Buying a home can be both exciting and tedious. While the feeling of purchasing your own home in Mumbai is priceless, the registration process can be draining. You need to consider a lot of factors like filling out the application form, submitting essential documents, understanding the terms and conditions, etc. All this is followed by paying Mumbai stamp duty on property.

Like all the other states in India, Maharashtra also has its own stamp duty and registration rates. If you’re not aware of the latest rates or the process of paying stamp duty, we’ve got you covered. In this blog, we will take you through the entire process of stamp duty and registration fees in Mumbai.

Table of contents

- What is the Meaning of Stamp Duty?

- About the Maharashtra Stamp Duty Act

- Stamp Duty on Property in Mumbai and other Nearby Areas

- Latest Stamp Duty and Registration Charges in Mumbai

- Mumbai Stamp Duty Value of Property as Per Area

- Property Registration Charges in Mumbai and nearby Areas

- Gift Deed Stamp Duty in Mumbai

- Mumbai Stamp Duty on Various Deeds

- What are the Determining Factors of the Stamp Duty Registration Rates in Mumbai?

- Calculation of Stamp Duty in Mumbai

- How to Pay stamp duty in Mumbai Online?

- Stamp Duty and Registration Charges for Resale Flat in Mumbai

- Stamp Duty Refund Process in Mumbai

- FAQ's about Stamp Duty in Mumbai

What is the Meaning of Stamp Duty?

Stamp duty is a charge levied by the government on the transfer of assets or property. These charges can be different for different states and are calculated based on the property’s market value. In the case of Maharashtra in particular, the government revised the stamp duty in Mumbai recently.

About the Mumbai Stamp Duty Act

To conquer the issues related to stamp duty in Maharashtra, the Maharashtra Stamp Duty Act was given a green flag in the year 1958. In this act, every instrument is covered which is mentioned in Schedule 1 of the Maharashtra Stamp Duty Act. One should know that the stamp duty is only chargeable on the instrument or the document and not on the transaction. Not only this, but the Mumbai stamp duty rates are also dependent on aspects of whether the property is in rural or urban areas.

Stamp Duty on Property in Mumbai and other Nearby Areas

In the year 2020, when real estate suffered a setback, the Maharashtra government decided to reduce the stamp duty rates on commercially operated properties. It was in August 2020 that the government announced the reduction in stamp duty for three months. The slashed Mumbai stamp duty rates were 2% which were earlier 5% from September to December. And, from January 1, 2021 people had to pay a stamp duty of 3%. The decision turned out to be fruitful in the beginning. The Maharashtra government further announced to not carry forward the reduction in March 2021.

From April 2021 onwards, the earlier stamp duty rates became applicable again i.e. 5%. In addition to that, a 1% rebate was announced for female buyers on 8th March 2021. This means that if the property is registered under a female’s name in Mumbai, there will be a 4% stamp duty levied on it. This rebate, however, does not apply to a co-ownership.

| Name of Cities | Mumbai | Pune | Thane | Navi Mumbai | Pimpri - Chinchwad |

Nagpur |

| Rates applicable from April 1, 2021, | 5% | 6% | 6% | 6% | 6% | 6% |

| Rates applicable from April 1, 2021, for females | 4% | 5% | 5% | 5% | 5% | 5% |

| Rates from September 2020 to December 2020 | 2% | 3% | 3% | 3% | 3% | 3% |

| Rates from January 2021 to 31st March 2021 | 3% | 4% | 4% | 4% | 4% | 4% |

Latest Stamp Duty and Registration Charges in Mumbai

Take a look at the current stamp duty charges in Mumbai in the table illustrated below.

| Category | Stamp Duty Charges in Mumbai |

| Stamp Duty for Males | 5% |

| Stamp Duty for Females | 4% (after 1% rebate) |

| Joint Ownership (Male + Females) Stamp Duty | 5% |

| Home Registration Charges in Mumbai | ₹30,000 for properties that cost more than ₹30,00,000. 1% of the property’s value for properties that cost less than ₹30,00,000. |

Mumbai Stamp Duty Value of Property as Per Area

- For urban areas falling under a municipality, the stamp duty rate is 5% of the total market rate of the property.

