The property purchasers need to pay the stamp duty in Bihar to the revenue department for all possessions associated with the agreement taking place. The stamp duty and registration charges in Bihar vary from other states along with the plot registration charges, house registration charges and flat registration charges in Bihar. As per the latest reports, the government is charging 6% stamp duty in Bihar.

When you acquire a house, a business establishment or land, the first thing you need to do is register it. This establishes your legality to carry out any transaction. Only when a property has been registered in the name of a person, he or she is regarded as the legal owner.If you fail to register the property, it will be assumed that the former owner or the builder is the legal and lawful owner. Legally, a property transaction isn't deemed complete until the sale deed is properly stamped and registered. The main goal of registration is to keep track of who owns the property.

The seller of the asset is known as the "transferor," while the buyer is known as the "transferee." Stamp duty and registration charges in Bihar are paid by the property buyer.

According to the Registration Act of 1908, a property must be registered for the purposes of sale, transfer, gift, or lease. All agreements involving the sale of immovable property for more than ₹100 must be registered, according to Section 17 of the Registration Act, 1908. If a person does not register a property while engaging in the aforementioned transactions, the transaction won’t be approved in a legal proceeding.

Section 25 of the Bihar Registration Act

The paperwork required for registering a property deed must be sent to the relevant Registrar official within four months after the date of property registration, according to Section 25 of the Bihar Registration Act. In the event of a violation of the foregoing, a fine of up to 10 times the amount of the property registration fee is applied.

Advantages of Online Property Registration in Bihar

By registering the property deed, you may take advantage of the following benefits:

- Offer assurance that the deed is genuine.

- Ensure that the prevention of fraud, the preservation of evidence, and the transfer of ownership to the owner.

- Make transactions more evident.

- Registering a property allows you to keep an up-to-date public record.

- To be able to detect whether or not the property has previously been sold.

- To present security of title deeds in the event that the original deeds are lost or damaged.

What Happens if You Don't Register Your Property?

The documentations will have no impact on the property and will neither provide any property rights nor any benefits of land registration in Bihar. In other terms, the purchaser will be treated by the law as an unacknowledged owner with no rights to the property.

Stamp duty and Registration Charges in Bihar

| CATEGORY | STAMP DUTY CHARGES IN BIHAR |

| Man to Woman | 5.7 % |

| Woman to Man | 6.3 % |

| OTHERS | 6 % |

Stamp Duty Property Registration Charges in Bihar

The terms describing the presentation of documentation for registration by a person are defined in Section 32 of the Registration Act of 1908. As stated in Section 33 of the Registration Act 1908, the relevant person, representative, or authorized agent must deliver the documentation to the proper registration office in order for it to be registered under the Act's requirements.

Registration Charges in Bihar for Men and Women

In the same way, if a property is sold from a male to a female, the registration fee is 1.9 percent. The fee is 2.1 percent if it is sold from a woman to a man.

It is important to note that purchasers must pay stamp duty of 6% of the transaction value and registration fees of 2% of the transaction amount to complete the formality. Despite repeated requests from the central government and the union Housing Ministry, most states have yet to declare any reductions in stamp duty or registration fees on property purchases following the COVID-19 outbreak. Only a few states, such as Maharashtra, Karnataka, and Madhya Pradesh, have declared cuts in these taxes in order to encourage purchasers to invest in real estate and boost economic activity. Despite the fact that the government has imposed high stamp duty charges in Bihar along with the registration fee, it has yet to announce any reductions.

In a typical case, a buyer would pay ₹3 lakhs in stamp duty & ₹1 lakh in registration fees for an asset valued at ₹50 lakhs.

Documents Required - For the Process to Register Land in Bihar

The following documentation must be submitted with the application to register a property in the state of Bihar:

- Certificate of Encumbrance

- The original document with all parties' signatures

- Specifications of the estate such as survey number, size of the plot, surrounding land details, etc.

