Owing to its rapid growth, Noida has become one of the most desirable options for property buying in India. Everyone, from new home buyers to experienced investors, has been keeping an eye on the property prices in this area. And while the opportunities for property buying are exceptional here, checking stamp duty in Noida is an important step.

Stamp Duty is the tax applied by the government on legal documents, generally while transferring assets or property. The objective of these taxes is to fund government activities and affirm a buyer’s ownership of the asset or property.

In this blog, we’re going to provide you with all the information on stamp duty and registration charges in Noida. Scroll down to learn more.

Table of contents

- Stamp Duty and Registration Fees in Noida

- Stamp Duty and Plot Registration Charges in Noida

- How to Calculate Stamp Duty in Noida?

- Stamp Duty Calculator in Noida

- Gift Deed Stamp Duty in Noida

- Flat Registration Charges in Noida

- How to Pay Stamp Duty Online in Noida?

- Paying Inadequate or Less Stamp Duty

- FAQ's about Stamp Duty in Noida

Stamp Duty and Registration Fees in Noida

Homebuyers are required to pay a percentage of the property or asset's value as a stamp duty to complete registration. In addition, they have to pay a registration charge for the completion of paperwork in Noida, which is 1% of the property or asset’s value.

Stamp Duty and Plot Registration Charges in Noida

The table below shows the stamp duty registration charges in Noida for both males and females.

| Property Registered in the Name Of | Stamp Duty | Registration Fees |

| Male | 7% | 1% |

| Female | 6% | 1% |

| Joint (Male + Female) | 6.5% | 1% |

| Joint (Female + Female) | 6% | 1% |

| Joint (Male + Male) | 7% | 1% |

Source: Integrated Grievance Redressal System UP (IGRSUP)

NOTE: The 1% reduction in stamp duty offered for females in Noida is applicable only up to ₹10 lakhs of the property’s total value.

How to Calculate Stamp Duty in Noida?

A lot of factors are considered while calculating the stamp duty on property. This involves

- The Property’s Total Market Value: If the property’s market value is high, you’ll be paying greater stamp duty and in case the total value is low, you will pay lesser stamp duty. If you have the agreement value as well as the market value, whichever is higher among the two will be charged.

- Gender of the Owner: Women in India receive a discount on stamp duty if the property is registered in their name.

- The Owner’s Age: All state governments, including Uttar Pradesh, have subsidised stamp duty for senior citizens. Therefore, the owner’s age is a major factor in calculating the stamp duty.

- Purpose/Objective: In comparison to residential buildings, commercial buildings have higher stamp duty. This is because commercial properties have greater floor space, security features and amenities.

- Location: If your property is situated in an upscale neighbourhood or municipality, the stamp duty will be higher. However, if the property comes under Panchayat limits or on the outskirts of the city, the stamp duty will be less.

- Amenities: The government charges an extra fee on registration for every additional amenity on your property. Noida’s government has listed over 20 amenities for which one requires paying an additional fee. Some of these amenities include a swimming pool, gym, lifts, sports area, club, community hall, etc.

Usually, stamp duty officials use Stamp Duty Ready Reckoner for fixing the property value. The Stamp Duty Ready Reckoner is issued by the state government on the 1st o January every year.

Stamp Duty Calculator in Noida

You can calculate stamp duty in Noida using an online calculator or by choosing the manual method. The online calculator for stamp duty value of property requires you to enter:

- The property’s basic information

- and the total property value

Hit enter or click on the Calculate button to receive an answer within seconds.

Let’s discuss the manual method for stamp duty charge calculation with an example.

Example: Rohan and Preeti have bought a property worth ₹50 lacs adjacent to each other. Calculate the stamp duty and registration fees they will pay.

Stamp Duty payable by Rohan

= ₹50,00,000 x 7÷100

= ₹3,50,000

Registration Charge

= ₹50,00,000 x 1÷100

= ₹50,000

Thus, the property’s total cost is

= ₹50,00,000 + ₹3,50,000 + ₹50,000

= ₹54,00,000

Stamp duty payable by Preeti

= ₹50,00,000 x 7÷100

= ₹3,50,000

As a woman, Preeti gets a rebate of ₹10,000 on the total stamp duty charge.

Registration Charge

= 50,00,000 x 1÷100

= ₹50,000

Hence, the total cost of the property

= ₹50,00,000 + ₹3,40,000 + ₹50,000

= ₹53,90,000

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

Gift Deed Stamp Duty in Noida

As per Section 122 of the Transfer of Property Act, 1882, a gift is the transfer of existing property (whether movable or immovable) made voluntarily by the donor (gift giver) to the donee (recipient). It is accepted by or on behalf of the donee.

