It is now easy and convenient to register your property in Odisha through the online portal of IGR. The organization serves the purpose of cooperative decision-making that makes the flow of communication smooth among the citizens. Through the Inspector General of Registration (Odisha) Revenue and Disaster Management Department or IGR Odisha, it can be conducted on the IGR Odisha website. The public authority provides a people-friendly registration service that helps in maintaining and protecting the interests of the Odisha Government and its people.

What is IGR Odisha?

The IGR Odisha is a body mainly responsible for the following:

- Digitisation of cadastral maps, updating of land records

- Undertaking survey operations with the help of modern technologies

- Computerisation of revenue offices

- Inter-connectivity among revenue offices

- Prohibition of tribal land alienation

- Acquisition of private land for public purposes

- Distribution of ceiling surplus land

- Distribution of wasteland for homestead purposes

- Conduction of decennial census

- Administration of minor minerals

- Formulation of comprehensive rehabilitation and resettlement policies for displaced persons

- Regularisation of pre-1980 forest villages and encroached human habitations in forest areas, etc.

IGR stands for Inspector General of Registration and is operated by Revenue & Disaster Management Department.

Registration Act (Odisha Amendment), 2013

This Act provides all the information related to the method of registering the documents along with the information that one will need for legal rights and obligations that can affect the details of immovable property. Under this Act, immovable property includes building, plots, fisheries, lands, and lights.

Registration under Section 17 of the Registration (Odisha Amendment) Act - An Obligatory Registration

Section 17 of the Act governs a range of categories of the deed. For these deeds, registration is obligatory. The deeds that are related to the transactions of the immovable property are mandated to register under this section. Such transactions are mentioned below:

- Gifted instruments of the immovable property.

- Extinguished instruments or creating any right or title relating to the property of value that is over a hundred rupees.

- Property lease for any term that exceeds the term of twelve months or from a year to another.

Registration under Section 18 of the Registration (Odisha Amendment) Act - Optional Registration

Section 18 of the Act governs the deed of immovable property for which the registration is optional and is not mandatory. Below listed are a few of these deeds:

- Instruments that relate to the transfer of the property (it contains the instruments other than gifts and wills) whose value is less than a hundred rupees.

- The instruments that acknowledge all the receipts and payments with respect to any consideration.

- Less than a one-year term lease of immovable property.

- Transferring of any decree or any order of the court with instruments where the matter of the subject of that decree or order is the immovable property. The value of it should be less than one hundred rupees.

Aim of the Odisha Property/Deed Registration

The below-mentioned benefits are of Odisha Property/Deed registration:

- Only if the deed is registered, then only you can acquire interest or title under Odisha transfer of property Act right.

- Once it is registered under the office of the Sub-registrar, concerned with the deed, it will be a permanent public record.

- Anyone can scrutinize the public record of the property transfer and can obtain the information from the sub-registrar office.

- The registration of the immovable property is making the general public aware that the property rights are transferred to its new owners.

- The encumbrance of the property earlier, during the transfer of ownership, can be verified by the public is possible with property registration.

- If someone wants to buy the property in the state, they can easily get access to the record index of the property available in the Sub-registrar office records. They can know when the last transfer deed was registered for the property.

See Also: Everything You Need to Know About IGR Maharashtra

Main Functions of IGR Orissa

Here are the few activities that this public authority handles and performs:

- Issuance of instruction or orders that will be implemented for the provisions of the Indian Stamp Act or Indian Registration Act.

- It is done to provide better services that can be facilitated to the general public along with protecting the interest of the Government.

- Establishment of all the matters related to the Registration offices of Orissa.

- Registering the societies under the S. R. Act, 1860.

- Firm registrar under the I. P. Act, 1032.

Responsibilities Of IGR Orissa

The IGR is mainly responsible for:

- Computerizing all the revenue offices,

- Land records updations,

- Digitalizing the cadastral maps,

- Bringing interconnectivity among the revenue offices,

- Using the modern techniques to undertake survey operations,

- Distributing the wasteland for homestead or agriculture purposes,

- Ceiling surplus land distribution,

- Alienation of tribal land prohibition,

- Regularising the pre-1980 forest Townley along with encroached habitats of the human habitation in these forest areas,

- For public purposes, acquiring private lands,

- Comprehensive resettlement and rehabilitation formation policies for the displaced people,

- Decennial census construction along with minor minerals administration, etc.

Services Provided by IGR Odisha Portal

IGR Odisha offers an online portal for filing applications for Encumbrance certificates, property registration, stamp duty calculation, and stamp duty payments. It also renders information related to the concerned SRO and facility for an online certified copy.

Some of the vital activities of the revenue department include the online facility of cadastral maps, computerisation of revenue offices, digitisation of land records, and land survey operations with advanced technologies. IGR Odisha also offered regularisation of forest villages and distribution of wasteland for agricultural goals and encroached upon properties.

