Planning to register a property in Maharashtra? If it is a thumbs up, then do the needful by registering your deed of sale by visiting the government office. This can be done after you have paid the registration and stamp charges. The whole process of registration is overlooked by the Controller of Stamps and Inspector General of Registration. In other words, the IGRMaharashtra. The government unit is responsible for collecting the revenue through the stamp duty along with certain other charges. These charges are levied on the registered documents like mortgage, license registration, etc.

What is IGR Maharashtra?

The IGRMaharashtra department has a better grasp of technology and is digitally advanced as compared to different states. One of the most important responsibilities of the IGR and Controller of Stamps is to perform registration of the documents according to the guidelines of the Registration Act and also collect the revenue generated. This department depends on modern technology in order to aid the citizens & offer their services efficiently. It registers and gathers the documents by using well-laid procedures and does it within the stipulated time with transparency. The citizens or users can check out the official website of IGR Maharashtra to know about the total number of documents registered daily, per month & even for the whole year. The accessibility of the website is in both Marathi and English languages. Well, to check the website follow this link www.igrmaharashtra.gov.in.

Services Offered by the IGR Maharashtra Portal

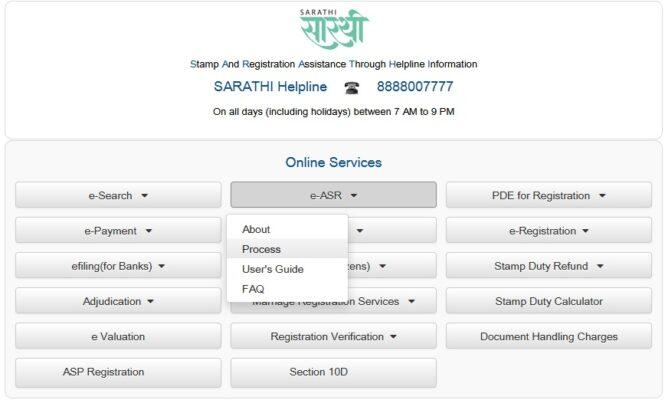

The user can avail of the following services from the activities section featured in the Homepage of the IGR Maharashtra.

- Document Registration

- Stamp Duty Collection

- Copy and Search

- Filing Notices

- Property Valuation

- Marriage Registration

- Deemed Conveyance

- Will Registration

How to Valuate Property Through IGR Maharashtra?