- Payment of transfer duty (if applicable), stamp duty, user charges, and registration fee as shown by a challan or DD

- Property card

- Both the seller and the buyer must provide identity documents, as well as the witness

- PAN Card

- Aadhaar card

- Original identification and proof of address must be shown to the registrar.

- A copy of the deed/document to be registered

- A map of the land

- Valuation Certificate as provided by the relevant Tehsildar

How to Prepare Registration Documents in Bihar?

At the time of property registration, the transferor and transferee must provide a number of documentations. When gathering this paperwork and documents, make sure they are imprinted on stamp paper or plain A-4 size paper that meets the criteria for royal executive bond paper. All maps and plans must be imprinted on A-4 bond paper.

Stamp Duty and Registration Charges in Other States

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

| Punjab | Stamp Duty in Punjab |

| Odisha | Stamp Duty in Odisha |

| Karnataka | Stamp Duty in Karnataka |

Property Registration in Bihar- In Person

- It is necessary to confirm that the property is held by the individual from whom the land will be acquired.

- So, please go to the registrar (Sub Registrar Office) and apply for an EC (Encumbrance certificate).

- As per the authorities' recommendation, the applicant must go to the appropriate Sub Registrar office and apply for EC (if an online method is available, then apply online).

- If the results are acceptable, the paperwork for registering the property will be prepared.

- Now go to the Sub Registrar's office and verify the registration date.

- Obtain stamp paper for land registration in accordance with the estimated land value. The government value for the region will be used to compute the land valuation.

- The transferor, transferee, seller, and witnesses should all go to the registrar's office on the specified day and wait for their turn.

- Please process according to the authorities' instructions at their appointed slot.

- Please present your original ID to the registrar, as well as the DD for the amount to be paid to the transferor.

- The registrar will sign the order after checking the data in person.

- To complete the registration, the transferor, transferee, and witness must sign the registry as well as the document's recommended sections.

| Point To Be Noted: At the time of registration, everyone engaged in the process must have original documents of their identification and proof of address. |

Online Property Registration in Bihar

The Government of Bihar has established the Bihar Property Registry Portal. Citizens of Bihar may now apply for land registration online using this platform. Citizens of Bihar would no longer have to go to a government agency to register their land. They can register their property from the comfort of their own home. This feature will help in saving time, money and increasing system transparency. E-Registration of Property is the term given to the Bihar Property Registration Portal. Along with registering the property, comprehensive information on the property may also be acquired through this site.

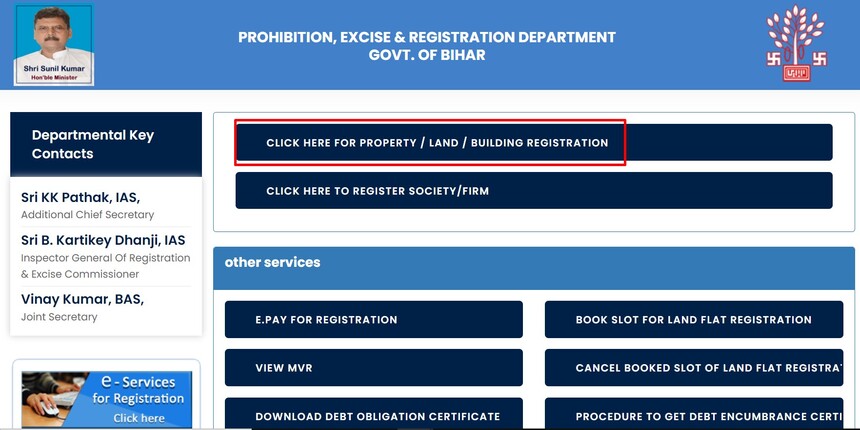

Register Property through an Online Portal in Bihar:

- Go to the Department of Registration's official website at www[dot]biharregd[dot]gov[dot]in. Select the ‘E-services for Registration' tab on the resulting page.

- Choose from the numerous options that show on the next page. Click the ‘Land/property registration' option for buyers who wish to register their flats or apartments.