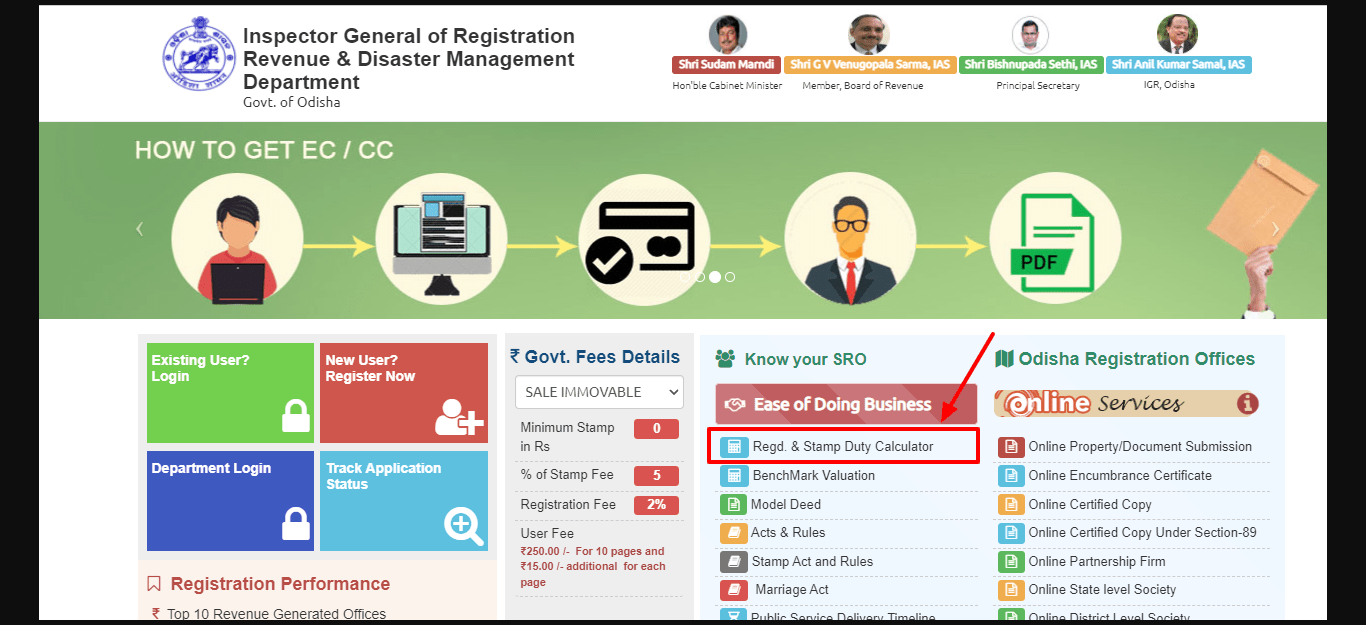

Calculate Stamp Duty on the IGR Orissa Portal

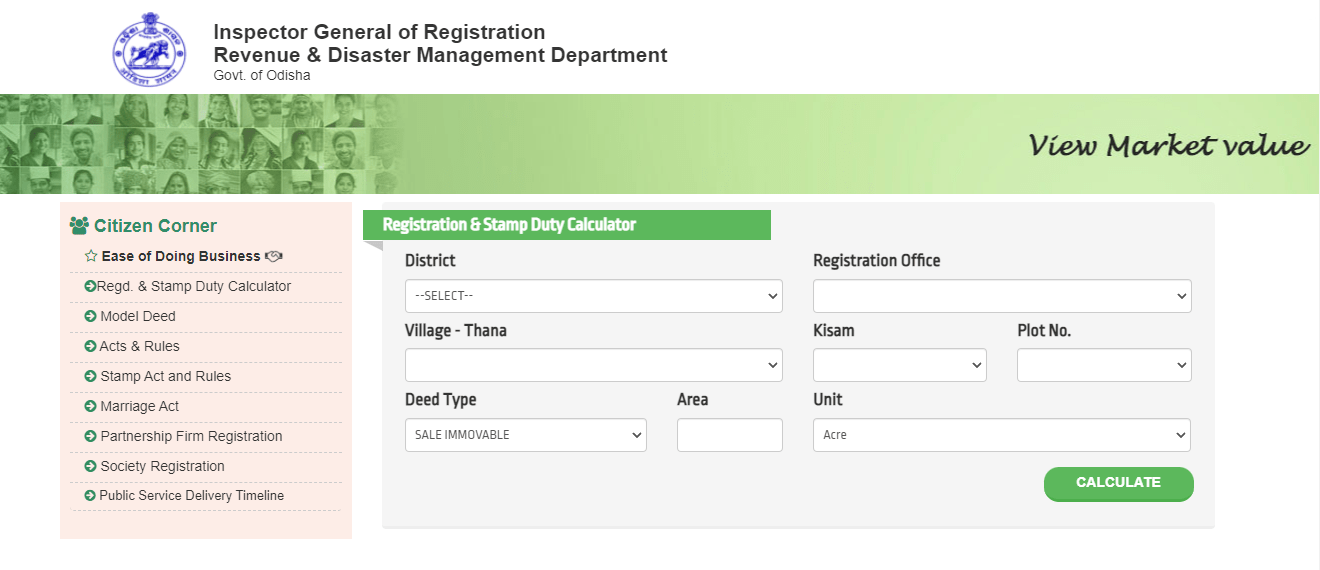

Step 1: On the landing page of IGR Orissa, go to the option “Regd. & Stamp Duty Calculator” under the Know Your SRO head.