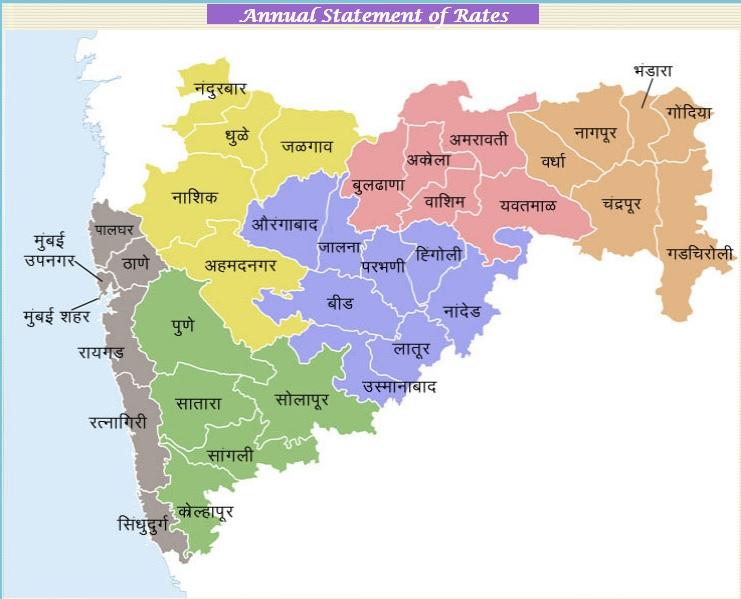

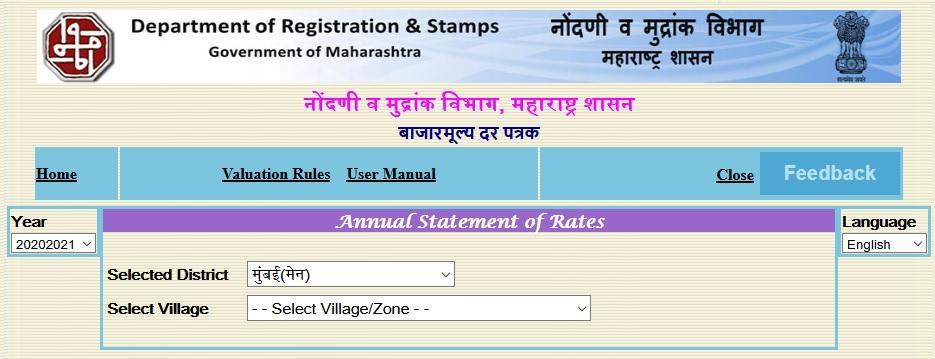

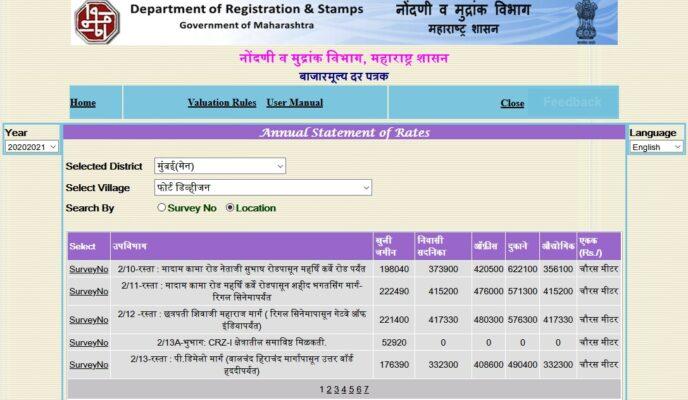

The citizens can find the amount of stamp duty for the purpose of registration through the platform of IGRS Maharashtra. But before you evaluate the stamp charges you need to find out the real market valuation of your property. For this purpose, this department is supposed to prepare an Annual Statement of Rates (ASR) which are commonly known as the ready reckoner rates. Well, the IGRMaharashtra valuation is evaluated every year. You can access these rates from the office of the sub-registrar or even online.

You just need to follow these simple steps for land valuation in Maharashtra:

Step 1: First and foremost, visit the official website of IGRS Maharashtra. Find the option ‘Online Services’ and then select e-ASR.

Step 2: When you click on e-ASR, the page gets redirected to a new webpage where you will see a map displayed. You need to click on the area on the map where the property is situated.

Step 3: After the previous step the screen will display the searched ready reckoner rates.

Property Registration Details Through IGR Maharashtra

It is mandatory in India to register all properties according to the Registration Act of 1908. Transfer of the immovable assets requires recording for obtaining the property rights on the date of the execution of the deed. Department Registration and Stamp or the IGR Maharashtra gov has the responsibility of registering properties in Maharashtra state.

Section 25 of Maharashtra Registration Act

Section 25 of the Maharashtra Registration Act says that to register a deed of property the expected document has to be furnished within a period of four months from the exact date of the registration of property. This document has to be submitted to the Registrar officer. In a scenario of preceding violation in such a case of property registration, a fine amounting to 10 times of property value would be remitted from the party.

Advantages of Property Registration

You can avail of the following benefits by registering a property deed:

- It can be used to provide an assurance of the authenticity of the deed.

- It helps in avoiding evidence tampering, fraud, and transfer of the title to the owner.

- It helps in determining if the said property has been sold or not.

Documents Required

If you want to register any property in Maharashtra, the following documents will have to be furnished along with the application:

- Aadhaar card

- Passport size photographs of seller & buyer

- Verified copy of the original sale deed

- Copy of Municipal tax bill

- Certificate of the construction completion

- Copy of latest property register card

IGR Maharashtra document search can aid you further if you have any doubts regarding the same.

Procedure For Registering a Property

These are the steps to follow for e registration in Maharashtra:

- Visit the office of sub-registrar

- Then, collect the application form

- Complete the application form by filling in the required details

- Your application will pass through the verification process

- Your payment will be processed

- You will be issued a registration number

- In the end, you will receive an acknowledgement receipt

You can explore the Maharashtra IGR website to learn more about property details.

What are Maharashtra Ready Reckoner Rates?

The prices set by the government are termed as ready reckoner rates. This price is the threshold below which the properties of an area are not allowed to be registered in the records of the government. The rates are fixed beforehand but keep altering according to time. These rates are also known as circle rate, guidance value, etc. But it is popularly termed as RR rates ( ready reckoner rate) in Maharashtra.

