In Chhattisgarh, registration is mandatory if you wish to own a property here. This entails paying the state government for registration rates and stamp duty. As per the Registration Act of 1969, you have to register stamp duty in Chhattisgarh your estate stamp duty costs.

Table of contents

- Stamp Duty in Chhattisgarh

- Objectives of Land Registration in Chhattisgarh

- Factors Impacting Stamp Duty in Chhattisgarh

- Stamp Duty and Registration Fees in Chhattisgarh

- How to Pay Stamp Duty in Chhattisgarh?

- Check Status of the Registered Plot in Chhattisgarh

- Documents Required for Property Registration in Chhattisgarh

- Land Registration: Benefits

- Contact Details

- FAQ's about Stamp Duty in Chhattisgarh

Stamp Duty in Chhattisgarh

According to Section 3 of the Indian Stamp Act of 1899, it is mandatory that a purchaser in all real estate transactions pay an income fee termed ‘Stamp Duty.’ The fees are imposed on the state government. There are two modes of payment: online and offline. The property is legally yours once it has been registered and stamp duty charges have been paid.

You can also reclaim a tax credit under Section 80C of the Income Tax Act of 1961. A tax benefit of up to 1.5 lakh can be claimed on registration fees paid. As of 2022, find out everything you need to know regarding stamp duty and registration rates in Chhattisgarh.

Objectives of Land Registration in Chhattisgarh

Chhattisgarh's objectives for land registration are mentioned below:

- Land registration in Chhattisgarh ensures that documents are properly recorded and authenticated.

- The primary goal of the registry is to keep track of who owns what.

- They are developing apps that assist people with spam detection, proof preservation, and title transference to the holder.

- The paperwork will keep up-to-date official records of the registered land.

- Once a document is certified by the appropriate office, it becomes a lifelong public record.

Factors Impacting Stamp Duty in Chhattisgarh

Since property rates are based on the instant reckoner price, a variety of criteria are taken into account when determining stamp duty charges. The following are the factors that influence Chhattisgarh's stamp duty on property rate:

Real Estate Price: From the fact that modern properties are much more costly and have higher stamp duty. Meanwhile, the older land has become cheap and has lower stamp duty.

Property Landlord's Age: In certain cities, stamp duty rates are reduced for those over the age of 60.

Type of Property: Houses and apartments are subject to lower stamp duty rates. In Chhattisgarh, however, autonomous houses get a cheaper stamp duty because this city is still growing.

Land Owner's Gender: In several cities, the stamp duty value on property are reduced for female purchasers.

Location of the Land: Land prices in metropolitan regions are higher than in rural areas, resulting in higher stamp duty payments in these places.

Additional Services Offered: A home with more facilities, such as a mansion, indoor pool, and fitness centre, will have higher stamp duty.

Stamp Duty and Registration Fees in Chhattisgarh

If you're purchasing a house in Chhattisgarh, the buyer must pay a stamp duty value of property charges,5%. Moreover, you have to pay an extra 1% of the amount as a processing fee for the land. However, these charges are valid if men buy the plot from its name.

| Category | Stamp Duty Fees | Registration Rates |

| Men | 5% | 4% |

| Women | 4% | 4% |

| Both (man + woman) | 4% | 4% |

For instance, let’s assume Neha has purchased a property in Raipur, the capital of Chattisgarh. The property costs Rs 45 lakh. Now she has to pay the registration cost and stamp duty fee according to the state government guidelines. The registration charges are 4%, and stamp duty charges are also 4%. The total calculation will be:

Stamp duty charges 4% of ₹ 45 lakhs = ₹ 1,80,000

Registration charges 4% of ₹ 45 lakhs = ₹ 1,80,000

Thus, the Overall total of stamp duty and registration charges ₹3,60,000.

Note: Like the majority of Indian states, Chhattisgarh provides a distinct benefit to female purchasers. As a result, they are eligible for a 1% point reduction in stamp duty on real estate. Therefore, the notarized estates of a woman are only subject to a 4% stamp duty.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Kerala | Stamp Duty in Kerala |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Jammu & Kashmir | Stamp Duty in Jammu & Kashmir |

| Noida | Stamp Duty in Noida |

| Andhra Pradesh | Stamp Duty in Andhra Pradesh |

| Mumbai | Stamp Duty in Mumbai |

| Bangalore | Stamp Duty in Bangalore |

| Assam | Stamp Duty in Assam |

| Jharkhand | Stamp Duty in Jharkhand |

How to Pay Stamp Duty in Chhattisgarh?

For paying stamp duty in Chhattisgarh, there are two methods: online and physical stamp paper.

