We all might be thinking that why do Governments levy taxes on us, but the simple answer to this is, Governments of every state impose these taxes or stamp duties on us to fund all the government programs and activities. It is known as Tnreginet stamp duty or documentary stamp tax because a physical stamp was used on the document as proof of document recording and tax liability pays.

How much are Tnreginet Stamp Duty and registration fees?

In Tamil Nadu, the charges levied as stamp duty for property registration is 7% on the value of the property in the market and the registration fee of 1% of the total value of the property.

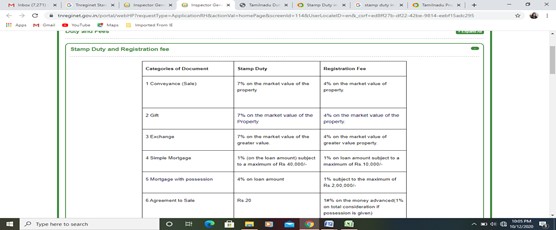

Now, we will discuss a bit about the other Tnreginet Stamp Duty rates and the registration fees:

- Registration of Property: The stamp duty applicable for this is 7 % of the value in the market and the registration fee is 1%.

- Registration of Gift Deed: The applicable stamp duty for this is 7% of the value of the property in the market and the registration fee for this is 1%.

- Exchange Deed Registration: The applicable stamp duty for this is 7% of the value of the property in the market and the registration fee for this is 1%.

- Simple Registration of Mortgage: The stamp duty applicable in this case is 1% of the loan amount is subject to Rs.40,000 and the registration fee for this is 1% of the loan amount that is subject to a maximum of Rs.10,000.

- Mortgage Possession: It is kind of same as the previous one, the stamp duty applicable is 4% of the loan amount which is subject to a maximum of Rs.40,000. The registration fee applicable for this is 1% of the loan amount is subject to a maximum of Rs.2,00,000.

- Selling Agreement: The stamp duty applicable in this case is 4% of the loan amount is subject to Rs.40,000 and the registration fee for this is 1% of the loan amount that is subject to a maximum of Rs.2,00,000.

- Cancellation Charges: Stamp Duty for this is Rs.50, registration fees are Rs.50

- Partition Deed(family members): The stamp duty applicable in this case is 1% of the value of the property in the market but not more than Rs.10,000 (per share) and the registration fee is 1% subject to a maximum of Rs.2000.

- Partition Deed(non-family members): The stamp duty applicable in this case is 4% of the property for separated shares and the registration fees applicable in this case is 1% of the property for separated shares.

- General Power of Attorney to Sell Immovable Property: The Tnreginet Stamp Duty for this is Rs.100, the registration fee is Rs.10,000 for property registration.

- General Power of Attorney to Sell Movable Property & Others: Stamp Duty for this is Rs.100, the registration fee is Rs.50.

- Settlement Deed (In favour of Family Members): The stamp duty applicable in this case is 1% on the value of the property in the market but not more than Rs.10,000 (per each share) and the registration fee is 1% subject to a maximum of Rs.2000

- Lease Deed (Below 30 Years): The Stamp Duty is 1% of the total amount of rent, premium, fine, etc. and the registration fee is1% subject to a maximum of Rs.20,000.

- Trust Registration: Stamp Duty for this is Rs.180, the registration fee are 1% of the amount.

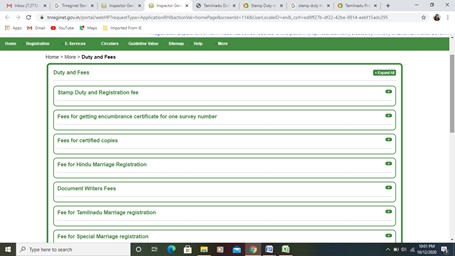

From where and how can I get detailed information about the Tnreginet Stamp Duty and Registration Fees online?

As mentioned before, In Tamil Nadu the stamp duty is 7% of the value of any property in the market with a registration fee is 1% of the value of the property. Previously, we have fetched in a few details on Tnreginet Stamp Duty and registration fees, but to get the detailed information on every duty and fees you have to follow the simple steps below:

- On Google, you need to type "tnreginet.gov.in” and open the official website of

- The home page will appear on the screen.

