Owning or purchasing a house is one of the heartiest desires for everybody. Undoubtedly, everybody needs a shelter that they can call home, and owning a home in a city like Pune is a big deal. So, if you are on a house hunt trip in Pune, then the very first thing you should know is the stamp duty charge and registration charges in Pune.

Knowing these charges will give you an idea of the cost you would have to pay at the time of purchase. Accordingly, you can also plan how much loan you would require from the bank.

When you buy a home, it’s crucial that you register it in your name at the Registrar’s office. This will help you get legal ownership of your property. Besides, you can live without any fear of stepping into any kind of trouble with the seller or the previous owner. Moreover, it eradicates the scope of any fraud.

However, the most distinguishing feature of the registration here is the payment and documentation. If you don’t pay attention to the same, your application may get rejected. So, stay here and read this blog carefully. It covers all the basics of stamp duty and registration charges in Pune.

Stamp Duty on Property Charge in Pune

Given below are the charges with respect to different genders and slabs under stamp duty in Pune:

| Description of the Instrument | Female | Male | Joint |

| Under the scope of any Municipal Council or any cantonment area affixed to it or any urban area not prescribed in sub-clause | 5% | 5% | 5% |

| Under the scope of any Municipal Corporation or Cantonment or Nagar Panchayat affixed to it or any rural area under the limits of the Mumbai Metropolitan Region Development Authority, or the influence areas as per the statement of rates published under the Bombay Stamp (Determination of True Market Stamp Duty Value of Property) Rules, 1995 | 5% | 5% | 5% |

| Under the scope of any Gram Panchayat area or any such area not prescribed in sub-clause (ii) | 4% | 4% | 4% |

It’s quite clear from the above chart that the stamp duties for the property registration are set irrespective of the gender of the homeowner. The charges remain the same in all the cases, except in the case of the gram panchayat.

How to Calculate Stamp Duty Value Of Property in Pune?

The calculation of stamp duty rates differs for different places in India. In fact, it varies from one state to another and sometimes, one city to another. However, the central government of India has fixed the registration charges and stamp duty rates for every city in India and it keeps changing every year.

Any delay in the payment will cause you a 2% penalty every month. Apart from this, the stamp duty on property also depends on its age- whether it’s old or new.

Here is an instance that will explain the calculation of stamp duty and flat registration charges, plot registration charges, and house registration charges in Pune:

Neha purchases a home with a carpet area of 1000 square meters. However, the circle rate of the property in the area that it is situated in has a rate of Rs. 45, 000 per meter. Therefore, the calculation of the stamp duty value of property would be as follows:

Since Property value = Carpet area * rate per square meter

Therefore, the property value = 1000 * Rs 45000 = Rs. 4,50,00,000.

Now, since the stamp duty rates in Pune for the properties are 5% of their value, therefore, Neha would be-

5% of Rs. 4,50,00,000 = Rs. 22,50,000.

Hence, Neha would be paying a stamp duty charge of Rs. 22,50,000. While the registration charges will be Rs. 30,000 as per the rules.

With this, I hope your concept of stamp duty flat registration charges, plot registration charges, house registration charges and property value calculation is completely clarified now.

Factors that Determine Stamp Duty Registration Charges in Pune

Not only in Pune, but certain factors affect the stamp duty rates and registration charges on property in most places and states. These may include the type of properties such as residential or commercial, the market value of the property, and more. To know what other aspects influence the tax on property in Pune, have a look below:

Property Type

Property can be residential or commercial. The stamp duty and flat registration charges, plot registration charges, and house registration charges on commercial properties are comparatively higher than the tax paid on residential ones.

Location of the Property

The location of the property also plays a significant role in the charges applied on stamp duty and property registration. Properties in semi-urban and rural areas are comparatively lesser than those in urban areas in Pune.

Market Value of the Property

Another most crucial factor that determines the tax on the property is its market value. Besides, the total area of the property also plays an important role while calculating the stamp duty and registration fees.

Gender & Age of the Owner

In most places, the government offers additional concessions to females, and sometimes, the age x of the property owner also gets the benefit. This is done to ensure that more female and senior citizens invest in properties and become independent owners. However, the stamp duty charges for both men and women are the same in Pune.

Property Registration Charges in Pune

Now that you are aware of the stamp duty in Pune applied for the property registration, here’s an overview of the registration charges to be paid by the homeowners to the government.

| Type of Homeowner | Property Value | Registration Charge |

| Male | For properties above Rs 30 lakhFor properties below Rs. 30 lakh | Rs 30,0001% of the agreement value |

| Female | For properties above Rs 30 lakhFor properties below Rs. 30 lakh | Rs 30,0001% of the agreement value |

| Joint | For properties above Rs 30 lakhFor properties below Rs. 30 lakh | Rs 30,0001% of the agreement value |

From the above table, it’s pretty clear that the flat and house registration charges are set irrespective of the type of homeowner’s gender.