Step 2: The form will appear on the screen, fill in the details such as district, registration office, area, measurement unit, plot number, village, and proceed. Then, next, hit the “Search” button after you have filled in all the details.

Step 3: A screen will appear where all the stamp duty details will be displayed, according to the information you filled in the last window.

Importance And Details in the Encumbrance Certificate

Let’s know why encumbrance certificates are important for your land registration in Odisha:

- One Should have an encumbrance certificate in order to get the loans from any of the financial institutions to ensure that the property is free from any legal liabilities.

- It is the proof of ownership title and is important for the transfer of property.

- In case, if the tax is not paid for consecutive more than three years, then it will be furnished by the village or panchayat officer for updating the land tax records.

- It is also important to withdraw the PF for purchasing the property or constructing a house.

Details included in the Encumbrance Certificate:

- Contains the name of the owner of the property.

- Has all the details regarding the property.

- The EC certificate Odisha will give all the descriptions of the property as in the sales deed.

- EC Certificate Odisha will have all the transaction details related to the property. Details of the transaction will get mentioned in chronological order.

- If you bought the property on loan, then the EC certificate will also have the details about the mortgage.

- All the details about gift settlement will be mentioned if it is a gifted deed.

- If any of the partners released their part of the share from a jointly purchased property, the details of the released deed will also be mentioned on the EC certificate Odisha.