Stamp Duty Refund in IGRMaharashtra

The Maharashtra Stamp Act of 1958 allows a refund on the purchase of the stamps if the utilization of it is called off or the stamp has been damaged before the usage. The price is refunded even if the purchaser overpaid for it.

An application needs to be given to the stamp collector from where the stamps were purchased to apply for a refund. You also need to furnish the following documents in the described format and time. The below-mentioned documents are necessary for stamp duty Maharashtra:

- The document which has the original stamp

- If you purchase the stamp physically then the affidavit of the person is required

- Online information filling token

- A verified copy of the power of attorney (Only if the refund is applied by an authorized person)

Following documents are required if you purchase stamps by franking:

- Excerpt of the stamp sales register or certificate of stamp sale

- Stamp dealer invoice

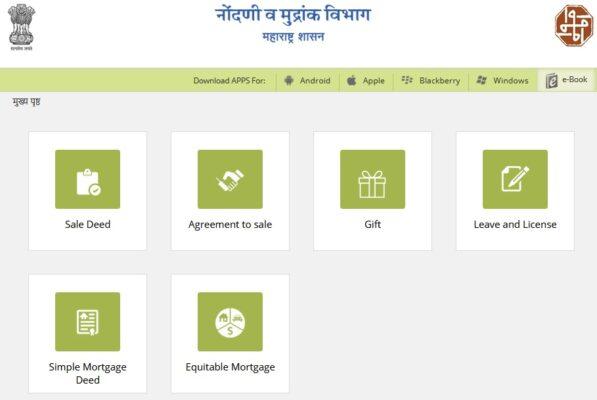

Calculate Stamp Duty Through IGR Maharashtra - Stamp Duty Calculator

Any buyer who wishes to buy a property can calculate the stamp duty Maharashtra rates through the official portal of IGR Maharashtra. Just follow these simple steps:

Step 1: You need to visit the website IGR Maharashtra. Find the option ‘Online Service’ and select ‘Stamp Duty Calculator’.

Step 2: A new webpage will open from where you will choose the document type which you are about to register.

Step 3: You now need to choose ‘Sale deed’ which would aid you in registering the property papers. After this, you can choose jurisdiction from: Gram Panchayat, Municipal Council, Municipal Corporation and Cantonment.

Step 4: You will have to enter the market value and the consideration value to calculate the amount of stamp duty. It will be displayed on your screen.

Stamp Duty and Registration Charges in Maharashtra 2021

- Stamp Duty in Mumbai- 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%)

- Stamp Duty and Registration Charges in Thane - 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%)

- IGR Maharashtra Pune - 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%)

- Pimpri-Chinchwad - 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%)

- Nagpur - 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%)

How to Pay Stamp Duty and Registration Fees?

The payment of stamp duty and registration fees can be done in both online and offline modes. The payment in the offline mode can be made by visiting the office of the sub-registrar of IGR Maharashtra. And the online payment can be done on the website of the Government Receipt Accounting System (GRAS). It is mandatory to pay the charges of the stamp duty in Maharashtra.

Follow these simple set of instructions to make an online payment:

Step 1: Visit the website gras.mahakosh.gov.in.

Step 2: Go on the main page and select the option ‘Pay Without Registration’.

Step 3: Click on the option ‘Citizen’ and select the option ‘Make Payment to Register Your Document’.

Step 4: You will have to select whether the payment you are making is stamp duty or only registration fee or both.

Step 5: All details about the parties involved in the registration have to be furnished. Details like the location of the property, property value, etc. have to be chosen from the drop-down menu. If the drop-down menu is not given, then you would have to fill in the information manually.

Step 6: Choose the payment mode and finish the process. Make sure to save the online receipt generated related to the payment.

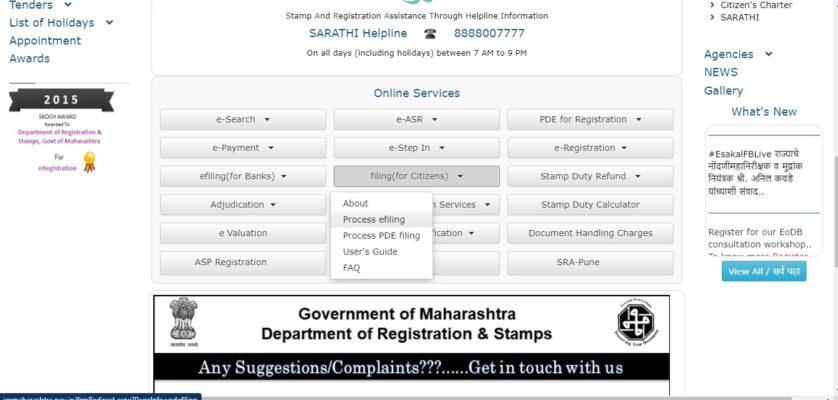

How to File the Notice of Intimation?

