Learning more about the ready reckoner rate in Maharashtra is important if you are looking at purchasing real estate in the near future. Here is a handy guide on the same.

On the 28th of April this year, ex-chief Minister of Maharashtra, Devendra Fadnavis, had suggested a reduction up to 40% for the ready reckoner rate in Maharashtra over the next couple of years across the State. He opined that this would give a massive boost to the sector. This suggestion came across on a webinar that was organized by NAREDCO (National Real Estate Development Council), an apex body for real estate developers.

His proposal was seconded by the moderator of the webinar and NAREDCO national president, Niranjan Hiranandani who added that lowering stamp duties and the ready reckoner rate may lead to higher demand for real estate in the State. While this is yet to become a reality, here is looking at some of the crucial aspects that you should know.

What is the ready reckoner rate?

The ready reckoner rate or circle rate as it is sometimes called, is the price at a minimum, at which registration must be done for any property if it is transferred. State Governments have jurisdiction for working out these rates and they are periodically revised based on the market circumstances. This rate could differ from one city to another in the State and even for various areas in the same city itself. Even within a particular locality, the rate could vary on the basis of factors like the location, type of property, plot size and so on. The rates indicate the expected property prices in several areas across the State.

Why are they important?

Ready reckoner rates are vital since registration of properties can be done on the basis of the actual transaction value or most importantly, the minimum government rate, whichever comes higher. Whenever any property in the State is sold or purchased, the stamp duty and charges for registration are paid to the State Government based on the circle rate/declared property value, whichever comes higher. The charges are a specific percentage of the value of the transaction and may vary from one State to another. Some States have kept this at even 8-10% of the value of the transaction.

In scenarios where actual property prices are lower than the ready reckoner rate, the registration has to be done on the basis of the circle rate itself. This may sometimes put off prospective buyers/sellers with regard to buying/selling at levels lower than the ready reckoner rates. If they do this, buyers will have to fork out extra stamp duty while sellers will have to pay up extra capital gains taxes upon notional gains. Lowering these rates or bringing them more in sync with current market prices may be a win-win for sellers and buyers alike, leading to higher demand in the real estate sector.

Ready reckoner rates- Key developments in Maharashtra

As per its last announcement, the ready reckoner rates have been kept unchanged by the State Government of Maharashtra owing to the slump in the real estate market. The Registrar of Stamps had previously proposed a marginal increase in the rates but the State Government has clearly stated that the old rates will continue. These rates are those rates for commercial/residential/plotting developments in a particular zone and are regulated/issued by State Governments. The updates to the rates mostly happen every year. The 2017-18 rates still remain applicable in Maharashtra and were deemed effective from 1st April 2019, onwards.

The previous increase in rates was even higher than current market prices for apartments and land, leading to lower transaction volumes. The rates will naturally vary from one area to another. The problem lies in places where property prices have come down and developers cannot sell at the same owing to the income tax rules where sale of property below the 5% threshold of ready reckoner rates is not allowed.

Ready reckoner rates in Mumbai- An overview

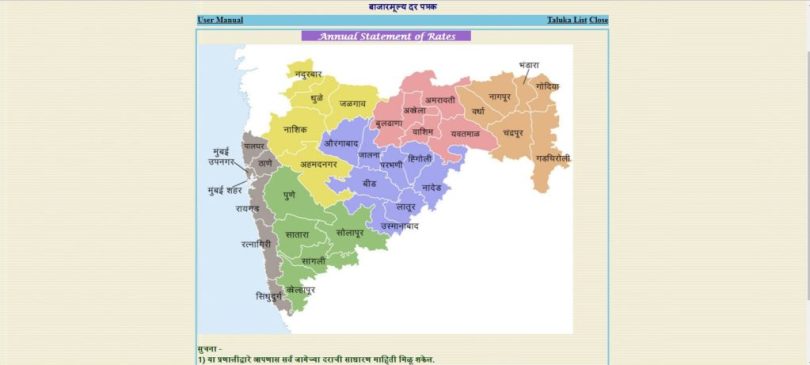

Here is a brief overview of ready reckoner rates in several localities of Mumbai that you may want to check out. Similarly, the rates will differ for Pune and other cities.