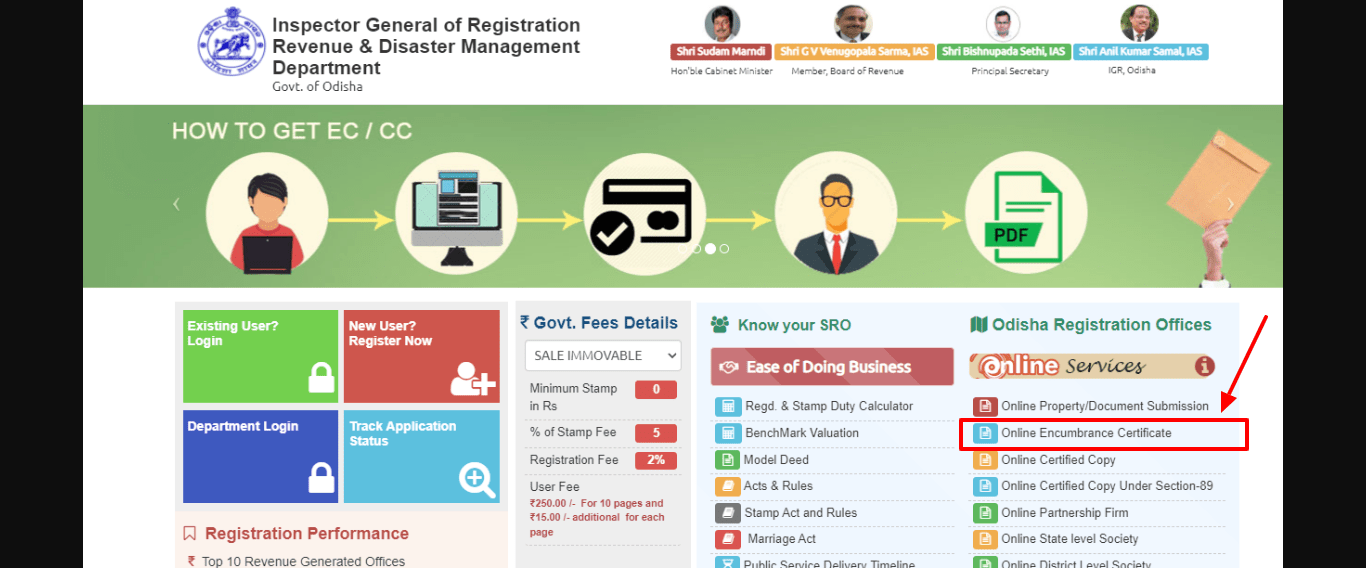

Steps to Apply Encumbrance Certificate on the IGR Orissa Website

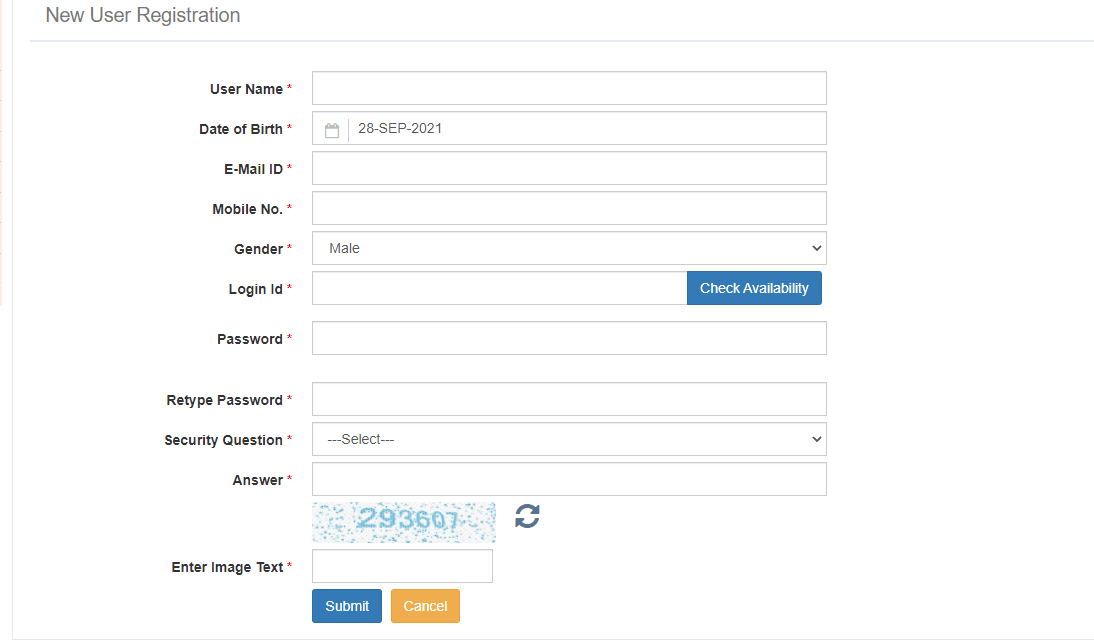

To get an encumbrance certificate, you will first need to register on the IGR Orissa portal. To register, keep the information such as date of birth, e-mail address, contact number, along with some other details asked by the portal. You can get the EC certificate Odisha easily in a few simple steps. Below mentioned are the steps for applying for an encumbrance certificate:

Step 1: Go to the homepage of IGR Orissa.

Step 2: In the services menu, select “Encumbrance Certificate”. Then you will be redirected to a new page.

Step 3: Register in the portal to avail of the certificate services. Fill in the form with the details asked by the portal, such as the name, DOB, e-mail id, and password.

Step 4: After typing the captcha, click on submit. Then login to the portal using the username and password.

Step 5: Provide all the information related to the property, along with the district and SRO where your property is located.

Step 6: Then provide the sub-registrar details and click on “Save and next”.

Step 7: Then enter all the property-related details asked by the portal, such as a village, taluk, and more.

Step 8: Also, fill in the details of the boundary of your property. This data is important.

Step 9: After entering the period you need the encumbrance certificate for, click on calculate the fee to know the EC certificate Odisha charges. The portal will automatically calculate the details and display them on your screen.

Step 10: You can make the payment for EC certificate Odisha online using a secured payment gateway using the online page of IGR Orissa.

Step 11: After the successful registration and payment, you will get a receipt, and the application will get transferred to the login of the concerned sub-registrar.

IGR Odisha Encumbrance Certificate Format

IGR Odisha allows you to apply for the Encumbrance Certificate online directly through the portal. Once the department has approved your application, the EC will be uploaded in the following format.

Encumbrance (EC) Certificate Odisha Charges

| EC | Fee Structure |

| First year general search | ₹ 25.00 |

| Subsequent year general search | ₹ 15.00 |

| Other kind of property | ₹ 20.00 |

| Delivering EC immediately | ₹ 15.00 for 12 years or less than that and ₹ 2.00/year for every year following year. |

| Fees for application | ₹ 1.00 |

| Charges for user | ₹ 75.00/year or it can go to ₹ 250.00. BUt if it goes up for more than 13 years then ₹ 75.00/year for every following year. |

