Though there exist multiple success stories of convergence during the pandemic across the world, the trend of deglobalization has also surfaced in the mainstream. The majority of large players are rethinking their investment strategies and going all-in for safer options. But with $12.2 billion worth of total construction and real estate industry cross-border deals announced globally for May 2022, is it right to say that the realty sector is defying the deglobalization trend? Let’s find out.

With the majority of the real estate investors favouring the local vendors and markets, historically the realty segment has always shown a strong home bias. Even when investors mulled on cross-border deals, they have mostly preferred markets entailing higher levels of coherence, favourable regulations, and better governance. Though this does not imply that investors have not pursued markets that are less transparent in the past years. But at a larger scale, market environments with higher transparency and government ESG scores have tended to garner more real estate deals and profits in the prevailing scenario.

Undoubtedly, deglobalization has had an immense impact on the construction portfolio. But conversely, there exists ample evidence that real estate as an investment avenue has become more widely accepted in the recent years. This has resulted in the emergence of real estate as an asset class as more “global” resulting in an increased number of cross-border deals. At Square Yards, digging deeper into the trends, we came up with some plausible reasons for how the realty segment has defied the deglobalization trends in the past and its implications in the future. Let’s dive in.

Based on Return Behaviour Real Estate is Becoming More Global

Driven by some of the largest investors across the world, the demand for real estate globally has witnessed a stronger rebound. Across the world, surveys have shown that the market has noted a continued strong demand for cross-border deals in the past few years. Approbating this sentiment, according to Global Data (Deals database), it was reported that about $ 12.2 billion worth of total construction and real estate industry cross-border deals were announced globally for the month of May 2022.

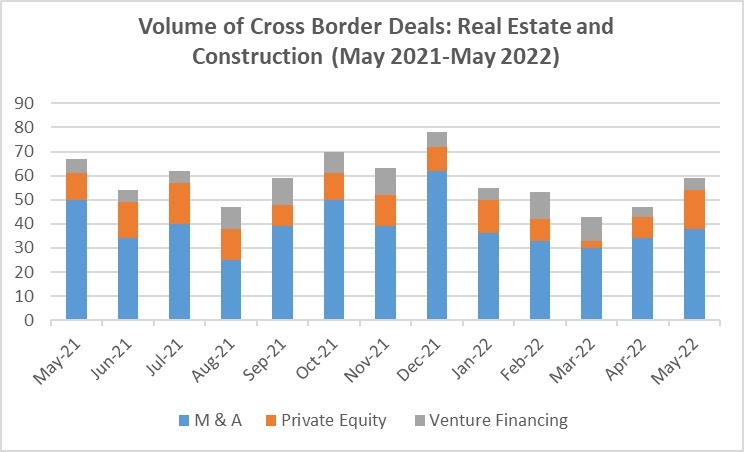

Source: Global Data (Deals Database)

Though in terms of the number of cross-border deals, the sector noted a flat growth with 59 deals for April 2022 as compared to the 12-month average of 59 deals. Even with relatively fewer flows across the borders, there is evidence supporting that based on the return behaviour, real estate has become more global.

As per MSCI Global Annual Property Index, since 2008 there has been a drop in total return across the national markets. But interestingly, during a similar period, the distribution of return across various property markets has increased manifold, mainly due to technological improvements like the emergence of e-commerce and the pandemic defining the new normal resulting in boosting industrial sectors. Rooted in these trends, the past two years offered a greater opportunity for outperforming allocation decisions based on property type rather than a specific country.

How does Deglobalization Affect Real Estate?

Amidst the pandemic, the scenario which was further aggravated by political polarities and rising geopolitical conflicts have altogether contributed to several concerns about deglobalization. Also, during this period, business cycles across the world differed considerably resulting in wider variations in the performance of bonds and equity in different markets across the world. This also resulted in lower correlations and higher volatilities among the countries.

However, moving forward it is anticipated that global investors in bonds and equities may adopt a more comprehensive and detailed approach towards asset collection. For example, to carry out broad allocation large investors might focus on countries by placing more emphasis on the convertibility of the currency, the reputation of the nations, and several other pertinent risks.

While several deglobalization blows can be expected for the realty segment but there also exists plenty of aspects that could reduce the impact. And why not! Given that market segments with higher transparency, better government policies, and key institutions form the lion’s share of the opportunities and transaction values, realty segment is all poised for higher returns.

Bottomline

One cannot deny that deglobalization can result in major consequences from asset allocation and portfolio construction per se, but different asset classes are also expected to be affected in a variety of ways. However, with over 91% of the capital value of USD 2.3 trillion of assets invested in real markets with liberal democracies as per MSCI Global Annual Property Index and MSCI Asia Annual Property Index, safety nets appear stronger.

Apart from the selective features associated with real estate investments along with the nature of opportunity as compared to other asset classes, it is more likely to infer that real estate will be less directly influenced by this deglobalization trend. Thus, maintaining its strong foothold stance in the upcoming years by preferring more coherent and stable markets to counterbalance the effect of deglobalization.