GIFT DEEDS: A COMPLETE GUIDE

All people like to give something to the one they love. Although donations are commonplace, few of us understand the legal implications of this process. The ideal way to donate is to give a gift deed. In some cases, the deed will rank above the word ‘Will’. The transfer of property to someone can be paid or given for free. When ownership transfer has nothing to do with currency transactions, this transfer is called a gift deed. The registration of a gift deed does not require any financial reward; however, the entire legal process will be followed for acquiring it. A registered deed of gift is also evidence of its own, and, unlike a will, the transfer of ownership is instantaneous, and you do not have to go to court for enforcement, which saves a lot of time and hassle.

EXPLANATION OF GIFT DEEDS

Documents to register a gift deed includes the voluntary transfer of a gift from a donor to a person without a monetary bonus. Such gift transfers must be registered in accordance with the "Transfer of Property Act". It is a means of tax avoidance. It can be transferred to an actual person or institution; the recipient must receive the gift while the donor is alive.

WHAT CONSTITUTES AS A GIFT

If you register a gift deed on file, it will help avert any litigation that may occur later.

- It must be either static or immovable.

- It must be an existing property; that is, it must exist in the present and should not be a property to be bought in the future.

- It must be transferable.

- It must be tangible.

INCLUSIONS IN A GIFT DEED

- The date and place of the issuance of the document.

- Information about the donor, such as name, address, date of birth, father's name.

- Details of the giver like name, father's name, address, and relationship with the donor.

- Signatures of the donor and the recipient and the signatures of the witnesses (two witnesses) present at the time of the handover.

- Photographs of the witness, donee, and donor.

PROCESS OF MAKING A GIFT DEED

Drafting the first step - The gift deed can be drafted by a lawyer who will enunciate what will be transferred and to whom. A deed is an agreement between the giver, that is, an agreement between the giver and the recipient. Also, it can be said that it's a reciprocal act of giving and receiving at the same time. For the gift to be effective, it must be offered voluntarily by the person, and no coercion or exchange of money is allowed.

Accepting the gift - Acceptance is also an important legal requirement for a valid gift. Once the gift is sent, the recipient must accept the gift for life. Otherwise, the gift will be invalid. The validity of acceptance can be determined through acts such as possession.

Registering the gift - Unless registered, recipients of real estate gifts cannot obtain ownership of such gifts. According to the provisions of Article 123, the Transfer of Property Act, the transfer of ownership can only be carried out during and after registration and post-registration, after being certified by two witnesses.

Donor-Recipient Relationship- If the donor and recipient are blood relatives, some state governments may grant a stamp duty reduction, but if not, it is important to establish the donor-recipient relationship.

Delivery Clause - on the gift, for example, if the recipient can rent or sell the property, etc., these clauses should be mentioned during the delivery of possession of the said property.

Revoking the gift- This mentions the express or tacit action of transferring ownership of the property, revocation of the gift, stating whether you would like the recipient to have inserted a revocation clause in the deed of gift. Both the donor and the recipient must agree to this clause.

Cite any Liabilities - rights or liabilities like if the recipient is eligible to sell off the property or lease it in the future should be mentioned expressly.

HOW TO REGISTER A GIFT DEED

The gift deed can be registered in accordance with the 1908 Registration Act. When registering, the following steps must be followed: The property is evaluated by an expert who evaluates the donated property. It varies from person to person, and the stamp duty on gift deed for women is slightly lower. Stamp duty on gift deeds also varies from state to state and can be viewed on the official website of the state government.

Gifts for Minors

From a legal point of view, the owner of the property can give gifts to others. An exception to this rule is that the donor or recipient is a minor. Minors are not allowed to sign contracts; therefore, they cannot give up their property. If the donor is a minor, the donation has no legal effect. If the recipient is a minor, the natural guardian can accept the gift on their behalf. Donating property, if the gift is onerous, then the obligation can only be imposed on minors. When the recipient grows up, he/she will either accept the encumbrance or return the gift.

Is a verbal real estate gift legal?

According to Article 123 of the Transfer of Property Act, it is very important to understand that verbal transfer and unregistered real estate deals have no legal effect. No rights will be granted if the delivery does not follow the legal procedures.

PROS AND CONS

- It runs for the life of the donor, and the transfer is instantaneous while the will lasts after death.

- The deed of a gift must be recorded; only then is it effective.

- Registering makes you less prone to litigation. On the other hand, the "will" is prone to litigation.

- The transfer via a deed of gift is tax-free in the hands of the donor and the recipient. It can be changed as often as possible.

- In the case of deeds of gift, there are additional costs in the form of stamp duty.

- Stamp duty varies from state to state.