You Might Also Like: View Tamilnadu Land Records Online: Patta Chitta

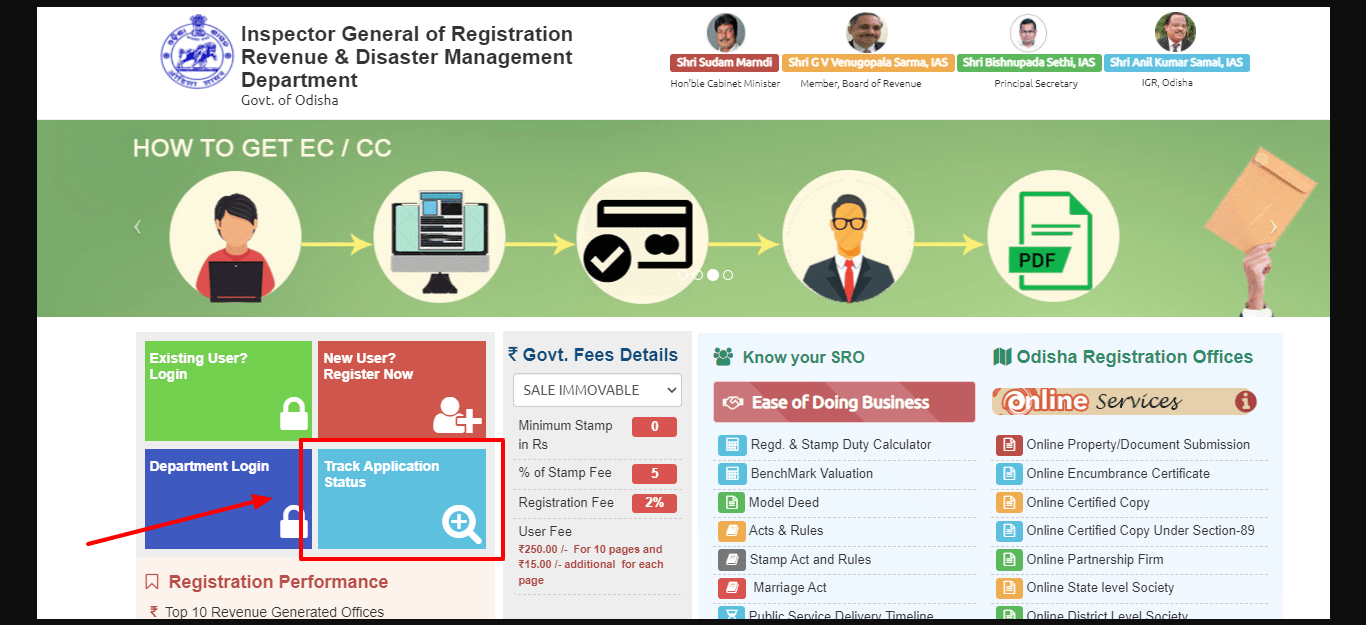

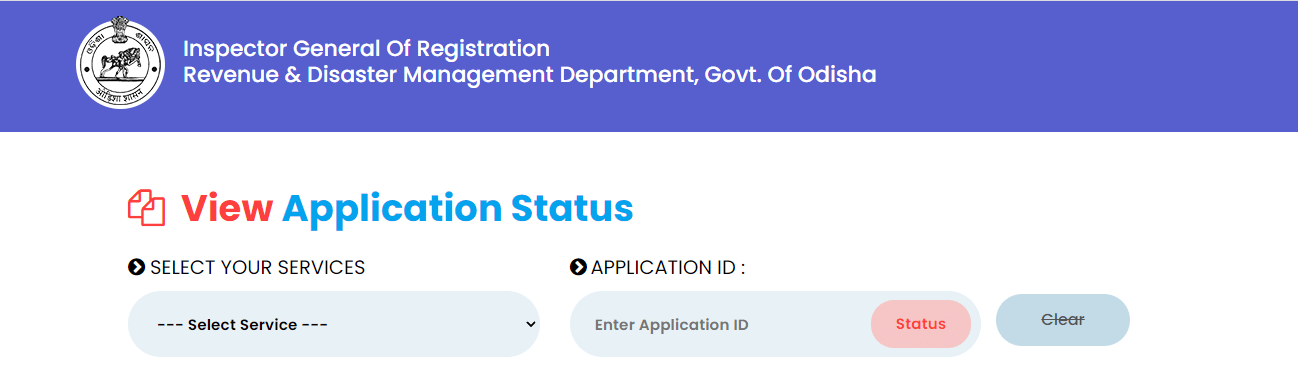

Tracking the Status of Online Application on the IGR Orissa Portal

Step 1: Go to the IGR Orissa website.

Step 2: On the home page, you will find the option “Track Application Status”. Click on that option.

Step 3: Now, you will need to fill in with your application number and proceed. Then the screen with your application status will appear on the screen.

Various Formats of Deeds for IGR Orissa

The various formats of deeds that you can check on the IGR Orissa website are as follows:

- Formats of Sales deeds in both Odia and English.

- Format of Lease deed.

- Format for House rent agreement.

- Format for Mortgage deed.

- Format for Gift deed.

Required Documents for Registering Under IGR Orissa

Here is the list of documents that one will need for Inspector General of Registration Odisha:

- All the documents that prove the ownership of that transacted property.

- Photo identity proofs for all the executants, identifiers, and claimants (ant one of these - aadhaar card, driving license, PAN card, passport, or EPIC.)

- Passport size photographs of all the executants, identifiers as well as claimants.

- If in case the document is valued at more than ten lakhs then the executants and claimants will have to submit a photocopy of the PAN card.

- If they are not able to submit the PAN card copy, they will need to submit Form No. 60 under the Income Tax Act.

- From the ROR published to date, submission of encumbrance certificate as well.

- Prescribed format declaration duly signed by both transferor and transferee, if there is no building or structure on the transacted property.

- Duly signed declaration in the prescribed form by both transferor and transferee, if there is any building or structure on the land.

- If there is any document registered by the attorney holder, Power of Attorney registration along with the attorney's photo identity proof document.

- Revenue officer’s requisite permission when an SC or ST individual transfers the property to a non-SC or ST individual.

- Issuance of NOC or requisite permission by the Endowment’s Competent Authority for transferring the property that belongs to the deity.