- For areas falling under panchayats, municipal councils, and cantonments under the MMRDA, the stamp duty rate is 4% of the total market value.

- The stamp duty rate is 3% of the market value for areas that fall under the Gram Panchayat limits.

Property Registration Charges in Mumbai and nearby Areas

When a buyer registers a property in his or her name, the government charges tax. This tax is levied in the form of flat registration charges in Mumbai, house registration rates, or plot registration charges in Mumbai. As mentioned previously, these charges vary from state to state and are set at 1% of the property’s market value in most states. Some states even fix these charges. The Maharashtra government for instance has fixed these charges for every property that is worth more than ₹30 lakhs in market value.

| Name of Cities | Mumbai | Pune | Thane | Navi Mumbai | Pimpri-Chinchwad | Nagpur |

| For properties over ₹30 lakhs | ₹30,000 | ₹30,000 | ₹30,000 | ₹30,000 | ₹30,000 | ₹30,000 |

| For properties less than ₹30 lakhs | 1% of the value | 1% of the value | 1% of the value | 1% of the value | 1% of the value | 1% of the value |

Gift Deed Stamp Duty in Mumbai

A gift deed is a legal document (signed) in which ownership of personal, real or intellectual property is transferred voluntarily and without any recompenses. The act of transfer is known as a gift while the legal document which states the transfer is known as the gift deed. In the deed, one party is defined as the donor (the person who gives the gift) and the other as a donee (person who receives the gift).

As per the Maharashtra Stamp Act of 2017, the State of Maharashtra would levy a 3% of the property value as a stamp duty charge in the case of a Gift Deed. In cases where the agricultural or residential property is gifted to a daily member, the gift deed stamp duty in Mumbai is ₹200. Besides this, the following duties are applicable to different deeds in Mumbai and all of Maharashtra.

You Might Also Like to Read: IGR Maharashtra

Mumbai Stamp Duty on Various Deeds

| Type of Deed | Stamp Duty |

| Gift Deed | 3% |

| Lease Deed | 5% |

| Gift Deed family (Agricultural/Residential property) | ₹200 |

| Power of Attorney | 5%- For properties in municipal areas 3%– For properties located in gram panchayat areas |

What are the Determining Factors of the Stamp Duty Registration Rates in Mumbai?

One cannot just skip the payment of Mumbai property registration charges and stamp duty. It is mandatory to pay these charges on the purchase of any kind of property whether residential, commercial, flat or land. The government of Maharashtra is no different. It levies stamp duty and registration fees on property transfers. Mumbai stamp duty charges are dependent on various factors including

Property Type: If you think a particular property type is spared from stamp duty and registration fees, you are wrong! One has to make stamp duty payments for all kinds of properties purchased in Mumbai. However, the charges are different for different types of property. For example, in commercial properties, more amenities are offered than in residential properties. Therefore, the stamp duty and registration charges for commercial properties are higher in comparison to residential properties.

The location: The Location: Another thing that determines the stamp duty is the jurisdiction of the property locality. Properties in urban areas have a greater stamp duty charge than those located in rural areas. This is because the urban areas in Maharashtra come under the municipality while the rural areas are included under the Panchayat.

Market Rate: While determining the stamp duty charge and house registration charges in Mumbai, the market value of the property is a major factor which is taken into consideration.

The Age of Property: When compared to new properties, older properties tend to have lesser market value. Therefore, the stamp duty changes for older buildings are lesser in Mumbai.

The Purchaser’s Sex: Female property buyers in India have to pay lesser stamp duty fees compared to male property, house or flat buyers.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Goa | Stamp Duty in Goa |

| Kerala | Stamp Duty in Kerala |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Jammu & Kashmir | Stamp Duty in Jammu & Kashmir |

| Noida | Stamp Duty in Noida |

| Andhra Pradesh | Stamp Duty in Andhra Pradesh |

| Chhattisgarh | Stamp Duty in Chhattisgarh |

| Bangalore | Stamp Duty in Bangalore |

| Assam | Stamp Duty in Assam |

| Jharkhand | Stamp Duty in Jharkhand |

Calculation of Stamp Duty in Mumbai

For calculating the stamp duty in Maharashtra, the total property value and ready reckoner rate in Mumbai is taken into account. The ready reckoner rate in Mumbai is fixed by the Maharashtra Government which is the minimum price below which a person cannot do any transaction on the property. So, for instance, if a flat in Worli has a market value of ₹7,50,00,000, the stamp duty will be 5% of ₹7,50,00,000 which is ₹37,50,000.

