Stamp duty is the one of the prominent constituents of the cost of a new property. Yes, the expenses associated with a new house are not limited to the mere purchase of a newbie building. It brings truckloads of other names of expenditure billing into a cost more than your calculations. The actual cost of a house includes stamp duty and registration rates in Gujarat. Crossing them off your new home checklist may not sound important to you but know, it is mandatory in India which spares you no chance. Here is one thing- you can experience a change in the amount payable depending on the location. Hello homebuyers, we are gathered here to know the stamp duty and registration charges in Gujarat. If you are a resident of Gujarat state and you are about to get all the information you need on Gujarat stamp duty rates applicable on the purchase of a property.

Table of contents

- What are Stamp Duty Registration Charges in Gujarat?

- How to Calculate Stamp Duty in Gujarat?

- How to Pay Stamp Duty in Gujarat?

- Property Registration Process in Gujarat

- Stamp Duty Charges in Gujarat

- Factors Affecting Stamp Duty Registration Charges in Gujarat

- Documents Required for Stamp Duty Payment in Gujarat

- Gift Deed in Stamp Duty in Gujarat

- Stamp Duty Value of Property and House Registration Charges- Final Thoughts

- FAQ's about Stamp Duty in Gujarat

What are Stamp Duty Registration Charges in Gujarat?

Stamp duty refers to a tax that needs to be paid by you while you commence the purchase of a new property in India. Every state government in the country levies a set percentage of stamp duty that is determined as per the market value of the property. As you pay this tax, you open your doorway to the legalization of documents related to your property which you have the Court of Law to help you with.

Another type of expense that you have to bear for the purchase of a new property is called registration charges. You have to make the payment of registration charges in order to have your house registered in your name. The amount is taken a call on by the State government and vary for men and women. One thing to make a note of here is that both these charges are not practised uniformly.

How to Calculate Stamp Duty in Gujarat?

When understanding the functionality of stamp duty and registration charges for your new property, it is important to know how they are calculated. These charges are calculated on the basis of the market value of your property. That is not, there are many other constituents that factor in the amount of tax you have to pay.

Other factors that impact the stamp duty and property registration charges for the purchase of the new property are the type and location of the property you are purchasing, your age and gender, amenities facilitated, the purpose of the property etc. Let us now move ahead and take a look at the cost of stamp duty and registration charges in Gujarat as set by the State Government.

How to Pay Stamp Duty in Gujarat?

The payment of stamp duty in Gujarat can be made via a number of channels. You can opt for e-stamping, franking or the paper-based method to pay stamp duty on property. If you want to go for the paper-based method then you can make a purchase of stamp papers from an authorised seller and pay the fees.

Another method to pay stamp duty in Gujarat is franking. You can head to the bank or a franking centre in order to make the payment through franking. If you want, you can complete the payment using e-stamping which is offered by several notaries, banks and stamp vendors etc. This method will help you get done with the payment of stamp duty on property once and for all. Without any fuss.

Property Registration Process in Gujarat

The government of Gujarat enables property buyers to have their property or Gujarat’s land/plot registration charges through online platform. Users have got Garvi, the official website, for the registration of property in Gujarat. We have mentioned the step-by-step instructions below to walk you through the registration process for property in the state of Gujarat.

Step 1- First of all, you need to walk yourself to the website called garvi[dot]gujarat[dot]gov[dot]in