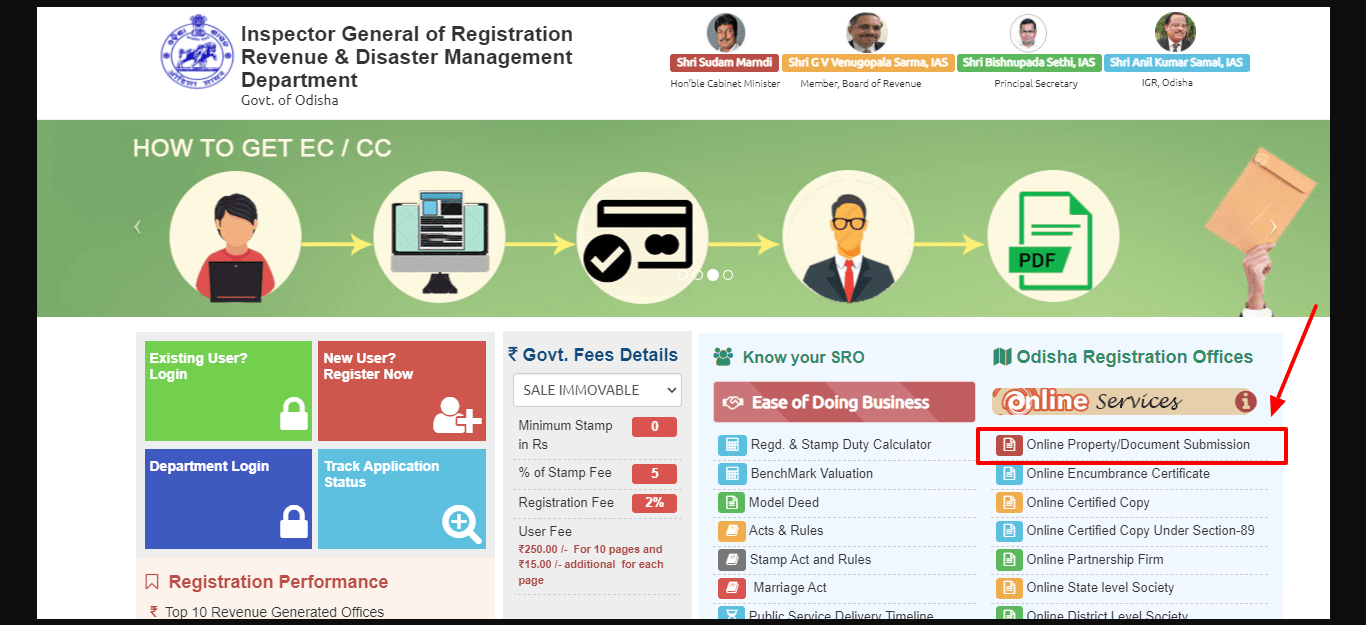

Submitting the Documents Online for Online Registration Odisha

You can easily go for online registration of land registration Odisha by following a few simple steps. Below mentioned are the steps for online documents submission for online registration Odisha:

Step 1: On the official website of IGR Orissa, go to the “Online property/document submission” tab under the Odisha registration offices.

Step 2: You will get redirected to a new screen where you will need to fill in all the details asked by the portal, such as username, E-mail ID, DOB, Login Id, Mobile number, Security question, and Password.

Step 3: Then, you can proceed by clicking the “Submit” button for registration. Then you will receive a one-time password to your registered mobile number. Fill that number in the box and click on the “Confirm” button.

Step 4: Then, you will receive an activation and confirmation mail on the registered mail id. Click on the link to activate your online registration Odisha account on the IGR site.

Step 5: After you have activated your account, you can log in on the portal using the username and password.

Step 6: Once you have logged in to the account, provide the property details asked by the portal. You can proceed after filling up the form with the deed’s details.

Step 7: Now, after proceeding, the following screen will ask for the details of the sellers. You will now be asked to provide the details of the consenter, identifier, witness, and buyer. In the next screen, you will be asked to fill in all the property-related details.

Step 8: Now upload all the supporting documents asked by the portal along with the deed you want to register. Then click on “Upload and Save” after you have uploaded the documents on the portal. Once you have finished uploading, click on “done and exit”.

Step 9: After you have uploaded all the documents and provided the portal with all the details, click on the Next button. Then pay the stamp duty payable for Land online registration Odisha. The amount will get automatically calculated by the Odisha land registration website and appear on the screen.

Step 10: An acknowledgment slip with your reference number for the registration will appear on the screen. You can note it down for future references. Then comes the last page. The last page will ask for confirmation. Once you confirm, the deed will get submitted to the relevant registrar's office to get it scrutinized and accepted.

Step 11: The registrar will verify all the details and documents. If the application is accepted, then you will need to pay the registration fees using the online treasury portal.

Step 12: The application fees can be paid using the Inspector General of Registration Odisha website. Go to the website, then on the home page, click on “online payment of registration fees”. The portal will redirect you to the treasury portal for payment.

Step 13: Provide the required details and make the registration payment. After the payment is successful, you will get an e-Challan. Keep this e-Challan safe as, during verification, you will need to submit it to the SRO.

