II households can acquire up to 200 sq. m. carpet area.

- LIG Housing Scheme can provide a loan of rupees 6 lakhs with a subsidized interest rate of 6.5% for the tenure of 20 years. Whereas MIG I and MIG II categories are eligible to get a loan amount of 9 lakhs and 12 lakhs with subsidized interest rates of 4% and 3% for the tenure of 20 years.

FAQs Q. What is CLSS for MIG Schemes? The Credit Link Subsidy Scheme for the middle-income group is often referred to as CLSS for MIG Schemes. Q. What is the last date for enrolling into the CLSS for MIG scheme? The last date for enrolling in the CLSS for the MIG scheme has been extended till 31st March 2021.