Online Property Registration Process in Chhattisgarh

To pay online stamp duty in Chhattisgarh, some of the steps are mentioned below:

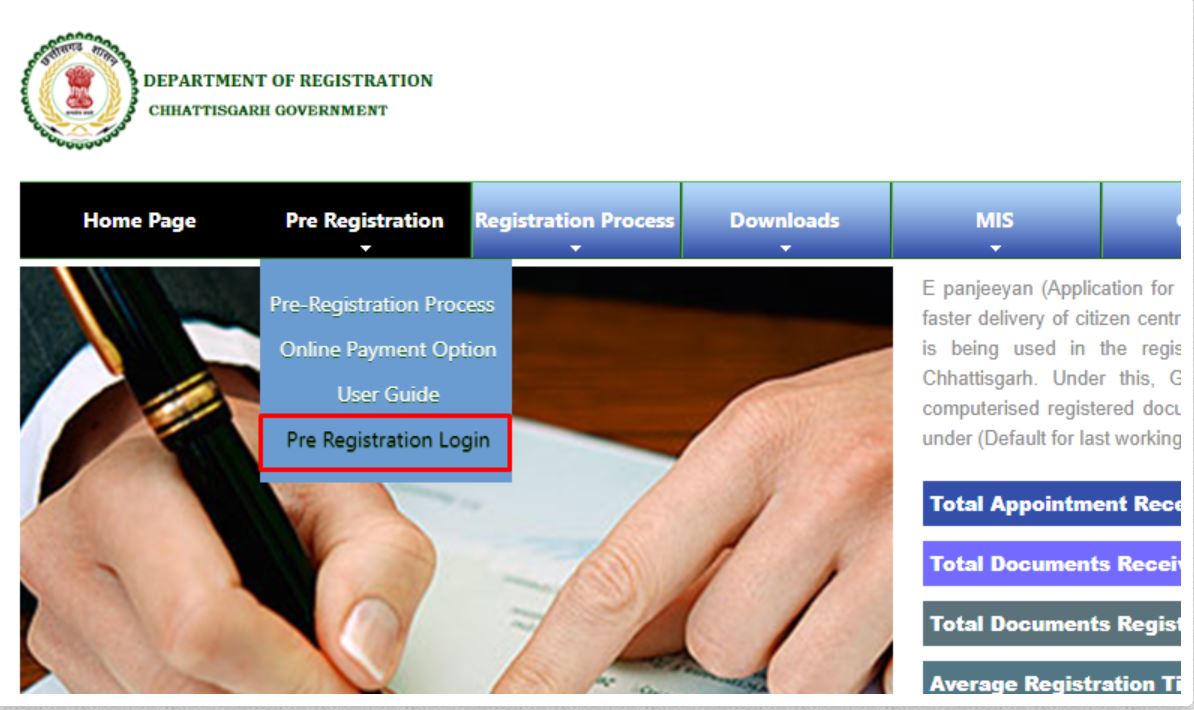

1. Visit the official website of 'E-Panjeeyan' of Chhattisgarh- epanjeeyan[dot]cg[dot]gov[dot]in/IGRPortalWeb/Home

2. Under the Pre Registration category, select 'Pre Registration Login'.

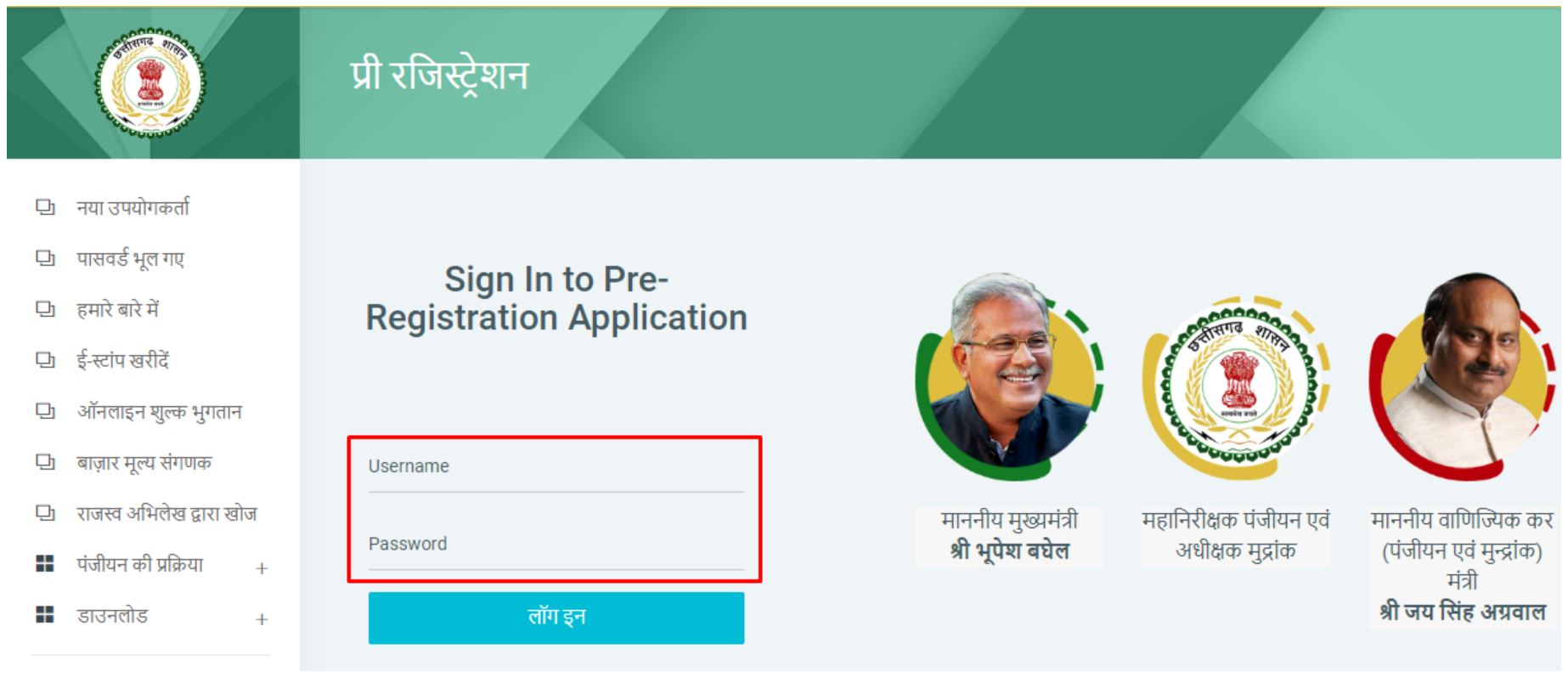

3. Fill out the credentials as mentioned in the below image.

4. After entering the credentials, fill in the required details such as name, mother’s name, father’s name, address, gender, contact number, and so on.

5. Once you have entered the details, select the 'Register' option, your profile will be created.

6. An 'E-panjeeyan' form will be created; Enter the details such as a lease for the district, property details of the property, and deed details. After filling in the details, click on the 'Save' button.

7. For online payment, select the 'Bhugtan' option. Fill in the details like card number, cardholder name, etc. Enter on the 'Proceed to Pay' button.

8. An OTP will be sent to the registered email ID and contact number. Fill out the OTP, and 'Submit' it.

9. A successful message will be displayed on the screen regarding payment status.

10. Choose the 'Token Date' and confirm it.

11. Finally, physically go to the SRO (Sub-Registrar Office) with the payment receipt and required documents and submit them.

Offline Property Registration Process in Chhattisgarh

Physical stamp paper: It is the most popular way of paying e-stamp duty. An approved seller can sell you stamp paper. Stamp duty paper has the same value as stamp duty costs. The stamp duty vendor must always be given a receipt of payment.

Check Status of the Registered Plot in Chhattisgarh

To check the status of the flat registration charges in Chhattisgarh, the following steps are mentioned below:

- Go to the official website.

- Choose the 'Corporation Type' and select the ' Proceed' button.

- Select the 'Track New Property Registration' option.

- Fill out the credentials like application ID and click on the 'Search' option.

- Select 'View Property Status' and check the registration status.

Documents Required for Property Registration in Chhattisgarh

Chhattisgarh plot registration charges, within four months, it is compulsory to deposit the required documents to the Registry office.

Under the 1969 Act of Registration, Section 25, it states that if they do not receive the required documents on time, then they will impose penalty charges. In order to avoid such scenarios, submit your documents on time. A list of documents is mentioned below:

- Application Form

- A duplicate copy of the land documents

- A copy of Hrin Pustika / Khasra document

- PhotoCopy of allotment letter of the plot

- Copy of an electricity bill, in case of invasion involved

- Sale with/without occupancy agreement

- Certificate of award

- Bond

- Letter of cancellation

- Transport (sale) deed

- Duplicate deed

- Asset exchange

- Deed of gift

- Deed of mortgage

- Deed of partition

- Attorney-in-fact

- Release document for mortgaged property reconveyance

- A bond of security

- Deed of Settlement

- Renewal of the lease

- Deed of transfer

- Transfer of a lease-by-assignment rather than via under-lease

Land Registration: Benefits

Some of the benefits of land registration are mentioned below:

- Provide assurance that the paper is authentic.

- Make transactions more visible and flexible.

- Guarantee that fraud is prevented, the proof is preserved, and ownership is transferred to the rightful owner.

- After licensing a property, you can keep a current public recording.

- Able to determine whether the land has been already sold or not.

- Ensure security of the land registry and give a guarantee for stamp duty documents.

Contact Details

Contact details:

0771 491 2523 / 1800 233 2488

Email Id:- techsupport@itsolutionindia[dot]com

Winding UP

In Chhattisgarh, plot purchasers must pay a percentage of the house registration charges in stamp duty and registration fees. In order for the sale deed to be registered in their names in official records, due to the fact that the plot is a state subject that comes under the Indian Constitution. However, stamp duty on property varies from state to state because each state has the ability to choose the amount of this tax levied.

FAQ's about Stamp Duty in Chhattisgarh

Q1. How can I check my land registration online in Chhattisgarh?

ou can check land registration online in Chhattisgarh by logging into the Bhuiyan official website at bhuiyan.cg[dot]nic[dot]in

Q2. How can I register property in Chhattisgarh?

You can register property in Chhattisgarh through online and offline modes. For online registration, you will require a few documents, such as an application form, Aadhaar card, Ration card, registration fees, and so on. On the other hand, for offline registration, visit the Registrar's Office and submit the documents.

Q3. Which department is responsible for registration charges?

The Chhattisgarh government levies the registration charges on the property. A Registration Department regulates the registration process and payment process.