Step 14: After paying the fees, you will be redirected to the IGR Orissa site. There click on time slot booking. Then the following screen will ask you your preferred time slots to book your time. Select the date as well as time from the given list which is convenient for you to approach the SRO. Then an OTP will be sent to the registered mobile number. Enter that for booking your time slot. If in case you do not receive an OTP, enter your mobile number and enter the OTP you received to confirm the time slot.

Step 15: A date for presentation will be assigned to you by the concerned officer, and you will have to make a physical appearance to get the registration of your property completed. When you appear at the SRO, make sure to keep the stamp certificate, slip of acknowledgment, and e-Challan with you.

Step 16: The sub-registrar will verify the following details mentioned below:

- Verification of documents

- Transaction oral verification

- Checking the entries made by the applicant

- Examining the e-Challan and the stamp certificate.

Step 17: After the verification, the SRO will update all the details on the Odisha land records website, which is named the Bhulekh website.

If in case, the application is rejected because of any reason, then it will be updated on the portal along with the reason of rejection.

Step 18: Provide the required details and make the registration payment. After the payment is successful, you will get an e-Challan. Keep this e-Challan safe as, during verification, you will need to submit it to the SRO.

Step 19: After paying the fees, you will be redirected to the IGR Orissa site. There click on time slot booking. Then the following screen will ask you your preferred time slots to book your time. Select the date as well as time from the given list which is convenient for you to approach the SRO. Then an OTP will be sent to the registered mobile number. Enter that for booking your time slot. If in case you do not receive an OTP, enter your mobile number and enter the OTP you received to confirm the time slot.

Step 20: Once the sub-registrar marks the deed, it will get recorded in the land records, and all the photographs of the buyer, witness, identifiers, and sellers, as well as the deed data, will also be recorded in the system.

Step 21: The SRO will obtain the biometrics of both seller and buyer in order to regularize the form of party details.

Step 22: After successfully registering, the registrar will update the details on the online platform (re-registration). It is for e-registration, and the applicant will need to pay the fees asked for it.

Step 23: After the successful e-registration, the registered deed will get uploaded to the site. You can download the deed from the website by logging in to the IGR Orissa website. To get the hard copy, you can go to the sub-registrar office.

Time Frames and Levels For IGR Orissa Decision Making Process

| S. No. | Activity | Level of Action | Time Period |

| 1 | Receipts of correspondence/letters/DAKs | Diarist | On the same day |

| 2 | Planced in front of the authority for perusal | Relevant concerned authority | On the same day |

| 3 | Receiving letters marking | Section officer | On the same day |

| 4 | Diarization of DAKs/Correspondence and distributing it to the Dealing Asst. | Diarist | Up to 2 to 3 days |

| 5 |

|

Dealing Asst. | Up to 3 to 7 days |

| 6 | Stimulating examination and comments | Section officer | Up to 2 to 5 days |

| 7 | The branch office begans the decision making process within their competency | Under the secretary Jt. IGR | Up to 5 to 7 days |

| 8 | Final Disposal | IGR Orissa | No fixed timeline |

User Charges for E-Registration

| S. No. | Type Of Deed | Charges for e-registration services |

| 1 | Immovable Sale | From ₹ 100 to ₹ 200 |

| 2 | Movable Sale | From ₹ 100 to ₹ 200 |

| 3 | Conveyance | From ₹ 100 to ₹ 200 |

| 4 | Adoption | ₹ 200 |

| 5 | Immovable Gift | ₹ 200. The immovable gift to the government is exempted from paying any amount. |

| 6 | Movable Gift | ₹ 200. The movable gift to the government is exempted from paying any amount. |

| 7 | Immovable Partition | ₹ 200 |

| 8 | Movable Partition | ₹ 200 |

| 9 | Reserved Less Rent | Between ₹ 100 to ₹ 200 |

| 10 | Lease with Advance only | ₹ 200 |

| 11 | Lease with Advance as well as Rent | Between ₹ 100 to ₹ 200 |

| 12 | Power of Attorney | ₹ 200 |

| 13 | Partnership | From ₹ 50 to ₹ 200 |

| 14 | Trust | ₹ 200 |

| 15 | Will | From ₹ 50 to ₹ 200 |

| 16 | Bond | ₹ 50 and ₹ 200 |

| 17 | Agreement | ₹ 100, ₹ 200 and ₹ 500 |

| 18 | Affidavit | ₹ 50 |

| 19 | Divorce | ₹ 200 |

| 20 | Exchange | ₹ 200 |

| 21 | Release | ₹ 100 and ₹ 200 |

| 22 | Settlement | ₹ 100 and ₹ 200 |

| 23 | Mortgage | From ₹ 100 to ₹ 200. Mortgage to the government is exempted from paying any fees. |

| 24 | Duplicate or Counterpart | ₹ 200 |

| 25 | For any other miscellaneous document | ₹ 150 |

Users are also charged ₹ 10 per page for any service rendered at the e-registration center. Also, if the user wants to get the grant of a certified copy for any reason, entries, or documents before or after registration, they will be charged ₹ 25 per page, and it can go up to ₹ 200 at maximum.

In Odisha, women have to pay less amount for stamp duty when dealing with properties in their name. The rate of Odisha property registration is 4% of the value of land in the market for women. But, in general, the rate of Odisha property registration is 5% of the value of land in the market except for the women.