Current Ready Reckoner Rate in Pune

Follow the table designed below to have a better outline of the present ready reckoner rate in Pune:

| Type of Property | Ready Reckoner Rate |

| Apartments and Flats | Rs.8,010 to Rs.1,47,730 per square meter |

| Office space | Rs.36,980 to Rs.1,98,350 per square meter |

| Residential land | Rs.1,330 to Rs.91,960 per square meter |

| Shops | Rs.41,530 to Rs.1,111,600 per square meter |

How to Pay Stamp Duty Registration in Pune: A Step-by-Step Procedure

In order to pay stamp duty registration charges in Pune, you must stick to a few steps as described below:

Step 1 – Firstly, navigate to the official portal of Maharashtra Stamp Duty Online Payment gras[dot]mahakosh[dot]gov[dot]in/echallan/

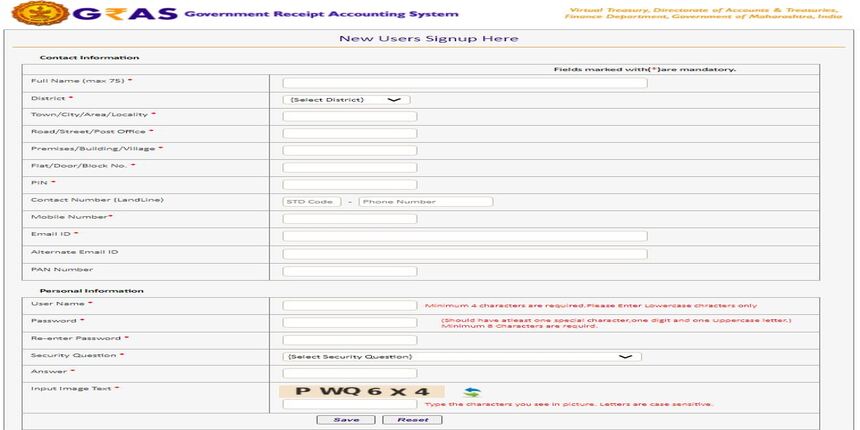

Step 2 – Secondly, register yourself on the portal.

Step 3 – If you want to pay without actually registering yourself on the website, then click on the tab “Pay without Registration,” then, tap on the option “select citizen” and the kind of registration you wish to initiate on the new page.

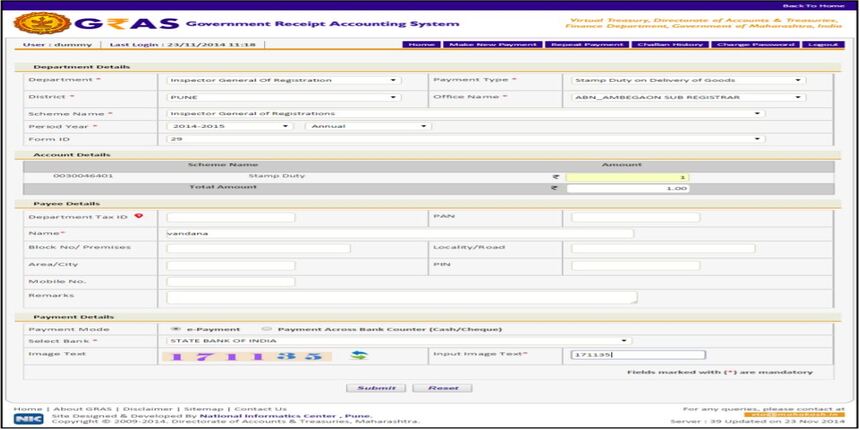

Step 4 – Next, you will find an option- “Pay to register your document.” Here, you can choose to pay solely the stamp duty charge or just the stamp duty registration charges of the property. Or you can also choose to pay both stamp duty and registration fees.

Step 5 – Now that you have chosen the type of payment, you need to enter the correct details such as property details, district, party details, sub-registrar office, and property value details.