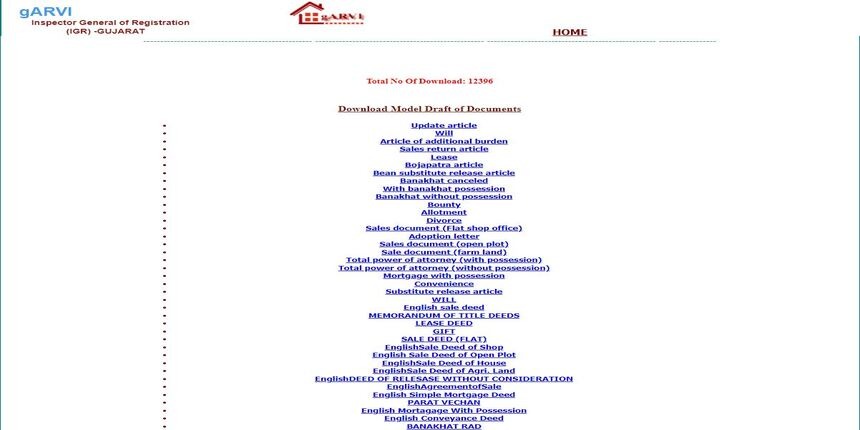

Step 2- Now choose the ‘Model Draft’ option given on the main page of the website. You have to download and fill the right draft.

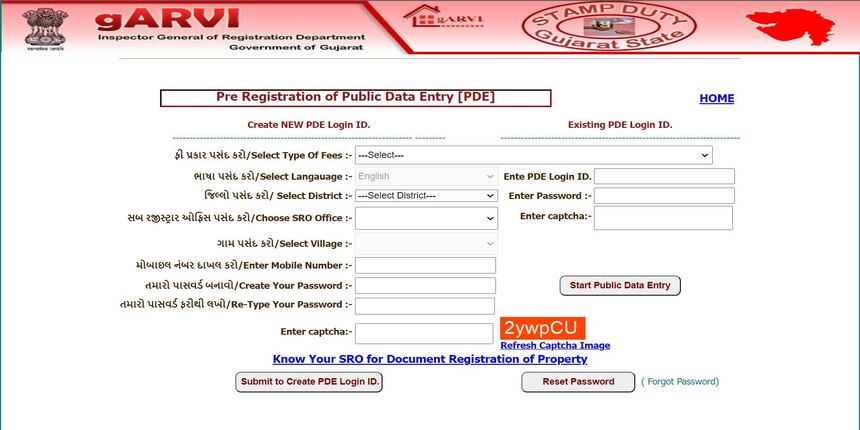

Step 3- Move back to the home page and hit the option for ‘Public data entry’.

Step 4- You must go through the information given on the new page you will end up on. Once done, select the ‘I Agree’ option and proceed.

Step 5- Choose the ‘Pre Registration Data Entry’ tab in order to move ahead with the process.

Step 6- Once you are on the page, you need to finish the prompt of ‘Start registration new data entry’. After you have filled in all the required details, hit the ‘Submit registration details’ button to proceed. Now that you have registered on the website, you can move with the property registration process.

Step 7- In order to register the property, you need to head to a number of pages and fill in the required details. Here, you will find pages including the ‘Presentation step 1’, ‘Payment details’, and ‘Payment status’.

Step 8- Once you are done finishing the payment, you will get a challan copy after hitting the ‘Print details’ button.

Step 9- Now you will receive a 13-digit number which you must keep saved for any reference in the future. Take a printed copy for the e-challan for future reference.

Step 10- Finally, you now have to submit the printed copy and the

Step 11- Then you just have to submit the printout and the 13-digit number with other documents at the office of the Sub-registrar at the time of your appointment.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Kolkata | Stamp Duty in Kolkata |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Goa | Stamp Duty in Goa |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Jammu | Stamp Duty in Jammu |

| Pune | Stamp Duty in Pune |

Stamp Duty Charges in Gujarat

The Gujarat government has levied 1% of the market value of the property or the transaction value (the one that is higher) as registration charges. There is a waiver for women buyers in the registration fees.