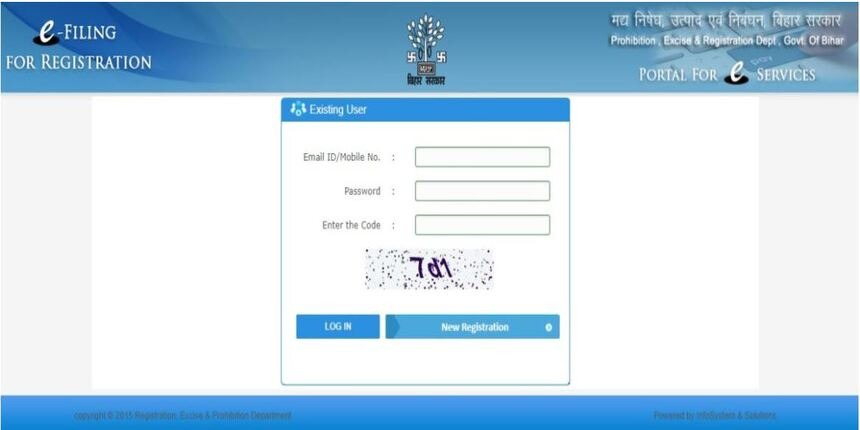

- While registered users may enter their email address/mobile number, password, and captcha on the next screen and click "Log In," new users must select the "New Registration" button.

- After the user fills out all of the required information, they will receive an OTP on their phone or email address, which must be entered to activate the account.

- To continue, a registered user must enter the property data and submit all property-related documentations. After you've uploaded all of your documentation, click on the 'Save' button.

- After you've saved the scanned copies of your documentation, you'll be sent to a screen where you may choose to "Pay Now." Choose the payment mode and click on the ‘online payment' button to continue with the process.

- The user will receive the eStamp when the payment has been processed successfully. An acknowledgement slip and a registration number will be produced.

- All parties concerned must appear at the sub-registrar's office at the scheduled time, bringing all property-related paperwork as well as evidence of residence and identification. All of the paperwork will be examined by the official in charge, after which the signatures, photos, and fingerprints of the transferor, transferee, and witnesses will be gathered. The property registration procedure will be completed at this point.

Bihar Property Registry Fees

You can pay the charge in one of two ways. Either, you can download and print your registration form and prove that you can deposit the fee in the bank. Or the second option is to pay the fee through the website; there will be an online procedure that you can complete using your credit card. Moreover, the money will be taken from your account, and you will receive information about it.

Return of the Registered Documents

The sub-registrar's office is required under the Bihar Registration Act 2008 to return the registered documentation as soon as the procedure is done.

Eligibility Criteria for Registering a Property in Bihar

- Those who own property in their name

- Those who are the legal heirs to the estate of a departed individual

- Authorized signatory with a legitimate power of attorney

Stamp duty on Rent Agreement in Bihar

For a person who desires to occupy a land/property for an agreed time period, a contract needs to be signed by him along with the owner of the property. This contract is called a Rent Agreement. A rent agreement or rent deed has the general information of a particular property, the owner, rent amount and the tenant. The rent agreement is drafted on a stamp paper in Bihar.

The rent agreement Stamp duty in Bihar is 1%, based on the yearly rent with the paid deposit, or INR 500, whichever is the lesser amount.

FAQ's about Stamp Duty in Bihar

Q1. What is the rate of registry in Bihar?

2% of the property’s value is charged in Bihar for registering property.

Q2. What is gift deed stamp duty in Bihar?

Man to Woman: 5.7% Woman to Man: 6.3% Others:6%

Q3. How is stamp paper value calculated in Bihar?

The stamp paper value is calculated on the basis of 6% of the property value.

Q4. Is it possible to register my property in Bihar online?

In Bihar, purchasers can complete part of the property registration procedure online. They will finally have to appear in person at the sub-registrar's office to finish the procedure.