Considering the fact that the real estate sector in India was a highly unorganized one, there were no regulations as such in place which could keep in check certain whimsical developers and did not give the buyers and investors their money’s worth. Hence, for the proper regulation of the real estate sector, the government came up with the Real Estate Regulatory Authority Bill or RERA. This was a move that was expected to help the homebuyers and protect their interest, especially with regard to the timely delivery of the project. The RERA bill was introduced in 2013 and was finally approved in March of 2016 and according to the Union Ministry of Housing and Urban Poverty Alleviation, this was a major milestone.

It should be noted that although RERA is a central law, the implementation of the law would depend on state authorities as real estate falls under the purview of the state. The Maharashtra Government has already approved the RERA, for example. Maharashtra went all out to ensure the implementation of RERA. They had released a draft version of the rules in December 2016 and thereafter it had asked for suggestions from stakeholders and experts. The final set of rules came into effect from the 1st of May 2017.

How will RERA help homebuyers?

Here are some of the ways in which RERA is expected to help home buyers.

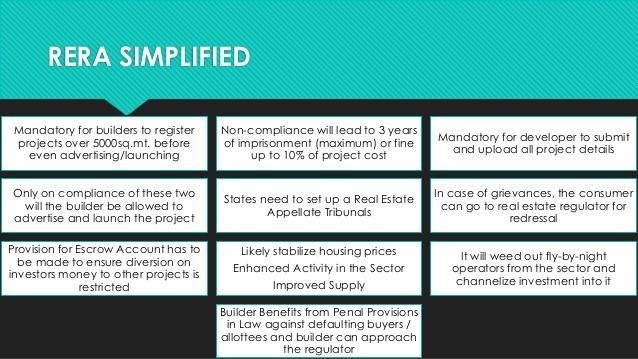

- To start with, under RERA, each state is expected to set up regulatory bodies as appellate tribunals so that all disputes between buyers and builders can be settled within 120 days of the filing of the complaint.

- The developer is required to set aside 70% of the money collected from the buyers in a separate account to meet the construction cost of that property alone and not use the money anywhere else. Any withdrawals made from this account will have to be notified to the CAs, architects, and engineers of the project. These numbers are to be audited each year and in case of false information, the developers would be required to reimburse the homebuyer in full, plus with interest, and will result in the freezing of that account.

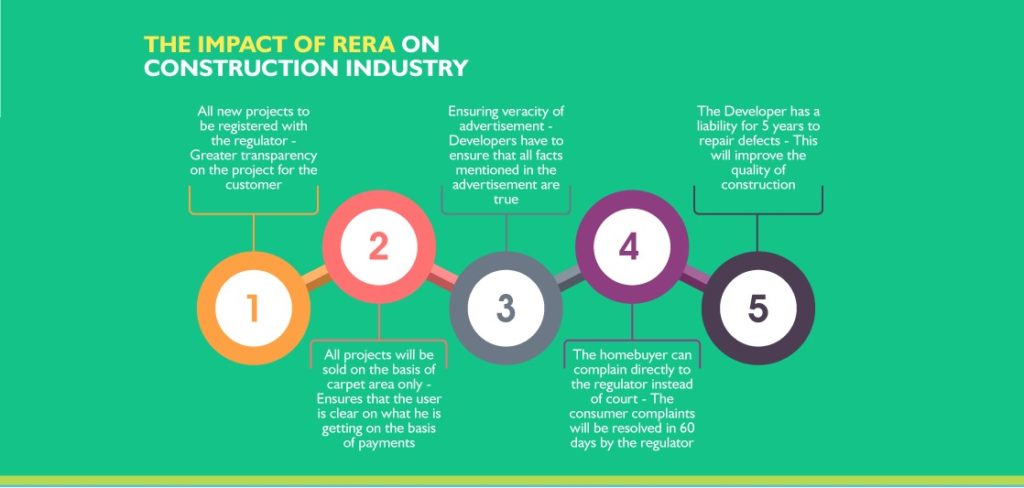

- It will be compulsory to register the project with a regulator before launching the project wherever the land is over 500 sq meters, or where there are eight or more apartments in the building. All financial and legal details have to be fully disclosed at this time. This way, even small projects by local promoters will be brought under the purview of the Act.

- There will be a number of restrictions put on the promoter to ensure that the project is completed on time. In case of delays, the developer will be liable to pay an interest rate of State Bank of India’s highest marginal cost of lending rate plus 2% within 45 days of due.

- The carpet area of the apartment has to be clearly defined and they will include the usable spaces in the flat like the kitchen and toilet. It is specified that in case of more than a 5% decrease in the carpet area, the promoter will have to refund the amount of that area. However, in case of an increase in carpet area, the buyer will not have to pay any additional amount to the promoter.

