Property tax Telangana is an important source of revenue for a state government which is imposed on the people who own a property. Telangana property tax is collected by various municipalities.

As already stated, a state government imposes property tax through its local bodies that are its municipalities from the property owners. They pay it because in return the municipalities utilize the revenue generated in building roads, drainage system, street lights and other amenities for the citizens. Property tax Telangana is levied based on different computation system, manner or mode of payment as decided by a relevant municipality.

You will read in this article about how to pay property tax levied by the Municipal Corporation of Telangana. Owners of property are supposed to pay the property tax every year. The municipal corporation utilizes the fund collected for the betterment of service provided to people. The corporation charges property tax Telangana based on rental revenue and there is also taxation based on slab rate. There is a property tax calculator on the website. This is utilized to know the value of tax imposed after filling relevant details of the property. The value will vary depending on the location of the property.

There is a particular formula for property tax calculation. Residential property tax computation is as follows:

Annual tax = gross rental value annually, that is GARV X (17% - 30%). Slab rate is arrived at based on MRV fixed by the municipal corporation – 10% of depreciation) + 8% cess.

GARV means Plinth is multiplied by the rental value per month in sq ft X 12.

Plinth area: Plinth area means the total built-up area that includes balconies and garage also.

There is a way to get rental value per month for the house occupied by the owner. To know the rental value per month of a self-occupied property, the corporation takes into account rentals of other similar properties in the area or locality. In case the property has been rented out, the rent will be determined by the figure mentioned in the rental agreement.

Commercial property tax computation

Annual tax = 3.5 ‘x Plinth area in sq ft X Monthly rental in per sq ft. the rental value per month, per sq ft for commercial property is fixed by GHMC which is based on the zone in which taxation is levied or the locality and also the construction type and in what way the property is used.

There is a due date, penalty and other provisions like rewards.

Under property tax, Telangana, last date for payment of half-yearly property tax is 31st July and 15 October. If there is a delay in property tax payment, penal interest is levied @ 2% per month on the outstanding amount. Telangana Property tax has taken initiatives to encourage payment of property tax by the residents. It is to encourage them to pay the arrears of the previous year and the current year. There is a provision of cash reward which is based on a lucky draw. It is for those people who pay up before the specified date.

Property tax assessment for new property

If it is the case of a property which is new, the application will be submitted with the sale deed, occupancy certificate and so on to the relevant Deputy Commissioner for assessment of the taxation on the property. Afterwards, an inspection will be done of the concerned property. The property tax officer or inspector or valuation officer or assistant municipal commissioner or tax inspector will inspect the building for verifying legal title and litigation, if any, and assess property tax. The property tax, in this case, will be subject to prevailing rates and fixed rates of non-residential or commercial property. A unique PTIN or property tax identification number will be generated. This is one of the steps in theTelangana Property tax system. A new house number is also generated.

Online self-assessment

If you are the new owner, you will submit an application for new assessment online and you will provide details of yours, and the details of property like Permission No., Occupancy Certificate No., name of the area, the type of building, use of the building, plinth area, etc. based on these, the annual tax will be coming on to the screen.

This online application is forwarded to the deputy commissioner. The concerned official like tax inspector will inspect the premises and then fix the property tax based on the prevailing rate. A notice will be issued to the owner with the new PTIN.

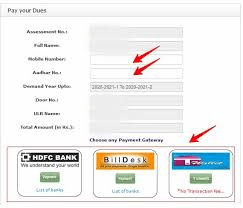

Steps of payment of Municipal tax:

- Visit the online payment portal

- Enter PTIN generated and click on Property Dues

- Verification of arrears and property tax along with interest on arrears and adjustments, etc. The payment will be via net banking, credit or debit card.

- Now you will be at the payment gateway page. You may log in to net banking or submit your card details and complete the payment procedure.

Also Read:

GHMC Property Tax: Paying Property Tax Online Hyderabad

Q. What is the frequency of payment of property tax?

Property tax can be paid twice a year at an interval of 06 months.

Q. What are the last dates for property tax payment?

The last date for payment of half-yearly property tax is 31st July and 15th October.

Q. Is there any penalty to be paid for delay in payment of property tax?

If there is a delay in property tax payment, penal interest is levied @ 2% per month on the outstanding amount.

Q. Is there any benefit of paying property tax before the last dates?

There is a provision of cash reward which is based on a lucky draw. It is for those people who pay up before the specified date.

There is a provision of cash reward which is based on a lucky draw. It is for those people who pay up before the specified date.

Q. Can property tax be paid online?

Yes through the online tax payment portal.

Q. Can one still pay property tax offline?

Yes, Payment by offline mode is also possible by Me-Seva counter or citizen service centre, bill collection centre, etc. it will be done through a demand draft. In this way property tax online payment Telangana will be done.