Alternatively, you can use a stamp duty calculator Mumbai to determine the stamp duty rate of your property. In the online calculator, all you need to do is select your state and enter your property value. The calculator will then automatically fetch the applicable stamp duty.

How to Pay stamp duty in Mumbai Online?

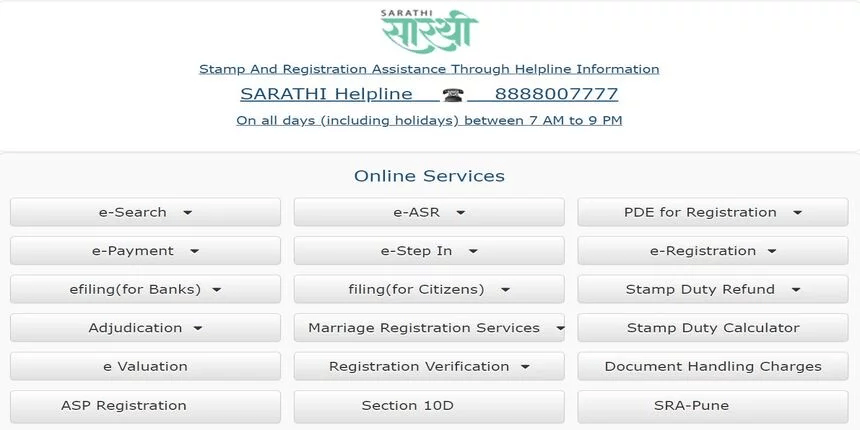

1. Go to the official website of the Maharashtra Government Department of Registration and Stamps.

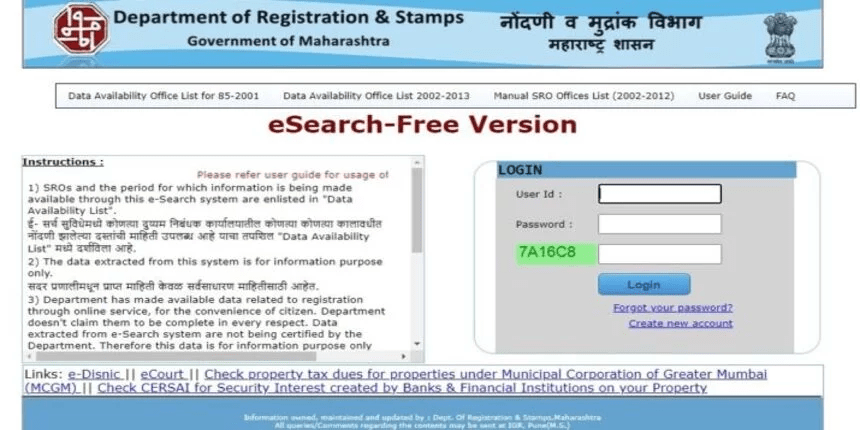

2. If you have already registered, log in using the existing credentials.

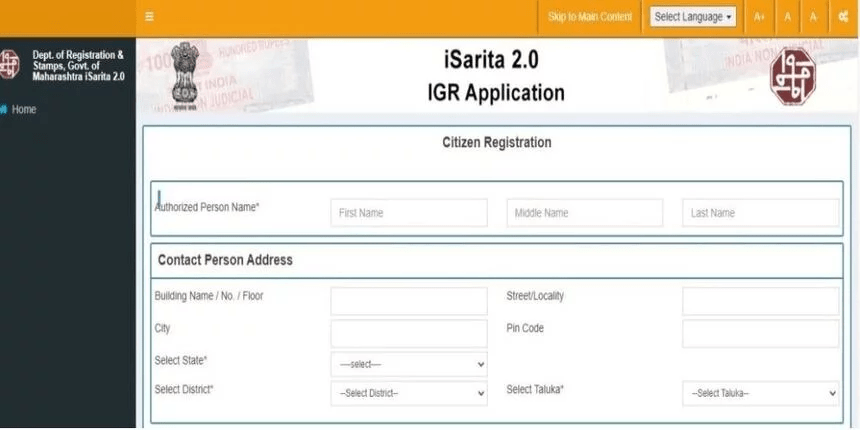

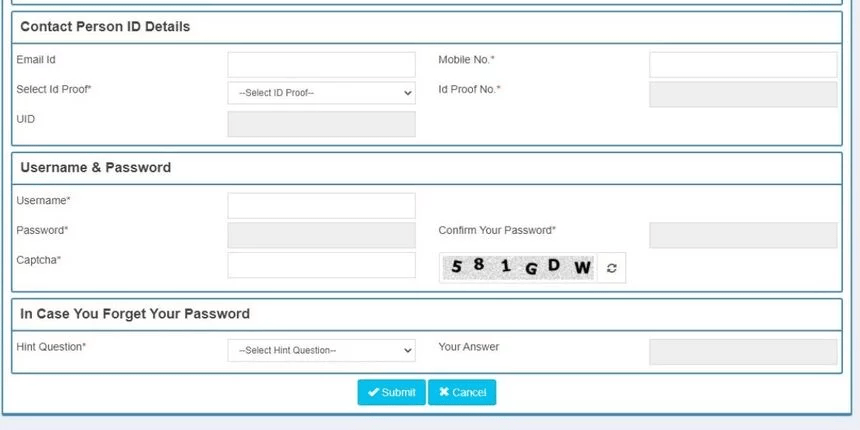

3. If you have not registered, choose the option of ‘Pay without Registration’

4. After this, you will be redirected to a different page. Select the option of ‘Citizen’ and then click on the type of transaction for proceeding.

5. Select ‘Make Payment to Register Your Document.’ Fill in all the details correctly and pay your registration and stamp duty charges.

6. Select the option of payment and keep the challan handy for the future. When you are in the process of executing the instruments, this challan will be required.

Note: You should be careful while purchasing a property because these stamp duty rates can add a lot to your budget.

Stamp Duty and Registration Charges for Resale Flat in Mumbai

Even if the project is resalable, you will have to pay the stamp duty and flat registration charges in Mumbai and these charges are determined as per the Maharashtra Stamp Duty Act, 1958. From 1st April 2021, for urban areas, the stamp duty on resalable properties will be 5% of the total market value of the property. The charges of registration for properties with a value less than ₹30 lakhs is ₹30,000 and for properties with a value above ₹30 lakhs, it is 1% of the property’s market value.