You no longer need to visit the office of sub registrar for applying the ‘Notice of Intimation’ as the IGR Maharashtra has granted permission to file this notice online. This service of filing a notice for a mortgage or loan deposit title deed is available throughout Maharashtra.

To file the Notice of Intimation online you need to visit the website of IGR Maharashtra. There under the option ‘online services,’ click on the ‘filing (for citizens)’ tab and then select the ‘process e-filing' option.

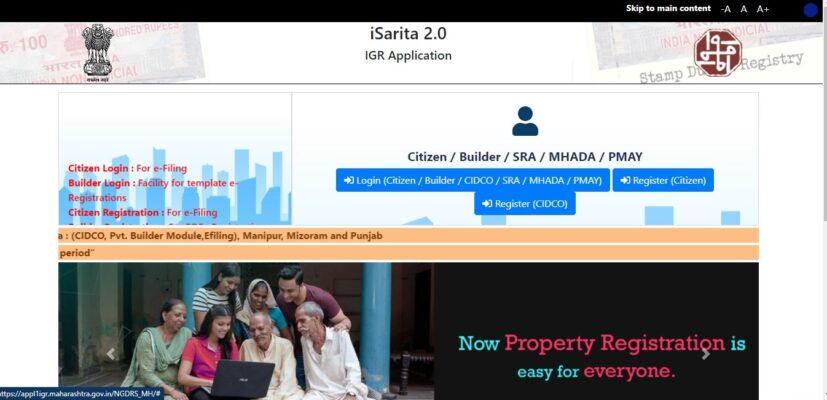

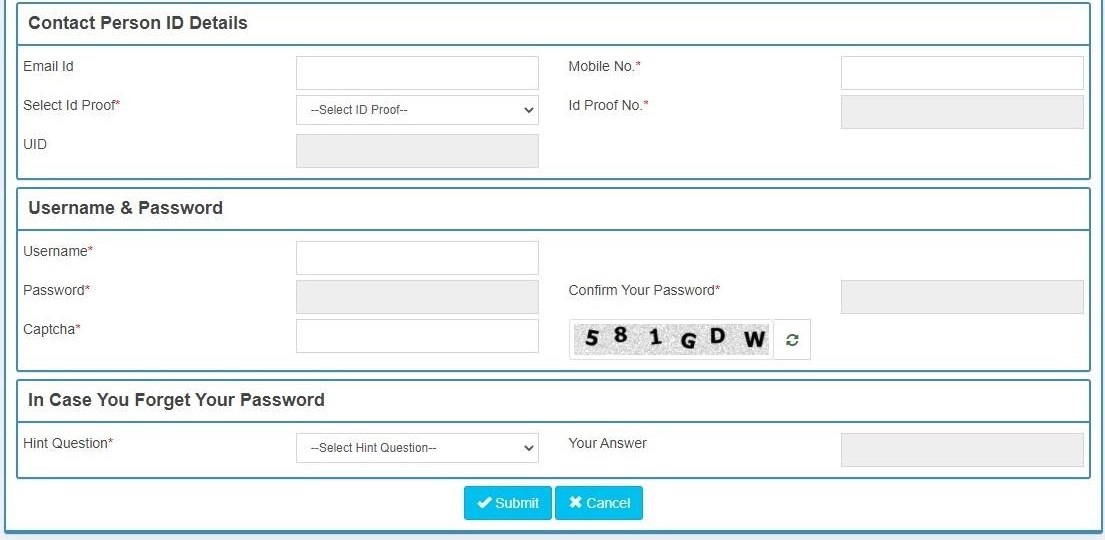

After this, you will be redirected to another page appl1igr.maharashtra.gov.in/NGDRS_MH/ from which you have to select the option ‘Register Citizen’.

Next, you will be redirected to a new tab in which you need to enter certain details like the authorized person name, Identification details of the contact person, contact person address, password, and username. A hint question would emerge if you have forgotten the password. You just need to submit then.