- Moreover, the liability period of the developers, which was earlier only two years, has now been increased to 5 years and they are responsible for clearing all structural defects within this time. The defects have to be renovated within 30 days of the matter being brought to the notice of the promoter and absolutely free of charge.

- The buyers are only going to pay for the carpet area of their apartment, that is, the area within their walls. Earlier, it was required that they had to pay for the super-built area as well. False representations will incur a heavy penalty.

- Once the majority of the units are sold, it is mandatory to set up an allottee association within three months. They will be able to interact and manage the common facilities that way.

- If any additions or alterations are to be made to the project at a later stage, the consent of at least 2/3rd allottees would be required before that can be done. The allottees will have to be duly informed by the engineers and architects that such changes are really required.

- The developers will not be able to start selling the project unless necessary clearances have been made. All developers and agents will have to register themselves with a regulator before they can start selling their projects.

Important Facets for Consumers

RERA is going all out to provide information to the buyers which is why it will ensure that all publications will come on their websites regarding all the projects and homebuyers will be able to make an informed decision based on it. The publication will include information pertaining to the track record of the promoters, details of all litigations, prospectus, and advertisement pertaining to the project, details of the apartments in terms of size, plots, garages, the registered number of the agents and consultant, development plans of the project, financial details of the promoters, the status of approval for the project and every other relevant detail.

The homebuyers will be able to judge for themselves whether they want to place their trust on the developer and wish to go ahead with the project or not.

Two Key Points worth Noting

Land of Slum Dwellers:

The interest of the slum dwellers have also been kept in mind and Gautam Chatterjee, the chairman of the RERA, had sent a letter to SRA under which they have been directed to register all the upcoming projects constructed on slum lands on the website. According to the Slum Rehabilitation Authority, developers are required to build a permanent structure in place of the land they are taking from the slum dwellers. In return, they would get an additional Floor Space Index and they could sell that to make a profit.

The interest of the developers will also be met through RERA:

A penalty would be imposed on anyone who will not pay their dues on time. The developer will also be able to approach RERA in case they do have some issue with the buyer. Nevertheless, the industry experts and the developers themselves think that the odds are against them as almost 10% of the project cost, or even imprisonment could follow if they do not register themselves with a regulator or do not deliver the project on time.

Anti Discriminatory Clause by Maharashtra Government

What is most striking about RERA is the anti-discriminatory clause, which was introduced by the Maharashtra government, and as mentioned above, had seen that the RERA was implemented in its full capacity. There were hundreds and hundreds of complaints being registered about builders not keeping their word, about delayed handover of projects, faults in projects and not getting the type of construction they were promised. More pressing than that was the matter that there were complaints builders were not willing to sell flats based on buyer’s religion, marital status and even dietary preferences because of which the Anti- Discriminatory Clause was introduced and it clearly stated that so far as any buyer could meet the price of the builder, there could no other grounds based on which the property cannot be sold.

The Maharashtra Government also went on to add new rules pertaining to parking spaces, to regulate the sales and they are now required to disclose the sale of parking spaces as well.

Registration & Functioning of RERA across States

- The status of Maharashtra has already been stated. In other states, like Andhra Pradesh, 328 projects were registered and 48 agents as well. The online portal is functional and APRERA has rejected 20 project because of non- compliance of rules.

- In Assam, the state rules have just been notified and measures are on the way.

- The Bihar RERA online platform has also started functioning. Till February 2019, 51 builders were served notices and a penalty of INR 10 lakhs would be levied for the rules being violated. The details of builders whose bank accounts were frozen were also published online.

- In Chhattisgarh, 847 applications for project registration were submitted and the online portal is underway. The same can be said about GOA RERA which has just started functioning so information is not much as yet.

- In Gujarat, 2687 residential projects and 1038 affordable housing projects were registered. The online portal has also provided a city-wise breakup.

- In Haryana, 301 projects submitted applications for registration and 714 agents signed up as well. It has been seen that it is also one of the most active regulators in the country.

- In Himachal Pradesh, 29 projects are there on the RERA portal but there is no chairman.

- In West Bengal, the RERA is not implemented as yet because of problems between state and center. Nevertheless, the state has its own housing regulatory authority, the HIRA or the Housing Industry Regulatory Authority.

Impact on Real Estate Sector

Overall, RERA has introduced many such rules to regulate the real estate sector more comprehensively. However, it did impact the real estate sector in some ways:

- According to several industry reports, new launches of residential projects fell by about 8% after RERA came into effect and this fall was mostly noticed in the NCR.

