When it comes to real estate, a certain trend has been noticed in the past decade. People are no longer waiting till their retirement, or even middle age to buy a home. The youngsters are buying a home around their early to mid- thirties, by the time they have acquired a secure position in their jobs and are ready to settle in their personal lives as well.

Young professionals today are in a better position of doing so because housing finance is easy to attain and there are EMI facilities, plus other attractive incentives which makes such a purchase easier these days. The purchasing factor is also driven by need- most youngsters today are moving out of their homes because of their job postings and for those who are moving out of their cities for good, it becomes imperative to buy a home in the new city, or even country, they are migrating to. Renting is an option, yes, but rentals work best for a short term scenario. This is because no matter how much rent one pays, a property will never become their own. It is a far better idea to use that sum for EMIs and using the money for the initial deposit for down payment instead. Eventually, one will have a property to his/her name which is always a future asset and adds to one’s net-worth. Hence, it can be safely said that one can be sure that purchasing a house is better than going for rentals when it comes to your basic needs.

However, what about investment?

When it comes to investment, the primary goal is wealth creation. And Real Estate has always been considered a safe option in this regard. That does not mean that there aren’t any ups and downs to contend with. In fact, anyone who is remotely familiar with real estate will tell you there are periods of slowdown in real estate as well. However, what makes real estate a safe option is that, no matter what the situation is, and no matter how much time it takes, property appreciation in real estate always happens. You could buy a home now, and even if it does not yield much returns now, you can at least hand it over to your children, and eventually they will be the ones reaping the benefits. If your property is well maintained, or at least not falling to pieces, there is almost always a chance of acquiring a return on investment from your home, or even your plot of land.

It has been seen globally that real estate is still the top choice for investors when they are looking for assured return on investment. That does not mean there are no other avenues for investments, does it? However, there is something very emotional when it comes to a home. Even if the property has been acquired solely for investment and even if one is not living in the house or apartment, there is something about a physical, tangible place that people become attached to. With this emotional factor combined and with the guaranteed returns that real estate offers, it leaves little scope for doubt that real estate has always been a top choice when it comes to investment.

What experts feel

When it comes to other options of investment, there are shares, bonds, mutual funds and equities, of which the latter is also a very popular option. Nevertheless, many industry experts have opined that housing is a better choice even it is susceptible to credit cycles. For first time investors, who are just starting their investment portfolio, this can be a little confusing because more often than not, financial planners induce one to invest in stocks and bonds and to stay away from real estate. The logic is that the former will help fetch better numbers in the long run. This is mostly based on the findings that in the long run, equities tend to outperform other asset classes in the market. However, recent data has unearthed something new.

According to a new global database of asset prices, Jordà-Schularick-Taylor Macrohistory Database, which is funded by Institute for New Economic Thinking or INET, it has been found that residential real estate, and not equity has been the best long- running investment option in modern history. This is because while both housing and equities have their own shares of risks, the housing market has been far less volatile in the recent part as a result of which risk- adjusted returns from real estate were much better in an extended time period.

So when it comes to Returns from Real Estate, what exactly does it entail?

Returns would mean both rental income and the price appreciation of the property. Even if one looks at it from the point of view of a layman and not that of an investor, it makes sense. Suppose you acquire a property in a developing area and then let it out for rent.

Let us assume that the property was let out for fifteen years. So, for fifteen years, you have steadily received rental income from that property. Even if you have paid a chunk of the rent for repaying the EMIs of that property, there was leftover which you have used for your personal needs.

Next, in the course of fifteen years, you have steadily paid your EMIs and as the years went by, your EMI amounts because smaller. On the other hand, the developing area in which you bought the property is fully developed within the next five years or so, and your rental appreciation goes up. As more amenities and infrastructural facilities are added to the location, this appreciation goes up every few years, which leaves you with greater and greater amount of cash after paying your reducing EMIs, which you are using for your personal expense, or could be reinvesting.

What happens thereafter?

At the end of fifteen years, you have two choices. With the EMIs fully paid, you have full possession of your home and you can enjoy the full rental income from your property. You can continue with your tenants for as long as you want. On the other hand, you have the option of selling the property, which has undergone a tremendous appreciation in the last fifteen years, and you will be selling the property at least three times the price you bought it for. The money acquired could be used for funding the children’s foreign education, a wedding in the family, or for treatment of a major illness in case of an emergency, or could just be invested in a lump sum for your retirement.

So no matter what you do, you can be sure that you will never fall short of income if you are buying a second property for investment. This is taking into account the fact that adjustments would be made from the total returns for volatility. There could be periods when you do not have a tenant. You might also have to pay a sum from time to time for the maintenance of the property. Nevertheless, in a span of ten years or more, these figures adjust themselves and you are still left with considerable cash at the end. Housing outperforms equities in all sixteen advanced economies that have been worked on by the researchers.

There is the Sharpe ratio which can be used to understand whether returns from the equity are better or returns from real estate and you should ask your financial advisor about it. It is simply the excess return that has been earned over a risk- free rate and divided by volatility.

