Buying a home in Kerala is a dream of numerous people. The state is rich in natural beauty. Moreover, it is superior because of its educational and medical services. If you wish to invest in real estate in Kerala, you will have to pay a few additional costs. The property's value includes stamp duty charges and land registration rates.

According to the Indian Stamp Act of 1899, stamp duty is a fee that must be paid to the government on particular documents. Additionally, under the Registration Act of 1908, all documents relating to the sale of land or immovable property must be certified. This article is about stamp duty in Kerala, property registration charges and rates in Kerala, and much more.

Table of contents

- Stamp Duty and Plot Registration Charges in Kerala

- How to Calculate Registration Charges and Stamp Duty in Kerala?

- House Registration Charges in Kerala

- Gift Deed Stamp Duty in Kerala

- Factors Affecting the Stamp Duty in Kerala

- Stamp Duty Tax Benefits in Kerala

- Documents Required for Property Registration in Kerala

- How to Pay Stamp Duty in Kerala?

- FAQ's about Stamp Duty in Kerala

Stamp Duty and Plot Registration Charges in Kerala

Kerala stamp duty on property has been imposed on the contemplation value, or the value of a purchase agreement as stated on the sale deed. Kerala's registration agency determines a land's value. In contrast to other Indian states, Kerala imposes a registration fee of roughly 2% of the property value.

When you purchase a flat, it is mandatory to do registration. Moreover, you must pay stamp duty as well, which is a tax on the purchase. It is recorded on your real estate paperwork during the transfer of your home.

| Category | Stamp duty charges | Registration rates |

| Female | 8% | 2% |

| Male | 8% | 2% |

| Both (male + female) | 8% | 2% |

| Both Female’s | 8% | 2% |

| Both Male’s | 8% | 2% |

How to Calculate Registration Charges and Stamp Duty in Kerala?

A stamp duty calculator, as the name implies, is a calculator that is used to compute the stamp duty or tax charged on a house upon registry in various states and cities. It will assist you to find out how much you'll have to pay for the plot you're buying.

If the user faces difficulty in calculating Kerala land registration fees, they can use advanced tools such as a stamp duty calculator to check the rates.

However, this tool is an open source and can easily be found on several websites. You can also log in via your registered mobile number. Let’s learn how to calculate registration rates.

For example: ₹ 9 lakhs (stamp duty) + ₹60,000 (registration charge) = ₹ 4.8 lakhs.

House Registration Charges in Kerala

In Kerala, stamp duties are imposed on the contribution value. Additionally, the stamp duty value of a property transaction is stated on the sales contract. Kerala's registration agency determines a land's value. In contrast to other Indian states, Kerala imposes a registration fee of roughly 2% of the property value.

Gift Deed Stamp Duty in Kerala

A gift deed binds a document or keeps a record that demonstrates the donor of a property.

The following conditions need to be met for a gift deed to be legally valid:

- When a contributor creates a gift deed in the name of a third-party, they must understand the ramifications of the contract before making such settlements.

- If the giver holds legal approval of the property, then only the gift deed will be issued.

- A gift can be made of either mobile or immobile property. However, the only immobile property requires the production of a gift deed.

- According to the law, as per the Indian Contracts Act, made in 1872, minor categories don’t have the authority to embrace the contract.

- Although a gift deed is also another kind of contract. If a minor wants to enter into the contract, then with the help of his/her guardian name, they can get the contract.

- The concept of 'free consent,' means that no contract will be legitimate. It includes statements made under pressure, compulsion, or impropriety, that influence the drafting of a gift deed under the Indian Contracts Act.

- Whenever a gift deed is signed in the name of a decedent, they must acknowledge the gift in the participant's life; otherwise, the court will not recognise it.

- Any agreement that comprises between two companies, must agree to the same legitimate and recognized it. As a result, donor approval is a vital part of the gift deed formation process.

In 2011, Kerala's government passed the Registration Act. However, for land transactions, the stamp duty fee cannot exceed ₹1,000. The maximum cost of registration is ₹25,000 among the families.

Factors Affecting the Stamp Duty in Kerala

As we have learned, stamp duty is calculated based on the price of the house. However, there are also a few other factors that influence such fees, including:

- Buyer's age: Kerala does not currently give any discounts to senior citizens; however, the government may reduce fees for elderly citizens in the future.

- Utilisation of property: Stamp duty and registration fees may differ depending on whether the property is used for business or residential purposes. Charges for commercial space are typically greater.

- Land location: Stamp duty may differ depending on the region of the plot registration charges in Kerala.

Stamp Duty Tax Benefits in Kerala

Tax benefits on stamp duty provide various merits under section 80C. For example, a new house purchaser can request stamp registration fees with a discount of up to 1.5 lakh. The section 80C of the Income Tax Act allows for a deduction under this section. Besides, discounts are available only for new properties. Moreover, it cannot be claimed on housing units, commercial properties, or resale estates.