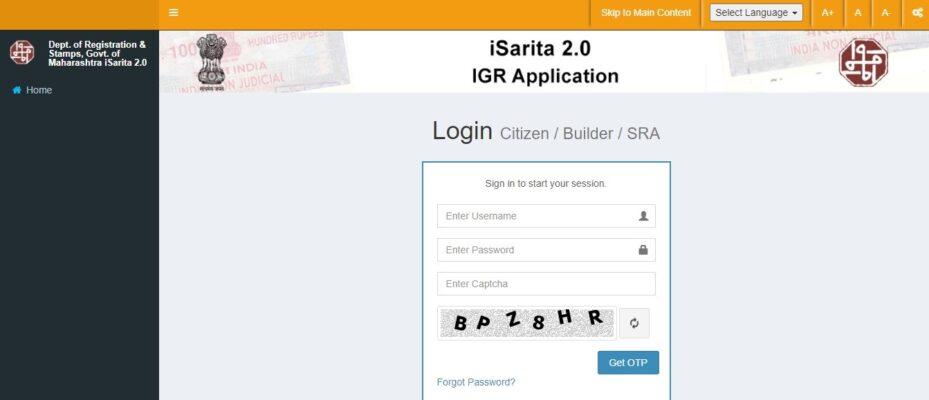

Once you are done with the registration, you need to log in through the Login tab. You will get this tab on the homepage of the official portal. Fill in your username, captcha, password. You will receive an OTP, just log in after that.

On the next page, you need to select the option E-Filing and fill in the necessary details. You will be able to access this page in both English and Marathi languages. There are delays in the services of e-Filing on the website of IGR Maharashtra because of some technical issues related to eKYC SMS services. So, the citizens are advised to file the NOI (Notice of Intimation) well before the notice period.

Index 1, 2, 3, and 4 in IGR Maharashtra

There are four types of indices prepared by IGR Maharashtra depending on the type of documents that are being registered:

- Index 1 and 2 are prepared for immovable properties

- Index 1 is prepared based on the initial of the parties’ name in the said document

- Index 2 is made based on the village name mentioned in the document

- Index 3 is made for Wills

- Index 4 is prepared for the movable properties

How to Search Property Registration Documents?

You can easily search the details of the property registration by following a simple set of instructions on the official website of IGR Maharashtra:

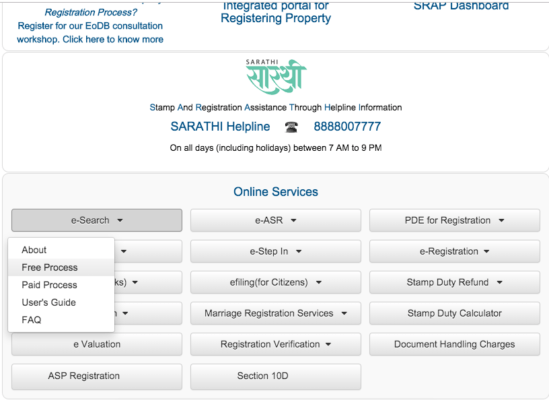

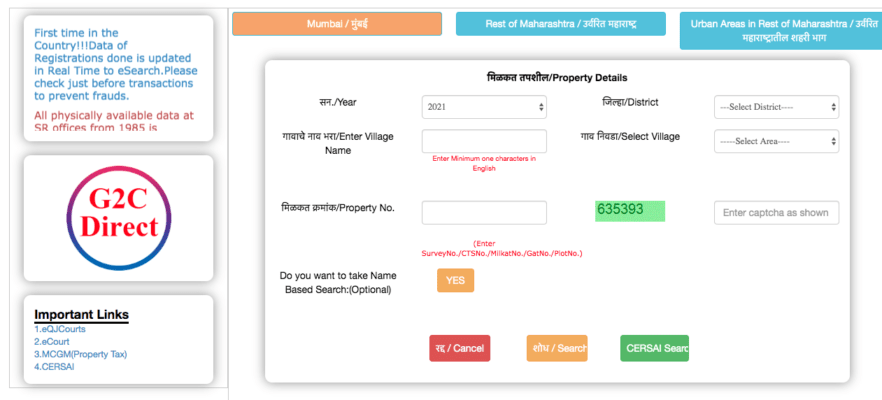

Step 1: Open IGR Maharashtra. Click on the option ‘e-Search’ and then choose ‘Free Process’.

Step 2: After the previous step you will be redirected to a new page. On this page, you will have to select the property location and input the details of the data required. The details required would be district, registration year, village, survey number, property number and more.