- Launches of projects in residential sector remained restricted till the end of 2017 as the developers were using this time to register themselves with RERA and making the necessary alterations which would be required to comply with the new norms.

- The share of the affordable segment in the total number of launches has also improved. Buyers were hesitant about investing in high end and luxury segment and there was a demand and supply discrepancy. With the introduction of RERA, such investors became more confident about their investments and the numbers increased.

- Not just the developers, it is required that all property brokers are also registered with real estate regulators in their respective states. Likewise, the bigger agents have become consolidated and small-time players went out of the market.

- RERA has also mandated that it will accept complaints about unregistered projects free of cost till the 90 day period granted to builders for registering their project ends.

Subsequently, a number of other regulations also came into effect. A new clause ordained that once developers upload a document on the RERA website, they will not be able to delete it. Naturally, developers have become more conscious about uploading the correct documents on the websites as even the slightest mistakes now will not go unnoticed and all details of registration and project updates will have to be provided, along with any changes that have been made along the way.

Builders can only upload the new, authentic, and fresh documents. It has also been ordained that if progress updates are not regularly uploaded on the website, then action will be taken against them as well. The real estate lobby has been unhappy with the new set of rules but is gradually adapting to the same. The biggest beneficiary, in this case, has been the customer above all else. Big and reputed developers or real estate brands have already made themselves RERA compliant while fly-by-night operators or small-time players have finally exited the market. This has led to higher accountability and transparency which has in turn revived the real estate sector at large throughout the country as per experts.

An updated list of flats already sold by the developer also has to be submitted when he is registering with the regulator. In this regard, the list would also include the delays in the erstwhile project, their timelines, and the measures taken to avoid such delays in the future. The timeline of such projects, with their agreement for sale, conveyance deed, proforma of allotment letter, land tile and construction insurance along with the names and addresses of all real estate agents, contractors, and structural engineers would also have to be included in the records. All of this will be a step forward in increasing the transiency in this field and will protect buyer’s interest.

As of now, a number of states and Union Territories like Andhra Pradesh, Bihar, Odisha, Gujarat, Kerala, Andaman and Nicobar Islands, Daman and Diu, among others have been notified about RERA and works are on in other states to implement RERA fully. The Act will be applicable to all upcoming commercial and residential projects.

Other points to take note

- The projects that have not received Completion Certificates will also be brought under RERA and they will then have to be registered within 3 months. However, the Act will not be applicable to the renovation, repair, or redevelopment projects which will not involve new sales, marketing, or advertising.

- The Act states that the promoter will be required to provide a declaration, which has to be supported by an affidavit, that he has the legal title of the land and that the land is free from any kind of dispute. This will ensure that there are no delays during the construction of the project or that the homebuyers will have not have to go through any legal disputes after they have invested their money in the project. It will also ensure that project delays are avoided.

- It has also been stated that the promoter will not transfer or assign his majority rights and liabilities with respect to a project to any third party whatsoever unless a prior consent has been obtained from the 2/3rd

- The maximum advance or application fee that a promoter can receive prior to the execution of a written agreement for sale is 10% of the cost of the apartment.

Penalties that can be levied

- It has already been stated that the promoters will be liable to pay 10% of the project cost in case of default and if it persists, then the developer could also face imprisonment for up to three years.

- In addition, in case of non-registration of real estate agents, the penalty will be as high as INR 10,000 per day up to 5% of the property cost.

- In case it is seen that the builder had provided false information regarding the property in the application for registration, 5% of the estimated project cost would be levied.

- In the same way, non-compliance with any of the provision of the Act will result in the imposition of penalty of 5% of the estimated project cost, of the agent as well as for the allottee.

- On the other hand, not complying with the order of the Appellate Tribunal will result in penalty up to 10% of the estimated project cost for the promoter. It could lead to imprisonment of three years and a penalty of 10% of the property cost or imprisonment for one year for the agent.

As of now, it has been two years since RERA came into force. The Center has claimed in a report to Supreme Court that a total of 42, 726 housing projects and a total of 33,906 real estate agents have been registered under RERA. Also, over 20,000 complaints have been solved till now.

It goes without saying that these measures have managed to organize and consolidate the real estate sector in India like never before and considering that this is one of the largest sources of revenue for India’s economy, such measures were long needed. Today, thanks to RERA, not only the domestic buyers but also the NRI investors are more confident about investing in luxury properties here, something they were always wary of doing as they felt they would not be able to manage their issues with the developer from another country if something happened out of line. Unscrupulous developers also took advantage of the fact. It has now been able to put an end to a number of malpractices that were previously associated with real estate development and this has brought a huge relief to the urban middle class who often invest their life savings into buying a home, which ends up becoming the most important investment that a family could ever make.