Also Read: All You Need to Know About Encumbrance Certificate

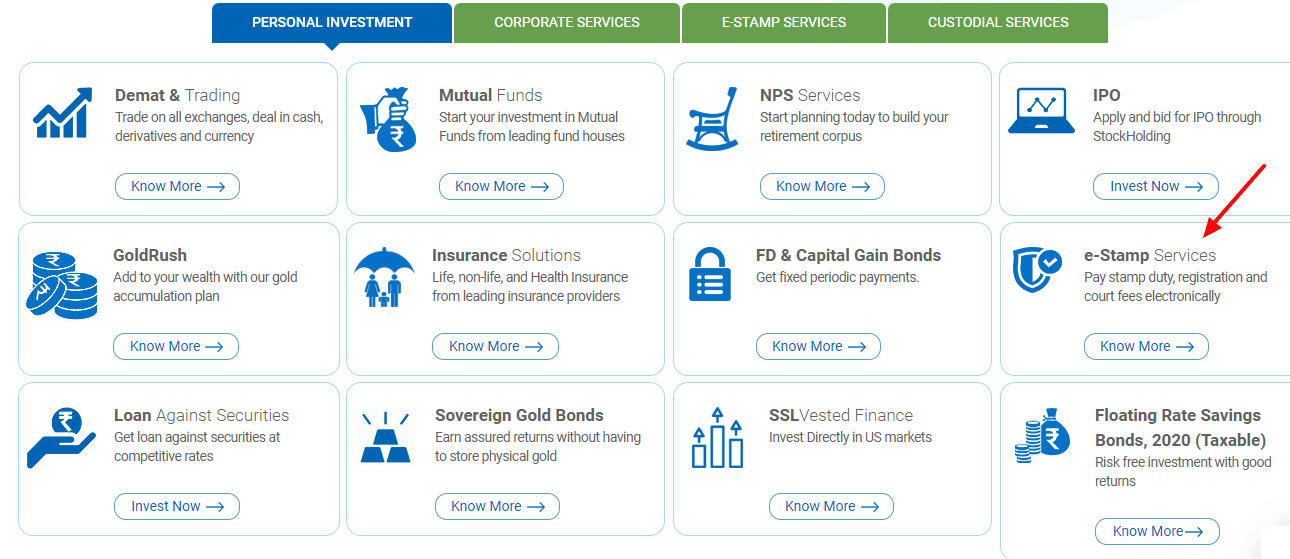

Methods to Pay Stamp Duty Through SHCIL Portal

Step 1: Visit the online portal of SHCIL and check whether your state provides the service of e-stamping or not. The site also has information like which transaction requires the address of the collection as well as stamp centers.

Step 2: If the service of e-stamping is available in your state, you will need to fill a form in the ACC. The form should have all the details of the parties involved as well as the transaction should be used for it.

Step 3: Submit the form and pay the fees for the stamp certificate. You can either pay in currency or use a cheque or the demand draft if it gets done in ACC. Online payment can be completed with the help of a debit card, credit card, RTGS, pay orders, account-to-account transfer, or NEFT.

Other Services provided by the IGR Orissa Site

On the IGR Orissa portal, you can access a range of services and easily register through the website. Below mentioned are the services offered by the IGR Orissa along with land registration:

- Online certified copy

- Online encumbrance certificate

- Online certified copy under section 89

- Online partnership firm

- Online state level society

- Online district level society

- Online marriage application

- Online payment of the registration charges

- Online payment for stamp duty

To register for any services mentioned above, you can simply go to the website of IGR Orissa and fill the application form in just a few minutes. Make sure you keep all the documents required to attach with the form handy to avoid any last-minute obstacles.

Contact Details of IGR Odisha

For any queries related to IGR, you can directly visit their office or connect with officials over call or email.

IGR Odisha Office Address:

Inspector General of Registration Odisha, 2nd-floor, Board of Revenue Building,

Chandni Chowk, Cuttack (Odisha)-753002

Phone Numbers:

(+91)7894438202

(+91)7894438220

Email Address:

helpdesk.igrodisha@gmail.com

Discover IGRS For Other States

| States | IGRS |

| Rajasthan | IGRS Rajasthan |

| Maharashtra | IGR Maharashtra |

| Telangana | IGRS Telangana |

| Andhra Pradesh | IGRS AP |

| Uttar Pradesh | IGRSUP |

Frequently Asked Questions (FAQs) About IGR Odisha

How can I see the land record of Odisha?

To see the land records of Odisha, simply visit the official website of Odisha Bhulekh. In the main menu, click on “Tahasil Info '' followed by the details of the district and Tahasil you're looking for.

What is the igr Odisha contact number?

You can contact IGR Odisha on (+91)7894438202, (+91)7894438220.

What are the Odisha stamp duty rates?

For women, it is 4% of the value of land in the market and for everyone else, it is 5% of the market value of the land in Odisha.

What is the registration fee in igr Odisha?

For registration, users will get charged ₹ 250 for a 10 page and ₹ 15 for every additional page after that.