Step 3: Select ‘Search’ and your results would appear on your screen.

What is the Importance of Index II in IGR Maharashtra?

The Registration Department issues the Index II extract. It is an official record of a transaction or document that is registered in the data of the registering authority. This confirms that the said transaction has been successfully completed.

The following information is provided by Index II:

- The type of document: Agreement for Sale, Sale Deed, Gift Deed, Exchange of Property, Mortgage Deed, etc.

- The consideration amount of the said property

- Details of the said property like municipal jurisdiction, sub-zone, and zone with a landmark, survey number, CTS number, hissa number, floor number, gat number, etc.

- Built-up area of the said property described in square metres

- The nature of property like residential units, land, industrial units, and commercial units.

- Execution date

- Serial number of registrations

- Name of parties included - vendor - vendee/ transferor - transferee/ assignor - assignee etc.

- Registration fee

- Amount of stamp duty

MoDT Registration Process in IGR Maharashtra

The people who are seeking a home loan must be aware of an undertaking that they have to sign known as the Memorandum of Deposit of Title Deed (MoDT). This undertaking has to be furnished by the borrower which states that he has positively deposited the title deed and other documents related to the property with the lender. You should be aware that the charges for stamp duty are 0.3% on the loan amount which is levied by the government. The undertaking is important since it could be used to recover the debts in the scenario of a borrower not making the payments or defaulting. It is compulsory for the borrowers to get the MoDT registered in Maharashtra.

IGR Maharashtra Online Search

IGR Maharashtra have framed a meticulous document on the data policy to implement a Data Management Framework, which would commence a data-driven transformation program. The data on the IGR Maharashtra can be accessed at

http://igrmaharashtra.gov.in/SB_CITIZENAREA/DATA/DataPolicy/GR_DataPolicy_Detailed.pdf.

Under the IGR Maharashtra online services, the portal offers a catalogue of 60 applications that provides a diverse range of services, such as property registration detail in Maharashtra. Some IGR Maharashtra applications are interlinked with other government departments like UIDAI, Income Tax, Land Records, etc., to share the data during registration and assist in online document searches.

IGR Maharashtra: E-Search Free Service

The user can avail of a free-of-cost document search process through the e-search Tab featured under the online services option. On selecting the ‘1.9’ IGR Maharashtra from the official service portal of IGR Maharashtra, the user will be redirected to the https://freesearchigrservice.maharashtra.gov.in page.

Where they can perform the IGR Maharashtra Property search option. Select fields such as Year, District, and Village in the property details search. The user must also mention the Property number Village Name and Captcha. After successfully mentioning the details, the user must click on the ‘Search’ tab.

It is to be noted that this facility allows the user to choose from three location categories that are

- Mumbai

- Rest of Maharashtra

- Urban Areas in the Rest of Maharashtra

To successfully facilitate a document search, the user is required to select the field features such as

- Registration Type

- District

- SRO

- Year

- Document Type

- Captcha

And conclude the process by clicking on the ‘search’ button.

It is advised that one must ensure data availability from the list of information on the SROs before using the IGR Maharashtra online document search facility. They should also evaluate the time the information is available.

How to Obtain a Copy of Registered Office Online Via IGR Maharashtra

To implement the online document search through the IGR Maharashtra portal, the user must select the e-search tab and the paid process to access IGR Maharashtra. You’ll be redirected to eSearch.

STEP 1: The user is then required to select the district and enter the first three initials of their area. Click on the submit button.

STEP 2: The user is then required to mention details such as

- The area from the Drop Down Box

- CTS Number

- Survey Number

- Plot/Flat Number

- GAT Number

And click on the ‘search button’ to review the IGR Maharashtra online document search. The user must pay a fee to avail of this facility from the portal. One must employ e-payment options available on the online services Tab on the IGR Maharashtra main page. By clicking on the payment option, the user will be redirected to https://gras.mahakosh.gov.in/echallan/

Users must pay a fee of Rs 25 to avail of the e-search option. The user must submit a toll of Rs 300 every time they search for property details through the e-search option. The user will be issued a receipt against the payment done for the IGR search. It is to be noted that the citizen can pay the fee online for a physical search in the Sub-Registrar’s office.

Stamp Duty and Registration Fee Payment Via IGR Maharashtra

The IGR Maharashtra Stamp Duty payment can be made via two methods- online and offline. A citizen can employ the Government Receipt Accounting System (GRAS) featured on the IGR website to compute the amount of Stamp duty. One can also pay property registration charges through the portal by utilising the details on the IGR website.

