One of the major financial decisions you will make in your life is buying a home and the entire process turns out to be quite overwhelming financially. With this process comes the need to select the property, down payment, loan application, and signing of an agreement and the final part is the registration and possession of the property. Once possessed, the property should be registered under your name as soon as possible but you should know that only physical transfer of the property is not sufficient, you will require some legal evidence to prove the possession. This is possible when you get the property registered in the local municipal records under your name.

During the process of registration, you will be required to pay government tax that is levied on the transaction of a property like the house registration charges and plot registration charges in Madhya Pradesh. The tax is termed stamp duty. In this article, we will be covering every detail that you need to know about the stamp duty and registration fees in Madhya Pradesh. But before we proceed to the specifications of the stamp duty on property in Madhya Pradesh, let’s get to know more about stamp duty in general.

What is Stamp Duty?

Stamp duty is similar to income tax that is collected by the government which is effective under section 3 of the Indian Stamp Act, 1899. The amount of stamp duty should be paid full and timely as any delay would lead to an addition of penalty. A document with paid stamp duty acts as legal evidence and is admissible in a court of law. And, if the document is not appropriately stamped, it will not be admissible in the court of law.

Stamp duty Registration Charges in Madhya Pradesh

One of the highest revenue generation departments of Madhya Pradesh is The Registration and Stamps Department and it is operational under the Zonal Deputy Registration Inspector General with its registered offices in Indore, Gwalior, Bhopal, and Jabalpur. There are 234 Registrar offices in the state and 52 Registrar Offices in the district which are all operating under the Registrar Officer which has its headquarters in the city of Bhopal.

With COVID-19 hitting the real estate market hard, the government decided to slash the stamp duty rates in Madhya Pradesh from 3% to 1% on 7th September 2021, in the municipal areas and the property registration charges in Madhya Pradesh were also altered. This was continued till December 2021. Presently, the Madhya Pradesh stamp duty rate is 7.5% with the house registration charges remaining 3%. The stamp duty registration charges in Madhya Pradesh remain the same for males, female, and co-ownership.

How is the Stamp Duty Value of Property in Madhya Pradesh Calculated?

When you are a homebuyer paying a government levied tax, you should be well aware of how it is computed. The stamp duty value of property in Madhya Pradesh is calculated on the consideration value/ready reckoner rate/circle rate, or the market value of the property depending on whichever is high. The definition of consideration value is the total amount that is present in the transaction and is agreed upon by both parties. Also, the kind of property you purchase has an effect on the Madhya Pradesh Stamp Duty rates. For instance, if the agreement value of the property is ₹70 lakh and the circle rate is ₹60 lakh, the stamp duty on property in Madhya Pradesh will be calculated at ₹70 lakh.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

Payment of Property Registration Charges in Madhya Pradesh

There are 3 options for paying your stamp duty in Madhya Pradesh. You can choose to pay the flat registration charges in Madhya Pradesh online through e-stamping, by franking, or by going to the sub-registrar’s office and submitting the fee.

Payment of stamp duty charges in Madhya Pradesh through e-stamping

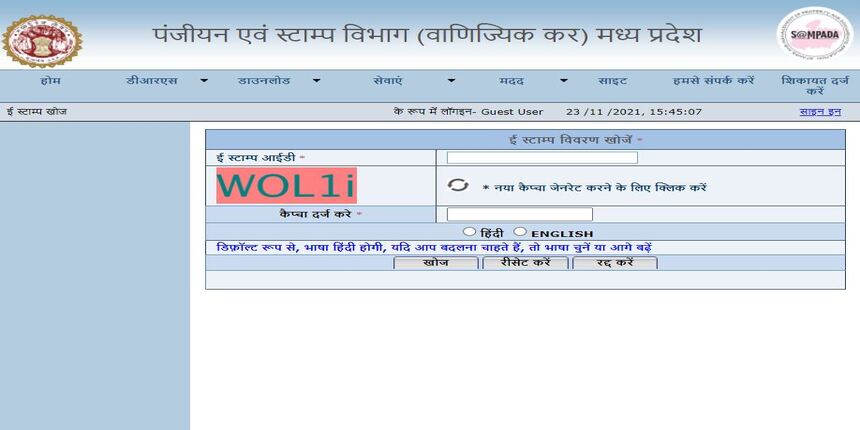

There is a dedicated portal for paying stamp duty in Madhya Pradesh which is the Stamps and Management of Property and Documents Application or SAMPADA. Before SAMPADA was launched, it was strenuous for people to complete the process of paying stamp duty and it would take days to get the certified documents.

You can follow the steps given below to pay the stamp duty online:

- Visit the official website using the link given: www[dot]mpigr[dot]gov[dot]in/Select the option of ‘Estamp Verify’ and proceed by paying the required charges.

Note: The authorities recommend using English as the language on the portal or else the payment might not get processed. Also, digital signatures are compulsory and do not refresh the page till the process of payment is complete. After the e-stamping is done you can check the details of the transaction, the amount paid, and the particulars of the party.

The Details on an e-stamped Document

- A unique identification number

- The time and date on which the document is issued

- The stamp duty paid in words

- Names of both the purchaser and seller

- Address of both the purchaser and seller

- About the property

- User ID

- The code of the specific service provider

- Barcode and Digital Signature

- All the security features

The Documents Required for Paying Stamp Duty and Registration Charges in Madhya Pradesh

Residence proof of both the parties, PAN card, and carefully filled Form 60.

Proof of identification of both the parties like Aadhar Card, Voter ID, or Driving Licence.

Passport size photographs of both the parties.

Principal Documents.

Stamp Duty and Registration Charges detail.

The Increase in Property Registrations in Madhya Pradesh despite the COVID-19 Outbreak

Though the outbreak of COVID-19 had an effect on real estate, the property registrations in Madhya Pradesh did not slow down. In the fiscal year of 2020-2021, about 1,07,000 properties were registered in Madhya Pradesh which is 8% more than that of the previous fiscal year while bringing a total of ₹1325 crores revenue. The demand for property was way more than the targeted number and the list included the registration of affordable homes that came through the first-time buyers.

Being a responsible homebuyer, one should be fully aware of the stamp duty and registration charges in Madhya Pradesh. With property rates being different for men, women, and co-ownership, one should keep an eye on the best deals.

FAQ’s about Stamp Duty in Madhya Pradesh

Q1. What is the stamp duty in Madhya Pradesh?

The current stamp duty rate in Madhya Pradesh is 7.5%.

Q2. How much is the registry rate in Madhya Pradesh?

For urban areas, the rate of registration in Madhya Pradesh is 12.5% while in rural areas it is 10.50%.

Q3. How is the stamp duty calculated?

The stamp duty is calculated on the circle rate or market value of the property.

Q4. What is the cost of stamp paper?

The cost of stamp paper is Rs. 10.