- From the menu bar, you have to select the "More" option

- Then from the drop-down, you have to select "Duty and Fee"

- A page will appear (shown below) with a whole set of new options to answer your needs like:

- Stamp Duty and Registration fee

- Fees for encumbrance certificate per survey number

- Fees for getting certified copies

- Fee for Registration of Marriage under Hindu Marriage Act

- Fee for Document Writers

- Fee for Tamilnadu Marriage registration

- Fee for Special Marriage registration

- The Fee for Christian Marriage registration

- Fee for Birth and Death registration

- Fee for Firm registration

- The Fee for Chit fund registration

- Fee for Society registration

All the above-mentioned options have details and pieces of information within it. When you will click on each option (+) you will get to see the entire data and values that you are looking for (shown below)

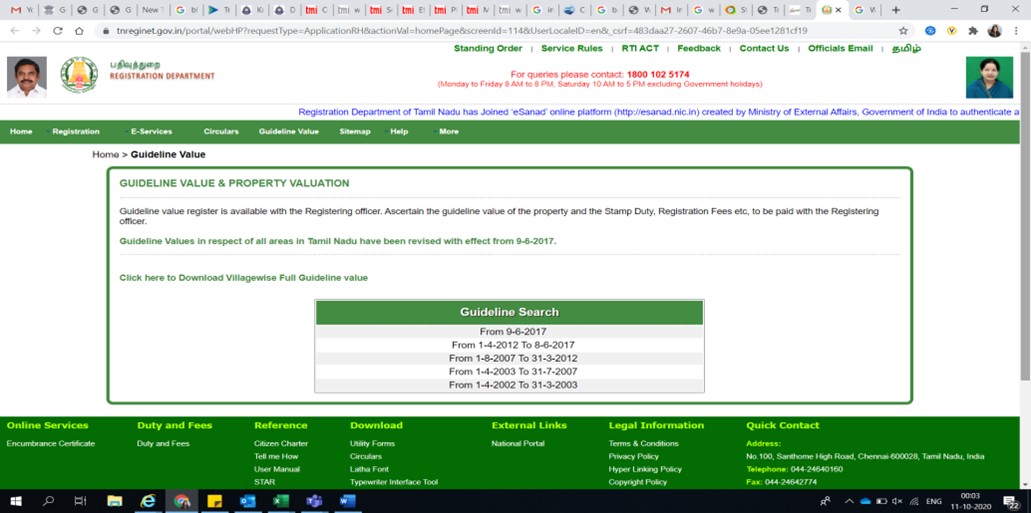

How to search Tnreginet Guideline Value?

Before knowing how to search the Tnreginet Guideline Value, we have to know:

What is the meaning of the Guideline Value?

Certain prices are fixed on everything by the government of every state for properties and other purchase-related factors under which the sales cannot take place. The term Guideline Value is popular in Tamil Nadu, in other parts of India it is known by some other names, but the meaning remains the same. The minimum value of an area that is identified by the state government to calculate the duty and the fees while the purchase of any property or maybe a transfer of the same, then the stamp duty is based on the sale or transfer of the property, this is known to be the guideline value of the state.

The procedure to know the guideline value of the state for 2019-2020 through this online portal, you have followed this portal's home guidelines by these simple steps:

- From Google, you need to type "tnreginet.gov.in” and open the official website of

- The home page will appear on the screen.