| Locality | Flats and Apartments (Rs. Per Square Meter) | Office / Shop (Rs. Per Square Meter) |

| Andheri East | ₹ 1.14 Lakh - ₹ 2.44 Lakh | ₹ 1.25 Lakh - ₹ 2.68 Lakh / ₹ 1.65 Lakh - ₹ 3.31 Lakh |

| Andheri East Kurla Road | ₹ 1.08 Lakh - ₹ 1.58 Lakh | ₹ 1.43 Lakh - ₹ 1.74 Lakh / ₹ 1.73 Lakh - ₹ 2.37 Lakh |

| Andheri East Marol | ₹ 92,100 - ₹ 1.57 Lakh | ₹ 1.11 Lakh - ₹ 1.78 Lakh / ₹ 1.40 Lakh - ₹ 3.38 Lakh |

| Andheri Oshiwara | ₹ 1.01 Lakh - ₹ 2.37 Lakh | ₹ 1.21 Lakh - ₹ 2.61 Lakh / ₹ 1.67 Lakh - ₹ 3.03 Lakh |

| Andheri Varivali | ₹ 1.45 Lakh - ₹ 1.73 Lakh | ₹ 1.66 Lakh - ₹ 1.90 Lakh / ₹ 2.07 Lakh - ₹ 2.50 Lakh |

| Andheri Versova | ₹ 1.49 Lakh - ₹ 2.09 Lakh | ₹ 1.64 Lakh - ₹ 2.60 Lakh / ₹ 1.97 Lakh - ₹ 3.25 Lakh |

| Andheri West | ₹ 1.38 Lakh - ₹ 2.10 Lakh | ₹ 1.56 Lakh - ₹ 2.60 Lakh / ₹ 2.14 Lakh - ₹ 3.25 Lakh |

| Bandra East | ₹ 1.11 Lakh - ₹ 2.90 Lakh | ₹ 1.30 Lakh - ₹ 3.27 Lakh / ₹ 1.88 Lakh - ₹ 4.17 Lakh |

| Bandra Reclamation | ₹ 2.43 Lakh | ₹ 2.79 Lakh / ₹ 3.59 Lakh |

| Bandra West | ₹ 1.32 Lakh - ₹ 4.50 Lakh | ₹ 1.51 Lakh - ₹ 4.95 Lakh / ₹ 1.91 Lakh - ₹ 6.02 Lakh |

| Bapnala | ₹ 91,200 | ₹ 1.11 Lakh / ₹ 1.49 Lakh |

| BKC and Kalina | ₹ 1.29 Lakh - ₹ 3.44 Lakh | ₹ 1.48 Lakh - ₹ 3.79 Lakh / ₹ 1.88 Lakh - ₹ 4.55 Lakh |

| Borivali East | ₹ 52,800 - ₹ 1.87 Lakh | ₹ 1.42 Lakh - ₹ 2.43 Lakh / ₹ 65,800 - ₹ 3.02 Lakh |

| Borivali West | ₹ 95,300 - ₹ 1.18 Lakh | ₹ 1.15 Lakh - ₹ 1.44 Lakh / ₹ 1.38 Lakh - ₹ 2.05 Lakh |

| Brahamanwada | ₹ 1.20 Lakh - ₹ 1.37 Lakh | ₹ 1.34 Lakh - ₹ 1.59 Lakh / ₹ 1.99 Lakh - ₹ 2.25 Lakh |

| Byculla | ₹ 82,000 - ₹ 4.70 Lakh | ₹ 1.05 Lakh - ₹ 5.30 Lakh / ₹ 1.57 Lakh - ₹ 6.36 Lakh |

| Colaba | ₹ 2.80 Lakh - ₹ 6.52 Lakh | ₹ 3.08 Lakh - ₹ 7.96 Lakh / ₹ 3.68 Lakh - ₹ 9.24 Lakh |

| Dadar | ₹ 71,300 - ₹ 2.22 Lakh | ₹ 1.05 Lakh - ₹ 2.50 Lakh / ₹ 1.31 Lakh - ₹ 3.32 Lakh |

