How will you go about with your PMC property tax payment? Need some help? Here’s a comprehensive guide for you.

There are various aspects when it comes to PMC property tax payment. You need to understand how to go about the process and what are the basic details that you need to remember in this case. For that, we have prepared for you a comprehensive guide, which will help you to navigate through the various steps with ease.

So, first things first – do you have to pay PMC property tax?

Well, if you own a property, residential or non-residential or even a plot of land with no construction, you will have to pay your property tax to the municipal corporation of Pune. There is a definite area that falls under the PMC and you will have to check whether your property is under the ambit of the same. If it is, then only will the rules of the pay property tax online Pune system be applicable to you. For example, if you have a property in the IT hub of Hinjewadi, it does not fall under the PMC (Pune Municipal Corporation).

So, supposing you own your property within the PMC coverage area, then what do you have to do? How do you have to pay property tax? How will you go about the process?

Well, to begin with, you need to make sure that all your property documents are in order, which indicates that you are the owner of the said property, for you to get your property registered and make it legal.

The next step for you would be to make the payment. This can be done both online and offline. If you are a little tech-savvy, then it is best if you can do it online, because it will save you a lot of time and effort. If you are not that comfortable doing it online, then you can always visit the PMC office and they will guide you through the process.

Online Payment Details Guide

So, how do you get your Pune Corporation property tax online payment done? Here’s a step by step guide for you to follow:

- The first thing that you will have to do is visit the link.

- You should ensure that you register for property tax payments online with your mobile phone number and other details.

- Once registered, you can simply click on pay online or the NEFT/RTGS payment, depending upon your preferences.

- Enter your basic details of property and then click Submit.

- Verify the details of property ownership and the dues of property tax which are shown on the screen.

- Enter the amount that you will be paying, verify your email ID and mobile phone number and choose the payment gateway including debit/credit cards, internet banking, etc.

- Thereafter, make your payment online without any hassles.

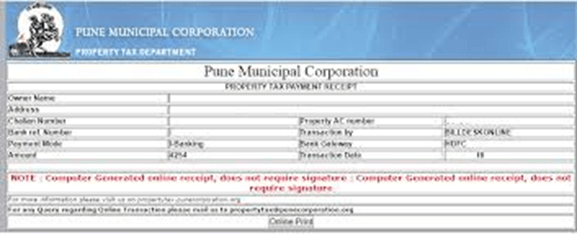

- Post making payment, you will get the e-receipt which should be kept carefully. You may take a print-out of the same for keeping it with you.

Late Payment/Defaulters’ Guide

What happens if you forget to submit your property tax? Like every other property tax regulations in place, you will have to then clear the dues and that too clear it with a fine. When it comes to defaulters in case of Pune Municipal Corporation property tax, you will have to fill out a form for that, which is also available online and then file your taxes.

This has to be completed before the next payment cycle or along with it because without paying or clearing your dues you won’t be able to pay for your next cycle of tax and if you become a serial defaulter then you might get into legal trouble. So, the point is, keep a track on things and do not miss out on your payment date because then that will save you a lot of trouble.

Tax Calculation and Payment

A lot of people wonder, how much property tax should I pay or have to pay and what is decided upon. Well, the thing is that every municipality has its system and similarly the PMC property tax payment amount also has its system of calculation. Let’s see how this is done.

Well, the system followed by the PMC is where the market value of the property determines the amount of tax that you will have to pay. The calculation is based on that. So, if the property value in the market increases over time, your property tax value will also increase, however, if the value decreases, then your property tax value will also go down. Thus, as the market value changes, your property tax value changes as well, which lead to frequent updates. Hence for you to be prepared, you can do your self-assessment.

Visit their online portal and you will get an option for self-assessment. You will need to provide the basic details of the property and the calculated value of the property tax that you have to pay will be displayed. Self-assessment helps you to be prepared for the tax amount and pay property tax online Pune on time as well.

Revision Of Submission Dates

There is a stipulated date by which you need to make the payments. In general, the date is fixed i.e., 31st May. This year, however, due to circumstances arising out of COVID19 Pandemic, the date had been revised and relaxation of one month was allowed. Thus the date of filing and paying your property tax for PMC this year was 30th June.

This revision was done, after several people complained of not being able to file their taxes because of various issues, one of which was the lockdown. Keeping the issues of the citizen in mind, the regulations were relaxed this year. In general, the self-assessment can be done up to a day before the final payment date of the PMC property tax payment.

Things That You Need To Remember

There are a few things that you need to keep in mind from your end, to ensure that you get the process done as seamlessly as possible. Make a mental note and keep these pointers in hand:

- First and foremost, your property documents. Yes, you have to be very particular about your property documents. Keep them with you at all times and more importantly, make sure that you have Xerox copies of each of the ones. Keep the set safe.

- The other thing that you need to remember is that rebates apply to various accounts. For example, if a woman has a property to her name, then she will get a rebate of 10% on general taxes and for her to file for it, she needs to make sure that she fills up the required form, which is available online and then submits it. If you have a place of religious worship, education, a charitable trust or if it has been designated as heritage land, then you will not have to pay any Pune Corporation property tax. If you practice environmental-friendly projects at home like say, vermiculture, installing solar panels, practicing rainwater harvesting, then you will be able to enjoy some rebates of about 10%. Apart from this if the property’s rateable value is less than Rs.25,000/-, then you will get a discount of 10% and if it is above that then the rebate percentage is 5. So, keep a track of these things, so that you do not end up paying more than you need to.

- It is important to remember that if you are buying a new property, then just signing the sale deed will not do. You will also have to note the ownership change with the PMC as well and get the name of the property owner changed as well. Do not miss out on this step, or else you might land yourself in legal trouble when filing for your taxes. And always remember to collect the last receipt from the previous owner, because you will need to show that when you pay your taxes the next time.

- The next thing to remember when you choose to pay property tax online Pune is that you must collect the e-receipt and store it for future use. If you do not get the receipt on making the payment, then as mentioned before you need to get in touch with PMC and clear the confusion out.

- Always remember that you can get your payment done online and a lot of forms are also available. So you do not need to travel unnecessarily and wait in queues to get your payment done or to collect a form. Choose a method of payment that is most suitable to you.

- And last but not the least, keep yourself updated for any changes of dates, dues, rates etc. Also, make sure that your property lies within the PMC and then only abide by its rules or else they won’t apply to you.

Property taxes are not exactly simple. They take time, patience and research to understand. It helps if you have a guide which would make the payment process simpler for you.

The process for making the PMC property tax payment has been made fairly simple and hence you will not have much difficulty doing it if you follow the guidelines properly. And this exactly what this step by step guide is all about. Go through it again, make note of the important pointers and when you pay your taxes make sure that you are making an informed choice and decision.