STEP 1: Visit gras.mahakosh.gov.in/igr/frmIndex.php

STEP 2: The user can log in and proceed in case they have a username and password. If the user is a first-time user, they can initiate the process of creating an account. Fill in the required fields on the form to establish an account.

- One can also avail of the ‘Pay without Registration’ option to pay stamp duty and property registration charges.

STEP 3: The user must click on the ‘citizen’ option and select ‘Make Payment to Register your Document’. The user must then select from the three options available on the screen.

- Stamp Duty and Registration

- Stamp Duty Only

- Registration Fee only.

If the applicant selects the first option, they must simultaneously pay the IGR Maharashtra stamp duty and registration charges. IGR Maharashtra charges, you must fill in the fields mentioned in the form. The applicant must mention details such as the district's location, the IGR Maharashtra SHO office, the Name of the Payer, the Amount paid, PAN card, property details - address, market value and considerable amount. The user must select the bank, and charges, mention the captcha featured, and select ‘proceed’.

The applicant must fill out a similar form and pay the fees if they opt for the second and third options.

IGR Maharashtra Stamp Duty Amount

The IGR Maharashtra can compute the amount on the stamp duty through www.igrmaharashtra.gov.in valuation. It is important to maintain consistency while mentioning the property details in the valuation process so one can determine the accurate market value of the property. The IGR Maharashtra frames the Annual Statement of Rates (ASR), also called IGR Maharashtra reckoner rates.

The Maharashtra government increased the reckoner rates on April 1, 2022, which are to be accounted for while considering the IGR valuation. As per the new rates, the average prices of the properties in Mumbai have increased by 2.64%. Maharashtra has experienced an overall increase of 5%, and municipal corporations have also witnessed a hike of 8.80%.

Procedure to Evaluate the Land Records

The citizen who wants to examine the IGR Maharashtra land records must visit the following website. The citizen can check the 7/12 records, property card and more. The citizen can also access Form 8A and Form 6 on the website to find details on the land.

IGR Maharashtra: Index 1, 2, 3 and 4

The department of registration and stamps in Maharashtra has the following indices, which are with respect to the department of stamps and registration in Maharashtra.

- The Index 1 and Index 2 are prepared for Immovable property.

- Index 1 on the IGR are prepared concerning the initials of the party's name on the document.

- Index 2 on the IGR Maharashtra property download is prepared concerning the village name on the document.

- For the preparation of the will on the IGR Maharashtra, Index 3 is utilised.

- Index 4 is employed for movable property.

Online Search Index 2

The index two on the property document download is issued by the IGR Maharashtra department. The index is the official record of the document or transaction that is recorded by the registration authority and authenticated by the conclusion of the transaction.

The IGR Maharashtra Index 2 entails the following information:

- Type of Document: Sale and Gift Deed, Agreement for Sale, Transfer, Mortgage deed, and exchange of property, etc.

- Property’s consideration amount.

- The applicant must mention details of the property, such as the municipal jurisdiction, zone and sub-zone with landmark and property description, such as the GAT number, survey number, CST number, Hissa Number, and Floor number.

- The total built-up area of the property

- Nature of the property such as land, residential unit, commercial and industrial unit.

- Name of Parties: vendors, vendee, assignor, assignee.

- Stamp Duty Document

- Registration serial number

- Stamp duty amount

- Registration Fee

Property Registration details on iSarita 2.0

As per the new guidelines of property registration details which came into effect on September 23, 2021, a citizen can employ iSarita 2.0 to ensure document registration in SRO Haveli 21st and 23rd, Pune. Citizens inclined to register IGR through these offices can utilise PDE 2.0 and eStepin 2.0, as the older version of these applications is incompatible with iSarita 2.0.

Abhay Yojana: IGR Maharashtra

The citizen can also avail of the Abhay Yojana, also known as Amnesty scheme 2022. Users can click on the ‘Amnesty Scheme 2022’ online services option.

The user will be redirected to the following tab: https://appl1igr.maharashtra.gov.in/AbhayYojana/login.php. If the user has registered with the IGR Maharashtra, Abhay Yojana can log in to the portal by mentioning their

Username, password, and captcha to log in.

If the applicant is a first-time user, the applicant is required to select the ‘Click here for new registration tab. The applicant will be redirected to https://appl1igr.maharashtra.gov.in/AbhayYojana/register.php.

