An easy method to pay taxes in minimal time is the need of the hour for every taxpayer in India. The property owners in India have to pay a direct tax to the government, which is also known as the property tax. This property tax needs to be paid throughout the time period they own the immovable property. The owners need to make this payment to their local bodies, either through the online payment mode or offline payment mode. e-Gras is the initiative of the Indian e-governance to make the payment of taxes and non-taxes easy for the citizens as well as the authorities.

In this article, you will understand how to pay tax as well as non-taxes via e-Gras.

What is e-Gras?

e-Gras refers to Online Government Receipts Accounting System. It is the first move by the e-governance of the government belonging to various Indian states. This portal is also part of the Integrated Finance Management System by the Indian Government under the Mission Mode Project of India.

The portal of e-Gras supports collecting both taxes and non-taxes through the online and manual modes. This initiative of making the tax/non-taxes payment via the online portal has not affected the existing system of the departments, executives and the account agencies.

How to Pay Stamp Duty through the e-Gras portal?

The citizens can make the payment on the portal of e-Gras stamp duty charges by following the steps below:

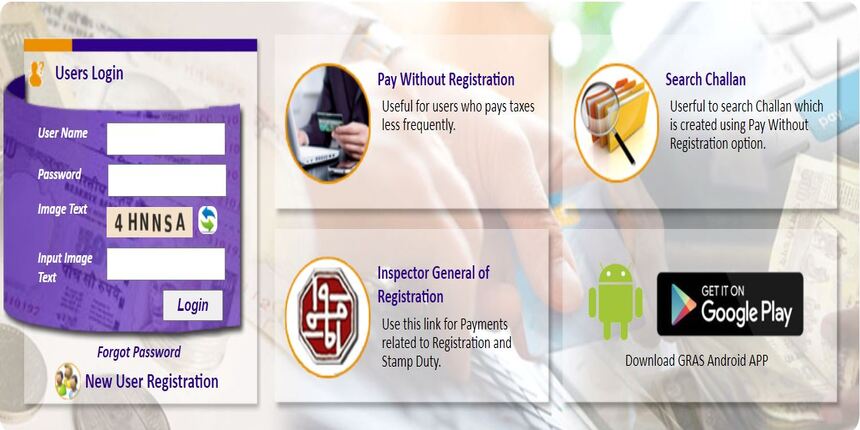

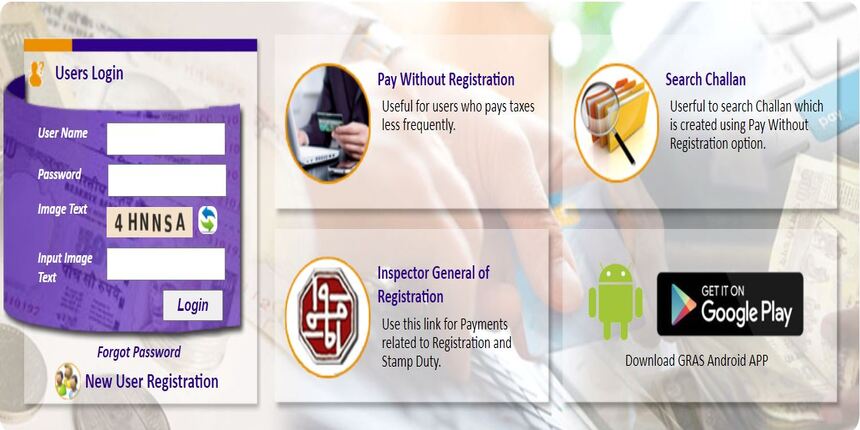

Step 1: Visit the official website of e-Gras.

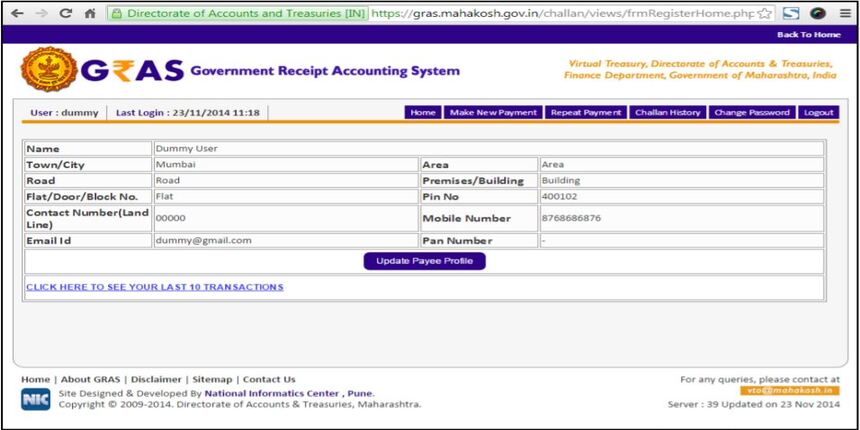

Step 2: Register or log in to the official e-Gras website.

Step 3: After logging, select the category as well as the purpose of making the payment through the portal for which the challan needs to be generated.

Step 4: After selecting the payment purpose, i.e, stamp duty, the ‘Major Head’ and ‘Department’ will be automatically selected. The users can select the major head and department manually instead of selecting the payment purpose.