A few minor pitfalls

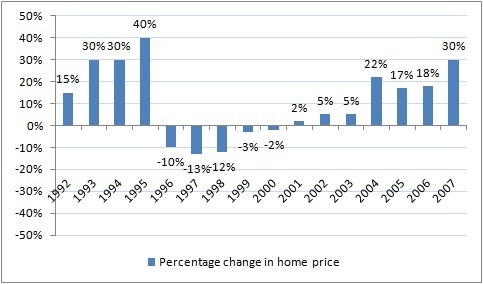

It should be mentioned again that it is not to be assumed that house prices would never fall. There are slumps in every sector and the idea is to wait it out. Invest your excess cash in short term returns at the time like short term FDs for a span of one or two years. The interest acquired from it will make up for the loss from real estate and things usually go back to normal again after a span of couple of years. It has also been seen globally that housing price have a direct relation with the overall credit growth of the economy.

It has also been seen that whenever the credit in the economy moves up, a lot of money is pooled into real estate and that again brings up the prices of properties and vice versa. Economists have found this while working of the financial cycle drag, or FCD hypothesis. In simple words, it has been seen that credit booms in any economy will inevitably pull up usually low productivity sectors like real estate. A debt overhang is created, and that does not always create productivity or potential output of the economy. When the credit boom starts reducing again, a protracted economic slowdown is gradually perceived again. In fact, according to economists, when the business cycles tend to coincide with the financial cycles, the period of recession that follows actually continues for longer and is more severe.

Although data on India is still not available largely, some limited house price data is available 2010 onwards. This suggest that the housing price movements were far less volatile that the equities during this period and residential house still remains the most popular choice for investment for most families and almost 90% of the wealth of the Indian households are either tied to land or buildings.

The last major boom in housing prices was seen in 2010- 2012 period and since then the prices have remained quite low. Globally, some other countries had also witnessed the rise and fall of credit cycle that had resulted in the increase and decrease of house prices in the country. India has been far less volatile in this respect compared to other emerging markets and development in the real estate markets have also contributed heavily to the 1997 crisis in Asia where unprecedented state led investment in real estate created ghost towns in China. Yes, there are upheavals in the Indian real estate market from time to time and developer loans turning bad and other factors has resulted in the loss of appeal among some investors, but the picture is far from bleak.

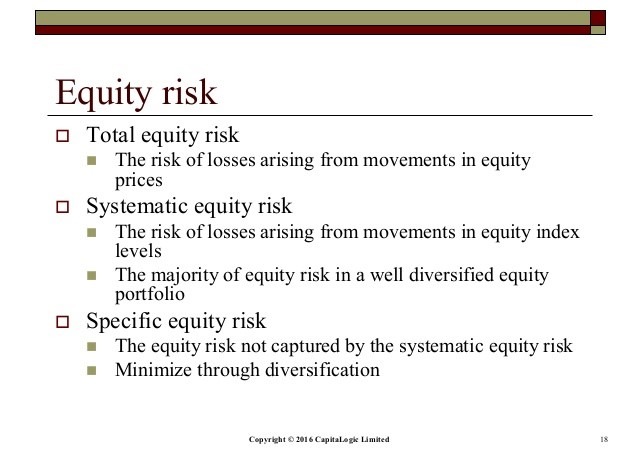

According to some economists, the attraction towards real estate is often more psychological rather than practical and has arisen from loss- aversion predominantly. However, it does seem like a rational choice now, considering the new developments taking place in real estate and with the market becoming more organized, risks are gradually eliminated one by one. The fact that real estate could be a better choice could be offset by some of the risks that equities pose.

Risks in Equities

To start with, the cost of issue of equity shares is quite high and the excessive use of equity shares will result in the over capitalization of the company. Moreover, with the issue of equity capital, dilution of control might occur of the equity holders. This is reflected during times of depression when dividends on equity shares are very low and that results in a massive fall in their market values. There is also the fact that equity dividend is payable from the post- tax earnings and the cost of servicing equity capital is also higher than the cost of issuing preference shares or debentures because of higher rise. The expectations of equity shareholders also rise with it. Some equity shareholders may put obstacles for the management by manipulation or forming their own organization and it would adversely affect the company as well as affect the other equity shareholders.

On the other hand, even when the market is doing well and higher dividends are being paid to the shareholders, a lot of speculations set in. So, investors who have a low risk appetite and rather opt for investments which guarantee fixed returns do not have much interest in equities.

The take-away

Hence, it can be said that shares and equities are mostly based on speculations. It is important to understand that market functions in different manners in different times of the year and global crisis may often lead to a crash in domestic market without any prior notice whatsoever. It is important to be prepared for such contingencies and it is equally important to come to terms with the fact that there are high chances that you will lose some amount of money first before you actually start making a profit and till you get the crux of how shares and equities work on a short term period.

Considering all these factors, it can be safely said that it is a far safer idea to invest in housing. Of course, the better your home is and the better the location is, the better will be your returns. It is a far better to purchase a property in a developing area at slightly higher prices than buying one is a very remote area for a low price. This is because even though you are investing higher amounts in the case of the former, the appreciation will be greater as well and you are sure to get better returns from your investment. Money begets more money and but you need to know which is your best shot and real estate will never let you down.