- From the menu bar, you have to select “Guideline Values” option

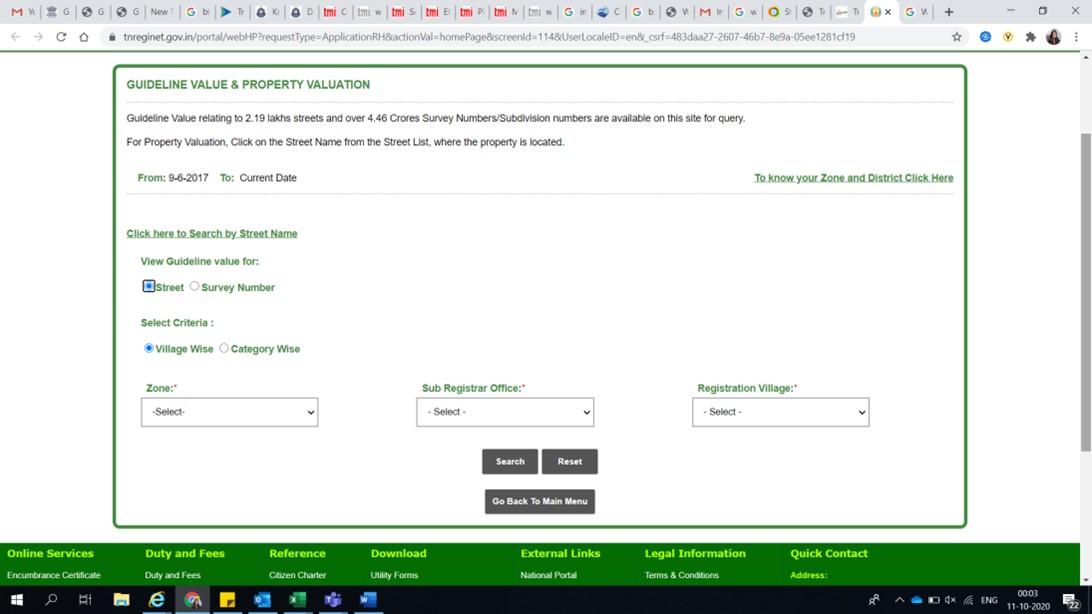

- Another page will appear (shown below)

- Then you have to select the option “From 9-6-2017” from the table below. This will help you to view the current guideline value of 2019-2020.

- Another page will open (shown below)

- Then you must select which option you want to search for among the two given- "Street" and "Survey Number".

- When you select the correct and required one option, you need to fill in all the details that are asked for in the form.

- After you’re done with the date entering part, enter the option "search" to view the current or the guideline value you want to see.

What are the revised guideline values of Tamil Nadu in 2020-2021?

The Government of Tamil Nadu has decided to revise the guideline values for the year 2020-21. This year the Government of Tamil Nadu has decided to effect a 33% reduction in the guideline values in the registration process for the properties and assets. This came into effect from 12th June 2020. Previously, there were a lot of obligations regarding property transactions especially in the rural areas due to high guideline values. But now, due to this step of the Tamil Nadu Government, the potential loss of the revenue shall be compensated a bit. The registration fee also got increased from 1% to 4% for the conveyance, exchange, gift and at the same time for the settlement of the deeds of the non-family members.

How to apply for Encumbrance certificate online?

An Encumbrance Certificate or commonly known as EC, which is a certificate, has a lot of value and it ensures the people of the state that any property which is in question or doubt is free from any legal or monetary liabilities like mortgage or loan that is yet to be cleared.

This document is mandatorily used for any in-house property transactions. This document holds a lot of importance in today’s world because while you are going to buy a property or a house, it is a must to check whether the property is free from legal or monetary liabilities or not. This document holds all the registered transactions done on a particular property during the period for which the EC is asked for. EC is also an assurance that the property is free and safe to be bought.

To apply for the Encumbrance certificate, just following the steps will do:

- From Google, you need to type "tnreginet.gov.in” and open the official website of

- Registration should be done earlier if not done.

- Then using your user id, password and code, you have log in to the portal.

- After all the required details are entered you have to select the option "sign-in".

- Then you must select “the Encumbrance certificate"

- Next option that will appear will be “Apply Online”

- Once you click the above option, a form will appear on the screen.

- Read the form clearly and fill in the necessary data required for the form.

- Certain documents might be needed to be uploaded.

- After the whole form is filled up, you must check the details filled in by you thoroughly before submitting.

- Once everything is done, the form is submitted.

- Last but not the least, a print out of the filled form has to be taken at the end.

How to search for Encumbrance certificate online?

- From Google, you need to type "tnreginet.gov.in” and open the official website of

- A page will appear on the screen, where, on a green coloured stripe on the top of the screen few tabs like "Home", "Registration", "E-Services" and much more are there.

