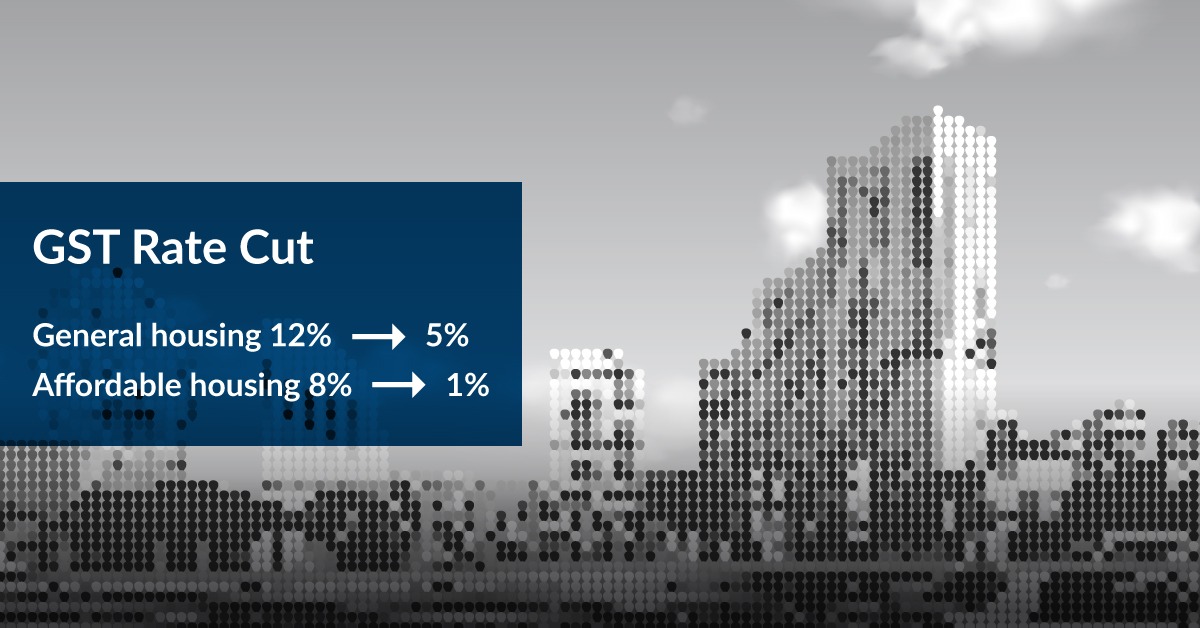

There are reports of the GST rate being slashed to 5% for under construction homes and this may be a big move with regard to benefiting homebuyers and developers alike.

- GST rates may be lowered for under construction apartments or homes

- The GST Council will be taking up the lower GST proposal for under construction apartments or houses at its next meeting.

- GST rates may be lowered to 5% for under construction property in a landmark move that will boost the sector.

- Union Finance Minister Arun Jaitley has already stated that the Council will be considering the proposal for rationalizing taxation on residential housing units.

- Examining the current scenario for GST on real estate

- At present, GST is levied on under construction apartments and homes at the rate of 12%.

- The same 12% rate is applicable in case of completed or ready to move housing units which have not got completion certificates issued at the time of their sale.

- In the ideal scenario, GST of 12% would have been offset to a large extent by the input tax credit (ITC) benefits for real estate developers on raw materials for projects.

- If this were to happen, the actual GST incidence would have come down to around 5-6%.

- Why 5% GST is necessary

- 5% GST (flat rate) on under construction property without input tax credit (ITC) will simplify the entire process for homebuyers who do not get the latter transferred to them in many cases.

- This will bypass situations where developers pay for inputs in cash and do not pass on ITC benefits to homebuyers.

- The lower rate will definitely boost housing sales across the country and encourage fence-sitters to invest in real estate.

- This will naturally help real estate developers increase sales volumes, clear out inventory and restore some balance to their account books.

- The Government will benefit from higher revenues arising from increased property sales, stamp duty and registration. Currently, with the GST rate being 12% on under construction property, buyers prefer ready to move properties with completion certificates which are exempted from GST. This actually lowers potential Government revenues from the real estate sector at the moment.

GST on under construction homes may be reduced to 5%

GST may be lowered to 5% for under construction homes in a major decision and this may boost the real estate sector and homebuyers in particular. Developers may also see a spike in real estate sales with this move.