Stamp Duty Refund Process in Mumbai

- A citizen can fill out the application for a stamp duty refund online.

- The required documents need to be submitted to the Collector of Stamps Office

- The collector will further handle the case of refund

- When you submit the refund application, you will get a Refund Code on the acknowledgement form which can be used for checking the status of the Stamp Duty Refund

FAQ's about Stamp Duty in Mumbai

Q1. What are the stamp duty and registration charges in Mumbai for females currently?

For females, stamp duty is 4% of the property’s market value and for males, it is 5%.

Q2. What is the stamp duty on residential property in Mumbai?

For properties located in the urban areas, the stamp duty charges for residential properties are 5% of the property value. While for properties located that are located within gram panchayat limits, the stamp duty is 3% in Mumbai.

Q3. What are plot registration charges in Mumbai?

Mumbai land/plot registration charges are ₹30,000 for properties costing more than ₹30,00,000. For properties that are worth less than ₹30,00,000, the registration charges are 1% of the property value.

Q4. Is stamp duty increased in Maharashtra?

The stamp duty in Maharasthra was reduced to 2% from 5% after the pandemic. However, from April 2021 onwards, the stamp duty charges in Maharashtra have increased to 5% again.

Q5. Is stamp duty applicable on the resale flats in Mumbai?

Yes, when you buy a house in Mumbai that will take two years to get ready for possession, you will have to pay 2% as stamp duty and 1% as the registration charge on the purchase. The same charges apply if you purchase a resale flat in Mumbai.