| Dharavi | ₹ 73,600 - ₹ 88,000 | ₹ 81,000 - ₹ 96,800 / ₹ 98,500 - ₹ 1.16 Lakh |

| Dindoshi | ₹ 93,700 - ₹ 1.70 Lakh | ₹ 1.25 Lakh - ₹ 2 Lakh / ₹ 1.61 Lakh - ₹ 2.52 Lakh |

| Fort | ₹ 1.82 Lakh - ₹ 5.92 Lakh | ₹ 2.32 Lakh - ₹ 7.10 Lakh / ₹ 2.61 Lakh - ₹ 8.37 Lakh |

| Girgaum Chowpatty | ₹ 1.65 Lakh - ₹ 4.51 Lakh | ₹ 2.01 Lakh - ₹ 5.51 Lakh / ₹ 2.41 Lakh - ₹ 8.23 Lakh |

| Goregaon East | ₹ 51,000 - ₹ 2.21 Lakh | ₹ 63,300 - ₹ 2.46 Lakh / ₹ 87,600 - ₹ 4.03 Lakh |

| Goregaon West | ₹ 68,700 - ₹ 1.77 Lakh | ₹ 81,300 - ₹ 2.39 Lakh / ₹ 97,400 - ₹ 3.17 Lakh |

| Jogeshwari East | ₹ 1.15 Lakh - ₹ 2.11 Lakh | ₹ 1.32 Lakh - ₹ 2.32 Lakh / ₹ 1.50 Lakh - ₹ 2.53 Lakh |

| Jogeshwari West | ₹ 88,400 - ₹ 1.97 Lakh | ₹ 99,000 - ₹ 2.21 Lakh / ₹ 1.51 Lakh - ₹ 2.88 Lakh |

| Juhu | ₹ 2.31 Lakh - ₹ 3.77 Lakh | ₹ 2.54 Lakh - ₹ 4.15 Lakh / ₹ 3.03 Lakh - ₹ 5.07 Lakh |

| Kandivali East | ₹ 42,900 - ₹ 1.69 Lakh | ₹ 1.48 Lakh - ₹ 1.86 Lakh / ₹ 53,700 - ₹ 2.12 Lakh |

| Kandivali West | ₹ 1.31 Lakh | ₹ 1.63 Lakh / ₹ 1.96 Lakh |

| Lower Parel | ₹ 1.78 Lakh - ₹ 5.24 Lakh | ₹ 1.89 Lakh - ₹ 6.51 Lakh / ₹ 2.14 Lakh - ₹ 7.66 Lakh |

| Madh Village | ₹ 58,400 | ₹ 90,400 / ₹ 1.32 Lakh |

| Mahim | ₹ 2.15 Lakh - ₹ 3.81 Lakh | ₹ 2.36 Lakh - ₹ 4.63 Lakh / ₹ 2.57 Lakh - ₹ 6.16 Lakh |

| Malabar and Cumballa Hills | ₹ 3.40 Lakh - ₹ 8.61 Lakh | ₹ 4.42 Lakh - ₹ 10.62 Lakh / ₹ 5.14 Lakh - ₹ 11.97 Lakh |

| Malad East | ₹ 74,600 - ₹ 1.63 Lakh | ₹ 98,000 - ₹ 1.88 Lakh / ₹ 1.27 Lakh - ₹ 2.48 Lakh |

| Malad West | ₹ 98,900 - ₹ 1.71 Lakh | ₹ 1.18 Lakh - ₹ 2.11 Lakh / ₹ 1.39 Lakh - ₹ 2.96 Lakh |

| Malad West North | ₹ 70,500 - ₹ 1.28 Lakh | ₹ 85,000 - ₹ 1.98 Lakh / ₹ 1.02 Lakh - ₹ 2.94 Lakh |

| Malad West South | ₹ 99,400 - ₹ 1.58 Lakh | ₹ 1.25 Lakh - ₹ 1.91 Lakh / ₹ 1.57 Lakh - ₹ 2.57 Lakh |