CHARGES FOR A GIFT DEED REGISTRATION

To register the gift certificate, you must pay stamp duty, which varies from state to state. You can also pay stamp duty online or at the registry office. Below are the mentioned rates for stamp duty at a few states-

| State | Stamp Duty |

| Delhi | Men: 6% Women: 4% |

| Maharashtra | Agricultural land/ residential property: INR 200 Family members: 3% Other relatives: 5% |

| Gujarat | 4.9% of the market value |

| Punjab | Family members: NIL Non-family members: 6% |

| Karnataka | Family members: INR 1,000- 5,000 Non-family members: 5.6% of the land value |

| Tamil Nadu | Family members: 1% Non-family: 7% |

| Rajasthan | Men: 5% Women: 4% and 3% Immediate family: 2.5% For spouse: 1% Widow: None SC/ST or BPL: 3% |

| West Bengal | Family members: 0.5% Non-family members: 6% More than Rs 40 lakh: Surcharge of 1% |

| Uttar Pradesh | Men: 7% Women: 6% |

GIFT DEEDS AND TAX IMPLICATION

Gift Deeds must be reported on an income tax return (ITR). In 1998, the Gift Tax Act of 1958 was repealed, but it came into force again in 2004. If the amount of stamp duty exceeds INR 50,000 and the property received does not obtain the required allowance, the tax implication would be enormous. For example, the tax rebate is INR 1.5 Lakhs, and the stamp duty is INR 4 lakhs, then the penultimate difference between is more than INR 50,000.

HOW TO REVOKE A GIFT DEED

According to Article 126 of the "Transfer of Property Act", the gift contract can be revoked if the following conditions are met:

- The donor and the recipient agree to cancel the donation.

- The transfer of ownership is based only on the wishes of the one who transfers the said gift deed, and the receiver is unwilling to accept the assets.

- For property created as part of a gift, this situation is not illegal or immoral. This means that the gift is not fraudulent. However, legal counsel should be sought to clear the underlying process.

- Remember, once the gift contract is ready, it cannot be revoked unless a revocation clause is added. Be sure to add an "exit clause" to avoid complications in the future.

CAN A GIFT DEED BE ALLOWED TO REGISTER IN A PERSON’S PRIVATE RESIDENCE

According to Article 31 of the Registration Act, it herein allows the registrar to visit the apartment or home of a person who wants to submit a gift deed certificate as evidence of a special reason (such as a physical disability). To register and accept this type of deed, the person in charge of the record must be convinced that the specific reasons provided are sufficient.

RELINQUISHMENT DEEDS AND GIFT DEEDS

Relinquishment deeds and gifts are different types of property transfer in the eyes of the law. The act of transfer enables a person to vacate or transfer their legal ownership of the property. However, in the deed of relinquishment, the transferred property is always hereditary, and the gifted asset is not necessarily hereditary. The person to whom the property is relinquished must be the co-owner of the property. In the case of a gifted property, anyone can do so by giving explicit favour to the property itself.

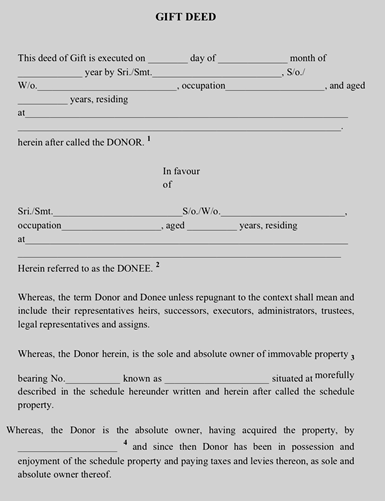

FORMAT OF A GIFT DEED: SAMPLE

CONCLUSION

On a voluntary basis, gift deeds are an effective legal tool for the smooth transfer of property in India. It also comes with Tax exemption within certain limits. In addition, it is exempt from sales tax and central tax. The main takeaway is that it is autonomous and does not mean any monetary reward; however, it should be noted that additional stamp duty on a gift deed, which may vary from state to state.

You Might Also Like

Frequently Asked Questions (FAQs)

What are the main things recorded for a gift deed?

It should primarily state that the donor is gifting voluntarily, and there is no external/internal influence or coercion for the same. The acceptance of the gift should also be mentioned

How to fix an appointment at the Sub-Registrar’s office?

Visit the official website of the state government and go to the Revenue Department. From there, select the district name, SRO address, area details where the gift deed is located. In the receipt, fill the e-stamp number. Fix an appointment with the SRO where an SMS alert will confirm the same.

Can a gift deed be revoked?

Under very special circumstances, but there’s no guarantee.

Can an NGO pay stamp duty if it was part of a gift deed?

Any charity centres do not fall under the purview of stamp duty; however, state authorities should be consulted on the matter. In most cases, an NGO cannot be acquired as part of the gift deed.

What are the names of the recipients of a gift deed?

They are usually called Donor and Donee. The Donor transfers the property, and the donee can be anyone, their relation will determine the amount of stamp duty on gift deed and other fees to be paid