With major players prioritizing technology-enabled contactless services, the Co-working sector in MMR registered an absorption of 0.19 million Sq. Ft. in the first quarter of 2021 itself. Also, with co-working space expanding its footprint in the commercial leasing sector, a closer analysis at the emerging trends seems to reveal some answers.

As COVID wreaked havoc around the world, in alignment with the disruption across other sectors, a similar downward trajectory was anticipated for the co-working industry as well. Survival of an industry built on the tenets of socializing, networking and shared spaces seemed challenging in such times when social distancing emerged as the new normal. However, in spite of this, the co-working segment in MMR registered an absorption of 0.19 million Sq. Ft. in the first half of 2021 itself. This is already a rise of 19% from the absorption recorded in the co-working segment in 2020. Delving in further, Square Yards takes a look at how the leasing trends in the co-working space of MMR had changed over the years and plausible underlying reasons!

Co-working space industry analysis 2021

Co-working or flex spaces have always been interpreted as the preferable product for startups, freelancers, and small enterprises offering a digitally enabled cost-effective space. With more new players entering the co-working industry, the niche customer segment was expanded to include medium and big enterprises also who looked for larger floor plates. Also, over the years, it became quite unequivocal among the co-working players, especially the big ones, that to be more profitable and gain market share, one must source larger independent enterprises as well.

With more number of large enterprise clients eyeing new concepts like gyms, creches, and sports zones to create a holistic experience for their employees within the workspace, co-working spaces are being designed to be more interactive. Apart from creating an interactive vibe in the common area of co-working spaces, the segment now also offers customising the dedicated office area as per the needs of individual companies, reflecting their ethos and work culture.

However, there is no denying that closing deals for large tenants require a long decision time as compared to the small startups or freelancers given the multiple stakeholders and technical intricacies involved.

Is the share of flex spaces expanding in the MMR Commercial leasing segment?

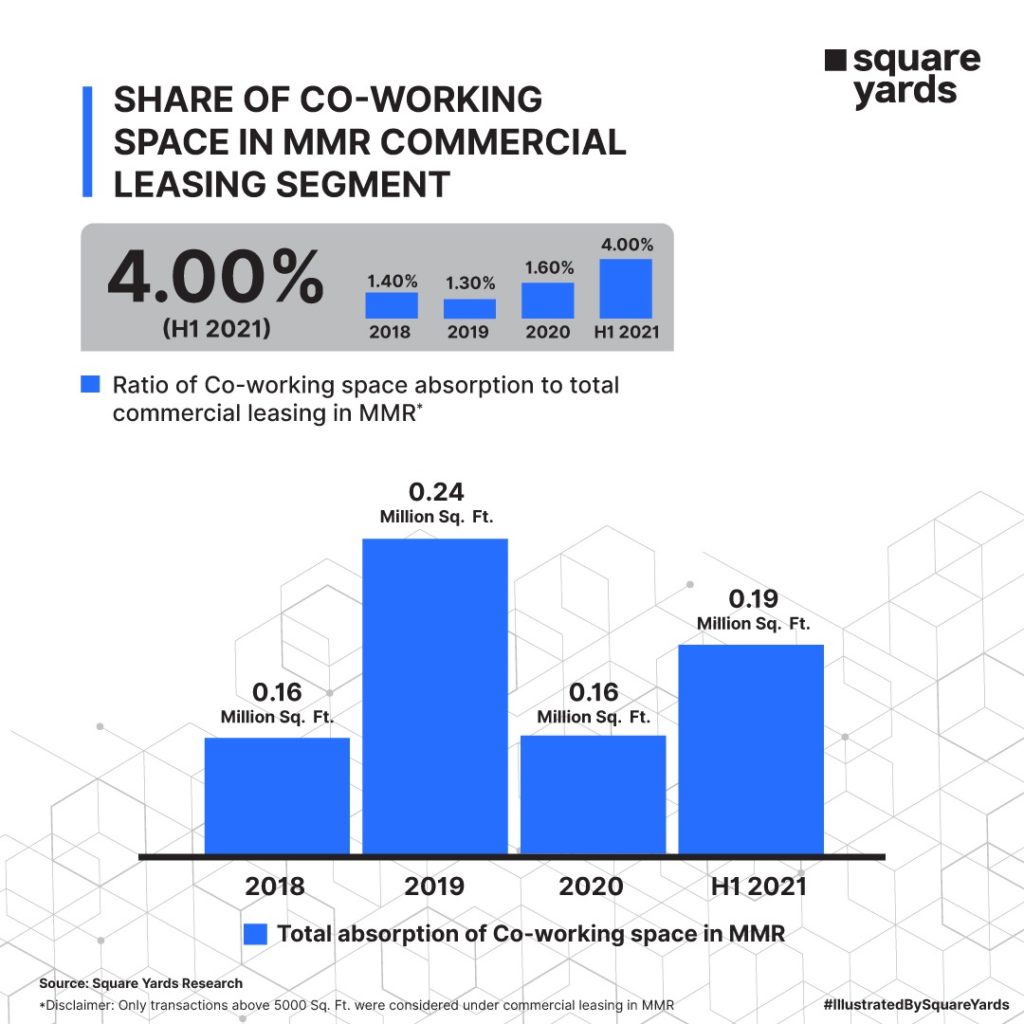

As per Square Yards research, the ratio of co-working space leased to commercial leasing for space more than 5000 Sq. Ft. grew from 1.4% in 2018 to 4% in the first half of 2021. This reflected that the share of co-working spaces registered significant year-on-year growth in the commercial leasing sector, even though the net leasing of shared office spaces declined by about 11.53% compared to the pre-pandemic level, resulting in an absolute decrease of 46, 015 Sq. Ft.

The increase in the flex spaces share in the commercial leasing market can also be attributed to the agility and adaptability of the co-working segment to be in tune with the changing consumer demands in the past few years.

How did the co-working segment fare amidst the pandemic?

With socializing, shared spaces, and networking at its core the co-working segment was considered to be a big misfit in the pandemic. To survive, there was no choice left other than adapting and evolving. To suit the clients’ concerns, several major players significantly tweaked their products and services in the flex segment. Overcoming the challenge of real estate being laggard in terms of adopting the pace of technology, the prime players in the segment came up with the highest technology-enabled safety measures. Adhering to the endeavour of offering contact-less services post-COVID, flex spaces are now providing facial recognition mechanisms for screening temperature and masks, mobile-enabled access control, facility of dispensing tea/coffee, and booking meeting rooms at the click of a button to mention a few.

As the pandemic has rendered working from home the norm, the biggest change observed was that people looked for flexibility within their work spaces. Thus, as companies prepare to come back to the office environment the void for a physical office space that fits the new norm remained prominent. To meet this demand, players have come up with the strategy of flexible lock-in on seats rather than Sq. Ft. area. Thus, the customized solution of availing a certain number of seats across different locations offers the requisite flexibility to many companies.

Is the upward growth trajectory of co-working spaces transient?

The flex spaces have always been at the forefront, ensuring lots of transformation to be in sync with its varied client base. As the sector is registering resurgence, one can expect boom of the co-working segment in the upcoming years. As flexibility has become more crucial than ever before, co-working spaces, with their inherent readiness seem to add value and natural flexibility which is apt to adapt and redefine the future of co-working and commercial leasing segment.

With more people opting for curated office spaces due to the convenience of cost optimization, the spur observed in demand is expected to stay for a long period. Also, as major players are bringing up more technology-enabled contactless services in the segment, the skepticism around the future of co-working spaces might diminish with time.