Documents Required for Property Registration in Kerala

The list of documents is mentioned below, which are needed for flat registration charges in Kerala:

- Sale deed

- Assessment of MC or mutation

- Ration Card/Voter ID/Driving Licence

- Evaluation of MC or mutations

- Identify proof like Aadhaar card/PAN card

- ID of two witnesses as proof

- Planning and descriptions of the map

- An image of the estate land

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Goa | Stamp Duty in Goa |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Jammu & Kashmir | Stamp Duty in Jammu & Kashmir |

| Noida | Stamp Duty in Noida |

| Andhra Pradesh | Stamp Duty in Andhra Pradesh |

| Mumbai | Stamp Duty in Mumbai |

| Bangalore | Stamp Duty in Bangalore |

| Assam | Stamp Duty in Assam |

| Jharkhand | Stamp Duty in Jharkhand |

How to Pay Stamp Duty in Kerala?

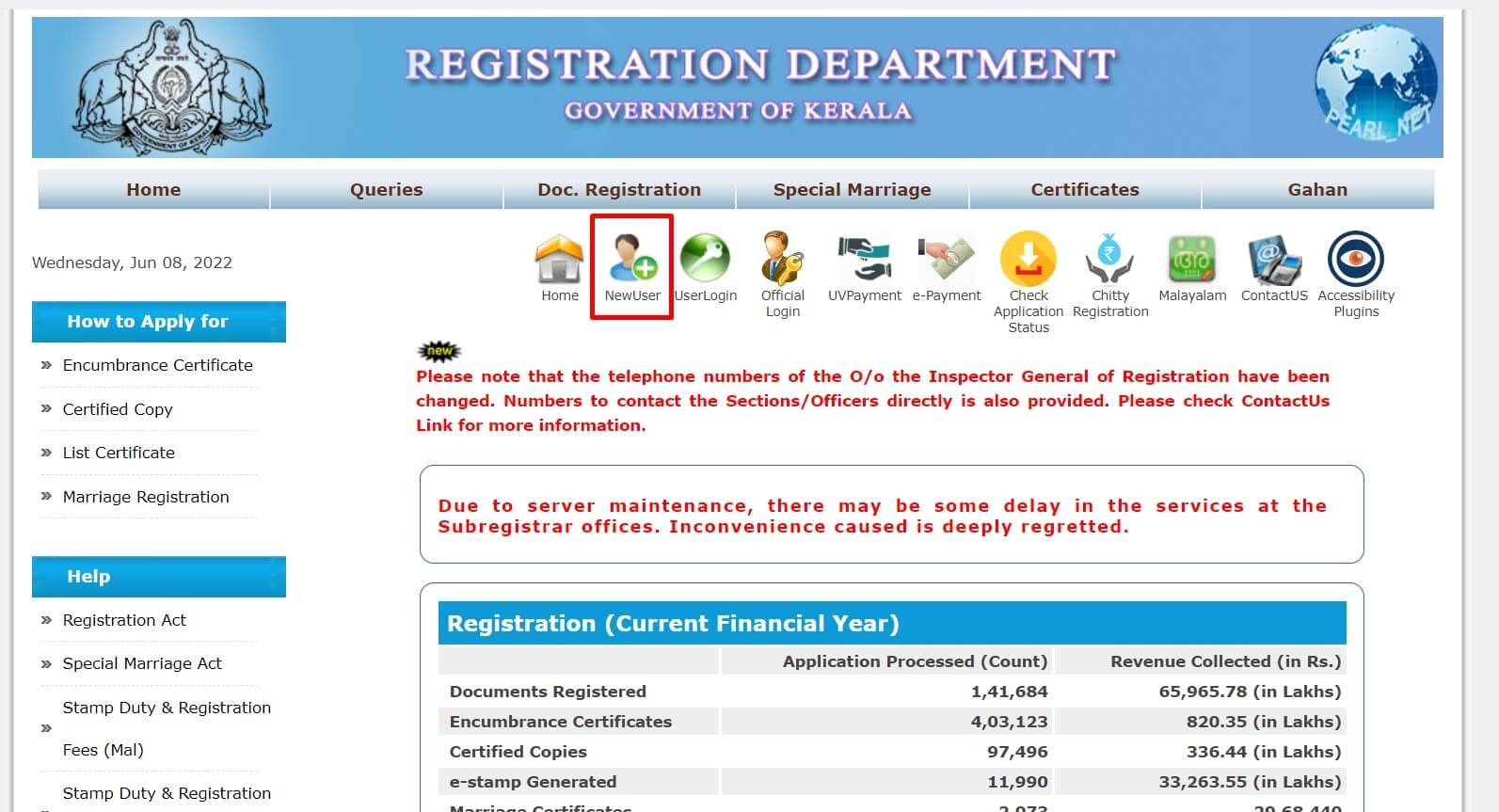

The registration of the property can be done online as well as offline. For offline mode, the purchaser needs to visit the administrator's office to perform the formalities. On the other hand, online registration can be made by following some steps as follows:

1. Visit the official website of the Registration Department, Kerala - keralaregistration[dot]gov[dot]in

2. Click on the 'New user' option and fill in the details as required.

3. You will receive an OTP on your registered mobile number and email id.

4. Once OTP is verified, then a successful text will appear on your screen.

5. After completing the registration details, log in.

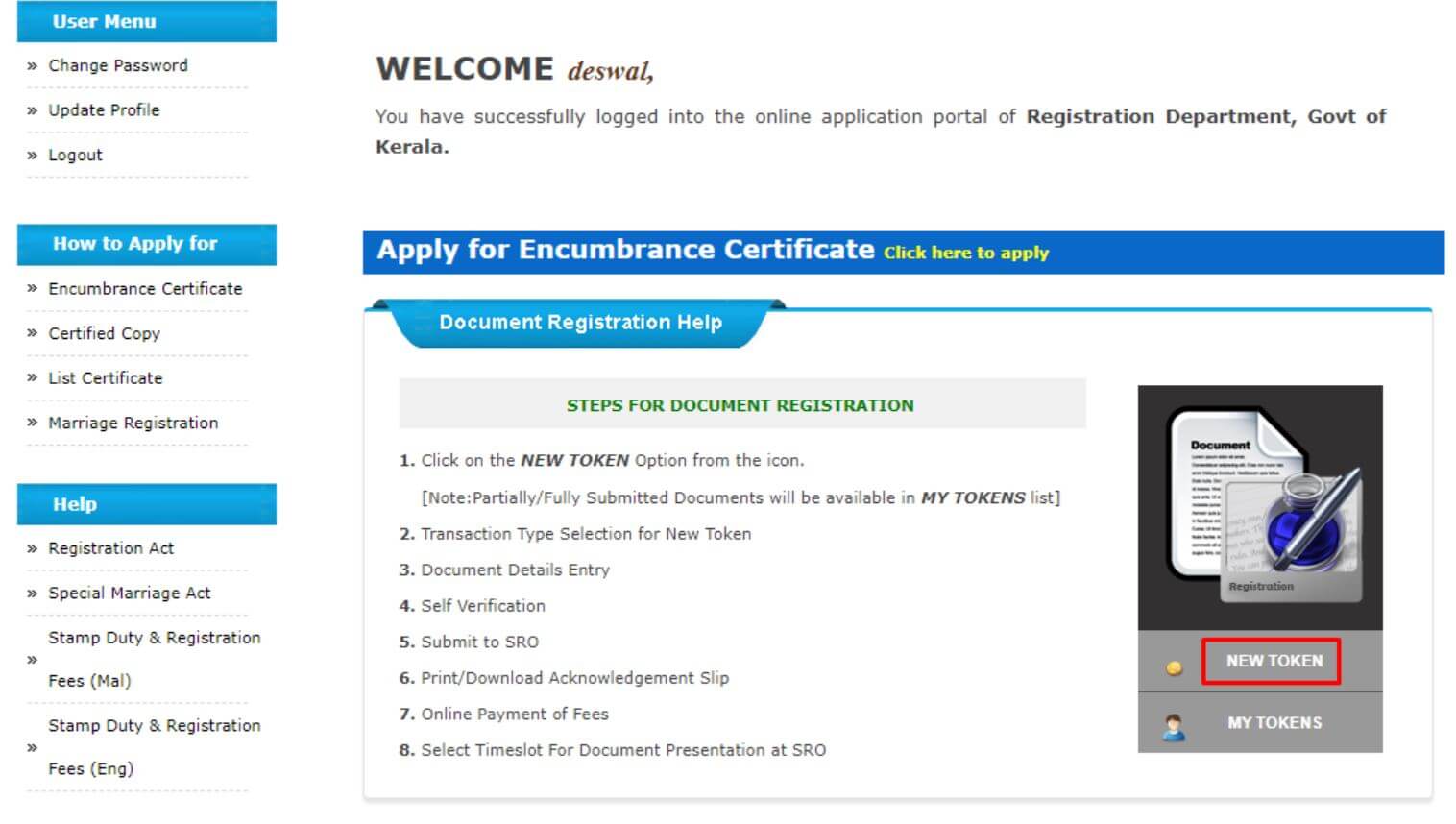

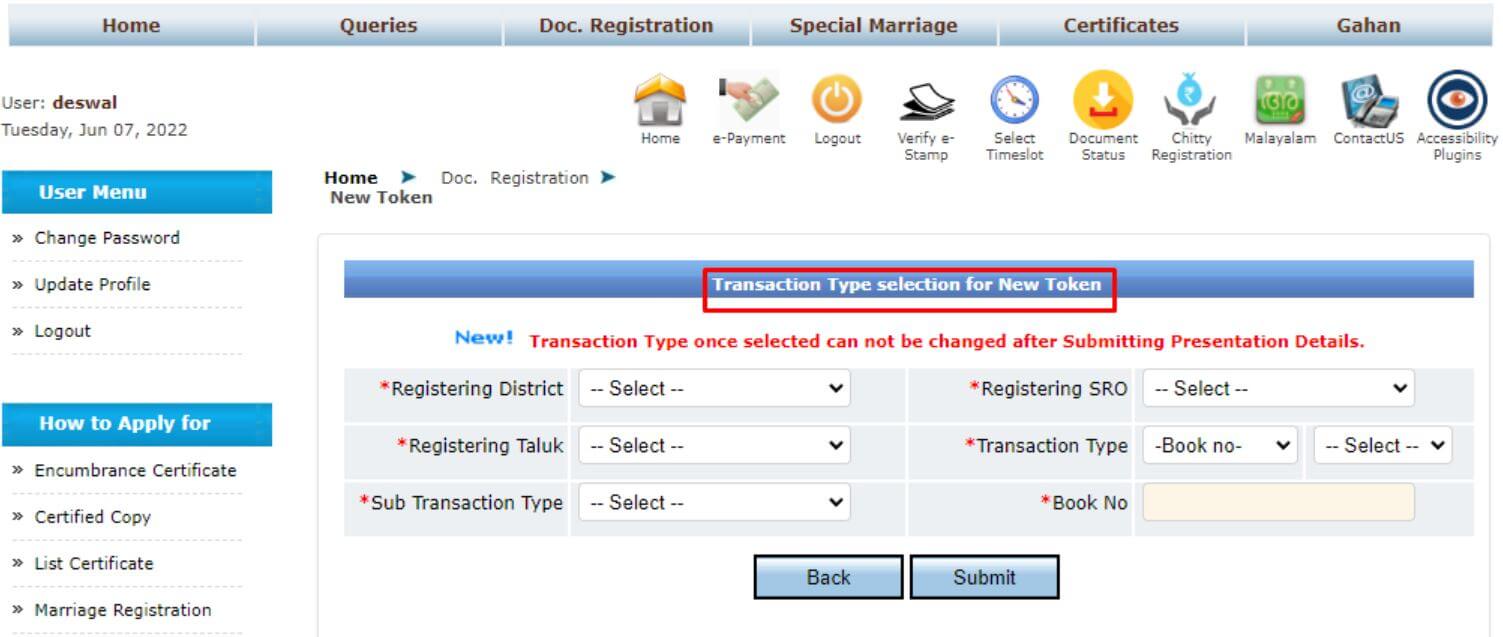

6. Click on the 'New token' under the document registration help.

7. Select the transaction type by choosing 'New Token'. If you wish to make a payment of more than 1 lakh, then select the payment form for e-stamp.

8. Fill in the details for Claimant & Executants, and real estate building data.

9. After filling out the credentials for self-verification and applying for the e-stamp method, submit it to the SRO (Sub-Registrar’s Office).

10. Click on the 'Pay' option under online payment to continue the payment process.

11. To access the e-stamp, click on 'view details.' A serial number and GRN will be printed on the e-stamp that is generated.

12. Choose the time slot for the verification of the documents at the SRO.

Note: On that day and time, reach the office to submit the documents.

To Sum Up

We can conclude from the foregoing explanation that if you or anybody else acquires a plot or house, they will be required to pay stamp duty and a registration fee.

The stamp duty, on the other hand, is useful in validating the registration of your land in your name. Additionally, it gives your property paperwork the validity of being legalised. If you ever have a disagreement with the buyer or anybody else involved in the sale of the house, the stamp duty on your asset paper will come in handy.

You will not be recognised as the legal owner of the property until you pay the stamp duty in Kerala.

FAQ's about Stamp Duty in Kerala

Q1. How much is the stamp duty in Kerala?

Kerala stamp duty on property, payment of stamp duty, and registration rates in Kerala are compulsory. As per the Indian Stamp Duty Act and Registration Act, presently, the property value of the stamp duty is 8%.

Q2. What is the stamp duty for gift deeds in Kerala?

Currently, the stamp duty fees for gifts, transactions, and release deeds are ₹1000.

Q3. What is the validity of stamp paper in Kerala?

The Court decided to utilise stamp paper that was bought six months ago. Now, it is being used in a contract, not as an obstacle. In Kerala, the stamp paper has no expiry date and can be utilized for document implementation.

Q4. How much is the registration fee for house in Kerala?

In Kerala, 2% is the registration fee. The registration department determines the value of the residence.