| Malvani | ₹ 78,800 - ₹ 1.06 Lakh | ₹ 90,000 - ₹ 1.19 Lakh / ₹ 1.03 Lakh - ₹ 1.37 Lakh |

| Mandvi | ₹ 1.26 Lakh - ₹ 2.21 Lakh | ₹ 1.93 Lakh - ₹ 2.89 Lakh / ₹ 2.33 Lakh - ₹ 3.69 Lakh |

| Marine Drive | ₹ 1.65 Lakh - ₹ 4.46 Lakh | ₹ 2.19 Lakh - ₹ 4.68 Lakh / ₹ 2.88 Lakh - ₹ 5.57 Lakh |

| Matunga | ₹ 1.43 Lakh - ₹ 2.52 Lakh | ₹ 1.71 Lakh - ₹ 2.96 Lakh / ₹ 2.13 Lakh - ₹ 4.02 Lakh |

| Mazgaon | ₹ 69,400 - ₹ 2.18 Lakh | ₹ 96,100 - ₹ 2.69 Lakh / ₹ 1.10 Lakh - ₹ 3.23 Lakh |

| Nariman Point | ₹ 4.14 Lakh - ₹ 5.76 Lakh | ₹ 5.18 Lakh - ₹ 6.99 Lakh / ₹ 6.55 Lakh - ₹ 8.31 Lakh |

| Parel Sewri | ₹ 84,600 - ₹ 3.36 Lakh | ₹ 1.21 Lakh - ₹ 3.78 Lakh / ₹ 1.51 Lakh - ₹ 4.38 Lakh |

| Parigha Creek | ₹ 89,100 - ₹ 1.72 Lakh | ₹ 1.06 Lakh - ₹ 2.90 Lakh / ₹ 1.51 Lakh - ₹ 3.03 Lakh |

| Parjapur Andheri | ₹ 85,400 | ₹ 1.02 Lakh / ₹ 1.22 Lakh |

| Princess Dock | ₹ 1.59 Lakh - ₹ 2.40 Lakh | ₹ 2.05 Lakh - ₹ 2.76 Lakh / ₹ 2.49 Lakh - ₹ 3.83 Lakh |

| Sahar | ₹ 1.41 Lakh | ₹ 1.55 Lakh / ₹ 1.74 Lakh |

| Salt Pan | ₹ 91,600 - ₹ 1.92 Lakh | ₹ 1.05 Lakh - ₹ 2.11 Lakh / ₹ 1.57 Lakh - ₹ 2.83 Lakh |

| Sion | ₹ 1.28 Lakh - ₹ 2.33 Lakh | ₹ 1.53 Lakh - ₹ 2.65 Lakh / ₹ 1.83 Lakh - ₹ 3.31 Lakh |

| Tardeo | ₹ 1.71 Lakh - ₹ 3.37 Lakh | ₹ 2.05 Lakh - ₹ 4.81 Lakh / ₹ 2.57 Lakh - ₹ 5.68 Lakh |

| Vile Parle East | ₹ 93,100 - ₹ 2.16 Lakh | ₹ 1.04 Lakh - ₹ 2.80 Lakh / ₹ 1.28 Lakh - ₹ 3.51 Lakh |

| Vile Parle West | ₹ 1.76 Lakh - ₹ 2.73 Lakh | ₹ 2.40 Lakh - ₹ 3.29 Lakh / ₹ 2.90 Lakh - ₹ 4.11 Lakh |

| Villages | ₹ 42,000 - ₹ 1.25 Lakh | ₹ 55,100 - ₹ 1.38 Lakh / ₹ 66,000 - ₹ 1.80 Lakh |

| Wadhvan | ₹ 64,200 - ₹ 1.30 Lakh | ₹ 80,200 - ₹ 1.68 Lakh / ₹ 96,200 - ₹ 2.07 Lakh |

| Worli | ₹ 1.73 Lakh - ₹ 5.88 Lakh | ₹ 2.13 Lakh - ₹ 5.96 Lakh / ₹ 2.67 Lakh - ₹ 7.01 Lakh |

Once you have learnt about the rates, you can definitely hope for an impending rationalization or reduction in the same which will lead to enhanced demand in the housing market.