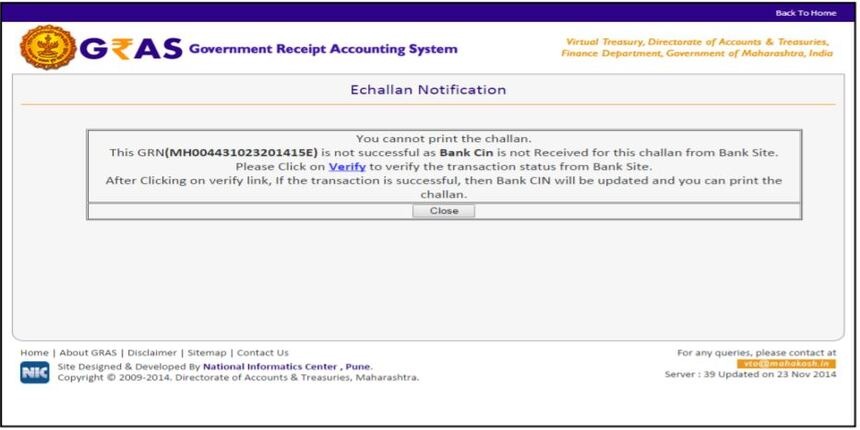

Step 6 – In the final step, you need to choose the desired payment method and generate the challan.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Kolkata |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Assam | Stamp Duty in Assam |

Checklist for the Documents Required for Property Registration in Pune

While registering the property, most of us often forget to attach the required documents. By doing so, your application for property registration may get rejected.

Therefore, you are advised to attach the following documents along with the application for the registration of the property.

- Two passport size photographs

- Two photocopies as well as the original copy of the deed document (to be submitted to the Sub-Registrar of Assurances)

- Identity proof such as the Passport, Pan Card, Driving License, Voter ID Card, etc. (of the buyer as well as the seller).

- Evidence of payment of Stamp Duty on property, i.e, Challan

- Particulars of the payment and the transaction done

- Certificate of the Khata and receipt of the taxes paid.

Stamp Duty Charges in Pune – Mode of Payments

You can pay stamp duty charges from any of these four modes of payment:

Franking a Document

It’s one of the payments made that depends on the applicant applying with a bank or authorised franking agency to pay the stamp duty rates along with the stamp. Nevertheless, the maximum stamp duty charge is rounded-off to ₹ 5000 per document.

Non-judicial Stamp Paper

It’s one of the least popular payment mode amongst all. It is full of hassles and demands more time. However, if you choose this mode of payment, you have to obtain physical stamp paper from a licensed vendor and print out the executed instrument on the stamp paper. It could be a feasible choice for stamp duty on resale property in Pune. However, properties with a larger stamp duty denomination must avoid this mode.

Electronic Secured Bank Treasury Receipt (e-SBTR)

Electronic Secured Bank Treasury Receipt (e-SBTR) is an online payment gateway that has eased up the process of stamp duty payment in Pune. The applicant has to fill the “input form” and pay the required stamp duty amount at the bank branch office.

Once the payment is done, the authorities will create a pre-printed e-SBTR via the Government Visual Treasury that will serve as a proof of payment. It is obligatory to collect the e-SBTR physically from the respective bank branch office.

Government Receipt Accounting System (GRAS)

If the applicant chooses to pay online entirely, he/she can do so through an electronic payment system GRAS. It allows the buyer to pay through e-challan. However, it’s restricted just to compulsory registrable documents (as stated in Section 17 of Registration Act, 1908.

GRAS mode of payment is mostly recommendable to buyers who have opted for home loans on the property.

Stamp Duty and Registration Charges in Pune- Takeaway

The main point to consider from the above discussion is that without paying the stamp duty and registration charges, you cannot become the owner of the property. Even if you become the owner anyhow, in case of any dispute or misunderstanding in the future with anybody will not be entertained by the court. It will need proof of ownership. Stamp duty and registration charges paid could act as the biggest evidence in the same.

In the beginning, you might feel monetary pressure over your shoulder, but by the end, you will understand how beneficial and important it was to go through it. Therefore, you must not hesitate even a little bit about paying the stamp duty and registration charges while purchasing the property. Just get it done with the Sub-Registrar and it will issue you with the certificate of registration.

FAQ's About Stamp Duty in Pune

Q. How much stamp duty do female homeowners have to pay?

Whether you are a female owner or a male owner, everybody has to pay a stamp duty of 5% on the property purchase in Pune.

Q. What happens if I don’t pay stamp duty on the property purchased?

Under Section 3 of the Indian Stamp Duty Act, 1899, stamp duty is a one-time charge. If you don’t pay the stamp duty during the property purchase, you will have to pay the outstanding amount with a 2% of the outstanding amount per month.

Q. How to calculate the stamp duty on the property?

To calculate the stamp duty, you need to first find out the property value. To gauge property value, you need to multiply the carpet area by the rate per square metre. After you have derived the property value, you can easily calculate the stamp duty rate charged on it.

As we know, the stamp duty applies at the rate of 5%. Therefore, 5% of the property value would be stamp duty you have to pay on the property you buy in Pune.

Q. What would be the registration charge on the property below Rs. 30 lakh?

If you buy a property below Rs. 30 lakh, you would have to pay a registration charge of 1% of the property value.