Here is the stamp duty value of property in Guajrat-

| Particulars | Charges |

| Basic Rate | 3.5% |

| Surcharge at 40% on basic rate | 1.4% |

| Total | 4.9% |

House/ Flat Registration Charges in Gujarat

Now let us gather knowledge on the property registration charges that apply to the properties in Gujarat-

| Gender | Registration Charges |

| Female | 0% - No Registration Charges |

| Male | 1% |

| Joint Buyer (Female and Female) | 0% - No Registration Charges |

| Joint Buyer (Female and Male) | 1% |

Apart from that, here are the additional charges that are to be paid by homebuyers for registration-

- Index fee- Rs 50 per copy

- Folio fee- Rs 10 or the as revised by the government

- Advocate fee

Factors Affecting Stamp Duty Registration Charges in Gujarat

There are several other factors, other than the type of property, that help determine the stamp duty value and registration fees in Gujarat. Not to mention, understanding these factors will help you with your call on home-buying journey and eliminate the scope of unnecessary hassle.

Here are the Crucial Determinants of Stamp Duty on Property and the Flat/Plot Registration Charges-

- Location of property: It is important to note that the stamp duty charges and registration fees in Gujarat are factored largely by the location of properties. In this case, the value is determined by checking whether the concerned property comes within the municipal confines or not. The properties that are beyond the municipal boundaries are usually higher.

- Age of the owner- The age of the owner of the property has a lot to do with the stamp duty rates. If the owner is a senior citizen then they are most likely to enjoy lower stamp duty rates.

- Gender- Women usually get concession on stamp duty rates. Government exercises this relief in order to encourage ownership of property among women. You must also note that the concession of such nature may differ across different states.

- Use of property- You will be charged a higher stamp duty rate if your property is going to be used for commercial purposes.

Documents Required for Stamp Duty Payment in Gujarat

Here are the documents which you are required to present during the payment of stamp duty charges and house registration charges-

- Identity proofs such as PAN Card, driver’s license, passport, etc. of the buyer and seller

- Agreement between the builder and buyer

- Sale agreement and deed

- Khata certificate

- Original copy of the power of attorney

- Proof of payment that has been made to the seller

Gift Deed in Stamp Duty in Gujarat

The Gift Deed in stamp duty in Gujarat comes under the Bombay Stamp Act 1958. As per Schedule I, Article 28, the gift deed in stamp duty has to be paid at the rate of 3.5% of the property’s market value.

Gift Deed in Stamp Duty in Gujarat must be implemented between a donor and a donee. They can be two close family relatives only. Including this, the gift deed in stamp duty has to be attested by two witnesses as well. Similar to registration charges processing, the gift deed in stamp duty has to be paid with valid registration.

As per the provision, a gift deed in stamp duty on the paper of 100 can not be implemented. This means the bequest made will only be in power after the donor’s demise. Including this, there will be no compromise or compensation made on the decided payable stamp duty charges on the property.

Stamp Duty Value of Property and House Registration Charges- Final Thoughts

As a homebuyer, it is your right as well as your responsibility to ensure that you are wide-eyed on the rates applicable to stamp duty and house registration charges, flat registration charges registration in Gujarat or any state for that matter. From the property registration process to the charges applicable to men and women, there should not be any skip button on your understanding of the fundamentals of land buying and selling errands. That was all for the stamp duty and registration in Gujarat.

FAQ's about Stamp Duty in Gujarat

Q1. What are registration charges in Gujarat?

The property registration charge in Gujarat for male buyers is 1% while on the other side, women have to no registration fee.

Q2. What are stamp duty rates in Gujarat?

Stamp duty rate in Gujarat is 4.9%. It includes as a basic rate of 3.5% and a surcharge rate on the basic rate at 1.4%.

Q3. Are there any tax benefits on stamp duty?

You can enjoy tax benefits on the payment of stamp duty and registration charges in Gujarat as per Section 80C of the Income Tax Act.

Q4. Which Stamp Act is applicable in Gujarat?

The Bombay Stamp Act, 1958 is the stamp act applicable for stamp duty and registration charges in Gujarat.

Q5. How is stamp duty calculated in the Gujarat lease?

A flat stamp duty charge for a lease is calculated at the rate of 0.25% of the cumulative paid as per the contract for up to 60 months.

Q6. Can I pay stamp duty Online in Gujarat?

Yes, the stamp duty on property can be paid online in Gujarat.