The registration fee for a Gift Deed in Noida is 2% of such value or consideration, whichever is greater. This fee is calculated to determine the stamp duty chargeable on the legal document. The minimum registration charge on a gift is ₹100, and the maximum registration on a gift is ₹20,000. The stamp duty and transfer duty is 7% of the property’s value if the donee is a man and 6% if the donee is a woman.

Flat Registration Charges in Noida

According to Noida Authority’s notification, flat stamp duty registration calculation will now be done on the basis of carpet area. This has come off as a relief for homebuyers and reduced the stamp duty burden on homebuyers.

Previously, this calculation was done based on the super built-up area. As a result, there was an increase in the flat’s purchase value for the buyer. With the latest notification, however, homebuyers have experienced a thaw in their worries.

How to Pay Stamp Duty Online in Noida?

To pay stamp duty online in Noida, you need to follow the below-mentioned steps:

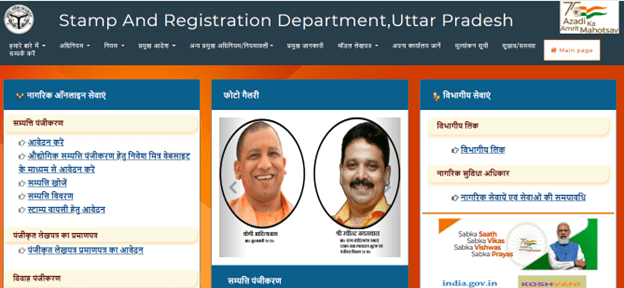

Step 1: Go to the official Stamp and Registration Department UP.

Step 2: When you enter the portal, it will open in Hindi. Do not worry when that happens. Simply click on the ‘आवेदन करें’ option and click on अंग्रेजी on the right-hand corner of the new page that opens.

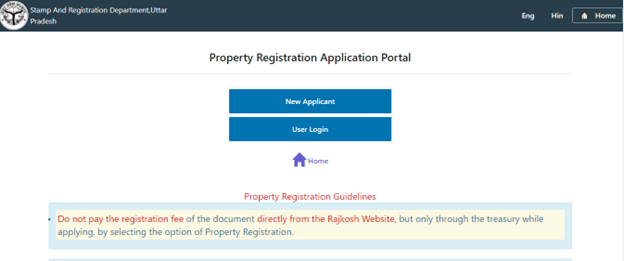

Step 3: Once the page appears in English, click on “New Applicant” to register. If you are already a member and have paid stump duty online before, just click on “User Login.

Step 4: After logging in, enter all the essential details of the property, the seller, and the buyer, along with the details of the witness. As soon as you submit these details, the system will automatically calculate your stamp duty and property registration charges in Noida.

Step 5: Make the payment using your preferred payment mode. Once done, you will receive a receipt number. Save this number for future purposes, and then proceed to schedule an appointment at the Sub Registrar’s office.

Paying Inadequate or Less Stamp Duty

Legally, it is not right to pay less or inadequate stamp duty on your property or asset. The law mandates that you have the correct stamp duty and house registration charges for successful registration.

To avoid paying higher stamp duty or Noida land registration fees, a lot of people undervalue their property and quote a lower value of their property. This is an illegal activity which can result in paying a hefty penalty when caught. So, whether you are a first time home/property owner or a commercial builder, make sure you do not take this step.

Final Thoughts

Purchasing or selling a property is a big decision. It is thus essential that you give a thorough look at the stamp duty and registration charges before making the final move. Doing so will save you considerable time as well as costs.

We have covered stamp duty registration charges of other cities too. You can visit our blog section to find out more about that. In case of questions and concerns, check out the FAQs below.

FAQ's about Stamp Duty in Noida

Q1. What are the stamp duty rates in Noida?

The stamp duty rates differ for men and women in Noida. For men, it is 7%, and for women, it is 7% (minus ₹10,000). If the property is owned jointly by a man and a woman, the stamp duty rate is 7% (minus ₹10,000).

Q2. How are registry charges calculated in Noida?

Registry charges are calculated in Noida using the manual calculation procedure or through an online stamp duty calculator. The latter only requires you to enter basic property details, and you can receive the result within seconds.

Q3. What is the circle rate of Noida?

The circle rate per Square Metre differs for all the sectors in Noida. It ranges between ₹32,000 and ₹55,000, depending on the sector the property is located.

Q4. Is there any house tax in Noida?

Yes. In Noida, property or house tax is determined based on the annual assessed property value and the location of the property.

Q5. How are flat registration charges in Noida calculated?

Flat registration charges in Noida are determined based on the flat’s carpet area. It was previously determined on the basis of the super built-up area.