The applicant must select the user category as citizen and entity as an individual on the registration form. The user must then mention details such as the name, gender, state, address, Pin code etc. After successfully mentioning the details mentioned earlier, the user must submit the username, password, e-mail ID, and mobile number.

How to Pay Document Handling Charges Via IGR Maharashtra Portal?

The citizen using the services offered must pay handling charges on the portal. The user can navigate the ‘Document Handling Charges’ tab on the online service segment. The user can refer to the following link:

https://igrdhc.maharashtra.gov.in/dhc/

This service allows citizens to make payments to the Sub-registrar’s office online. It is to be noted that the applicant this service is exclusive for payments of document handling. It cannot be employed to make payments of stamp duty and registration charges. The tariff for document handling by the IGR Maharashtra is Rs 20 per page.

The applicant must select the fees payable per the services, such as registration, e-filing or for ASP. To facilitate the document handling payment process, the user must agree to the terms and conditions featured on the pop-up page and proceed.

The user may or may not opt to make the payment through Public Data Entry (PDE) number. The user must mention details such as district, article, SRO, document title, and mobile number in front of the appropriate fields. After successfully mentioning the details, the user must conclude the process by paying the fee online after submitting the form.

The user would be issued a receipt authenticating the transaction performed. The user can refer to the search PRN option and enter the transaction ID and bank reference number.

Latest Update Pertaining to IGR Maharashtra

- As per the sources, it has been hinted that the IGR Maharashtra will soon adopt the blockchain technology. This will promote transparency and efficiency in facilitating transactions and assist the department in maintaining records.

- Around 8,149 properties were registered in Mumbai in August. The state's revenue from property registration grew by 47% in August.

Dated 17 August 2021

The latest news on stamp duty in Maharashtra as of 17 August 2021 is that the IGR has probed approximately 27 SROs in Pune.

The IGR Maharashtra has imposed a ban on the registration of fragmented and small pieces of land. It says that it is in violation of the Maharashtra Prevention of Fragmentation and Consolidation of Holdings Act of 1947. According to the department of IGR Maharashtra, only the land size is 11 gunthas/ 11,000 Sq. Ft or more can be registered. So, when the news regarding the illegal registration of small lands surfaced, the department initiated probes against 27 sub-registrar’s offices in Pune. These illegal registrations are also prevalent in other parts of Maharashtra as well like Aurangabad and Nanded.

Apparently, it has been alleged that the SROs registered the lands of lesser areas by involving a few people who were not aware that they were committing fraud.

To avoid the crowding at the office of property registration, the government has made it compulsory for the property owners to book a slot through the IGRMaharashtra portal or at the office of the sub-registrar before they proceed for documentation. The owners can book up to 30 slots in each SRO for the purpose of property registration.

In a Nutshell

The entire process of property registration on the IGRMaharashtra platform would be completed. You will receive a certified copy of the registered document. It will be issued within a period of 45 days from the date of the application received.

Discover IGRS For Other States

| States | IGRS |

| Rajasthan | IGRS Rajasthan |

| Odisha | IGR Odisha |

| Telangana | IGRS Telangana |

| Andhra Pradesh | IGRS AP |

| Uttar Pradesh | IGRSUP |

Frequently Asked Questions (FAQs) About IGRMaharashtra

What is index 2 in property agreement?

Index 2 is a document which is issued by the Sub Registrar’s office. It entails the names of the purchasers and sellers of the property. These details are provided regarding the document which is registered.

What is the process of notice of intimation?

The notice for intimation must be filed within 30 days from the said date of the mortgage. The notice is applicable only in the case of a mortgage where the agreement has not been executed by the way of deposit of a title deed.

Where do I send notice of intimation?

Citizens can file the notice of intimation offline as well as online. Physically, the notice has to be filed with the sub-registrar’s office under whose jurisdiction the property is situated. You can also opt for e-filing for the online mode.

What will happen if notice of intimation is not sent?

If you do not file the notice of intimation, the non-registration of documents would beat the legitimacy of the mortgage and would cause legal injuries to the parties involved. If a person fails to file this notice within the authorized period, then he would be liable for punishment under section 89C of the said Act.

What is DHC in registration?

The Department of Registration and Stamps of Maharashtra has designed the Document handling Charges (DHC) portal. This portal would help the users to smooth out the process of making online payments for the charges which are collected by the Sub Registrar's office for handling documents. The charges are ₹20 per page.