Step 5: Then, click on the ‘Submit’ button. After submitting, the portal will redirect you to the e-challan page.

Step 6: On this new page, fill in all the details, such as the department for the payment that needs to be made, district, office name, treasury, year, PAN number, and the period.

Step 7: Next step is to enter the tax payment nature, total amount, and amount.

Step 8: Now, select the ‘Security Question’. Lastly, enter the mobile number and email ID on the portal.

Step 9: Select the payment option from the given options. If ‘manual option’ is selected, the payment needs to be made with the printout of challan at the selected financial institution. For the ‘e-banking’ option, enter the details of the bank and make payment via the government receipt, directly.

Step 10: In the next window, enter the details asked by the portal, such as the name of the tender, identity, town/district, city, PIN, particular (payment’s purpose), and address.

Step 11: Click on the option of ‘Add More Details’ (in case there are more details to add for the challan).

Step 12: In the next window, click on the option of ‘New Add Detail’. Enter all the details and save them. This new detail will be added for the challan.

Step 13: Click on the ‘Submit’ option. Challan will be generated after successfully submitting the form.

In case extra details have been added to the challan, click on the option of ‘View Extra Detail’.

Services Available on e-Gras Portal

The e-Gras portal offers a range of services to the citizens. In this section, find the services offered by the portal to the citizens via the portal.

- e-Gras challan verification

- e-Gras stamp verification

- e-Gras payment verification

- e-Gras forgot GRN service

- e-Gras tatkal appointment service

- e-Gras stamp duty payment

Who is Eligible for e-Gras Service?

The answer to this question is simple. The citizens who need to deposit government receipts can use the services provided by the e-Gras portal. The person who is eligible for availing the services can be an individual, entity, association, semi-government units, government units, departments, etc.

Stamp Duty and Registration Charges in Other States

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Bangalore | Stamp Duty in Bangalore |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

| Punjab | Stamp Duty in Punjab |

| Odisha | Stamp Duty in Odisha |

Benefits of Using e-Gras Stamp Duty Payment Method

As the e-Gras platform is one of the e-governance initiatives, it offers a range of benefits to the citizens. These benefits have made it easy for them to pay stamp duty on time and with ease. Below are the advantages offered by the portal:

- Convenient and easy to operate.

- The facility of e-Gras is available 24*7.

- Easy and hassle-free payment of stamp duty and taxes without the need to stand in long queues.

- File a single challan with minimum fields. Also, most of the challan fields are automatically populated.

How to Search and Verify Challan on the e-Gras Portal?

Step 1: Visit the official e-Gras portal of the state.

Step 2: Log in to the portal using the username and password. If you are a new user, register on the website and log in.

Step 3: Click on the ‘Verify Challan’ option.

Step 4: Enter the GRN number and click on the ‘Find Status’ option. The portal will redirect you to a new page where it will show you the challan for verification with the details.

e-Gras Portal of Different Indian States

To view the services, pay the e-Gras stamp duty charges, and for other facilities available, visit these official websites of e-Gras of different Indian states.

| State | Website |

| Haryana | https://egrashry[dot]nic[dot]in/instructions[dot]html |

| Rajasthan | https://egras[dot]raj[dot]nic[dot]in/ |

| Maharashtra | https://gras[dot]mahakosh[dot]gov[dot]in/echallan/ |

| Manipur | https://egrasmanipur[dot]nic[dot]in/echallan/frmIndex.php |

| Jammu and Kashmir | https://jkgras[dot]jktreasury[dot]gov[dot]in/ |

| Assam | https://assamegras[dot]gov[dot]in/ |

| Tripura | https://www[dot]egras[dot]tripura[dot]gov[dot]in/Default.aspx |

e-Gras Tatkal Appointment Charges

Citizens can also take tatkal appointments for the services. There are applicable fees on the tatkal appointment for deed registration. An amount of INR 25,000 needs to be paid by the applicant for availing of a tatkal appointment to get their deed registered in the form of e-challans.

How to Get an e-Gras Challan Refund?

Below-mentioned is the way in which e-Gras challan can be initiated:

Step 1: Submit a written application request to the respective DDO, department, or office.

Step 2: That respective department, office, or DDO will receive the application and process the application internally for a refund.

Step 3: That respective DDO, department, or office will verify and take approval from the concerned authority.

FAQ' about E-Gras Stamp Duty

Q1. How do I pay stamp duty through E grass?

To pay stamp duty through e-Gras, visit the official website. Log in/register on the website and select the category along with the purpose of the payment. Then, select the department and fill in the details of the department, select the payment details and fill out your personal details and submit the form.

Q2. How to check e grass challan?

The e-Gras challan can be checked on the official portal of e-Gras. Click on the search challan option on the website and check the e-Gras challan using the GRN number.

Q3. How to download e grass challan?

Visit the official portal of e-Gras of the state you are looking for and click on the option of ‘Download Challan by GRN Number’ and enter the details in the next window to know the status and download the e-Gras challan.

Q4. What is E grass stamp duty payment?

e-Gras is the initiative of e-governance that facilitates collecting tax as well as non-tax in both online and offline mode.