- Among all the tabs, you need to click on the “E-services” tab

- A drop down will appear, and it will show “Encumbrance certificate”

- Then you must select “View EC”

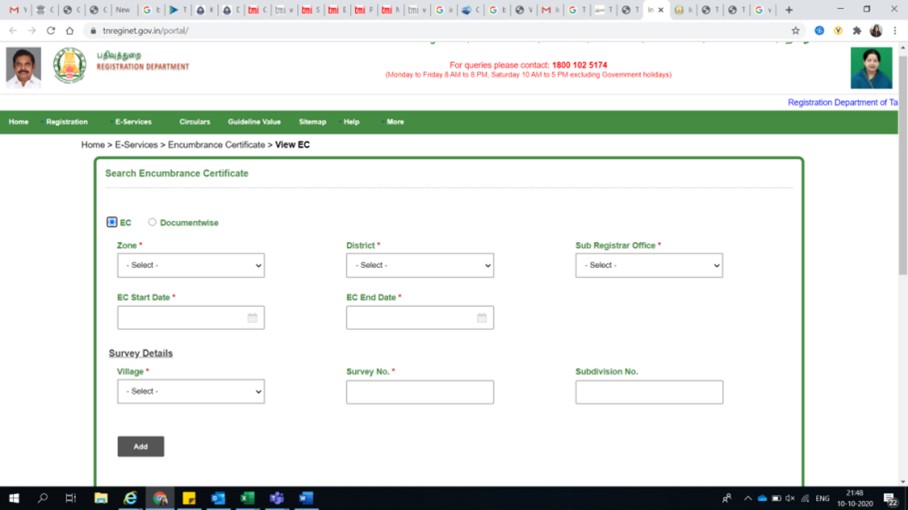

- A form will appear (shown below)

- There are two options as you will see in the form- EC or Document wise

- Select the one you need

- If you go for “EC”, then you have to enter, your district, zone, sub-registration office, Start Date of EC, EC End Date, survey no, village and sub-division number etc

- If you chose "document wise" option then enter the sub-registration office, document number, year etc

- Fill in the details required as per your selection

- Enter the given code on the screen

- Then enter “Search”

- You will find an answer to your query.

Also read: What is Tnreginet Patta and Chitta?

FAQS

Q. How can I know about all the online services provided by Tnreginet?

Ans : The process of availing the Tnreginet online portal services is very easy. On Google, you just have to type the name or address of the website of Tnreginet and log into it to avail all the services online.

Q. How are the stamp duty and registration charges calculated in Tamilnadu?

Ans : In Tamil Nadu, The stamp duty for any property is 7% of the total market value of the property. The registration fee is 1% of the value of the property.

Q. What is the stamp duty in Tamilnadu?

Ans : In Tamil Nadu, The stamp duty is 1% of the value of any property in the market, not more than Rs.10,000 for each share.

Q. What is Tnreginet Patta & Chitta?

Ans : Patta is a Hindi term which is a land deed or document issued by the Government to an individual or an organization. This particular term “Patta” is used in India and other parts of South Asia for a piece of land which is granted by the Government of a state to a farmer with approved papers of land revenue.

A “Chitta” has equal importance as well. It provides all the relevant and detailed information about the ownership of the particular land, area, the size and much more. This Patta and Chitta of tnreginet were merged into a single document which contains all the relevant details that require to be mentioned for the purpose. Tnreginet Patta is generally maintained by any Village Administrative Officer (VAO) of a place.

Q. Is there any helpline number for additional help regarding the same?

Ans : Yes. You can call at the helpline number 1800 102 5174 from Monday to Friday from 8 am to 8 pm for any additional help. Only on Saturdays calls will be active from 10 am to 5 pm on 044-24640160/ 044-24642774 for any further help.

Q. Is it important to have a Patta?

Ans : Patta is a legal document and also a very important one that certifies that a person legally owns land or property. It also plays the role of evidence when any complications, like dispute, arise. Patta here is issued by the government of Tamil Nadu.

Q. What is the meaning of Adangal in Tamil Nadu?

Ans : Simply this term means revenue record. Adangal is a revenue record that bears all the details and records of the land, area, possession, liabilities, total crops grown, trees standing on all Government Lands etc. It is maintained by the Village Administrative Officer and is written and maintained each year.

The document contains records of:

· Patta lands: Dry, Wet, Manavari

· Assessed wastelands: Wet, Dry

· Poramboke land

Q. What is the helpline number of e-services Tamil Nadu?

Ans : Applicants facing any kind of problems on the portal can raise their query at eservices@tn.nic.in.