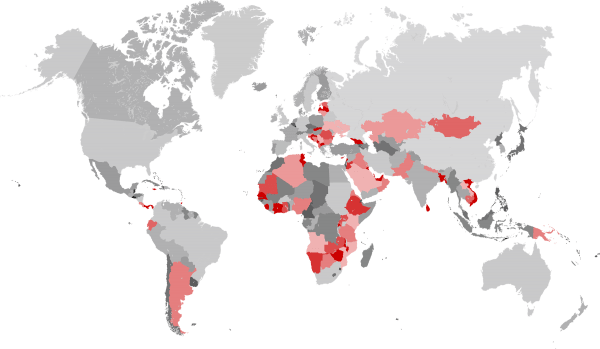

Frontier Markets are generally classified as growing & expanding economies spread across the world. Generally ranked below emerging markets, these economies offer tremendous growth opportunities driven by a host of new policy changes, a rise in exports & lower base.

As a premier real estate advisory, Square Yards presents a list of Frontier Market, that we feel could give higher returns to the discerning real estate investors, looking to expand their wealth through meaningful investment.

Argentina: Once considered in the list of an emerging economy, the South American nation has been badly hit in the recent times. The strong exchange control policies implemented by its previous government had been inimical to its real estate industry. In 2014, in the capital city of Buner Aries, the monthly residential transaction has gone down to 2000/ month- a debacle when compared to 2010; when the transaction volume was hovering northwards of 7000/ month.

However, with a power change in 2016 & softening of the currency policies, market have started to emerge back. In 2016, most of the major localities in the capital city have appreciated in tune of 5-7% in the primary real estate section. There is also a notable increase in terms of new launches & uptake in the market.

There are still gray areas that remain to be worked upon in the times to come. The inflation is at around 30%, that is not enabling the government to reduce the central government loan rates- a stand that has to be reversed in the coming time; as the economy is set for a further reduction in 2017. Argentina also has a very low private sector housing lending that is presently in tune of 14% of the GDP. However, the new government has pledged to offer one million mortgages in its full tenure & this will be a major boost to the economy.

Myanmar Real Estate: After political reforms in 2011, Myanmar was considered as one of the last frontier markets to capitalize upon. Soon political transitions were followed, resulting in soaring FDI inflow & surge in real estate sector. Property prices appreciated by a significant value. The bullish sentiments softened with a string of regulatory norms including a rise in transaction price & ban on building over 9 floors in Yangon region.

However, Myanmar will continue to gain traction in the coming times. The GDP growth at 6.5% in 2016 is significantly higher than the global average. With the implementation of the condominium law, foreign investors can buy condominium properties in Myanmar- One of the most sought after real estate assets in the recent times.

Mexico Real Estate: Rising middle class, safer market sentiments & exotic beachfront residences will keep driving the Mexican real estate industry. Although the markets have been subject to risk from the recent US election, where one of the major election rhetoric of Donald Trump revolved around the idea of building a wall around Mexico; the underlying sentiments in Mexico look healthy & the real estate industry is expected to showcase admirable growth patterns. The market is inclusive, with around 60 million of the population covered by banking financial system.

Mexico’s beach communities continue to be a favorite amongst the international investors. The transaction cost that lies around 4-11%, relatively cheaper when compared to other international markets. Although heavy taxes are levied on transaction done by foreign nationals.

Vietnam Real Estate Industry: The South East Asian nation that offers a low-cost manufacturing alternative to China, will be one of the major frontier markets to capitalize upon. The country has registered a growth of 6.3% in 2016 & is expected to expand by 6.8% in 2017. Annual inflation is within 5% & with rolling out of a host of policy level changes, Vietnam will further consolidate its position as one of the major FDI destination in the Asia Pacific region. Vietnam’s expanding economy & surging middle class will continue to stimulate its real estate industry. It is expected that by 2020, the total number of the middle class will reach 33 million in Vietnam with an average income of around USD 750.

Vietnam is amongst one of the brightest hot spot on global reality landscape with prices moving aggressively upwards in the recent times. In Q3 2016, Primary real estate prices in HCM City appreciated by around 7.2% wherein in Hanoi the prices moved up by around 8%. In 2015, Vietnam has also liberalized its policies & have allowed foreign investors to buy local properties.

Kenya Real Estate Industry: Kenya’s GDP is expected to grow by near around 5.7-6% in 2017 & a surging GDP will give a push to the construction & real estate industry. Kenya’s real estate industry have been bullish in the recent times, with double-digit returns. Although it is expected that demand will soften in 2017 & investors will be more cautious in terms of investment. However, a surge in international MNCs & PE investment will continue to drive the market.